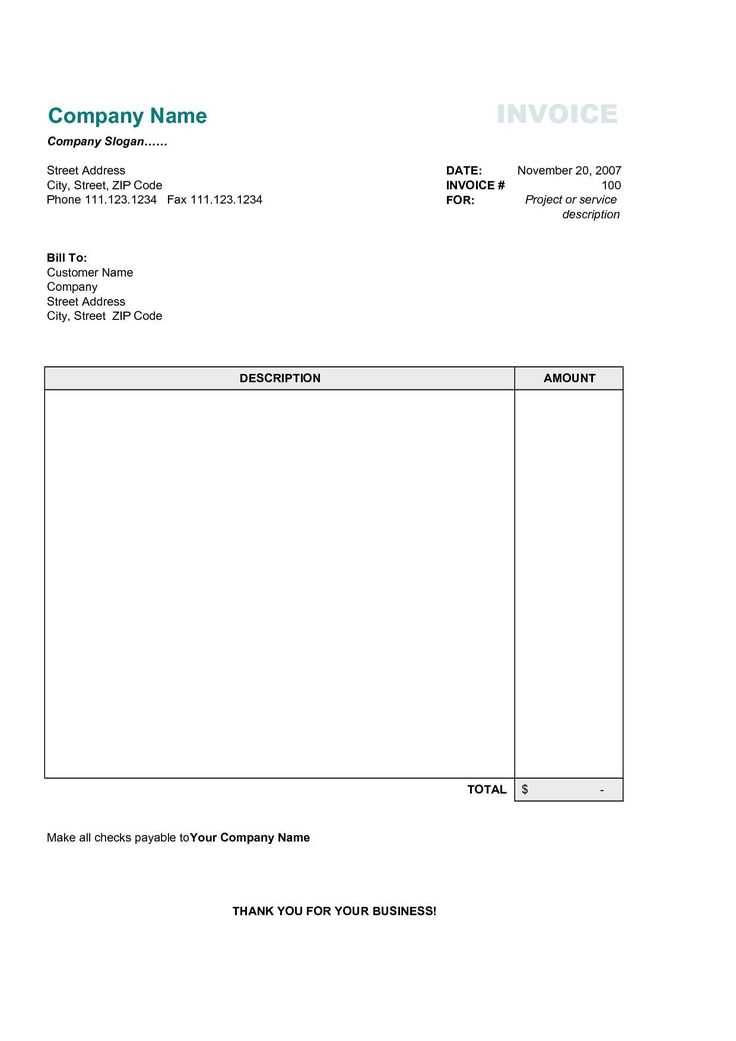

Use a simple invoice receipt template to ensure fast and transparent payment processing. Whether you’re a freelancer, small business owner, or independent contractor, a well-structured receipt keeps your records in order and provides clients with clear payment details.

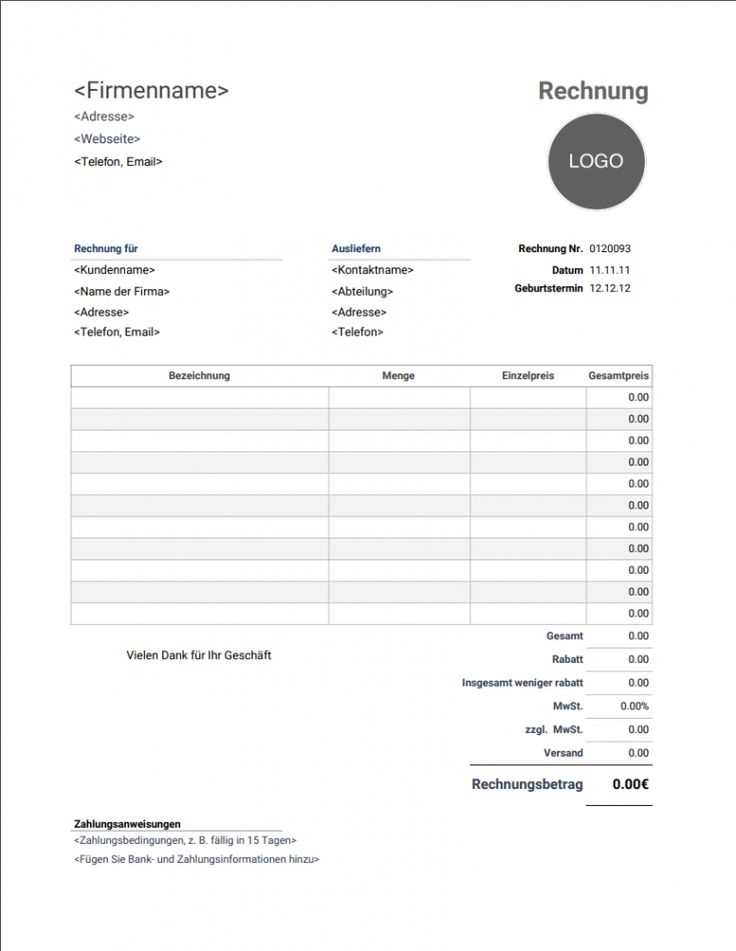

A good template includes essential elements such as invoice number, date, itemized services or products, total amount, and payment method. Adding your company logo and contact details enhances professionalism, making the document more recognizable.

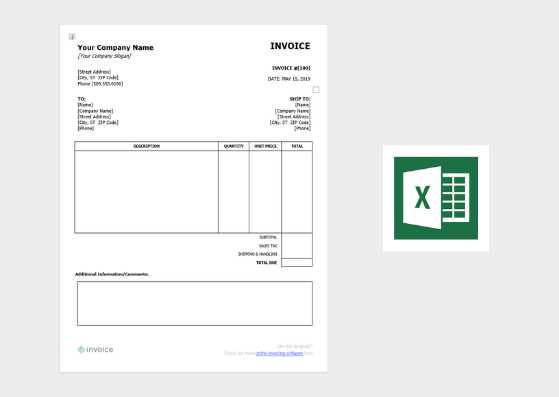

Choose a format that suits your needs: PDF for a polished look, Word for easy editing, or Excel for automatic calculations. If you issue receipts frequently, consider using invoice software to streamline the process and reduce manual entry errors.

Download a template, customize it with your details, and send receipts effortlessly. A clear, structured invoice receipt strengthens client trust and simplifies financial management.

Here is the corrected version with duplicates removed:

Ensure that each field in the invoice is filled with accurate, non-repetitive information. Include the company name, address, and contact details only once, ensuring they are clearly visible at the top. List products or services with their description, unit price, and quantity without repeating any item. For payment details, state the total amount clearly, along with the payment method, avoiding redundancy in the wording. When including dates, ensure that both the invoice date and the due date are specified only once to avoid confusion. Check for unnecessary phrases and simplify where possible for clarity.

- Simple Invoice Receipt Template

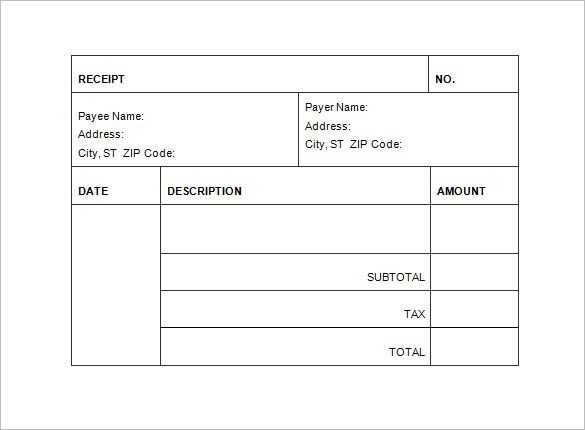

For a clean and straightforward invoice receipt, include the following key elements:

- Invoice Number: This uniquely identifies the receipt. It helps with tracking and future reference.

- Date of Issue: Include the date the payment was received or the service was completed.

- Seller Information: List the business name, address, and contact details.

- Buyer Information: Include the customer’s name, address, and contact information.

- Description of Goods/Services: Detail the items or services provided, including quantities and unit prices.

- Total Amount: Clearly state the amount received from the customer, along with any taxes or discounts applied.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, check, bank transfer).

- Signature: Optionally, include a space for both parties to sign as a confirmation of the transaction.

To keep the template simple, ensure each section is clearly separated and labeled for easy readability. Avoid clutter and stick to essential details only.

A simple receipt should include the following key elements:

1. Business Information

Include the name, address, phone number, and email address of your business. This helps the recipient know where to reach you if there are questions or issues regarding the purchase.

2. Receipt Number and Date

Each receipt should have a unique number to track transactions and prevent confusion. The date of the transaction is also necessary for both the business and the customer for record-keeping.

3. Description of Products or Services

List the items or services provided, including a brief description, quantity, and individual price. This ensures transparency and allows the customer to easily verify what they have purchased.

4. Total Amount

Clearly display the total amount paid, including taxes and any other charges. This allows for easy understanding of the final amount owed and paid.

5. Payment Method

Indicate how the payment was made (e.g., cash, credit card, debit card, etc.), which helps in confirming the transaction type and ensuring proper records.

Select a format based on the purpose and audience of your invoice receipt. For standard use, PDF works best due to its compatibility with most devices and ability to maintain formatting across platforms. PDFs also look professional and are commonly expected in business settings.

If you’re sending the document via email and need it to be easily editable, consider using Word or Excel formats. These allow the recipient to fill in details directly, making them ideal for more interactive transactions or recurring payments.

For simple or quick receipts, a plain text or HTML format can be effective. HTML offers the benefit of easy customization and can be styled to fit your brand, especially when used in email templates.

- PDF: Professional, fixed formatting, widely accepted.

- Word/Excel: Editable, ideal for recurring or customizable receipts.

- HTML/Text: Quick, simple, and customizable for emails.

Always keep your recipient’s preferences and the level of formality required in mind when choosing the format. A simple, clean design works best in most cases to ensure the receipt is clear and easily readable.

Adjust the template by replacing the generic business name and address fields with your own company details. Include your logo for a professional touch. Modify the header section to reflect your business identity, such as a specific tagline or brand color.

Customize the item list to match the products or services you offer. Add or remove columns as needed, such as quantity, description, or discounts, depending on your business model. You can also set up a payment terms section based on your preferred methods, whether that’s immediate payment or net terms.

Ensure that tax rates are configured based on your location or industry standards. Some regions have specific sales tax rates, so update this section to comply with local regulations. Include any relevant terms or policies, such as return policies or shipping charges, to avoid confusion.

If you use specific invoicing software, you might have the option to integrate your invoice template directly into the system, reducing manual work. This can help automate invoice numbering, due dates, and reminders, ensuring smooth operations.

Lastly, adjust the font size and style to suit your brand guidelines. A clean, readable format makes it easier for clients to understand your invoice. Test different customizations to find what works best for your needs.

If you need a quick way to create receipts, there are several free tools and templates that can help. Canva offers a variety of customizable receipt templates. Simply select a design, add your business details and transaction information, and you’re ready to go. It’s a user-friendly option that doesn’t require design skills.

Microsoft Word and Google Docs also provide free templates that you can easily edit. Both platforms offer simple, clean designs that can be tailored to match your business branding. These templates typically include all necessary sections, such as the date, items purchased, prices, and customer details.

Another solid option is Zoho Invoice, which allows you to create professional-looking receipts for free. You can easily customize the layout and include additional details like tax rates and payment terms. Zoho also offers free cloud storage for your receipts, making them easy to access later.

If you prefer a straightforward approach, Invoice Generator is a free online tool that allows you to create and download receipts instantly. It doesn’t require registration, and the interface is simple to use, making it ideal for quick, one-off transactions.

Each of these tools gives you the flexibility to create customized receipts that suit your needs without the hassle of complicated software or high costs. Whether you’re handling personal sales or managing a small business, these free resources will streamline your process and help keep everything organized.

Common Mistakes to Avoid When Designing One

Avoid cluttering your invoice with excessive details. Only include the most necessary information, such as the service/product description, amount, due date, and payment instructions. Too much text or irrelevant information can confuse the recipient and delay payments.

1. Not Including Clear Payment Terms

Clearly state the payment terms, such as the due date and late fees, to avoid confusion. Missing this step may lead to delayed payments or clients misunderstanding when payment is expected.

2. Using Unreadable Fonts or Colors

Stick to simple, legible fonts like Arial or Times New Roman. Avoid fancy fonts or hard-to-read color combinations that might make the invoice difficult to interpret. Readability should be your priority to ensure all important details are easily accessible.

3. Failing to Include a Unique Invoice Number

Each invoice should have a unique identifier. This helps both you and your client track payments and avoid confusion. Without it, it becomes challenging to reference past transactions or reconcile records.

4. Ignoring Consistent Formatting

Inconsistent alignment, font sizes, or spacing can make your invoice appear unprofessional. Make sure to use a uniform structure and layout across all invoices to create a polished and cohesive appearance.

5. Missing Company or Client Contact Information

Include your full company name, address, phone number, and email address. This makes it easy for clients to reach you if there are any questions about the invoice or payment.

6. Forgetting to Include Taxes

If applicable, list taxes clearly and separately from the total amount due. Failure to include taxes can lead to misunderstandings and may violate local tax regulations.

Ensure your invoice or receipt meets local legal requirements. It is necessary to include specific information, such as the business name, address, and tax identification number (TIN). Many jurisdictions require invoices to have clear details regarding the nature of the transaction, the amount charged, and any applicable taxes. Non-compliance with these requirements can result in fines or legal complications.

Tax Information on Invoices

When issuing receipts, including the correct tax information is critical. In some regions, businesses are required to charge Value Added Tax (VAT) or sales tax, which should be clearly itemized on the invoice. Be sure to include the tax rate applied, the total amount of tax, and the subtotal before tax. Incorrect tax calculations or omissions can cause issues during tax audits.

Record Keeping for Tax Purposes

For tax purposes, keeping accurate records of all issued invoices and receipts is necessary. Many tax authorities mandate businesses to retain these documents for a specific period, typically between 5 to 7 years. This will help in case of any disputes or audits, as it allows you to verify the financial transactions with supporting evidence.

| Document Component | Legal Requirement |

|---|---|

| Business Name | Must be included on all invoices and receipts |

| Tax Identification Number (TIN) | Often required for tax purposes |

| Transaction Details | Should clearly state the services or goods provided |

| Tax Information | Itemize the tax rate and total tax charged |

| Retention Period | Typically 5 to 7 years for tax audits |

Make sure to stay up-to-date on the specific tax rules in your area, as tax regulations can change over time. Keeping a consistent and accurate invoice system is an important part of maintaining compliance and avoiding penalties.

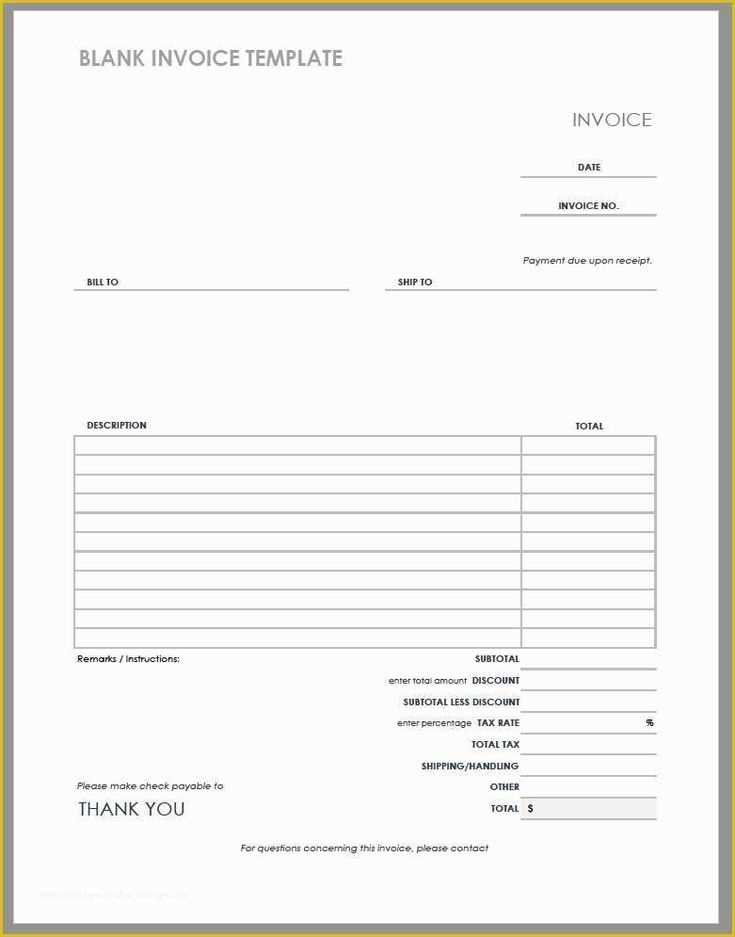

To create a simple and clean invoice receipt template, include the following key sections for clarity and professionalism:

- Header: Use your business name, logo, and contact information at the top of the template. This will ensure that customers know exactly who issued the invoice.

- Invoice Number: Assign a unique invoice number for tracking purposes.

- Date: Include the date of the transaction and the payment due date, making it clear when the payment is expected.

- Customer Information: List the customer’s name, address, phone number, and email. This helps ensure there is no confusion about the recipient.

- Itemized List: Detail the products or services provided, along with their quantities and unit prices. Add a column for the total price of each item.

- Subtotal: Calculate the total amount before taxes and discounts.

- Taxes and Discounts: Clearly show any applicable taxes or discounts, so the customer understands how the final amount was reached.

- Total Amount: List the final total, which includes the subtotal, taxes, and any discounts.

- Payment Instructions: Provide clear instructions for how the customer can make the payment, such as bank details, online payment links, or methods of payment accepted.

- Thank You Note: End with a polite note thanking the customer for their business, fostering a positive relationship.

Formatting Tips

- Use a clean and simple layout. Avoid clutter to make the invoice easy to read.

- Consider including bold text for headings and totals to draw attention to key information.

- Make sure to leave enough white space between sections to enhance readability.