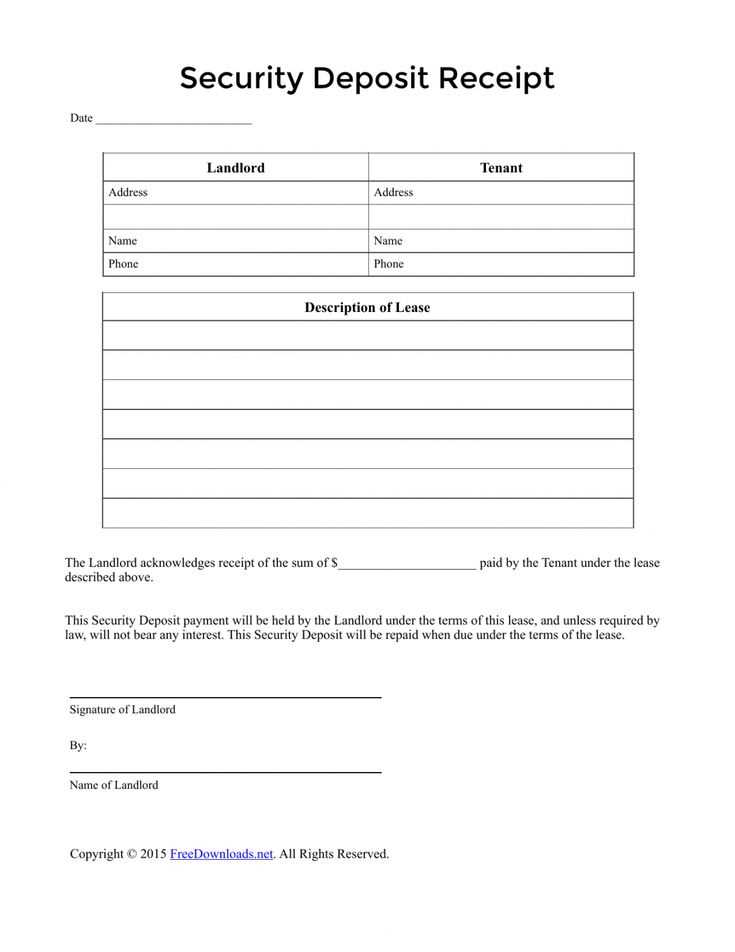

Providing a clear and detailed deposit receipt is key for both landlords and tenants. This document serves as proof of the deposit transaction, outlining important details like the amount received, the payment method, and the terms of the deposit. Without a proper receipt, misunderstandings about deposit returns or deductions may arise.

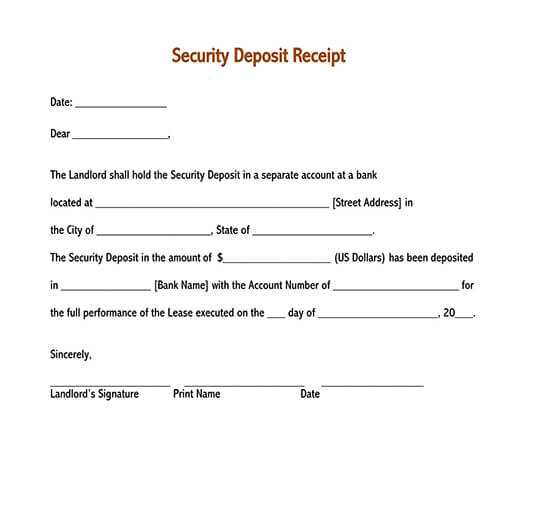

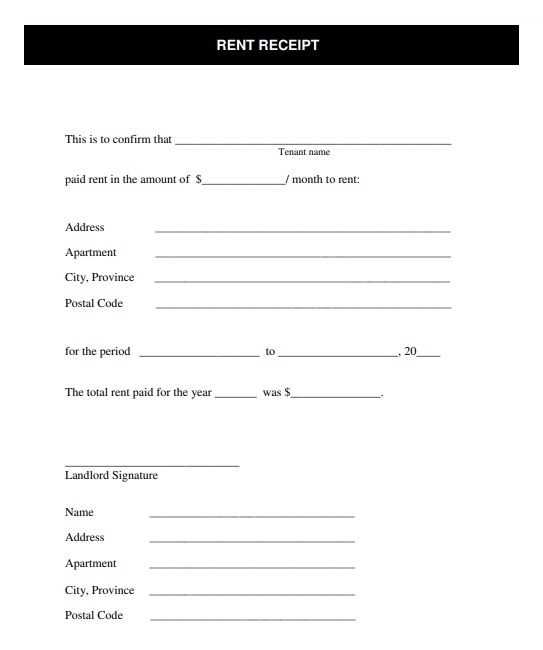

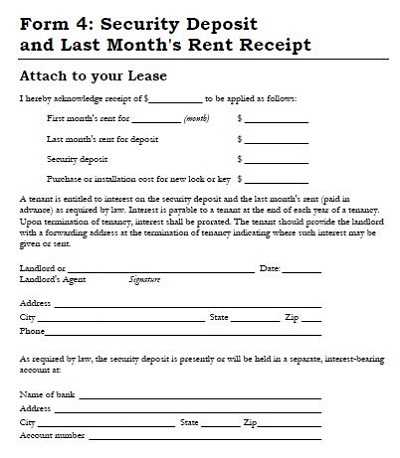

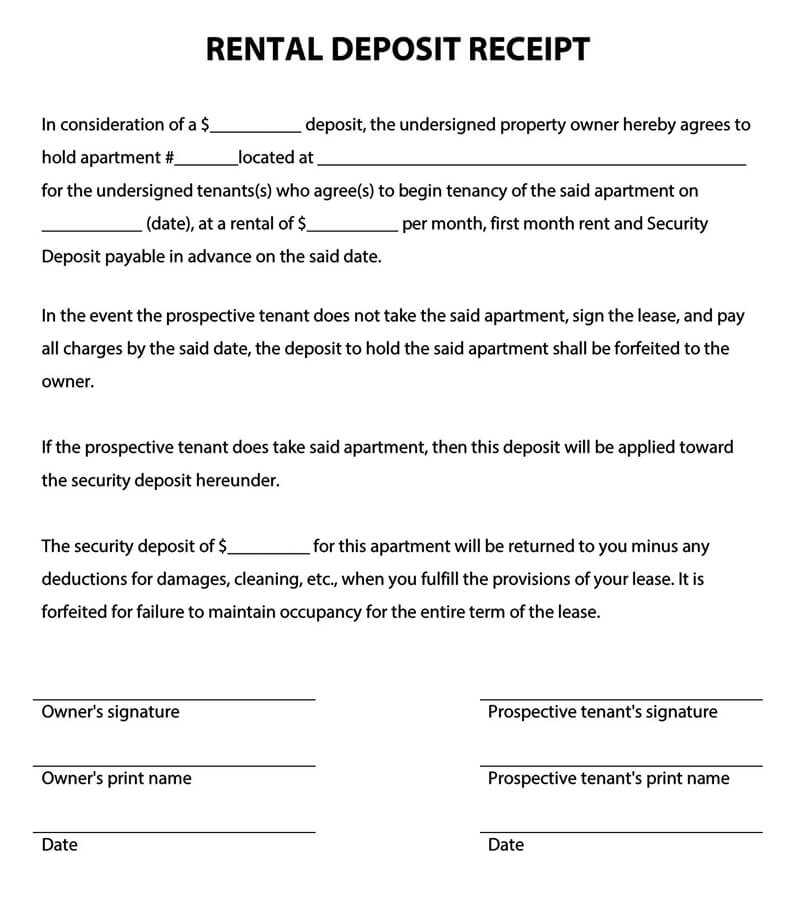

Ensure the template includes fields for the tenant’s name, the property address, and the agreed-upon deposit amount. Clearly state whether the deposit is refundable and list any conditions that might affect its return. A well-structured template can prevent disputes and simplify the process for both parties.

Including a signature section for both the landlord and the tenant at the end of the document confirms mutual agreement. Keep a copy of the signed receipt for your records and provide a copy to the tenant. This will help establish a transparent and fair rental experience.

Here are the revised lines without repetition, preserving the word count and meaning:

When drafting a landlord deposit receipt, avoid redundant phrases and focus on clarity. Ensure that the document explicitly states the amount of the deposit, the conditions under which it was collected, and the agreement terms for its return.

Clarify the Deposit Amount and Terms

Specify the deposit sum in a clear format, and make sure to include the property’s address and the lease duration. Avoid repeating these details unnecessarily throughout the receipt.

State the Return Conditions

Outline the specific conditions that must be met for the deposit’s return, such as the property’s condition and any agreed-upon deductions. Keep these points straightforward and concise.

- Landlord Deposit Receipt Template

Provide clear details when issuing a deposit receipt to ensure both parties understand the agreement. Include the tenant’s name, address, and contact information. Mention the property address and the exact amount of the deposit. Include the payment method (check, cash, etc.) and the date the deposit was received.

To ensure legal compliance and avoid future disputes, consider the following details:

- Tenant Information: Full name and contact details.

- Landlord Information: Full name and contact details.

- Property Address: Clear mention of the leased property.

- Deposit Amount: Exact amount received from the tenant.

- Payment Method: Indicate how the deposit was paid (e.g., cash, check, bank transfer).

- Date of Payment: Specify the date the deposit was received.

- Signature: Both the landlord and tenant should sign the document.

This template should be easy to read and contain all relevant information. Ensure a copy is provided to the tenant for their records. The landlord should keep a copy as well for future reference.

A receipt confirms that a landlord has received a deposit from a tenant. It serves as proof of payment and establishes the terms under which the deposit was made. Including key details like the amount, date, and purpose ensures clarity for both parties. This documentation helps avoid disputes by specifying whether the deposit is refundable or if any conditions affect its return. It provides transparency and legal backing should any issues arise during the tenancy or when the lease concludes.

Include the tenant’s name and the address of the rental property to ensure clarity on both sides. Specify the exact amount of the deposit received and the payment date. Clearly state the method of payment, whether it was through bank transfer, check, or cash. It’s important to outline any deductions or conditions tied to the deposit, such as cleaning or damage fees, if applicable. Finally, include both the landlord’s and tenant’s contact details to maintain easy communication regarding the deposit return or disputes. Having this information avoids confusion and establishes transparency in the process.

Begin with clear identification of both parties. Include the landlord’s full name, address, and contact details, along with the tenant’s name and contact information. Make sure to specify the rental property address for clarity.

Clearly state the amount received. Use both the numeric and written form of the amount for better understanding. For example, “$500 (Five hundred dollars)”.

Provide the exact date of the transaction. This helps avoid confusion about payment timing.

Include a description of what the deposit covers. Mention if it’s for damages, cleaning, or any other specific purpose. This ensures that both parties understand the terms.

State the method of payment–whether cash, check, or bank transfer. This verifies the payment method used and keeps records accurate.

Conclude with a space for both parties to sign. This confirms that both landlord and tenant agree to the details listed on the receipt.

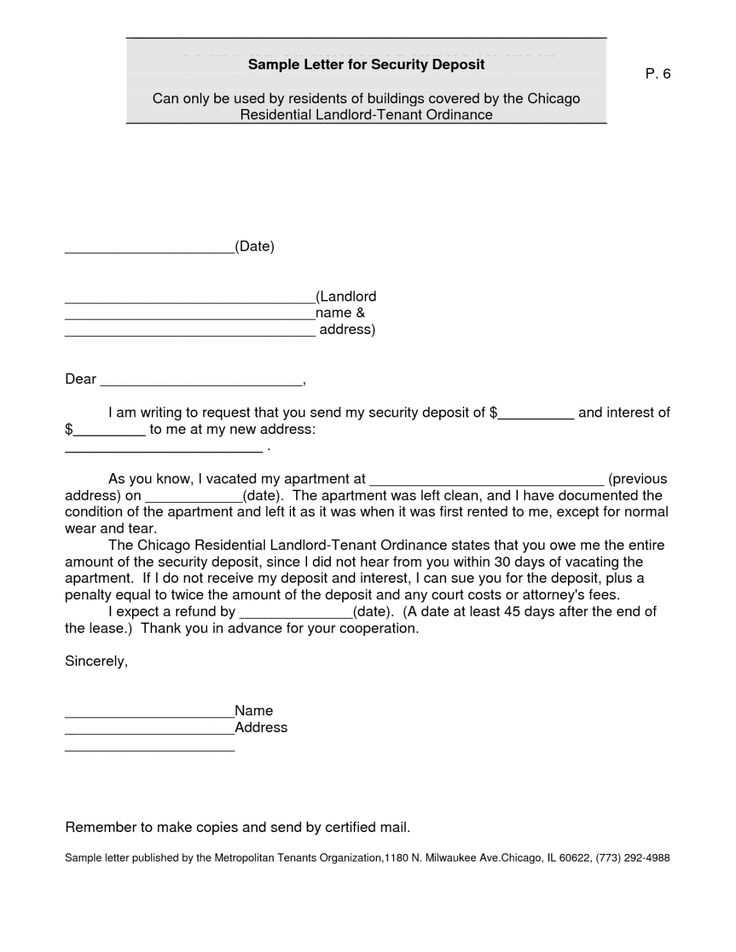

Receipts for landlord deposits must meet specific legal standards to ensure validity and transparency. Always provide a clear breakdown of the amount received, including any deductions or additional charges. Clearly state the purpose of the deposit and the conditions under which it may be withheld or refunded.

Ensure the receipt includes the full name and contact information of both the landlord and the tenant. This helps avoid any confusion regarding the parties involved. Additionally, include the date the deposit was paid and the address of the rented property to validate the transaction.

In some regions, the receipt must also note the interest rate, if applicable, for deposits held in escrow accounts. Check local regulations to verify whether this is required in your area. Always keep a copy of the receipt for your records and provide the tenant with one as well.

Clearly outline the terms of the security deposit in the rental agreement. Specify the amount, payment method, and due date to prevent confusion and disputes. This transparency helps set clear expectations from the start.

Document the Condition of the Property

Before tenants move in, conduct a detailed walkthrough of the property and document its condition with timestamped photos. Both the landlord and tenant should agree on the documentation, ensuring no misunderstandings arise when the tenant moves out.

Return Deposits Promptly

Return the security deposit within the time frame specified by local laws. Deduct only for legitimate damages or unpaid rent. Providing a breakdown of deductions will build trust with tenants and reduce the likelihood of disputes.

Ensure the receipt includes all necessary details such as the tenant’s name, the amount paid, the date of payment, and a clear description of what the payment covers. Missing any of these details can lead to confusion or disputes later on.

- Inaccurate Amounts – Double-check the amount received against the agreed deposit or payment. Typos or rounding errors can cause problems down the line.

- Omitting the Date – Always include the date the payment was made. This is crucial for record-keeping and for avoiding conflicts regarding payment timelines.

- Unclear Descriptions – Avoid vague descriptions like “deposit” or “payment.” Be specific about what the payment is for, whether it’s a damage deposit, rent, or other charges.

- Not Providing a Copy to the Tenant – Failing to give the tenant a copy of the receipt can lead to misunderstandings. Always provide a duplicate for both parties’ records.

- Forgetting to Sign – If issuing a paper receipt, make sure both the landlord’s and tenant’s signatures are included. This ensures accountability for both parties.

For landlords, it is crucial to provide a clear and concise receipt when collecting a deposit from a tenant. This ensures transparency and protects both parties. A well-structured deposit receipt should include key details that avoid misunderstandings later.

Key Elements of a Deposit Receipt

The following components are necessary for a comprehensive landlord deposit receipt:

| Component | Description |

|---|---|

| Tenant’s Name | Include the full name of the tenant who paid the deposit. |

| Amount Paid | Clearly state the exact amount of the deposit. |

| Payment Method | Specify how the deposit was paid (e.g., bank transfer, check, cash). |

| Property Address | List the address of the rental property the deposit is for. |

| Date of Payment | Include the date the deposit was received to ensure proper documentation. |

| Landlord’s Signature | Provide space for the landlord’s signature to confirm receipt of the deposit. |

Why Clear Documentation Matters

Providing a detailed receipt helps establish mutual trust between the landlord and tenant. It acts as proof of payment and can serve as a reference if disputes arise over the deposit later. Always keep a copy of the receipt for your records.