Using a receipt template for rental payments ensures clear documentation and smooth transactions for both landlords and tenants. A well-designed receipt offers an organized way to track payments, making it easier to manage financial records and avoid misunderstandings. With the right format, you can quickly create a receipt every time a payment is made.

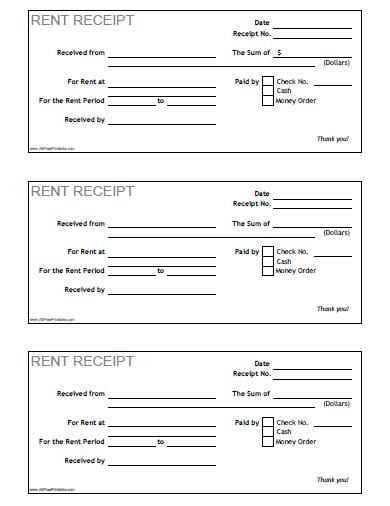

To create a rental payment receipt, include key details such as the tenant’s name, the amount paid, the date of the payment, and the rental period covered. This helps maintain accurate records and provides transparency for both parties. For simplicity, consider adding a unique receipt number for each transaction to easily reference specific payments.

Ensure the receipt also includes information on the rental property and the payment method used. Clear communication about late fees or any other terms agreed upon can prevent future disputes. Always keep copies of these receipts for personal or tax-related purposes.

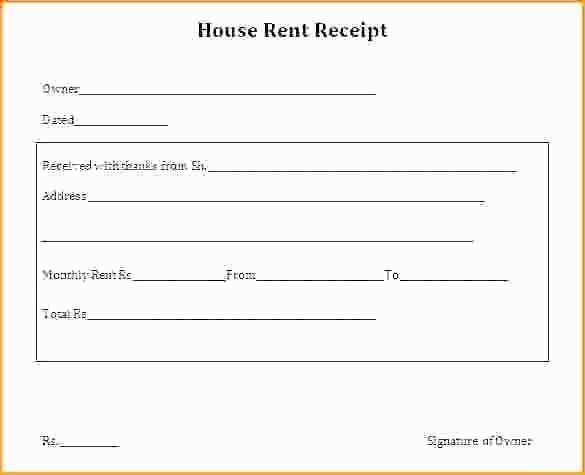

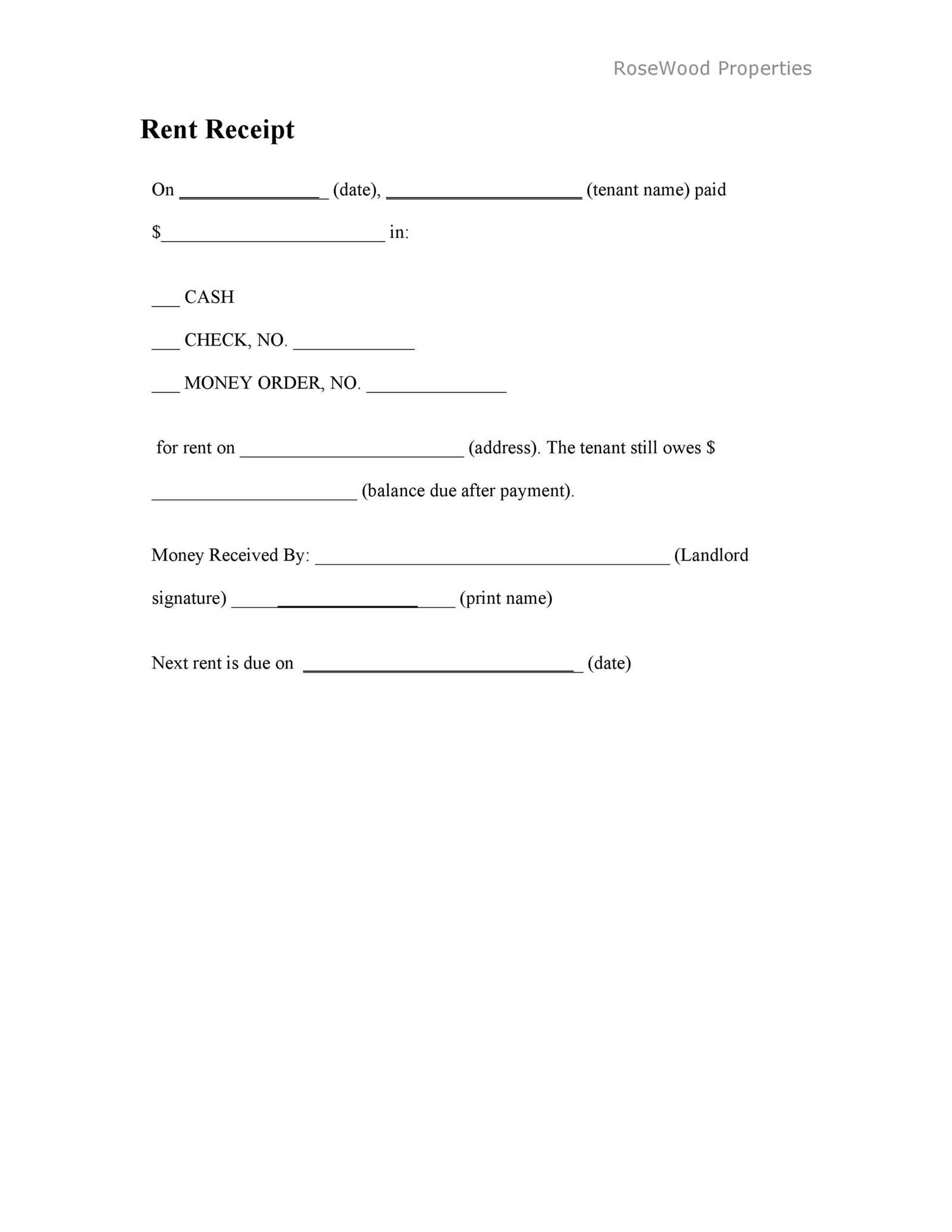

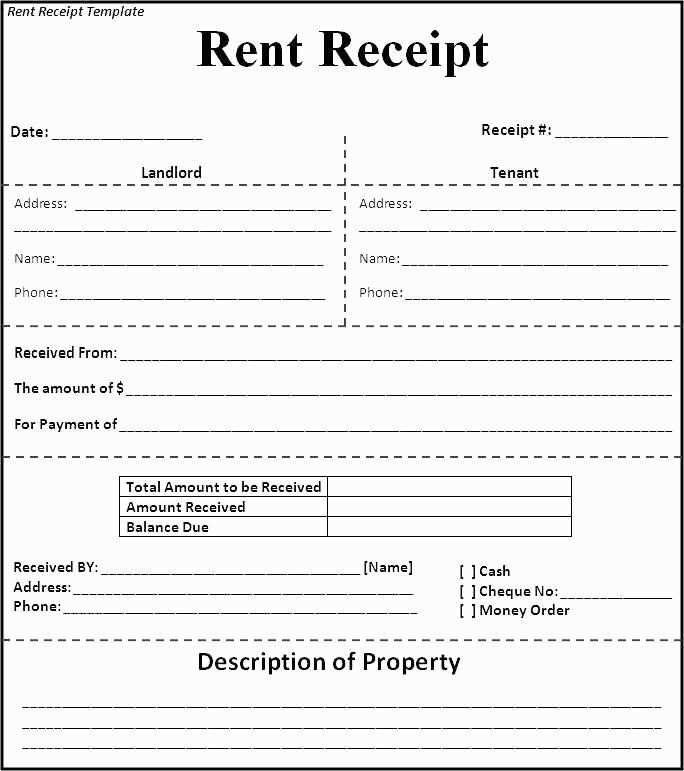

Receipts for Rental Payments Template

Use this simple template to document rental payments. It helps maintain clear records for both landlords and tenants. The receipt should include the tenant’s name, rental property address, the amount paid, the payment date, and the payment method. Clearly state the rental period covered, such as “for the month of February 2025.” Include any outstanding balances or notes if applicable.

Make sure to sign and date the receipt to authenticate it. It’s also helpful to provide the tenant with a copy for their records. Ensure that the template is easy to read, with sections for both parties to fill in the necessary details.

Here’s a basic structure for your template:

- Tenant’s Name

- Property Address

- Amount Paid

- Payment Method

- Rental Period

- Outstanding Balance (if any)

- Landlord’s Signature and Date

This format keeps everything organized and clear for both parties involved.

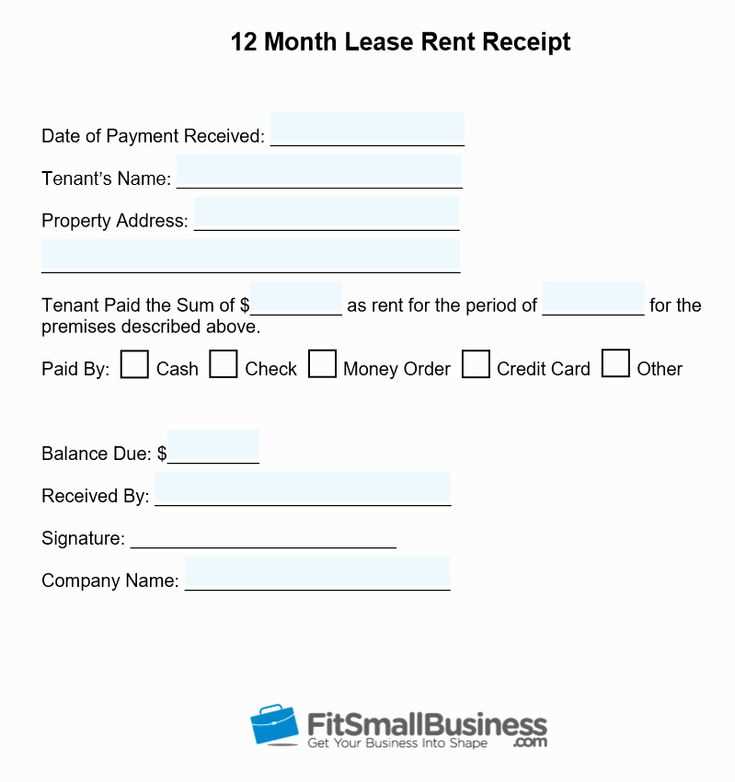

How to Create a Rental Payment Receipt Template

Begin with the tenant’s full name, followed by the property address, to clarify who made the payment and for which property. Include the rental period covered by the payment to ensure both parties are clear on the timeframe.

Next, add the total amount paid, specifying the currency. If there are additional fees, like late charges, mention them separately to avoid confusion. Also, note the payment method, such as cash, check, or bank transfer, for transparency.

Make sure to include the date of payment. This helps confirm the exact moment the transaction took place. Include the landlord’s contact details and a unique receipt number for easy tracking and reference.

Conclude with a section for both parties to sign, which validates the transaction. Keep a copy for the landlord’s records and give one to the tenant.

Customizing Your Receipt Template for Different Payment Methods

Adapt your receipt template to match the specific payment methods your customers use. This ensures clarity and smooth record-keeping.

For cash payments, include a clear note of the exact amount paid. You may also want to list the denomination of bills received, particularly for larger sums. This provides both parties with a transparent record.

For credit card payments, include the last four digits of the card number and the card type (Visa, MasterCard, etc.). Avoid full card numbers to maintain privacy. Additionally, indicate if a transaction fee was applied, if relevant.

For bank transfers, mention the bank’s name and the transaction reference number. This helps track payments that may take time to process. You can also specify whether the payment was received in full or if there is a balance remaining.

For digital wallets (e.g., PayPal, Venmo), note the wallet’s name and transaction ID. Since digital wallets often process payments instantly, consider adding the transaction time to show when the payment was completed.

For checks, list the check number, bank name, and the check’s amount. It’s important to state whether the check cleared or is still pending to avoid any misunderstandings later.

By tailoring your template for each payment type, you help ensure accurate documentation for both yourself and your clients. Each payment method should be reflected clearly, so there are no questions regarding the transaction.

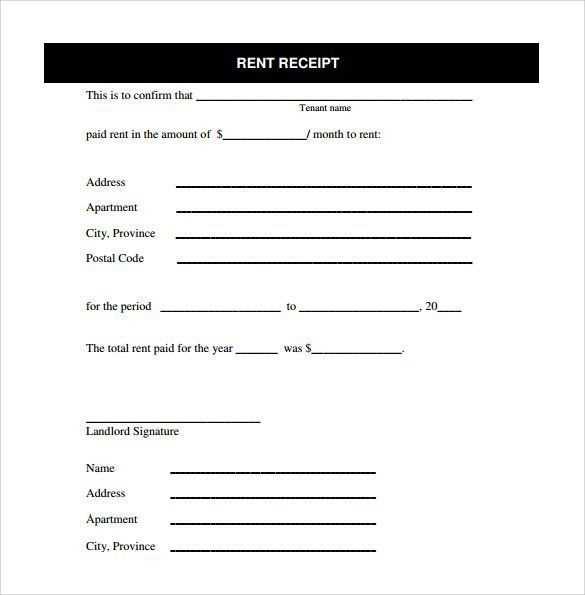

Legal Considerations When Issuing Rental Payment Receipts

Ensure that your rental payment receipts include accurate and specific details to comply with legal requirements. Here are the key points to focus on:

- Clear Identification: Include both the landlord’s and tenant’s full names, the rental property address, and a description of the payment (e.g., rent for the month of January).

- Payment Amount: Clearly state the total amount paid and specify the payment method (e.g., check, bank transfer, cash).

- Receipt Date: The date of the payment should be included to avoid any confusion regarding payment periods or late fees.

- Lease Agreement Reference: It’s helpful to reference the lease agreement or rental contract, specifying which terms are being fulfilled by the payment.

- Legal Language: Use concise and neutral wording in your receipt. Avoid overly formal or ambiguous language that could lead to misunderstandings.

- Retention of Records: Retain copies of all receipts issued. These may be required for tax purposes, future disputes, or audits. Tenants should also be encouraged to keep copies for their records.

- Late Payment Clauses: If the payment is late, indicate any late fees or penalties as outlined in the rental agreement. This will help prevent disputes over additional charges.

By adhering to these recommendations, both landlords and tenants can avoid legal complications and ensure transparency in rental transactions.