Providing a clear and professional donation receipt is an effective way for nonprofits to maintain transparency and build trust with their donors. A well-structured template not only ensures compliance with tax regulations but also makes it easier for donors to claim deductions.

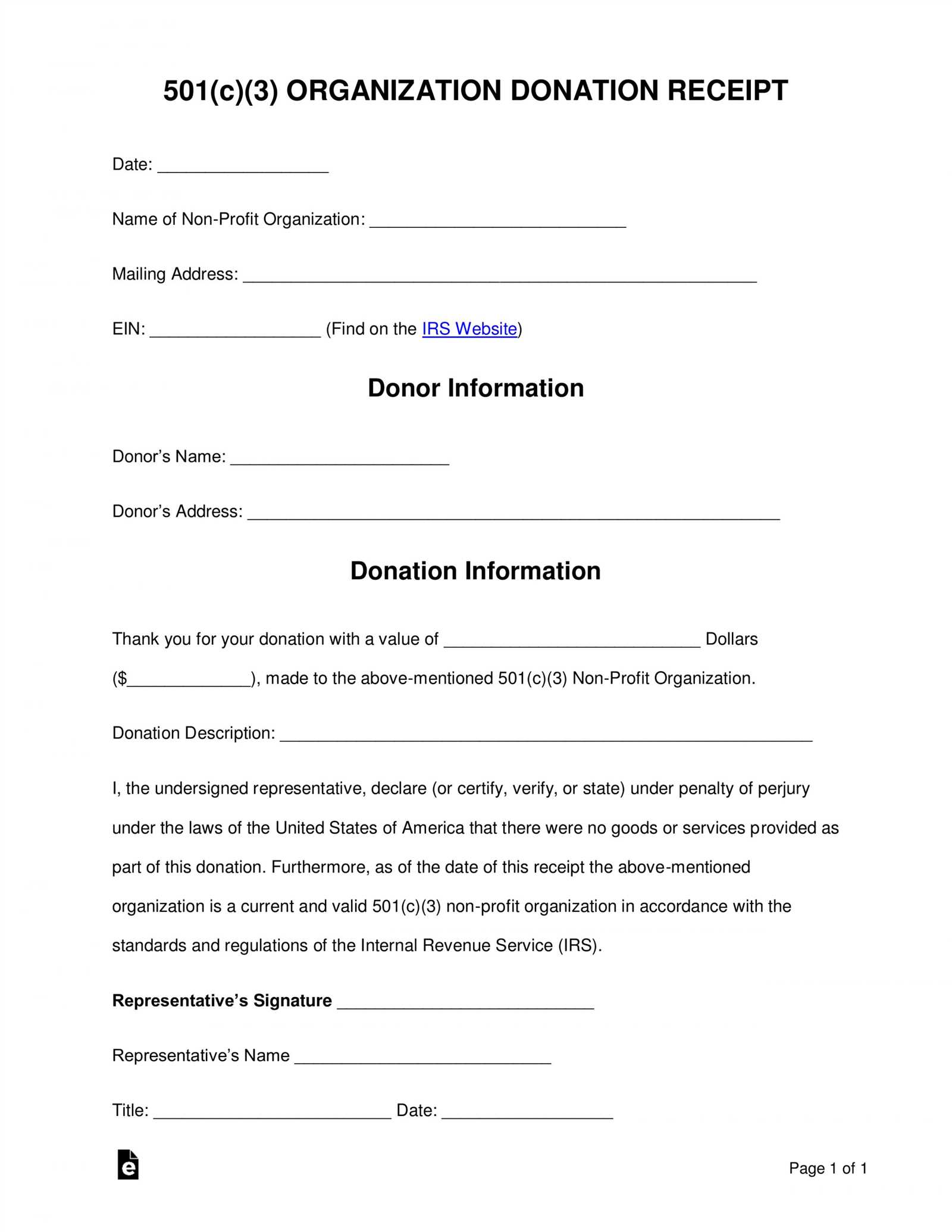

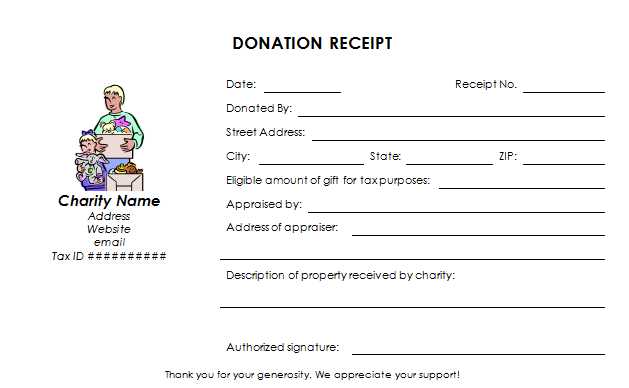

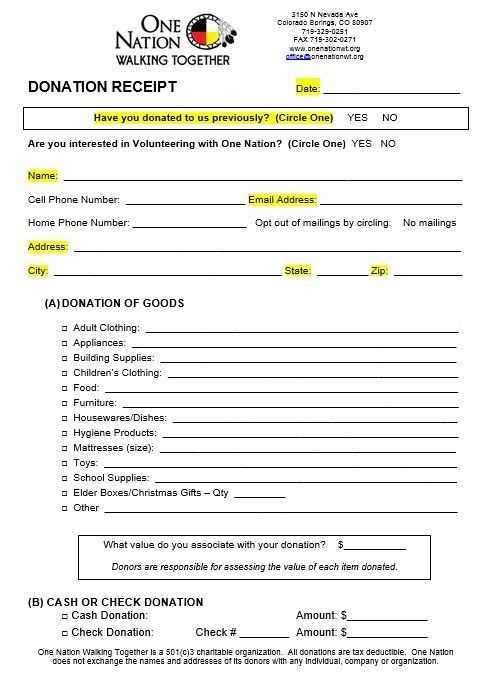

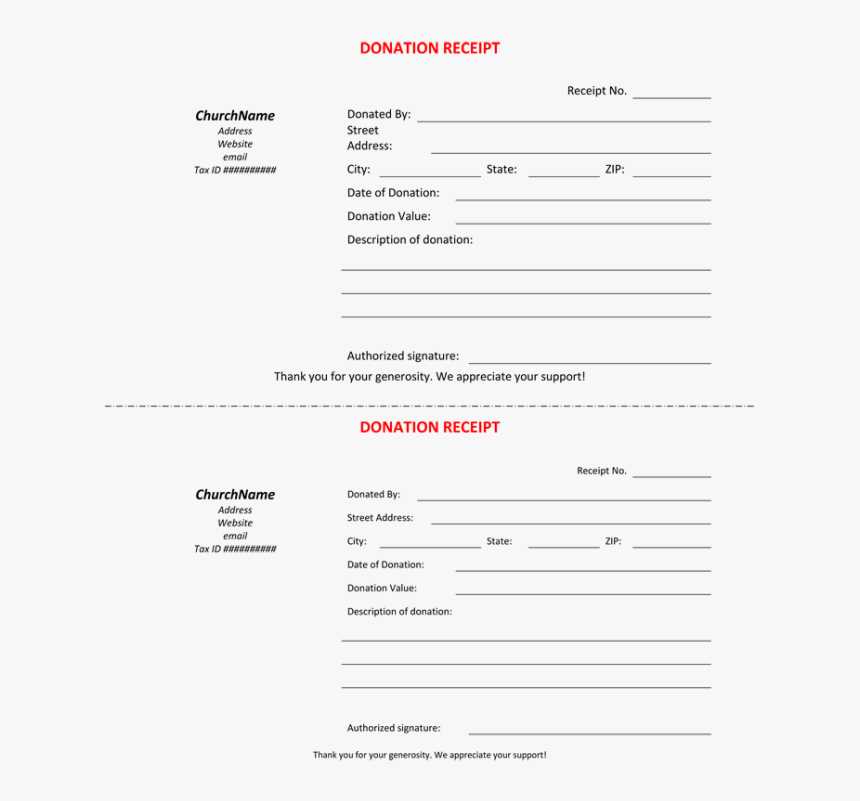

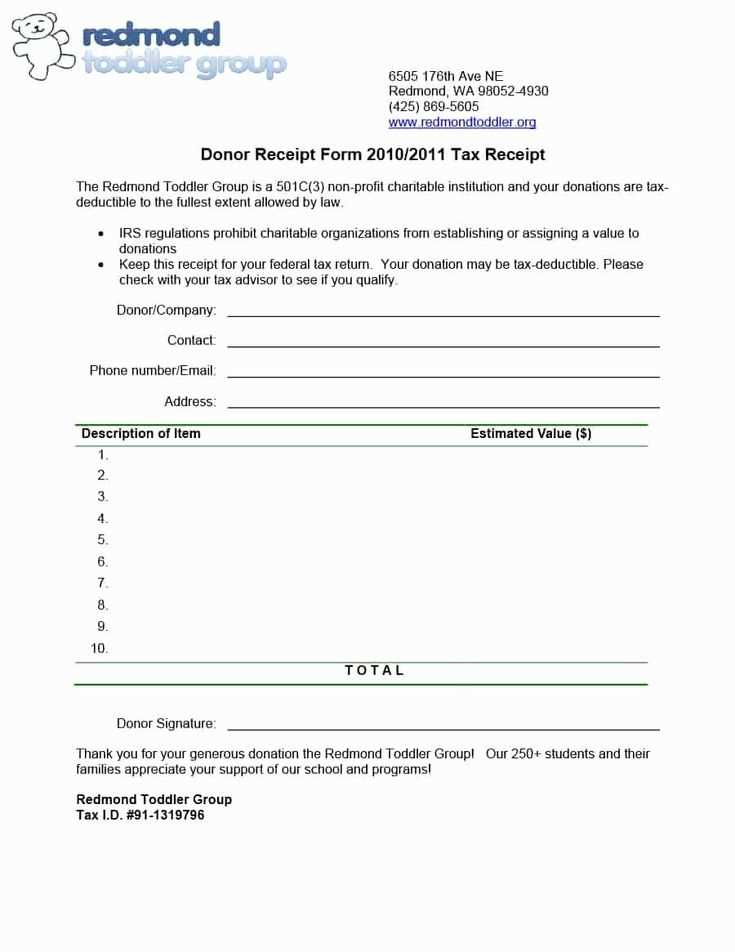

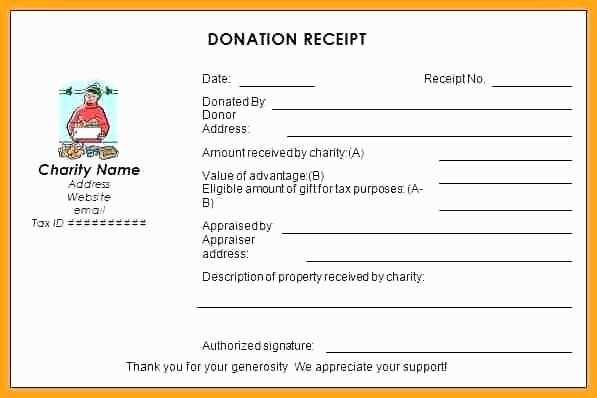

The key to an effective donation receipt template is including the necessary information such as the donor’s name, donation amount, date of the contribution, and a clear statement confirming whether any goods or services were provided in exchange for the donation. Always include the nonprofit’s contact information and tax identification number to simplify the process for donors.

Using a template saves time and ensures consistency across all donations. Adjust it as needed to suit your nonprofit’s specific needs, but make sure all required details are present in each receipt to avoid any confusion for your donors or your organization.

Here are the corrected lines with repetitions removed:

Ensure that the donation receipt includes the donor’s full name, donation amount, and the nonprofit’s tax-exempt status. These key details should be presented clearly to maintain transparency and compliance.

Details to Include

Provide a breakdown of the donation’s purpose, if applicable, along with the date the donation was made. Include an acknowledgment of whether goods or services were provided in exchange for the donation. If so, this should be noted as the fair market value of the benefit received.

Formatting Tips

Make the receipt easy to read with clear fonts and logical spacing. Avoid cluttering the document with unnecessary information that does not contribute to the donation details or tax compliance.

- Donation Receipt Template for Charities

Creating a clear and concise donation receipt is key for charities to stay compliant and build trust with donors. Include the following elements in your template to ensure it meets legal requirements and provides clarity:

- Organization Details: Clearly display the charity’s name, address, and contact information at the top of the receipt.

- Donation Information: List the donor’s name, the date of the donation, and the amount donated. If the donation is in-kind, provide a description of the items donated.

- Tax Exemption Statement: Include a statement confirming that the organization is a tax-exempt entity and that the donation is deductible under applicable laws.

- Non-Exchange Statement: Make it clear that the donor received no goods or services in exchange for the donation, which is a necessary component for tax purposes.

- Receipt Number: Assign each receipt a unique number for record-keeping and tracking.

- Thank You Note: A brief expression of gratitude for the donor’s support can help maintain strong relationships and encourage future contributions.

Ensure the template is easy to read and includes all necessary details without overwhelming the donor with excessive information. Adjust the layout as needed to fit the specific branding and style of your organization. Always review local tax laws to verify the requirements for your area.

Begin with a clear statement of donation, specifying the exact amount given. If the donation is in kind, describe the items donated in detail.

Donor’s information should be listed, including full name and address. This ensures that both the donor and the nonprofit have accurate records for tax purposes.

Include the date of the donation to establish the donation period, which may be relevant for tax deduction claims.

Clearly mention the nonprofit’s name, address, and tax identification number (TIN). This is crucial for donors when claiming their tax benefits.

If the donation was monetary, include a statement of whether any goods or services were provided in exchange. If so, describe the value of those goods or services to differentiate the charitable contribution from a transaction.

Finally, include a signature line for an authorized representative from the nonprofit, ensuring the receipt is official.

To ensure your donation receipts meet legal requirements, include specific details such as the nonprofit’s name, address, and tax-exempt status. Be clear about the donation amount and its nature (cash, property, or in-kind). If applicable, state whether any goods or services were provided in exchange for the donation, and if so, provide a description and estimate of their value.

Required Information for the Receipt

Include the nonprofit’s EIN (Employer Identification Number) and ensure that the receipt is signed or otherwise verified by the organization. For non-cash donations exceeding a certain threshold, the IRS mandates a more detailed description, including a fair market value estimate.

Record-Keeping Tips

Keep a copy of each receipt and maintain a well-organized record system. This makes it easier for both the nonprofit and the donor to track and verify donations, especially during tax season. Regularly updating your receipts ensures ongoing compliance with tax laws.

To create a personalized donation receipt, tailor the template to reflect the specific donation type. For one-time donations, ensure the receipt includes a clear date and donation amount. Highlight the donor’s name and add a unique receipt number for tracking. For recurring donations, include the frequency (monthly, quarterly, etc.), the amount, and note any upcoming payments to give the donor a clear view of their commitment.

In the case of in-kind donations, mention the item’s description and estimated value. Provide a detailed breakdown of each item donated to ensure the donor has a proper record for tax deductions. For fundraising event contributions, include a note about the event and any benefits the donor received, such as tickets or items, to avoid confusion about the tax-deductible portion.

When dealing with large donations, include a thank-you message that reflects the significance of their contribution. You can also offer the option to customize the receipt with the donor’s preferred recognition method, such as listing their name on a donor wall or including it in newsletters.

To create a donation receipt for nonprofits, always ensure it includes clear details about the donation received, the donor’s information, and a thank-you note. This not only helps your nonprofit remain compliant but also builds trust with your donors.

Clear Breakdown of Donation Information

Clearly list the total amount donated, including any specific details, such as the date, check number, or transaction ID. If the donation was in-kind, provide a description of the goods donated, with an approximate value when possible.

Donor Details and Tax Compliance

Include the donor’s full name, address, and email address. For tax purposes, ensure the donor understands if the gift is tax-deductible. This can be done by adding a statement like: “No goods or services were provided in exchange for this donation” if applicable.