For non-profits, providing a donation receipt is not just a legal requirement, but a vital step in maintaining transparency and trust with your supporters. A simple, clear, and well-organized receipt can prevent confusion and protect both the donor and the organization. Use this template to ensure your receipts meet all necessary standards.

Your receipt should include donor information, such as their full name, address, and donation details. Be sure to specify whether the donation is monetary or non-monetary, and include the fair market value if applicable. Non-cash donations must also be described in detail for tax purposes.

Additionally, always remember to include your organization’s tax-exempt status number. This assures donors that their contributions are eligible for tax deductions. A clear thank you note goes a long way, reinforcing the positive impact of their generosity.

Keep in mind that your receipt should be delivered promptly, ideally immediately after the donation, either via email or postal mail. This practice fosters trust and helps donors with their tax filings for the year.

Not for Profit Donation Receipt Template

Make sure your donation receipt template is clear, accurate, and includes all necessary details to satisfy both legal requirements and the donor’s needs. A well-structured receipt not only helps in tax deductions but also builds trust with your supporters.

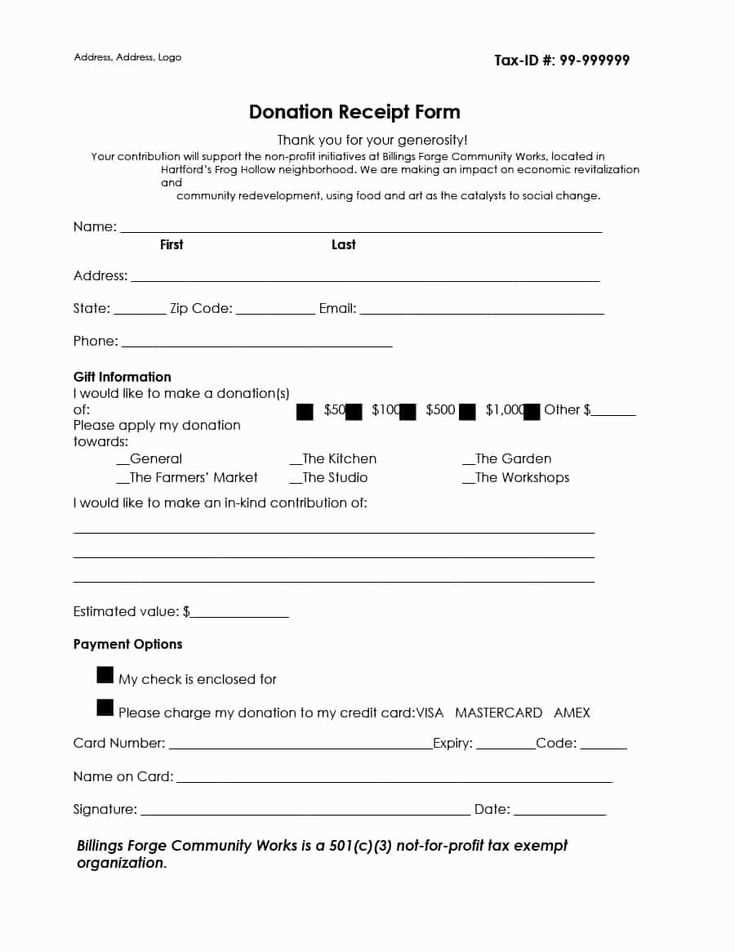

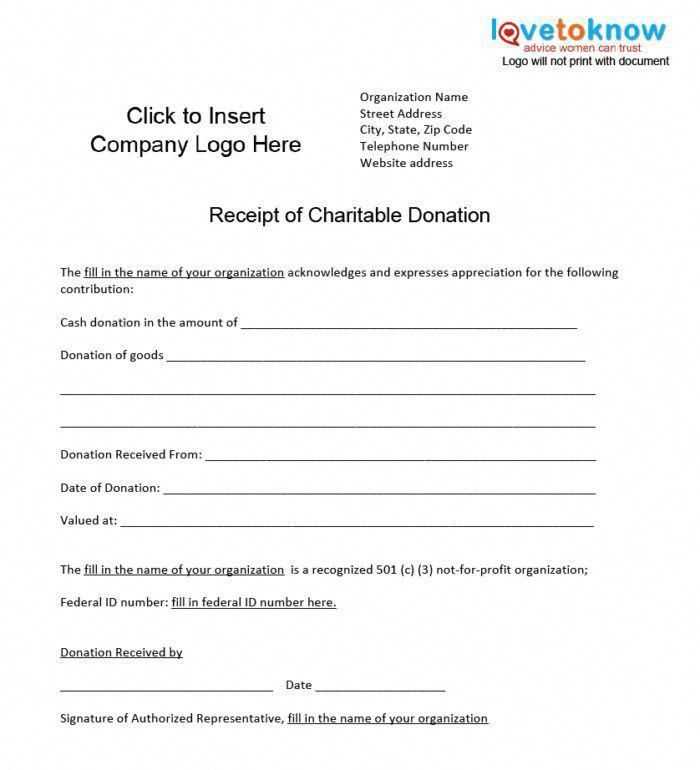

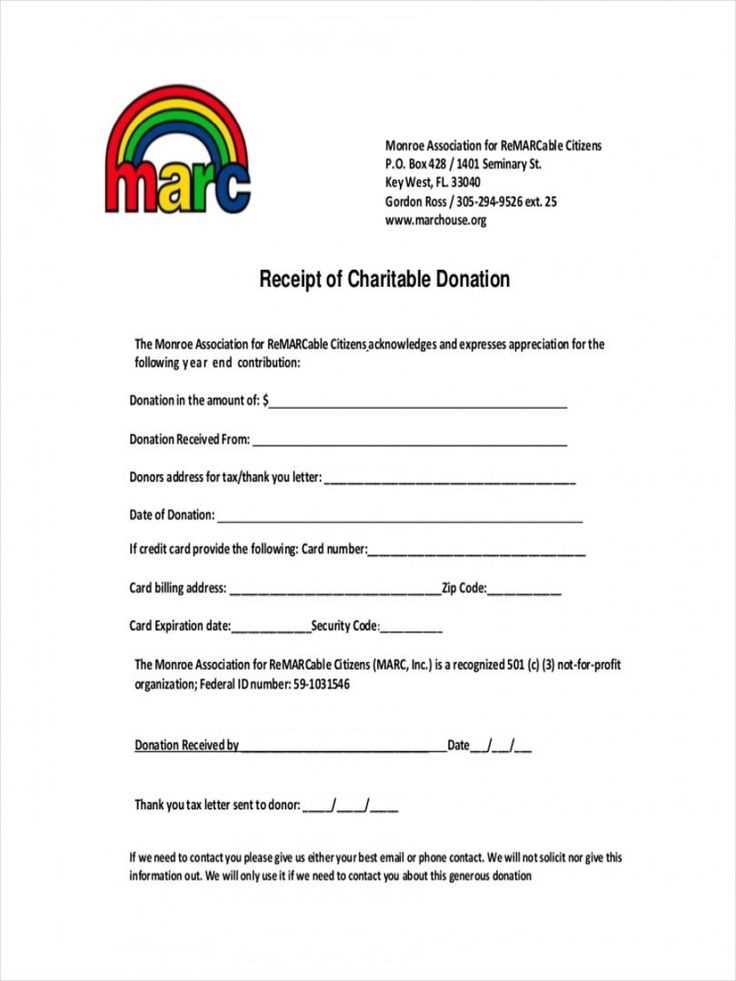

- Organization Information: Start with the name of your organization, address, and contact information. Include your tax-exempt status or EIN (Employer Identification Number) if applicable.

- Donor Information: Clearly state the name and address of the donor. This ensures the receipt is personalized and can be used for tax purposes.

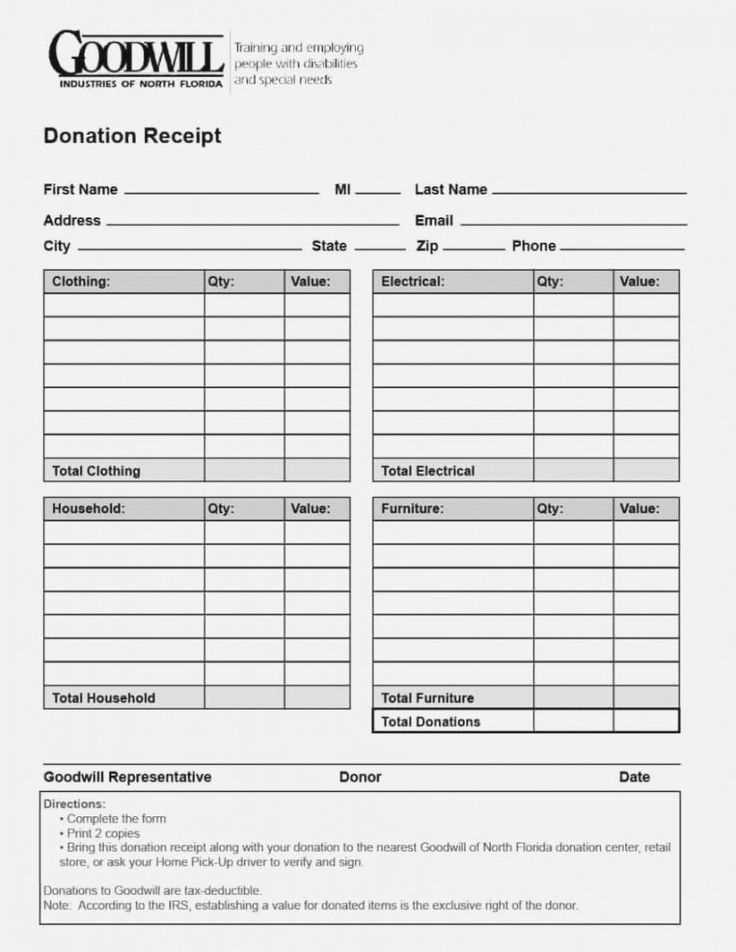

- Donation Details: Specify the date of the donation, the amount donated, and whether the contribution was monetary or non-monetary. If the donation is in-kind (e.g., goods), provide a description of the items.

- Statement of No Goods or Services Provided: If your organization did not provide any goods or services in exchange for the donation, include this statement: “No goods or services were provided in exchange for this contribution.” This is crucial for tax purposes.

- Signature: Include a signature from an authorized representative of your organization. This adds legitimacy and confirms the donation was officially received.

By ensuring these elements are included, you create a reliable, transparent receipt that donors can use for tax deductions and your organization remains compliant with legal standards. Make it easy for your donors to understand the impact of their support with a simple, straightforward receipt format.

How to Structure a Donation Receipt for Tax Purposes

Make sure your donation receipt includes the donor’s full name, address, and the date of the donation. This establishes a clear record of the transaction and verifies the donor’s identity.

Clearly state the amount donated, or, for non-cash donations, describe the donated item(s) and estimate their fair market value. If the donation involves goods or services, the receipt must note the value of any benefits the donor received in exchange for their gift. Subtract the value of those benefits from the total donation amount to calculate the eligible tax-deductible contribution.

Include the name of your nonprofit organization, its tax-exempt status, and the IRS tax ID number. This confirms that your organization is eligible to issue tax receipts and that the donation qualifies for deductions.

For donations over a certain threshold, provide a written acknowledgment of the contribution. This helps your donors claim deductions accurately. Make sure to include a statement that no goods or services were provided in return for the donation, if that’s the case.

Lastly, use clear language and a professional layout. A well-structured receipt makes it easier for both your nonprofit and the donor to maintain proper tax records.

Customizing a Template for Your Organization’s Needs

Adjusting a donation receipt template to reflect your organization’s unique style and requirements helps make your receipts more professional and aligned with your values. Here’s how to personalize it effectively:

1. Add Your Organization’s Branding

Ensure the template includes your logo, name, and contact details. This creates consistency across all your communications. Use your official brand colors and fonts to make the receipt visually align with your organization’s other materials.

2. Include Specific Legal and Tax Information

Make sure the receipt complies with local tax laws. Include necessary tax-exempt status details, IRS numbers, or other relevant regulatory information. This ensures donors can properly claim deductions and reinforces your credibility.

To further personalize, include a section for a brief description of your mission or a thank-you note, showing appreciation for the donor’s support. Customization helps make each receipt feel meaningful and tailored to the donor’s contribution.

Common Mistakes to Avoid When Issuing Donation Receipts

One of the most common mistakes is failing to include the required information on the receipt. A donation receipt must clearly state the charity’s name, the donor’s name, the donation amount or description, and the date of the donation. Leaving out any of these details could lead to confusion or issues with tax deductions later.

Another issue is incorrectly valuing non-cash donations. If the donor contributes goods or services, you must either include the fair market value or describe the donated items in a way that allows the donor to assign their value. Avoid overstating or understating the value, as it may lead to audit risks or penalties.

Some organizations fail to issue receipts on time. Ideally, receipts should be given immediately after the donation is made, or within a reasonable timeframe. Delaying this process can frustrate donors, especially around tax time when they need their documentation to file returns.

Not providing a proper acknowledgment for in-kind donations is another mistake. In-kind donations require a separate receipt that outlines the goods or services provided, as well as their fair market value. Without this acknowledgment, donors cannot claim a tax deduction.

Another key mistake is issuing receipts that are not signed or include inaccurate details. Ensure the receipt is signed by an authorized individual from the organization and that all fields are filled out correctly. A receipt with errors or missing signatures can be flagged by tax authorities.

Lastly, be cautious with the wording. Avoid phrases like “donation of services” or “exchange of goods.” Tax authorities expect clear, itemized descriptions, and any ambiguity may cause complications. Stick to the language that is transparent and easily understood.