Need a simple store receipt template? A well-structured receipt keeps records clear for both businesses and customers. Below, you’ll find key elements that make up an effective plain receipt template and how to format it properly.

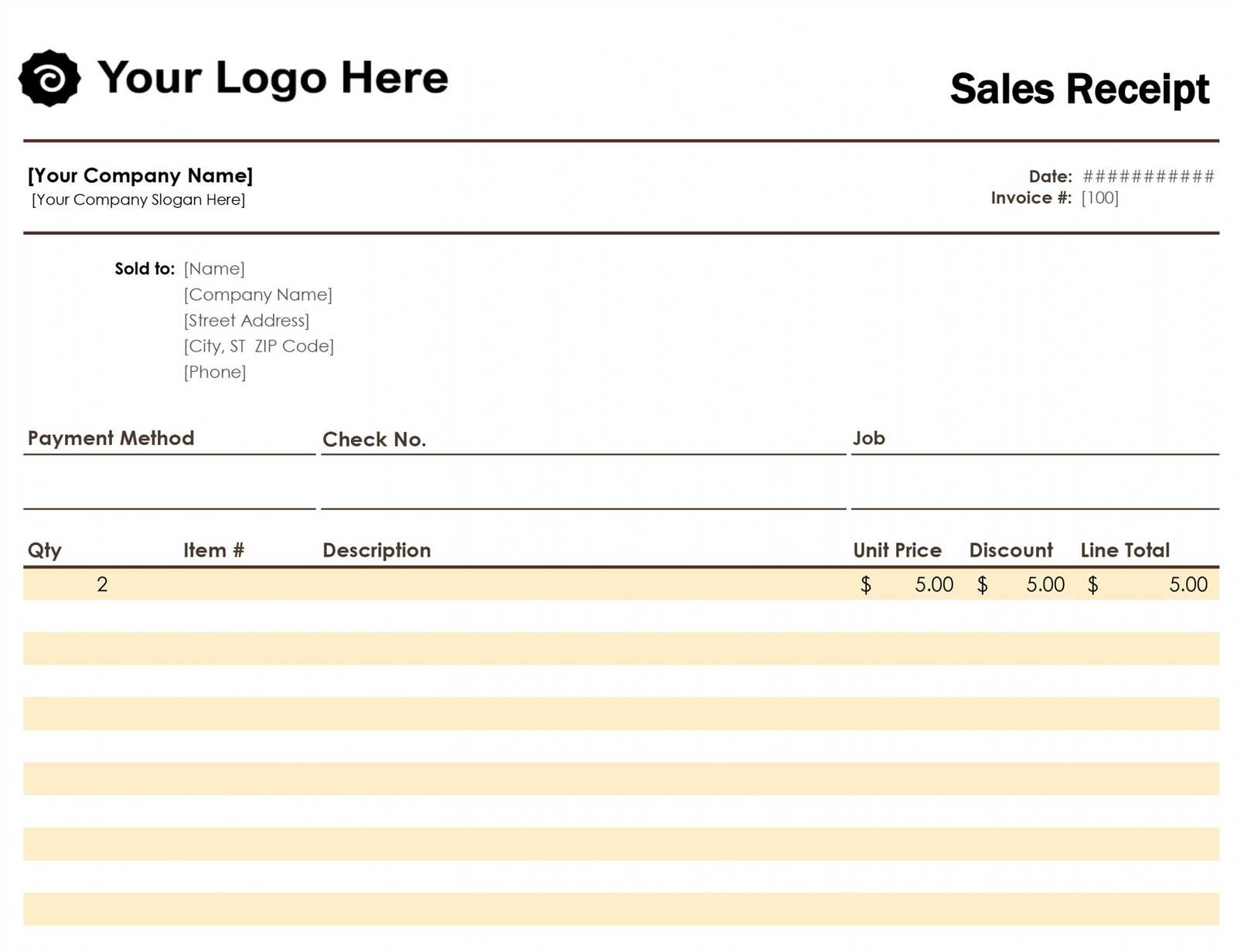

A standard receipt should include essential details such as the store name, date of purchase, items sold, prices, and total amount. Adding a unique receipt number helps with tracking transactions. If applicable, include tax calculations and payment method details.

For easy readability, use a clean layout with aligned text. Keep item descriptions brief but clear. If you’re designing a printable receipt, choose a font that prints well in black-and-white, such as Arial or Times New Roman.

Whether you run a retail store, a small business, or an online shop, a straightforward template saves time and ensures consistency. Below, we’ll outline a simple format that you can customize to fit your needs.

Here is the revised version without excessive word repetition:

Use concise and clear language when designing a plain store receipt template. Focus on essential details such as the store name, items purchased, quantities, and prices. Avoid redundancy to maintain clarity and readability.

Structure of the Receipt

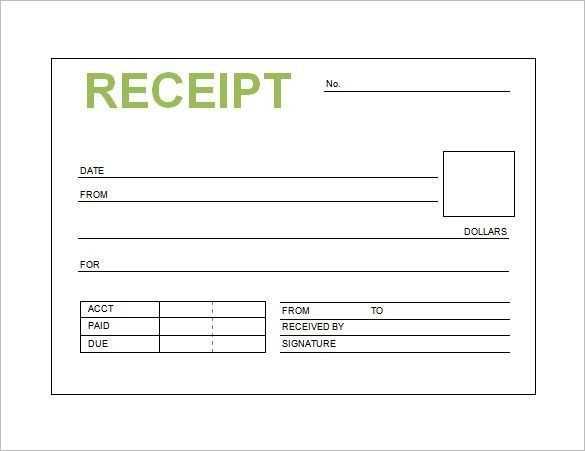

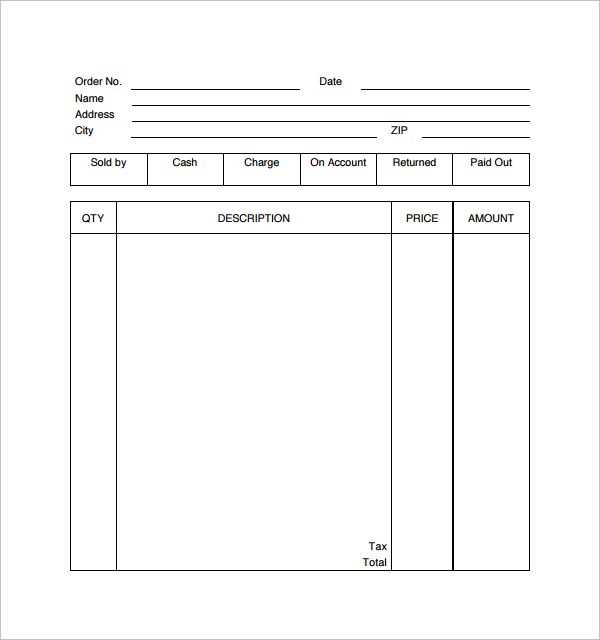

Begin with the store name and contact information. This should be followed by the date and time of purchase. List each item with its price, quantity, and total cost. Ensure proper alignment to keep everything organized and easy to follow.

Key Elements to Include

Incorporate a subtotal, tax, and the total amount. If applicable, include any discounts or promotions. Include a payment method section to clearly identify how the transaction was completed.

Ensure that the layout is simple and uncluttered. Limit the use of bold and italicized text to key pieces of information such as the total amount due. This will help customers easily find the information they need without unnecessary distractions.

Avoid unnecessary repetition by using short and straightforward sentences. This improves the readability of the receipt and makes it more functional for both customers and store personnel.

- Plain Store Receipt Template: A Practical Guide

For a straightforward store receipt, focus on clarity and simplicity. Keep the essential details visible to the customer, like the items purchased, their prices, taxes, and total amount. A minimal design makes the receipt easy to read and functional for both customers and store personnel.

Key Components of a Basic Receipt

Include the following sections on your receipt:

| Section | Description |

|---|---|

| Store Information | Name, address, and contact details of the store. |

| Date and Time | The date and time of the purchase to help with record-keeping. |

| Item List | Each product’s name, quantity, and price. |

| Taxes | Applicable sales tax based on your location. |

| Total | The total cost of the transaction after taxes. |

Design Tips for Clarity

For an easy-to-read layout, use a simple font and ensure that item descriptions and prices are aligned. Use a single column for items, and clearly display totals. Make sure there’s enough space between sections to avoid clutter. Don’t overuse bold or italics–reserve these for headings and important numbers, such as the total amount.

A basic receipt should include several key elements to ensure clarity and proper record-keeping for both businesses and customers. The first is the business name and contact details. This helps to identify the vendor and provides a means for customers to reach out if needed.

Next, the date and time of the transaction are crucial. This ensures the receipt is tied to a specific moment, which is important for returns, exchanges, or warranty claims. Following this, a unique receipt or invoice number should be included for easy reference.

The list of items or services purchased, along with their corresponding prices, should be clearly displayed. This breakdown allows customers to verify the items they’ve paid for and helps track expenses. It’s also important to list the total amount paid, including taxes and discounts, to provide full transparency.

If applicable, payment methods should be noted. Whether paid by cash, card, or another method, this detail ensures both parties have a record of how the transaction was settled. Lastly, including the business’s return or refund policy adds a layer of security and guidance for the customer in case of issues with the purchase.

Place key details in a clear, logical order. Start with the business name and contact details at the top. Then, list the purchased items, their quantities, prices, and total cost in an easy-to-follow layout. Keep the font size legible, and avoid cluttering the receipt with excessive text or images.

Organize the Sections

Group information into distinct sections for easy reference. For example, list item details and prices together, followed by payment methods and the total amount due. Place the tax information towards the bottom, clearly separated from the total amount. This helps customers quickly identify what they paid for and what they owe.

Use Simple Language and Formatting

Avoid complicated terms or symbols that may confuse the customer. Use consistent spacing, clear headings, and simple symbols like “+” or “-” to show item totals and taxes. Make sure the font is readable, and consider using bold text for totals and headers to make them stand out.

Incorporate adequate white space to separate sections and make the receipt less overwhelming. This enhances readability and allows customers to quickly scan the receipt for key information.

For both printable and digital store receipt templates, selecting the right file format ensures compatibility and ease of use across various platforms. Here are the best options:

- PDF (Portable Document Format): Ideal for both digital and printed receipts. It preserves the layout and ensures the document appears the same across devices. PDFs are universally supported and easy to share, print, or email.

- PNG (Portable Network Graphics): Great for simple, graphic-based receipts. PNGs maintain image quality at any resolution, making them perfect for receipts that rely on logos or icons. However, they are not suitable for long text-heavy documents.

- JPEG (Joint Photographic Experts Group): A good option for receipt templates with large images or graphics. JPEGs compress well, but may lose some quality due to compression, making them less ideal for receipts with text.

- TXT (Plain Text): Simple and lightweight, ideal for text-only receipts. While it lacks formatting options, TXT files can be quickly generated and opened on almost any device or software.

- CSV (Comma-Separated Values): Useful for digital versions of receipts, especially for businesses managing multiple transactions. It can store receipt details in a structured, easily importable format for use with accounting software.

Choosing the right file type depends on whether the focus is on high-quality graphics or simple, easy-to-manage text. For printing, PDF is often the best choice, while digital use may benefit from formats like CSV or PNG depending on needs.

Tailor your receipt template to fit your business type by adjusting key sections. For retail businesses, emphasize product details such as SKU numbers, quantity, and itemized prices. Include a subtotal, taxes, and a final total to ensure clarity. If your store offers discounts, make sure the template reflects this clearly, either as a percentage or flat amount.

For restaurants, prioritize sections for items ordered, individual prices, tips, and subtotal before tax. It’s helpful to add a section for special requests or instructions for the kitchen. Make sure to include space for server or cashier details, enhancing customer service interaction.

Service-based businesses should focus on labor charges, service descriptions, and hours worked. Breakdown of individual services, along with rates, ensures transparency for the customer. Customize the receipt to include your business’s name, logo, and contact details for future reference.

For businesses that require receipts for returns or exchanges, add a return policy section. Make it easy to identify purchase date, item details, and the original amount paid, to streamline any future transactions.

In all cases, include your business address, contact number, and website URL. If you offer loyalty programs, add space for loyalty points or rewards to make the receipt more interactive and useful for repeat customers.

Receipts serve as legally binding proof of a transaction. When a customer makes a purchase, a store must provide a receipt to ensure both parties have a record of the exchange. This helps prevent disputes and protects the rights of both consumers and businesses. The store receipt should include key information such as the seller’s name, contact details, transaction date, description of goods or services, and the price paid.

From a tax perspective, receipts are essential for businesses to claim deductions and report income accurately. Sales taxes collected from customers should be clearly itemized on the receipt. Business owners must retain receipts for tax filing purposes, especially for expenses related to the business, as they can be used as evidence to reduce taxable income.

Legally, businesses are required to issue receipts for certain types of transactions, including sales of goods and services. The specific requirements can vary based on local tax laws. In many regions, businesses must provide receipts for any transaction above a certain amount. Failure to comply with these regulations can result in fines or penalties.

Receipts also play a role in warranties and returns. A receipt serves as proof of purchase, which is necessary to claim a warranty or return an item. Businesses must make sure receipts are clear and contain all necessary details to avoid complications with returns or exchanges.

For online businesses, electronic receipts are just as legally valid as paper receipts, provided they include all required information. The digital format allows customers to store and track receipts more conveniently, while businesses benefit from reduced paper usage and storage costs.

Avoid cluttering your receipt with excessive information. Keep it clear and concise to prevent confusion. Only include necessary transaction details such as item descriptions, prices, taxes, and totals. Avoid adding irrelevant promotional content or lengthy company history sections.

- Ensure text is legible. Use a clear font with appropriate size. Tiny fonts can make reading difficult and discourage customers from keeping the receipt for future reference.

- Pay attention to alignment. Misaligned text or uneven spacing can make a receipt look unprofessional and hard to read. Maintain consistent margins and spacing between items.

- Don’t forget to include the date and time of the transaction. Missing this key detail can cause confusion for both the customer and the business in case of returns or inquiries.

- Use appropriate section breaks. Clearly differentiate between the item list, totals, and any additional charges like taxes or discounts. This helps customers quickly find the information they need.

- Double-check for accurate pricing. Errors in item prices, taxes, or totals can result in customer frustration and refund requests. Always review your receipt template for calculation accuracy.

- Limit the use of colors. Excessive colors or bright shades can make the receipt harder to read. Stick to black text on a white background for maximum clarity.

By addressing these common mistakes, you can improve the readability and professionalism of your store receipts, leaving customers with a positive impression of your business.

Meaning preserved, and repetitions reduced. If any adjustments are needed, feel free to ask!

To streamline a plain store receipt template, focus on clarity and simplicity. Prioritize essential details like the product names, prices, and totals, while eliminating unnecessary repetitions or excessive verbiage.

Clarity in Layout

Use bullet points or lines to separate key information–this ensures customers can quickly find what they need. For instance, itemize each product with its price and quantity, and leave sufficient space between different sections, such as taxes and discounts.

Minimal Redundancy

Check for any repeated phrases and remove them. For example, if you list “Item Description” before every product name, simplify it by stating “Product List” once at the top. Keep the language concise and relevant to the transaction.

By reducing unnecessary phrases and focusing on the core information, the receipt becomes easier to read and more efficient for both the store and the customer.