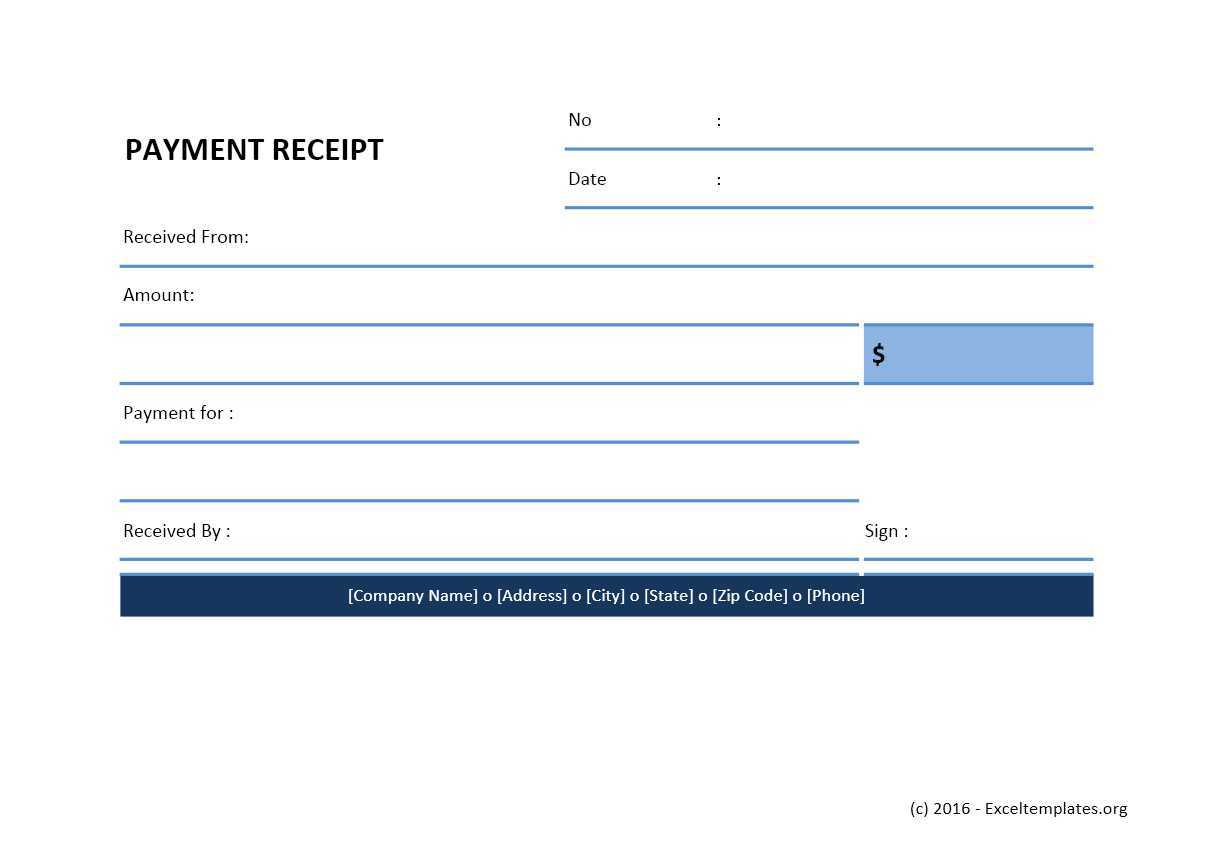

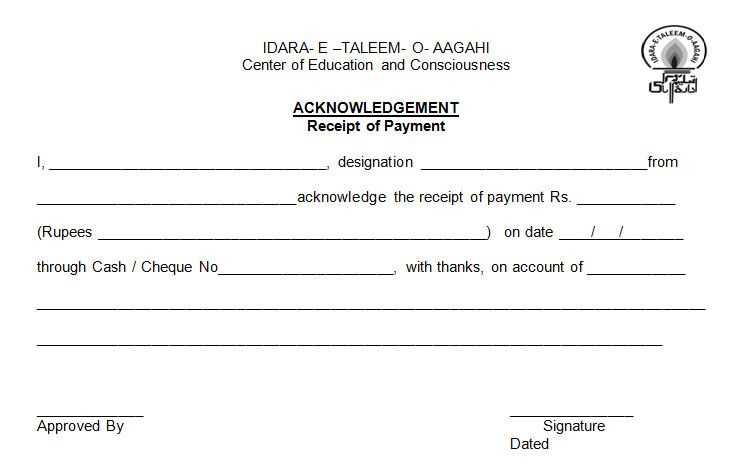

Creating a PMT receipt template can save time and ensure consistency in documenting transactions. A well-structured receipt should clearly outline all relevant details, such as payment amount, date, and the service provided. By using a template, you can quickly generate receipts while maintaining accuracy and professionalism.

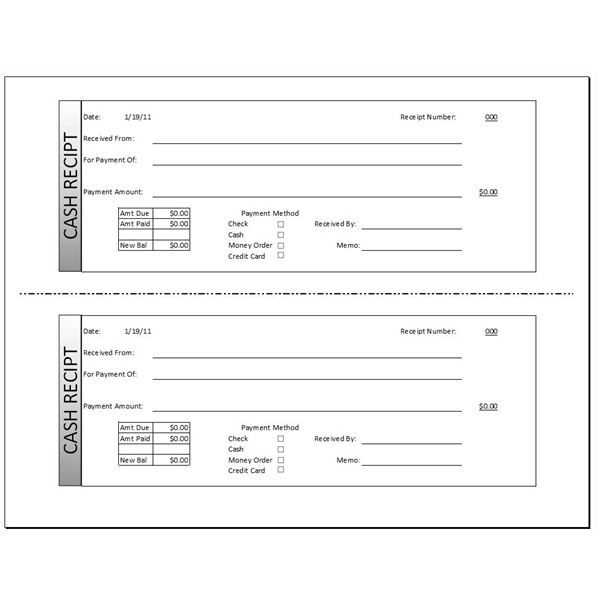

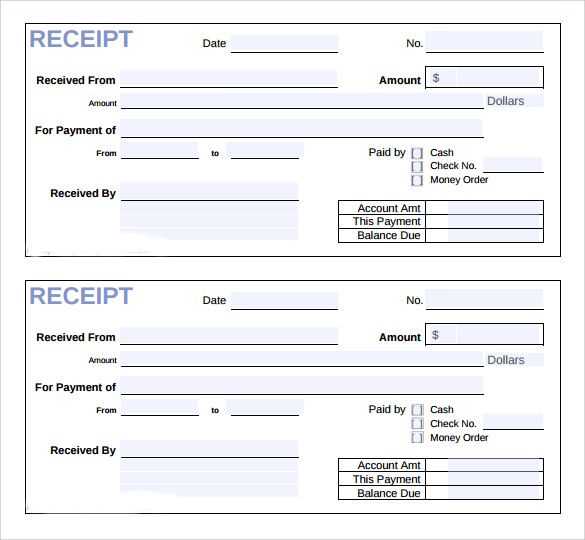

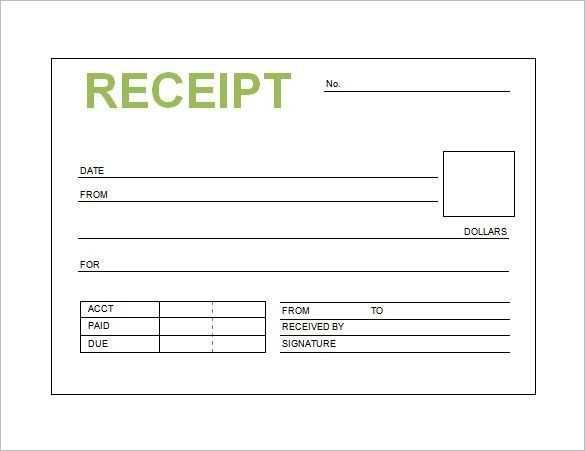

A basic template should include sections for the payer’s name, payment method, transaction number, and the total amount paid. Including the name of the person or organization receiving the payment is also key. You can add a notes section to provide extra details about the payment or purpose, but this should be optional to keep the receipt clean and to the point.

The layout of the receipt should allow for easy reading. Use clear headings for each section and ensure all text is legible. If applicable, include a payment reference number or invoice number to make it easier for both parties to track the payment in the future.

Finally, consider designing your template to be easily customizable, so you can adjust it for different clients or payment amounts. A simple, adaptable format will make generating receipts hassle-free every time.

Template for a PMT Receipt

Creating a precise and professional Payment Receipt (PMT) template requires including specific details to ensure clarity and transparency for both parties. Below is a recommended format that covers the necessary elements for tracking payments.

Receipt Number: Each receipt should have a unique identification number for easy reference. This helps in keeping track of payments, especially if multiple receipts are issued.

Date of Payment: Clearly state the date when the payment was made. This helps both the payer and the recipient track the transaction timeline.

Payer Information: Include the payer’s name, address, and contact details. If applicable, specify the company name or organization they represent.

Amount Paid: List the exact amount paid. Be sure to include the currency, whether it’s USD, EUR, or another, to avoid any confusion.

Payment Method: Specify how the payment was made–whether by cash, credit card, bank transfer, or other methods.

Description of Goods/Services: Provide a brief description of the goods or services the payment covers. This could be a product name, service description, or invoice number.

Payment Due Date (if applicable): If this payment is part of a larger installment plan or due date arrangement, indicate the next payment’s due date.

Recipient Information: Clearly state the name and contact details of the person or organization receiving the payment.

Signature: If required, include a space for both the payer and recipient’s signatures. This confirms the completion of the transaction and both parties’ agreement.

Terms and Conditions: If necessary, include any terms related to the payment, refund policy, or additional details specific to the transaction.

By following this template, you ensure the payment receipt is both professional and easy to understand for all parties involved.

Designing a Structured Template for Clear Data Entry

Focus on organizing the template fields to match the exact data you need. Each section should have clearly defined spaces for user input, minimizing confusion during data entry.

- Use distinct sections: Separate the receipt into logical sections such as “Customer Details”, “Payment Information”, and “Transaction Summary”. This structure prevents users from skipping over important fields.

- Label fields clearly: Use straightforward labels that clearly identify the data being requested. For example, “Full Name” instead of just “Name” or “Transaction Date” instead of just “Date”.

- Group related fields together: Place similar data points close to each other. For example, grouping payment methods and amounts together makes the template intuitive and easy to follow.

- Provide helpful instructions: Add short instructions or examples next to fields that require specific formats, such as phone numbers or currency amounts.

- Limit free-text fields: Minimize open-ended text fields to reduce variability and improve data consistency. Use drop-down menus or checkboxes where possible.

- Use consistent formatting: Ensure that dates, numbers, and other data types follow a uniform format throughout the template to prevent errors.

- Validate inputs: Include validation rules to ensure users input data correctly. For example, make sure that email addresses contain “@” or that phone numbers have the correct number of digits.

By focusing on clarity and simplicity in design, users will be able to complete the receipt accurately and with fewer mistakes. A well-structured template reduces errors and makes data collection more reliable.

Implementing Validation Features to Avoid Errors

To minimize mistakes in a payment receipt template, use real-time data validation. This ensures users input accurate information without delays or errors.

Field-Specific Validation

For fields like payment amount, verify the number format and range. For example, ensure the value is numeric and falls within acceptable limits, such as preventing values below zero or excessive amounts. Use regex patterns for specific input types, like dates or phone numbers, to restrict the format strictly to what’s expected.

Immediate Feedback

Provide instant feedback for invalid input. Display clear error messages next to the field, specifying exactly what needs correction (e.g., “Amount cannot be negative” or “Invalid date format”). This avoids frustration and helps the user quickly fix mistakes without needing to resubmit the form.

Integrating validation reduces data entry errors, speeds up the process, and improves the overall user experience in the receipt generation process.

Customizing the Template for Various Payment Methods

Adjusting your template for different payment methods requires specific tweaks to handle the unique data each method provides. Whether you’re processing credit card, PayPal, or bank transfer payments, each has distinct fields that need to be displayed clearly for users and administrators.

Credit Card Payments

For credit card payments, the template should include details like the card type, last four digits of the card number, and authorization code. Display the transaction date, payment amount, and any applicable fees. This ensures transparency and helps with dispute resolution if needed.

| Field | Details |

|---|---|

| Card Type | Visa, MasterCard, etc. |

| Last Four Digits | xxxx-xxxx-xxxx-1234 |

| Authorization Code | ABCD1234 |

PayPal Payments

For PayPal, include the PayPal transaction ID, payer’s email, and the payer’s shipping address (if applicable). The template should also display the payment status and any associated fees, as these can vary depending on the user’s location or currency exchange rates.

| Field | Details |

|---|---|

| Transaction ID | 5SM68218HR4213417 |

| Payer’s Email | [email protected] |

| Shipping Address | 123 Main St, City, Country |

Customizing templates based on the payment method ensures that each receipt delivers the right details for each transaction type, offering clarity for both customers and businesses.