Using a receipt for payment template in Word can save time and ensure consistency in your transactions. These templates provide a quick and easy way to create professional receipts without the need for manual formatting. You can personalize them with your business details and adjust the structure to fit different payment scenarios.

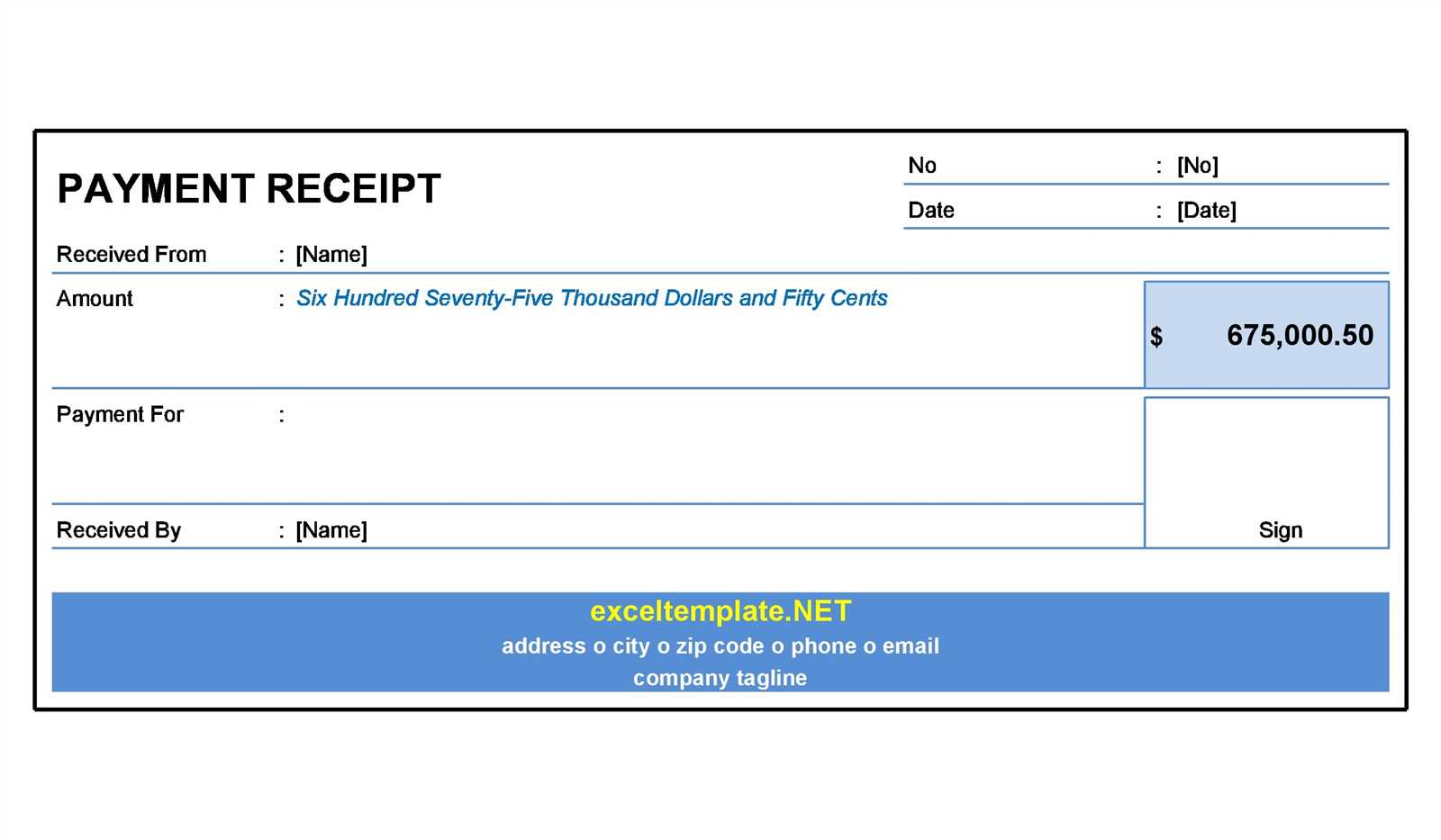

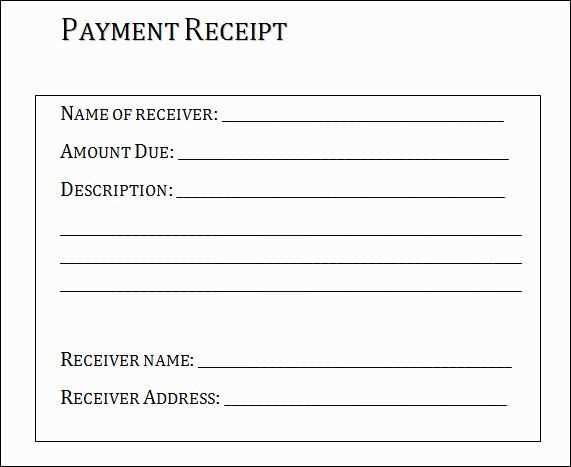

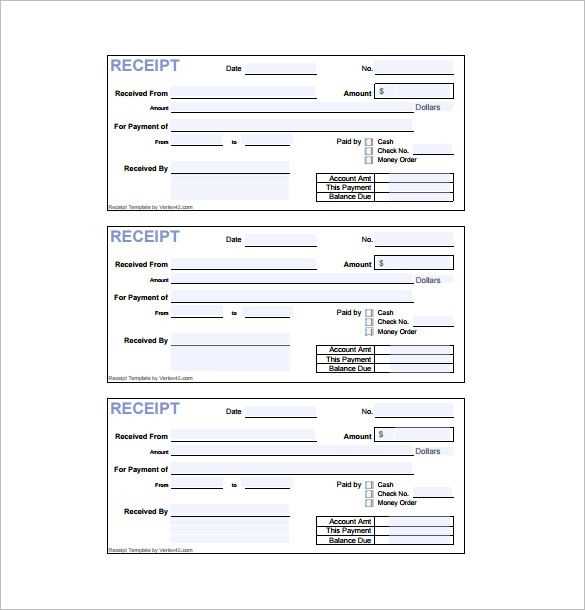

When selecting or creating a Word template, ensure it includes key elements such as the payer’s information, payment amount, date, and a description of the goods or services provided. A clear breakdown of these details minimizes confusion and provides both parties with a transparent record. It’s also helpful to include a unique receipt number for tracking purposes.

To make the template even more practical, consider incorporating fields that automatically update based on the data you input. This can reduce errors and speed up the process, especially when dealing with multiple payments. For more flexibility, you can also include customizable sections for taxes, discounts, or additional fees.

Of course! Here is the revised HTML article plan for the topic “Receipt for Payment Word Template” with practical and focused subheadings:

Start by selecting a reliable template that suits the purpose of your transaction. You can create a receipt using Microsoft Word by leveraging pre-designed templates, or by building one from scratch.

Choosing the Right Template for Your Needs

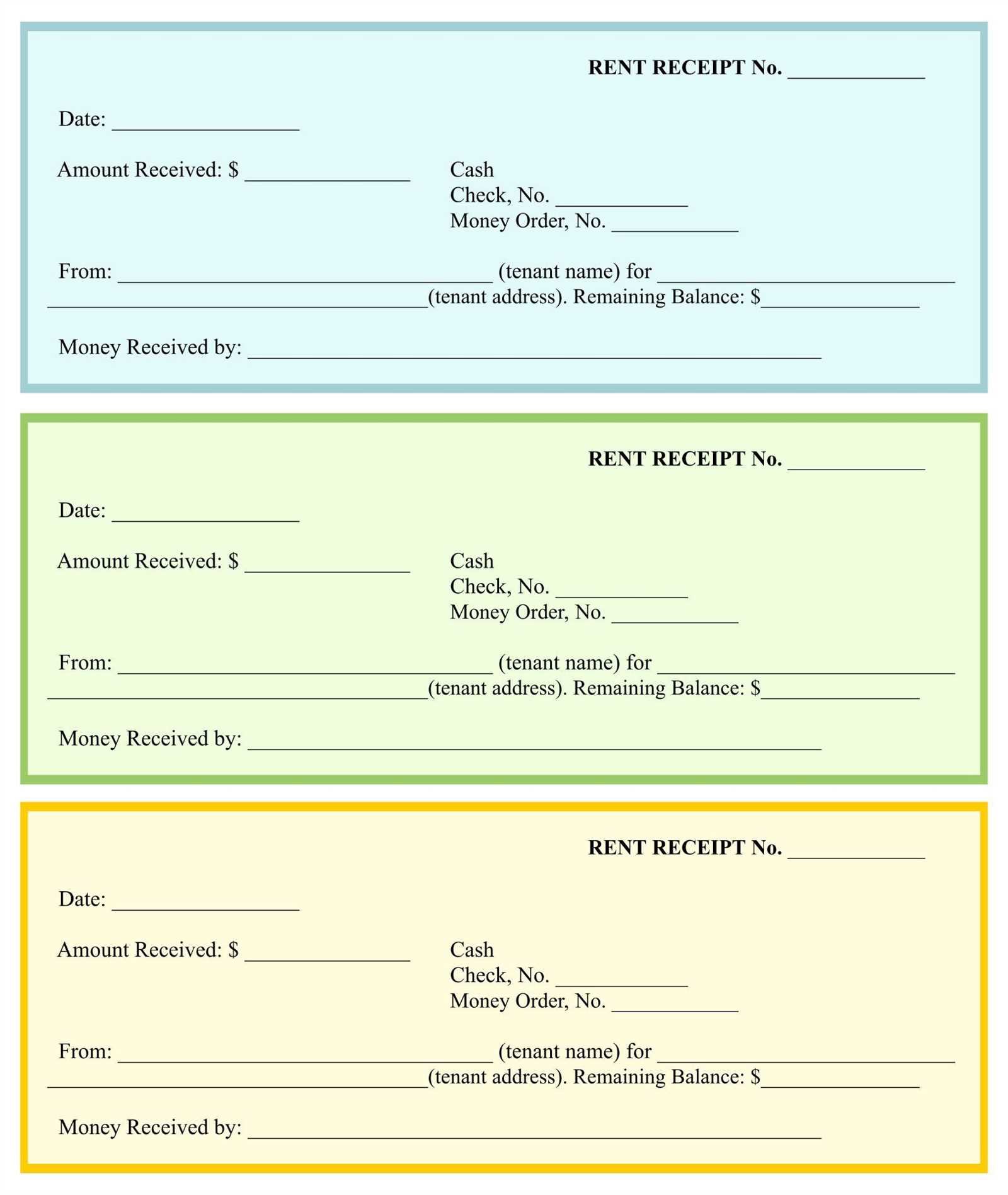

When searching for a receipt template, ensure it contains key sections such as the payment amount, the payer’s details, the date, and the purpose of payment. Templates can be found on various websites, or Word itself has built-in options that you can customize.

Customizing the Template in Word

Once you’ve selected a template, adjust it according to the specifics of your transaction. Replace placeholders with accurate information, such as your company name, address, and the date. You can also modify the layout if needed to fit your branding style.

Finalizing the Receipt and Printing

After filling in all necessary details, review the receipt for accuracy. Ensure that the totals are correct and that all required fields are filled. Once finalized, you can save it as a Word document or convert it to PDF for easier sharing and printing.

How to Create a Payment Receipt in Word

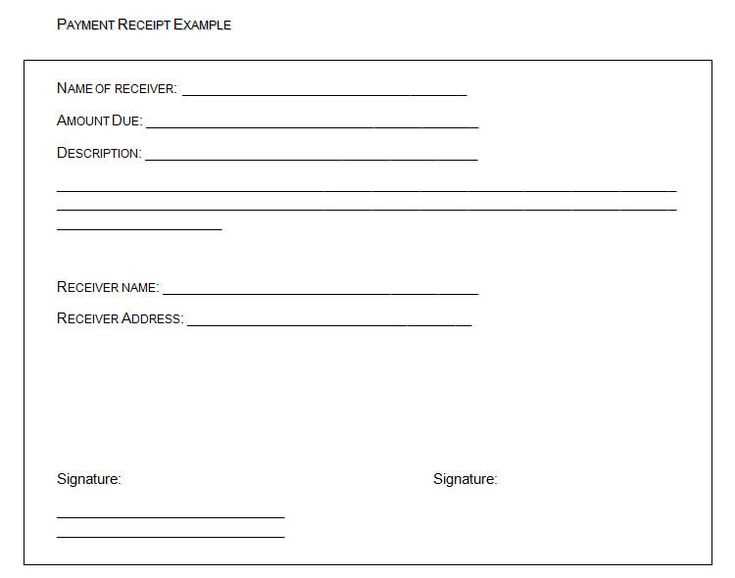

Open Microsoft Word and select a blank document. Start by inserting a header with the title “Payment Receipt.” Use a large, bold font to make it stand out. Next, create a section for the receipt details such as the payment amount, date, and payer information. Add a table to organize this data neatly.

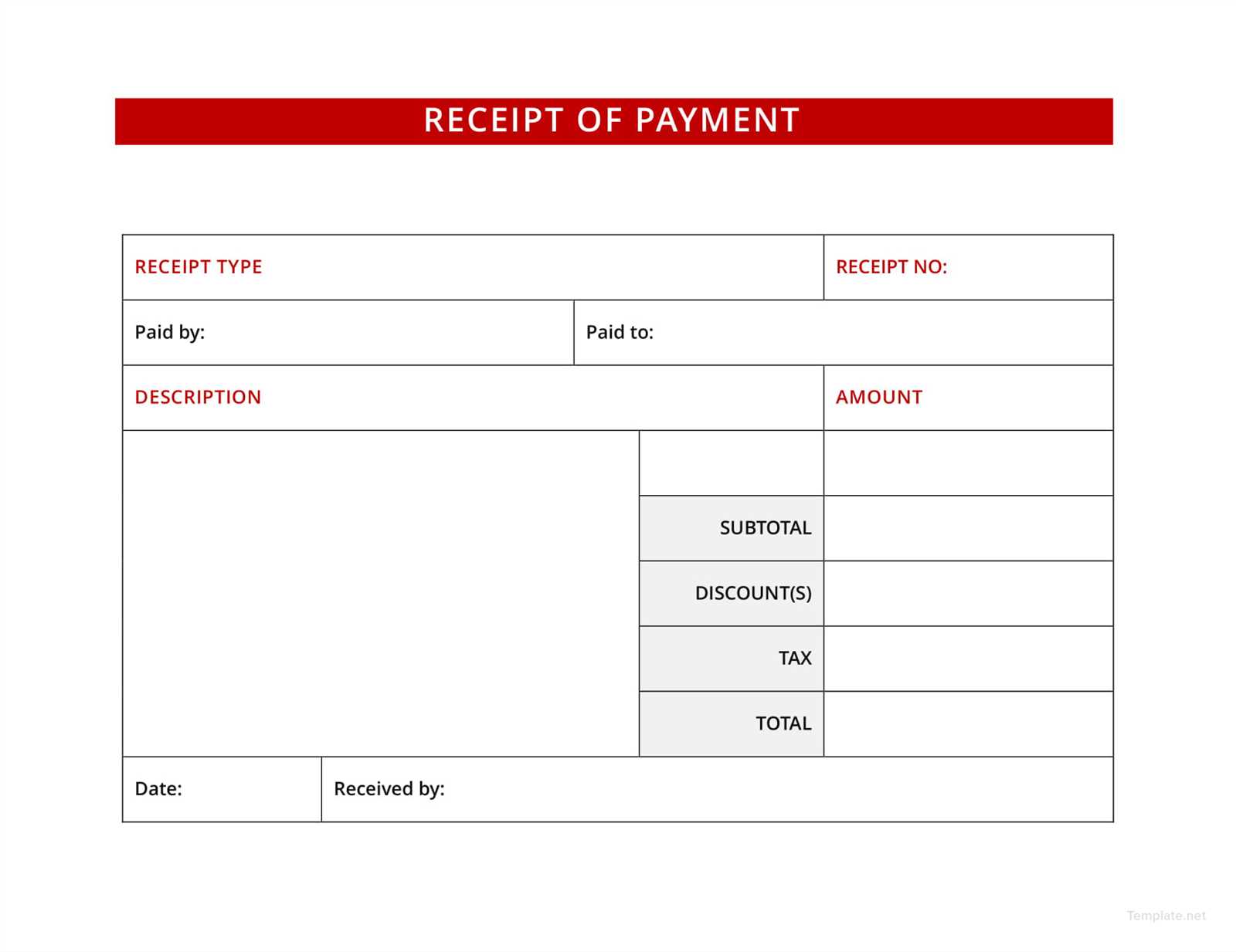

For the payment details, label columns with headings like “Amount Paid,” “Date of Payment,” and “Payment Method.” Enter the corresponding information in the rows below. You can use the “Insert Table” option to set up these sections easily.

Ensure there is a space for both the payer’s signature and the recipient’s signature. Add a footer with additional details such as terms and conditions or your business contact information.

When you’re satisfied with the layout, save the document as a template for future use. To do this, choose “Save As” and select “Word Template” from the options. This way, you can easily fill in the details for each new transaction without starting from scratch.

Customizing the Template to Fit Business Needs

Adjust the payment receipt template to reflect your business’s branding and specific operational requirements. This helps ensure consistency in communication and improves professional presentation.

- Logo and Company Details: Place your logo and company name at the top to maintain brand identity. Ensure that the contact information, such as phone number and email address, is clearly visible.

- Invoice Numbers and Dates: Customize the format of invoice numbers to match your internal tracking system. Adjust the date field to reflect the payment date accurately.

- Payment Terms: Modify the payment terms section to match the agreements you have with clients, whether it is “Net 30,” “Due on receipt,” or another term.

- Itemized List: If your business offers products or services, include a clear, itemized list. Define the quantity, description, unit price, and total for each item or service provided.

- Tax Information: Make sure to adjust tax calculations based on the region and applicable tax rates. Include any necessary disclaimers or tax identification numbers required by law.

- Payment Methods: List accepted payment methods, such as credit cards, bank transfers, or checks. Make sure the instructions are clear and easy to follow.

Consider incorporating additional fields for discounts, late fees, or custom notes based on your business’s needs. This enables you to tailor the receipt for specific circumstances and maintain clarity in your transactions.

Best Practices for Using Word Templates for Receipts

Choose a clean, easy-to-read layout that highlights the most important information, like the amount, date, and payment method. Avoid overcrowding the receipt with unnecessary details that may confuse the recipient. Use consistent fonts and colors to keep it professional and organized.

Ensure all fields are clearly labeled. Include sections for buyer and seller details, transaction number, and itemized list if applicable. This clarity prevents mistakes and helps with future reference.

Customize templates to match your brand identity. Add your logo, business name, and contact details at the top of the template for a personalized touch. This makes your receipts look official and trustworthy.

Use tables to neatly organize itemized lists or amounts. Tables make it easier to read and compare items or prices at a glance.

Save templates in a format that’s easy to reuse, such as .docx or .dotx. This allows quick modifications when needed, without the hassle of creating a new receipt each time.

Regularly update your template to include any changes in tax rates, payment methods, or other relevant details. This ensures your receipts always reflect accurate and up-to-date information.