Avoiding unintended tax consequences in a 457(b) deferred compensation plan requires careful structuring of distributions. The concept of constructive receipt plays a key role in determining when funds become taxable. If income is available to an employee without restriction, the IRS may classify it as received–even if it has not been withdrawn.

To maintain tax deferral, compensation must remain subject to a substantial risk of forfeiture or an explicit distribution schedule. Employers should ensure that plan documents and payout structures prevent early access that could trigger unwanted tax liabilities.

A well-drafted agreement outlines deferral elections, distribution timing, and permissible changes. Clarity in these terms minimizes the risk of early taxation and aligns with IRS regulations. Understanding how constructive receipt applies to different scenarios helps participants maximize benefits while staying compliant.

457(b) Deferred Compensation Constructive Receipt Template

Ensure compliance with IRS regulations by structuring deferral elections correctly. Contributions must be designated before the start of the plan year and remain irrevocable once the election period closes.

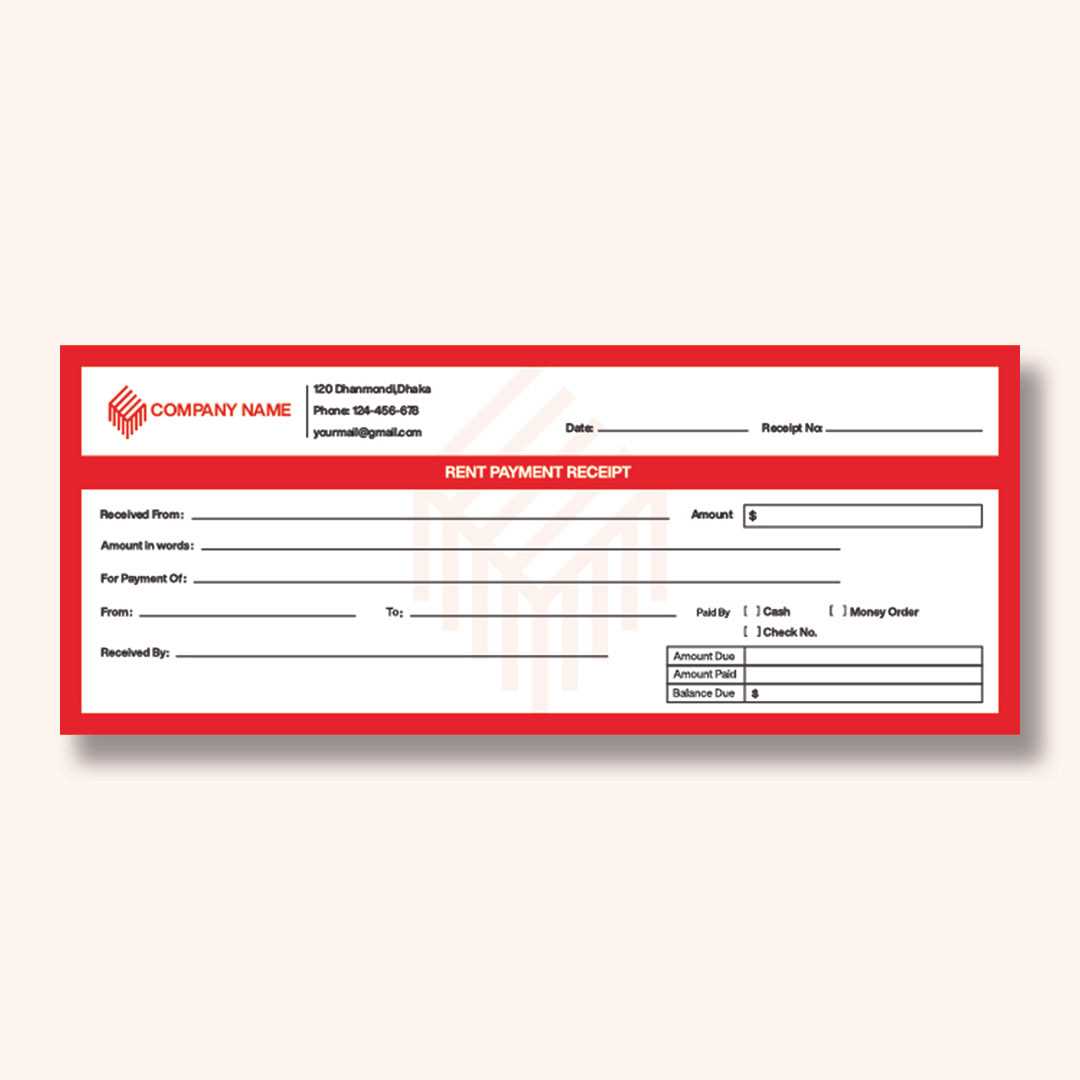

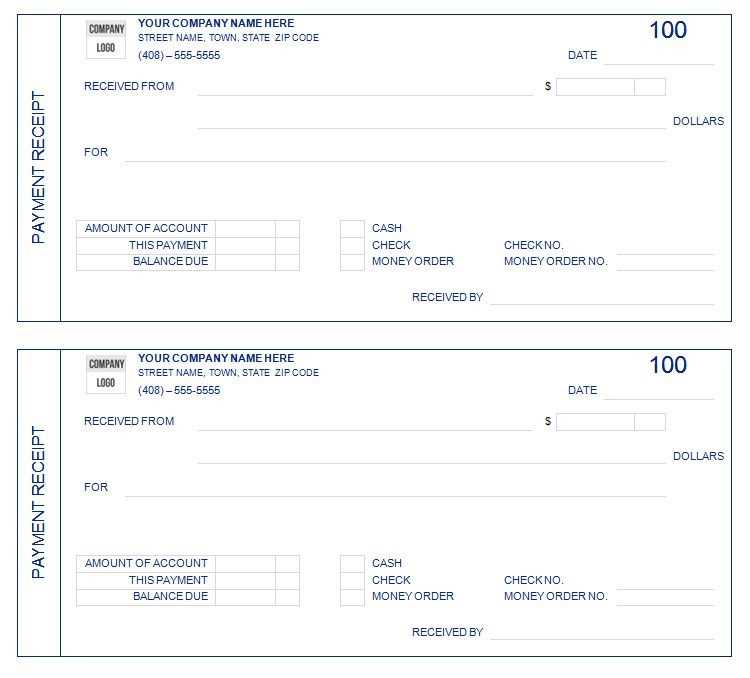

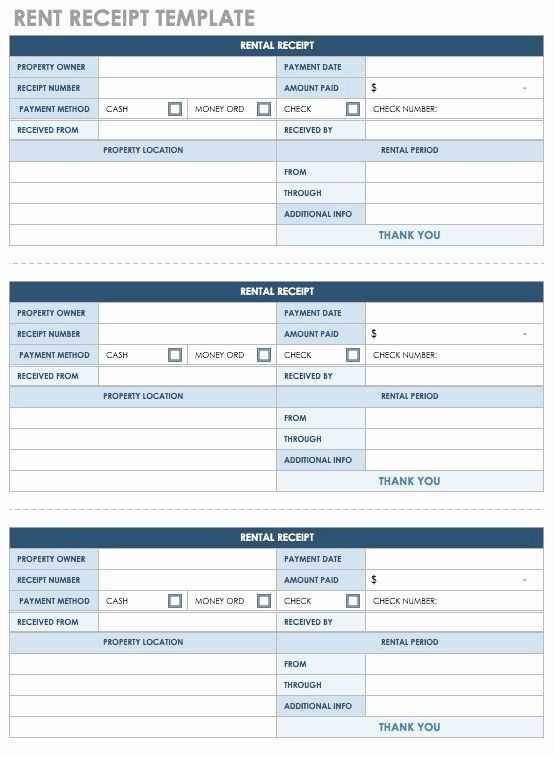

Use the template below to document deferral elections and distribution preferences clearly:

| Employee Name | Deferral Amount (%) | Distribution Trigger | Payout Option |

|---|---|---|---|

| [Full Name] | [Percentage or Fixed Amount] | [Retirement, Separation, or Specific Date] | [Lump Sum or Installments] |

Specify distribution conditions precisely. A change in payout elections is only allowed under specific circumstances, such as an unforeseen emergency, subject to plan approval.

Verify that deferrals are credited correctly and that distributions align with pre-set elections. Noncompliance may result in immediate taxation and penalties.

Ensure records are maintained for audit purposes. Retain signed election forms and any amendments to avoid disputes regarding payout terms.

Defining Constructive Receipt in 457(b) Plans

Income in a 457(b) plan remains tax-deferred until distribution, but constructive receipt rules determine when taxation applies. The IRS defines constructive receipt as income that is made available to the participant without restriction, even if it is not physically received.

- Nonqualified Status: Unlike 401(k) plans, 457(b) accounts for government and tax-exempt employees operate under different tax principles. Deferrals remain untaxed as long as the funds are unavailable for withdrawal.

- Restrictions on Access: Participants cannot freely access funds before an eligible event, such as retirement, separation from service, or an unforeseeable emergency.

- Impact of Plan Design: Some plans allow elections to delay distributions beyond initial payout dates, preventing constructive receipt as long as deferrals follow plan terms.

- Risk of Early Taxation: If funds are transferred outside the plan’s structure or participants gain unrestricted control, taxation occurs immediately.

To maintain tax-deferred status, contributions must remain subject to substantial limitations on withdrawal. Reviewing plan terms ensures compliance and prevents unintended tax liabilities.

Key IRS Rules Affecting Deferred Payouts

The IRS enforces strict timing rules on deferred compensation to prevent early or improper distributions. Payments can only be made under specific conditions, such as separation from service, disability, death, a fixed date, change in company ownership, or unforeseen emergencies. Any deviation can trigger immediate taxation and penalties.

Once a payout schedule is set, changes require a minimum five-year delay from the original date and must be requested at least 12 months in advance. This prevents last-minute adjustments that could be seen as an attempt to access funds prematurely.

Deferrals must be documented before the year they take effect. Late elections result in immediate taxation, eliminating the intended tax advantages. Employers must ensure compliance with Section 409A to avoid penalties, including a 20% additional tax on affected distributions.

Failure to meet these guidelines can result in the entire deferred amount being taxed in the first year it becomes non-compliant. Proper planning and adherence to IRS regulations help maintain tax deferral benefits and avoid unnecessary financial consequences.

Structuring a Template for Payment Deferrals

Specify eligibility criteria clearly. Define which employees or contributors qualify for deferrals based on income thresholds, tenure, or other relevant factors.

Outline deferral limits with exact percentages or dollar amounts. Ensure the template reflects IRS regulations and aligns with the organization’s financial policies.

Detail the election process by setting clear deadlines and submission methods. Require written or electronic confirmations to avoid misunderstandings.

Include distribution rules that explain payout schedules, withdrawal conditions, and tax implications. Address hardship withdrawals and early distributions with precise terms.

Ensure compliance by referencing specific legal provisions. Regular updates to the template prevent conflicts with changing regulations.

Provide a signature section for both the participant and an authorized representative. This final step formalizes the agreement and confirms mutual understanding.

Tax Implications of Early and Late Distributions

Early distributions from a 457(b) deferred compensation plan can lead to significant penalties. If you withdraw funds before the age of 59½, the IRS imposes an additional 10% penalty on the distribution, unless you meet specific exceptions. This penalty is applied on top of regular income taxes. For instance, if you take an early withdrawal of $10,000, you could face a penalty of $1,000, plus the tax due on the distribution.

On the other hand, late distributions–those made after reaching the age of 72–are subject to Required Minimum Distribution (RMD) rules. Failure to take the RMD on time triggers a penalty of 50% of the required amount not withdrawn. For example, if your RMD is $5,000 and you fail to withdraw it, you could owe a penalty of $2,500 in addition to any regular income taxes.

Both early and late distributions require careful planning to avoid unexpected tax burdens. Ensure you account for penalties and RMD obligations to manage your tax liabilities effectively.

Compliance Checklist for Employers and Plan Administrators

Ensure the plan complies with all IRS regulations to avoid penalties. Regularly review IRS guidelines related to deferred compensation plans. Check if the plan design aligns with Section 457(b) requirements, such as eligibility criteria and deferral limits.

Verification of Eligibility

- Confirm that the plan only applies to eligible employees and independent contractors.

- Ensure that the participant’s deferrals do not exceed annual limits set by the IRS.

Plan Documentation

- Maintain clear, written agreements for each plan participant, outlining the terms of deferral and distribution.

- Ensure the plan includes provisions for employer contributions and conditions for vesting.

Annual Limits and Reporting

- Verify that deferrals are within IRS limits for the calendar year.

- File the appropriate IRS forms annually to report deferral amounts and other necessary details.

Constructive Receipt Rules

- Confirm that no participant is in constructive receipt of deferred compensation before the distribution date.

- Review the plan’s structure to ensure compensation is not made available to the employee earlier than permitted by the agreement.

Plan Termination Compliance

- Establish clear guidelines for the termination of the plan, addressing the disbursement of deferred amounts.

- Ensure compliance with IRS rules regarding early distributions and penalties.

Common Errors in Constructive Receipt Documentation

Accurate documentation is key when managing constructive receipt, but common mistakes can lead to complications. One frequent error is failing to clearly define the actual date of constructive receipt. If the timing of the receipt isn’t explicitly documented, it may result in the improper application of tax laws.

Misidentifying the Control Transfer Date

It’s crucial to document the exact moment when control over funds or assets shifts to the employee. Ambiguity in this process can lead to discrepancies in tax reporting. Always clarify whether the employee has unrestricted access to the funds or if certain conditions need to be met before access is granted.

Improperly Handling Delayed Payments

Another common mistake is not properly documenting delayed payments. If payments are deferred but not clearly stated as such in the documentation, they could be mistakenly considered as received, leading to premature taxation. Keep records of any agreements or modifications to the original payment schedule.

Ensure all records are thoroughly reviewed for consistency and accuracy to avoid the impact of errors on tax calculations or regulatory compliance.