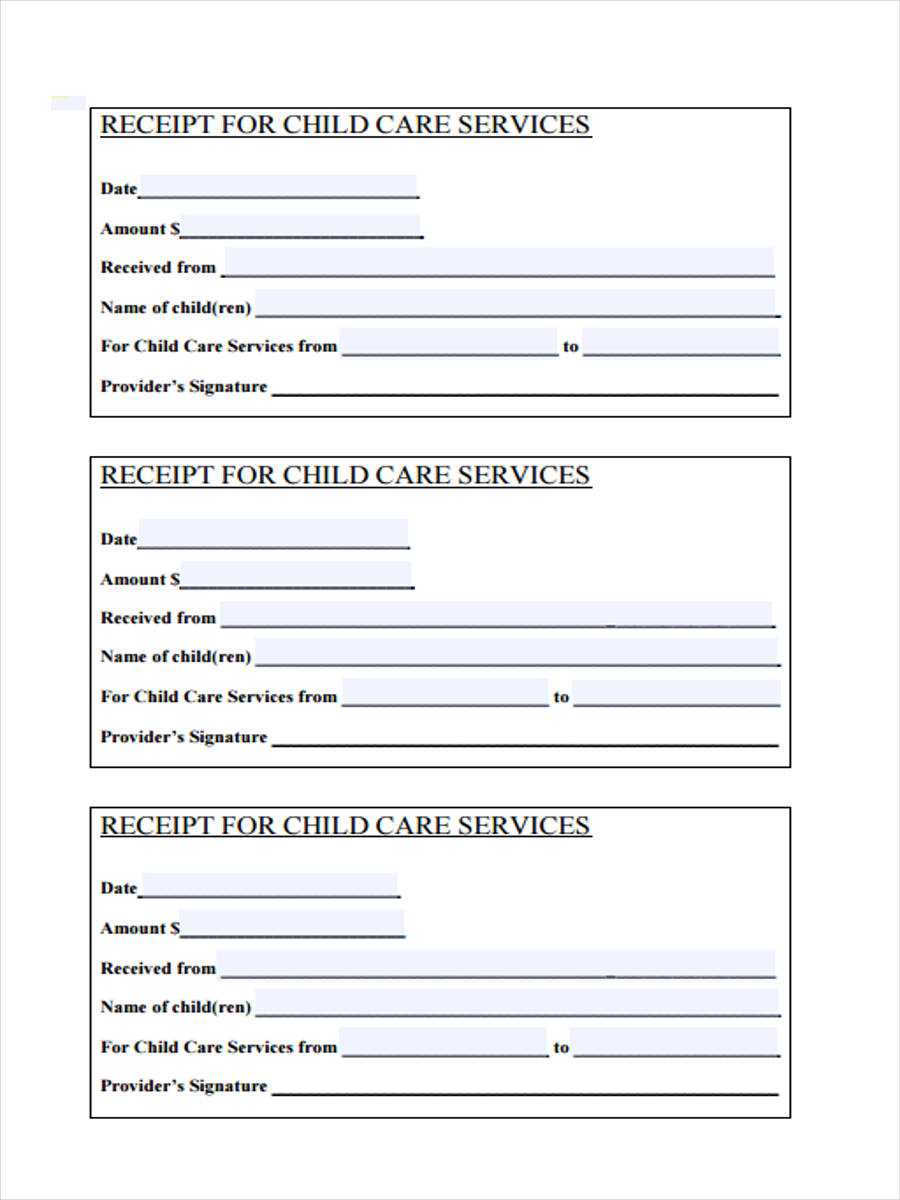

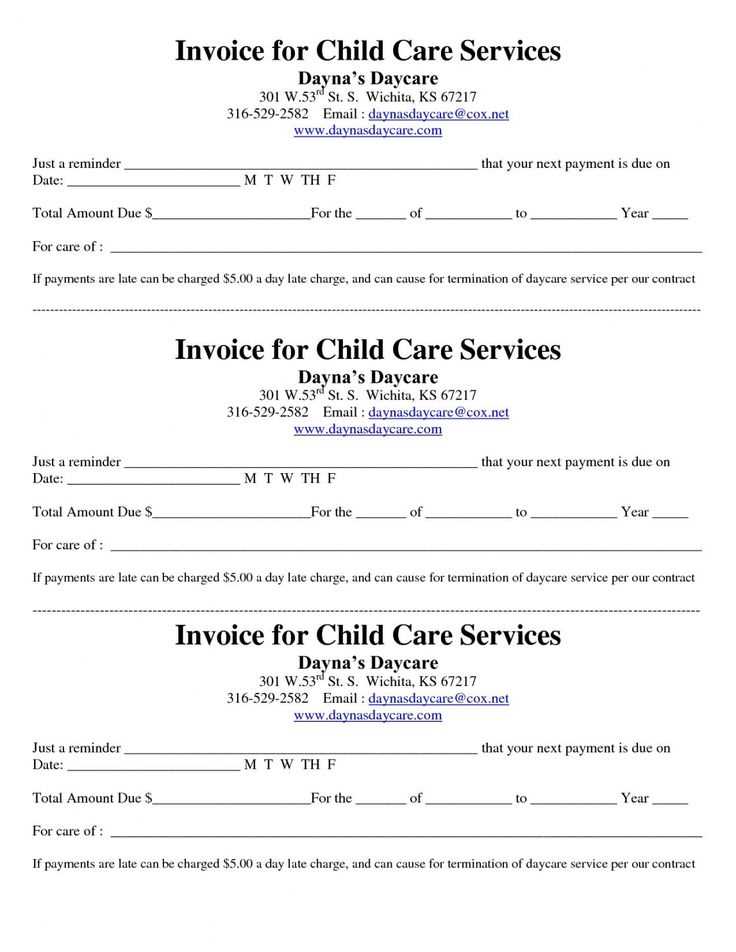

For accurate tax reporting, use a daycare tax receipt template that includes all required details. This will ensure that parents or guardians can claim the correct deductions. A good receipt should outline the daycare provider’s name, business address, and contact details. It must also include the parent’s name, the child’s name, the period of service, and the total amount paid. Make sure the receipt clearly states that the payment is for childcare services.

Ensure correct date formatting for both the start and end of the service period. This avoids confusion during tax filing and ensures that parents have the necessary information for their tax returns. It’s also helpful to itemize any extra charges, like meals or supplies, separately from the basic childcare service fee.

Include your tax identification number (TIN) or business registration number on the receipt. This is a requirement for tax purposes and validates the transaction. Finally, provide a summary of the payment, specifying the total amount paid and any applicable taxes. This will simplify the process for parents when they submit their claims for tax credits or deductions.

Daycare Tax Receipt Template: A Practical Guide

Use a daycare tax receipt template to streamline tax season and ensure accuracy. This template should include basic details such as the daycare provider’s name, address, and tax identification number (TIN). Additionally, include the period of service, total fees paid, and the child’s name. Make sure to specify whether the payments were for childcare, after-school care, or both, as this impacts potential deductions.

Key Information to Include:

- Provider’s Name and Contact Information: Include the full name, address, and TIN or EIN for proper identification.

- Parent’s Information: List the parent’s name and address to verify the individual claiming the deduction.

- Service Dates: Clearly state the start and end dates for the childcare services provided.

- Amount Paid: Total amount paid for services during the tax year, broken down if necessary by type of service.

- Service Description: A detailed breakdown of services rendered (e.g., daycare, extended hours, or special programs).

Ensure accuracy and transparency in the total amount to avoid discrepancies. Provide any necessary supporting documentation or payment receipts that show the amounts paid during the year.

At the end of the year, send the completed template to parents so they can claim appropriate childcare deductions on their tax returns. This simplifies their filing process and ensures that both parties meet tax requirements.

Creating a Simple Daycare Tax Receipt Template

Design your daycare tax receipt template by focusing on clarity and key information. Begin with the name and contact details of your daycare center at the top, followed by the parent or guardian’s name and the child’s name.

Key Details to Include

Ensure the receipt contains the following:

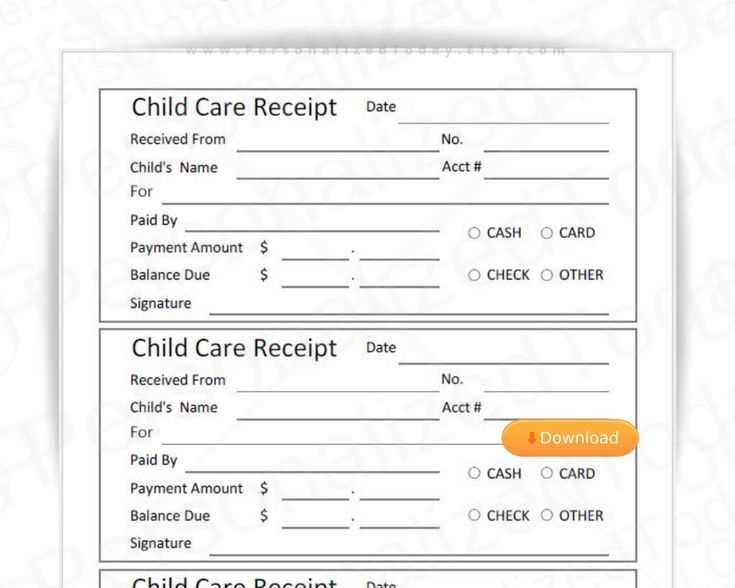

- Receipt Number: Assign a unique number for tracking purposes.

- Date of Service: Specify the exact dates the service was provided.

- Total Amount Paid: Include the total payment received for daycare services during the period.

- Payment Method: Mention whether payment was made by check, cash, or credit card.

- Tax ID Number: Provide your daycare’s tax identification number for the parent’s tax records.

- Signature: Leave space for the daycare provider’s signature for authenticity.

Simple Template Layout

Structure the template in a clean, easy-to-read format. You can use a simple table to organize the data:

| Daycare Center: | [Daycare Name] |

| Parent Name: | [Parent Name] |

| Child Name: | [Child Name] |

| Receipt Number: | [Unique Number] |

| Service Dates: | [Start Date] to [End Date] |

| Total Amount Paid: | [Amount] |

| Payment Method: | [Payment Method] |

| Tax ID: | [Tax ID Number] |

Finish with a clear sign-off and contact details for any follow-up. Keep the receipt concise, with no unnecessary details or decorative elements. This will help parents keep track of their expenses easily for tax purposes.

Required Information for Daycare Tax Receipts

Ensure your daycare tax receipt includes these key details to comply with tax requirements:

- Daycare Provider’s Name and Address: This must include the full name of the daycare facility or individual, as well as the physical address where services are provided.

- Tax Identification Number (TIN) or Employer Identification Number (EIN): This is required to verify the legitimacy of the daycare provider for tax reporting purposes.

- Parent or Guardian’s Name: The full name of the parent or guardian who is claiming the tax deduction.

- Child’s Name: The name of the child receiving daycare services must be clearly stated.

- Dates of Service: Include the specific range of dates during which daycare services were provided, often broken down by month or week.

- Amount Paid: List the total amount paid for services, including any additional fees or charges for special activities or services.

- Payment Method: Note the method of payment (e.g., check, credit card, cash), especially if it’s relevant for tax documentation.

- Signature of Provider: A signature or stamp from the daycare provider, confirming the authenticity of the receipt.

Accurate and complete information ensures that the receipt can be used for tax filing purposes without issues. Keep all receipts organized to streamline your tax process.

How to Customize the Template for Multiple Children

To customize your daycare tax receipt template for multiple children, you need to include separate entries for each child’s care costs. This can be done by adjusting the template structure to accommodate multiple sections or rows dedicated to each child. For each child, include their name, dates of attendance, hours of care, and the corresponding fees. This makes it clear for tax purposes how much was paid for each individual child.

Step 1: Add Separate Child Sections

Start by creating a new section in your template for each child. Label each section with the child’s name and identification details (if necessary). For example:

- Child’s Full Name

- Dates of Attendance

- Total Hours of Care

- Total Fees

This organization will keep the receipt neat and easy to follow. Repeat this for each child you are claiming daycare costs for.

Step 2: Modify the Total Calculation

Ensure that the total fees section reflects the sum of all individual child entries. This total should account for all the children under your care. In your template, adjust the total line to include a formula that adds the costs for each child’s section. For example, if you are using spreadsheet software, use the SUM function to calculate the total automatically.

By customizing this way, you can easily manage multiple children on a single receipt, ensuring that each child’s expenses are clearly listed and tracked for tax purposes.