Key Elements of a Rent Receipt

A proper rent receipt should include essential details to ensure clarity and legal validity. Use the following structure:

- Date of Payment: The exact date the rent was received.

- Tenant’s Name: The full name of the tenant making the payment.

- Rental Property Address: The location of the rented property.

- Amount Paid: The total rent amount received.

- Payment Method: Cash, check, bank transfer, or any other method.

- Rental Period: The month or period the payment covers.

- Landlord’s Name and Signature: Confirmation from the property owner or manager.

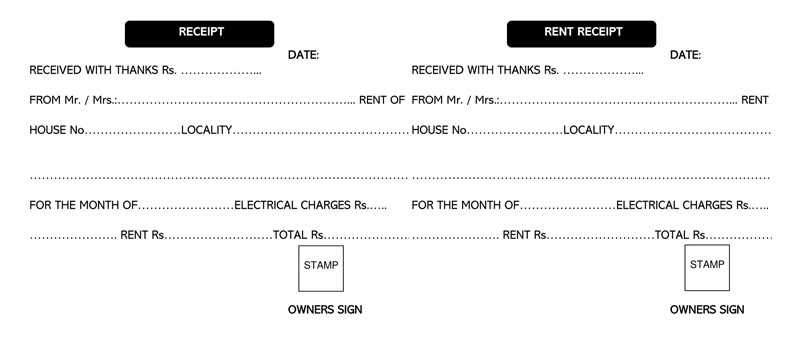

Sample Rent Receipt Template

Use this format for a simple and clear rent receipt:

Rent Receipt Date: [Insert Date] Received from: [Tenant’s Name] Property Address: [Rental Address] Amount Paid: $[Amount] Payment Method: [Cash/Check/Transfer] Rental Period: [Month/Year] Landlord’s Name: [Landlord’s Name] Landlord’s Signature: __________________

Tips for Proper Documentation

Keep copies of all rent receipts for tax or legal purposes. If issuing digital receipts, ensure they are properly dated and signed electronically.

Common Mistakes to Avoid

- Missing the date or payment period.

- Omitting the landlord’s signature.

- Using vague descriptions instead of clear payment details.

Following this template helps maintain accurate records and prevents disputes over rent payments.

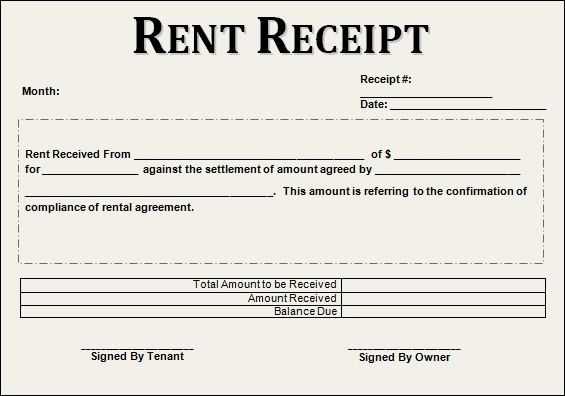

Official Rent Receipt Template

Key Elements to Include in a Rental Record

How to Format a Receipt for Legal Use

Printable and Digital Options for Rent Documentation

Common Mistakes to Avoid When Issuing Records

Tax and Record-Keeping Benefits of Rental Receipts

Where to Find Free Templates for Rent Documentation

Include essential details: Every rent receipt must have the tenant’s name, landlord’s details, payment date, rental period, amount received, and payment method. Add a unique receipt number to maintain organized records.

Ensure legal formatting: Use a clear layout with sections for each detail. Specify whether the payment covers rent, utilities, or deposits. If applicable, mention late fees or partial payments.

Choose between digital and printed formats: Paper receipts work well for in-person payments, while digital receipts offer convenience for online transactions. PDFs and structured email receipts ensure accessibility and easy storage.

Avoid common mistakes: Missing signatures, incorrect amounts, or vague descriptions create disputes. Always verify accuracy before issuing a receipt.

Leverage tax benefits: Well-documented receipts help tenants claim deductions and assist landlords in reporting rental income. Keep copies for compliance with financial regulations.

Find free templates: Many government websites and rental platforms offer downloadable receipt formats. Ensure the template aligns with local rental laws before use.