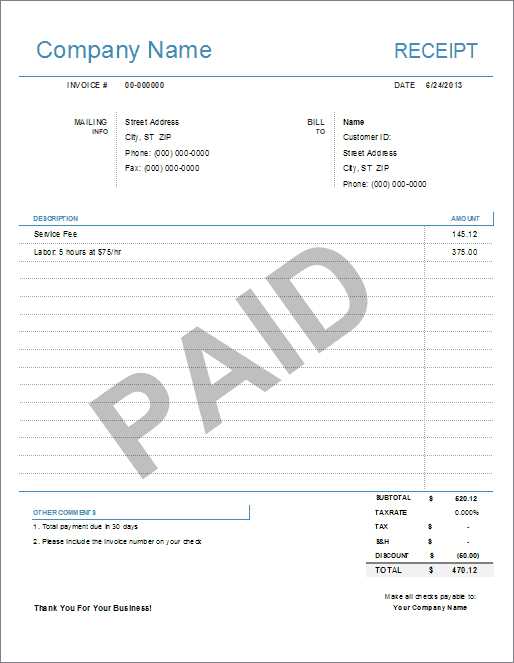

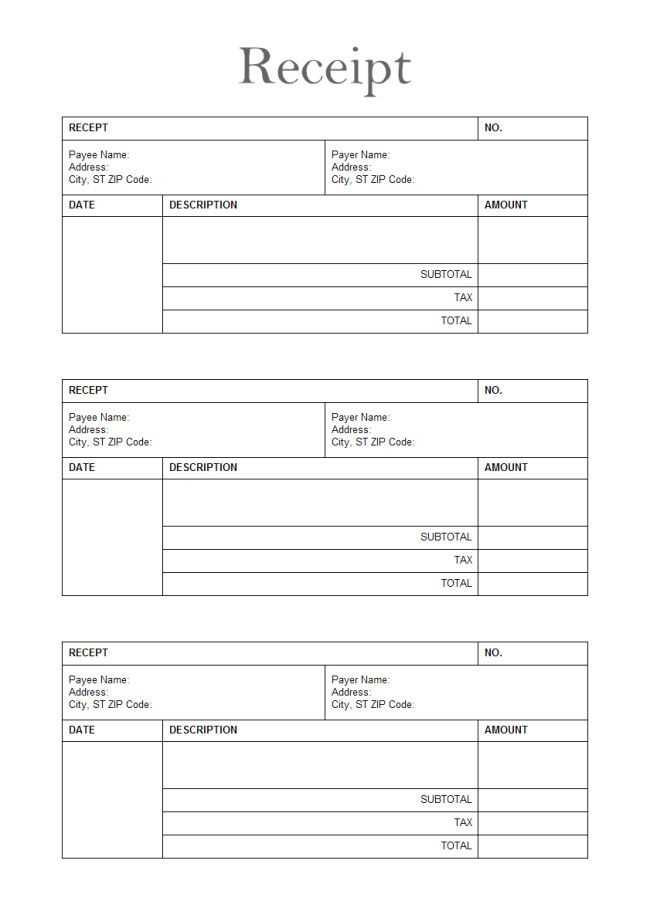

Use a structured format to ensure every receipt issued in Singapore meets legal and business standards. A well-designed template should include key details such as the seller’s name, company registration number, date of transaction, itemized costs, and total amount. For tax compliance, include the GST registration number if applicable.

Clarity and readability are essential for a professional receipt. Use a clean layout with clearly defined sections for payment method, terms, and buyer details. Digital templates offer convenience, but printed copies remain necessary for some transactions, especially in retail and service industries.

Ensure your receipt format aligns with regulatory requirements. Businesses registered under Singapore’s GST system must issue tax invoices for taxable sales exceeding SGD 100. Non-GST registered entities should state explicitly that GST is not included. Proper documentation simplifies bookkeeping and enhances trust between businesses and customers.

Receipt Template Singapore

Ensure your receipt format meets local tax regulations by including business registration number, tax invoice label (if GST applies), and breakdown of charges. Each receipt must display the issue date, itemized costs, and total amount clearly.

Key Details to Include

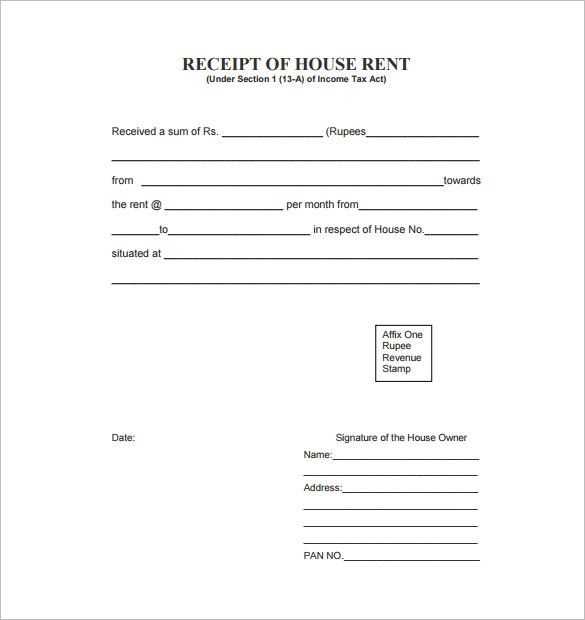

Structure receipts with sections for buyer and seller information, payment method, and currency. If GST applies, list the rate and collected amount separately. For non-GST businesses, add a statement confirming tax exclusion.

Formatting Best Practices

Use a clean layout with aligned columns for item descriptions, unit prices, and quantities. Digital receipts should be in PDF format for easy sharing and record-keeping. Maintain a consistent numbering system for tracking transactions efficiently.

Legal Requirements for Receipts in Singapore

Businesses must issue receipts for transactions exceeding SGD 100 unless the customer requests otherwise. These receipts serve as proof of purchase and help with tax reporting.

Mandatory Information

- Name and registration number of the business

- Transaction date

- Itemized list of goods or services

- Total amount, including applicable taxes

- Payment method

Tax Compliance

Businesses registered for GST must include:

- GST registration number

- Breakdown of taxable and non-taxable amounts

- Explicit mention of GST applied

Non-compliance may result in penalties. Always ensure receipts align with tax regulations.

Mandatory Information to Include in a Receipt

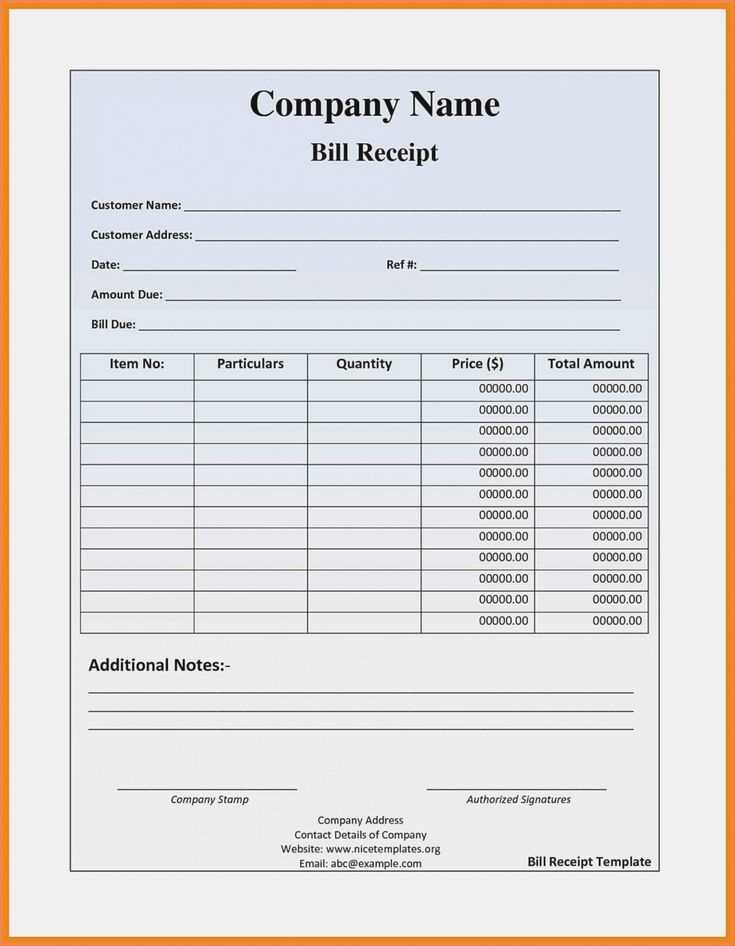

Business Name and Contact Details: Display the registered name, address, and phone number. If applicable, include the company registration number for legal compliance.

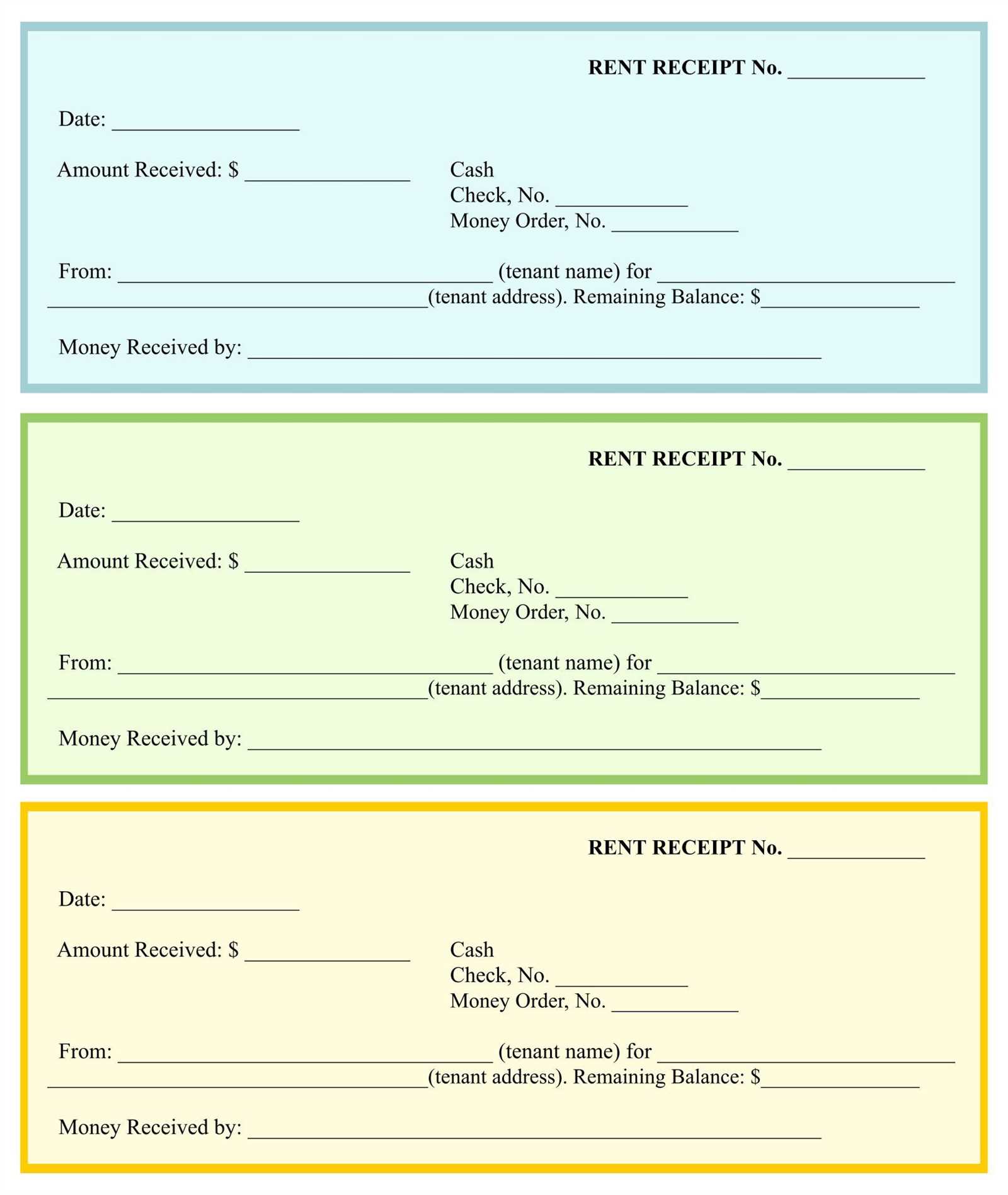

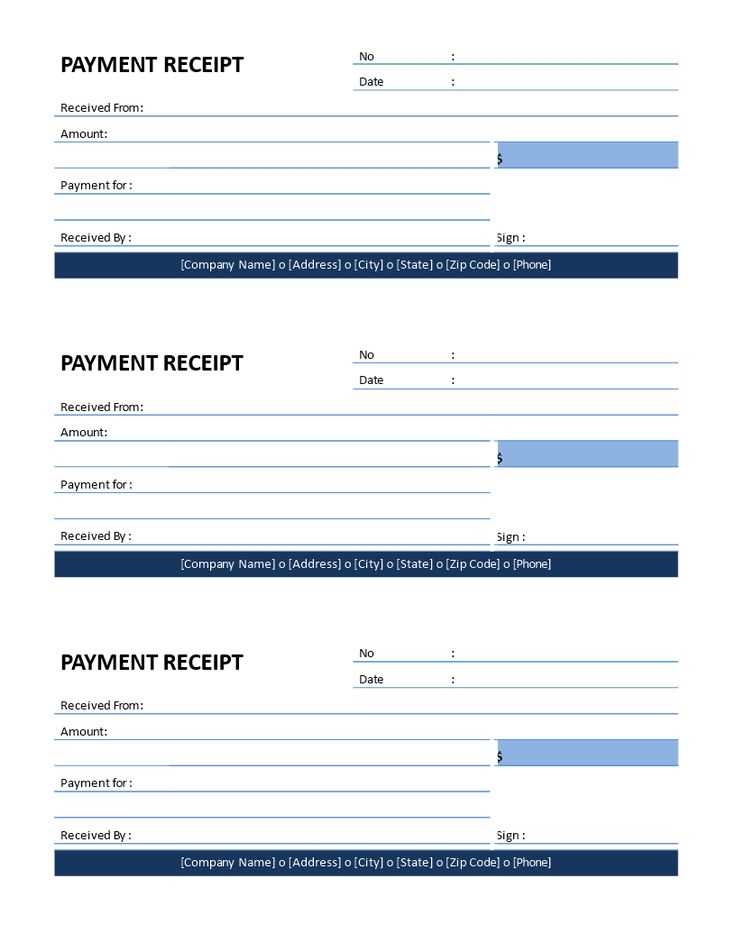

Receipt Number: Assign a unique identifier to each transaction. This helps with tracking and record-keeping.

Date and Time of Transaction: Specify when the purchase occurred. This detail is essential for returns, warranties, and bookkeeping.

Buyer Information (if applicable): Include the customer’s name or business details for corporate transactions or customized orders.

Itemized List of Goods or Services: Describe each product or service provided, including quantity, unit price, and total amount. Use clear descriptions to avoid disputes.

Subtotal, Taxes, and Discounts: Break down the costs, showing applicable taxes and any discounts applied. This transparency ensures accurate financial reporting.

Total Amount Paid: Highlight the final sum after all calculations. Specify the currency to prevent misunderstandings.

Payment Method: Indicate whether the transaction was completed via cash, credit card, bank transfer, or other means. Include partial payments if relevant.

Terms and Conditions: If applicable, outline refund policies, warranty coverage, or other conditions affecting the transaction.

Authorized Signature or Digital Confirmation: For paper receipts, a signature may be required. For electronic versions, include a confirmation code or digital stamp.

Differences Between Cash and Digital Receipts

Choose digital receipts if you need easy access to past purchases, automated expense tracking, or seamless integration with accounting software. Printed receipts work best for quick verification at checkout or transactions requiring an immediate physical record.

- Storage and Accessibility: Paper receipts clutter wallets and fade over time, while digital versions remain searchable and accessible from cloud storage or email.

- Security and Durability: Printed receipts can be lost or damaged, making returns and warranty claims difficult. Digital receipts provide a secure backup and prevent unauthorized alterations.

- Business Integration: Digital receipts automatically sync with financial tools, reducing manual data entry and errors. Paper receipts require scanning or manual input, increasing processing time.

- Environmental Impact: Paper receipts contribute to waste and require thermal paper, which often contains chemicals. Digital alternatives reduce paper consumption and promote sustainability.

Retailers offering both options let customers choose the format that suits their needs, balancing convenience and record-keeping preferences.

Customizing Receipt Templates for Business Needs

Choose a format that aligns with your transaction type. A service-based business may need a breakdown of labor costs, while a retail store benefits from itemized lists with unit prices and totals.

Include only relevant fields. Remove unnecessary sections to streamline readability. Key details typically include date, transaction ID, customer name, item description, quantity, unit price, subtotal, taxes, and the final amount.

Ensure compliance with local regulations by incorporating necessary tax identifiers, business registration numbers, and payment details. This helps in record-keeping and simplifies audits.

Integrate branding elements. Add a company logo, business contact details, and a color scheme that matches your corporate identity. A well-designed receipt enhances professionalism and customer trust.

Offer multiple format options. Digital receipts in PDF or email format cater to online transactions, while printed copies remain useful for in-person sales.

Automate generation through accounting or point-of-sale software to reduce errors and save time. Set up templates that auto-fill recurring details, minimizing manual input.

Common Mistakes to Avoid When Issuing Receipts

Failing to Include Complete Transaction Details

Every receipt must clearly list the date, item descriptions, quantities, unit prices, total amount, and applicable taxes. Omitting any of these can create confusion and disputes. Ensure all figures are accurate, especially when applying discounts or additional charges.

Using Unclear or Inconsistent Formatting

Receipts should be easy to read and follow a uniform structure. Avoid handwritten corrections or inconsistent spacing, as they may appear unprofessional. Standardize font sizes and align numerical values properly to enhance readability.

Errors in numbering or missing serial identifiers can also cause tracking issues. Assign a unique number to each receipt and maintain a record for reference. This improves accountability and simplifies audits.

Best Practices for Storing and Managing Receipts

Use a consistent and organized system to categorize receipts. Store them based on transaction type, date, or vendor. This will make retrieval faster when needed for returns or tax purposes.

Digitize Receipts for Easy Access

Scan or photograph receipts and save them in cloud storage for quick access. Ensure the file names are descriptive, such as including the date or vendor name, to make searching easier. Avoid physical storage clutter by going paperless.

Regularly Back Up Your Data

Make a habit of backing up your scanned receipts regularly. Use automated cloud storage systems to reduce the risk of losing important data. Ensure your backups are organized and up-to-date.

| Storage Method | Pros | Cons |

|---|---|---|

| Physical Storage | Easy access, no need for technology | Space consuming, prone to damage |

| Digital Storage (Cloud/Local) | Space-saving, accessible anywhere, secure | Requires tech setup, relies on cloud services |

For businesses, keep receipts in a format that is compatible with accounting software to streamline expense reporting and tax filing. This can save significant time during audits or reviews.