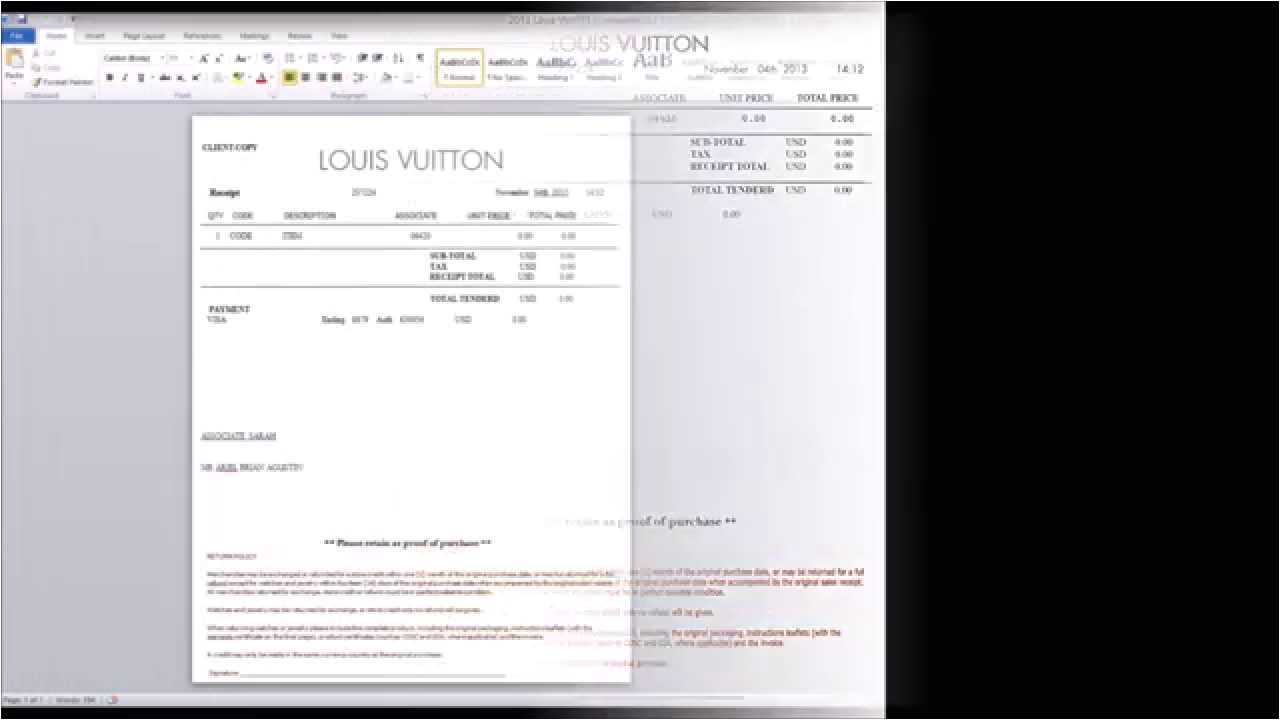

To create a Barneys receipt template, focus on the key elements that customers expect: a clear summary of their purchase, precise item descriptions, and relevant transaction details. Start with the header that includes the Barneys logo and store address, ensuring it is easy to spot. The receipt should also feature the date, transaction number, and cashier name for reference.

List each purchased item with its name, price, and quantity, followed by the total amount. Incorporate a tax breakdown, clearly showing applicable rates and calculations. For returns and exchanges, include space for dates and reasons to make tracking simple. If loyalty points or promotions apply, display them prominently, as these details are often crucial for customer satisfaction.

Keep the template simple yet effective. A clean layout allows customers to quickly identify the most important information. Ensure there is enough space between sections, making it easy to follow the receipt at a glance. Adding a footer with contact information and store policies also helps create a professional touch.

Here’s the updated version:

When designing your Barneys receipt template, pay attention to key details that ensure clarity and professionalism. Start with clear headings for sections like the store name, date, and item list. Ensure the logo is placed at the top for visibility and brand recognition. Make sure the font is easy to read, avoiding overly decorative styles.

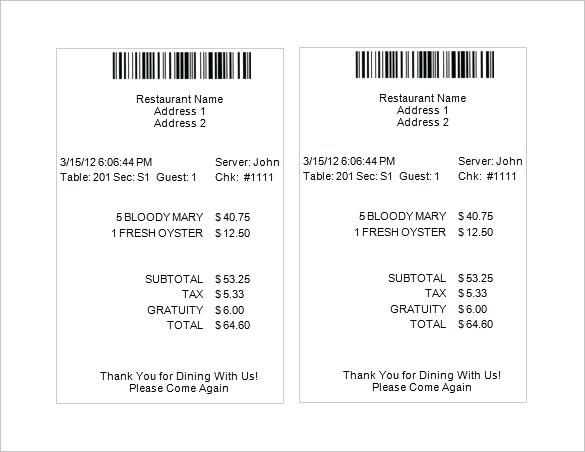

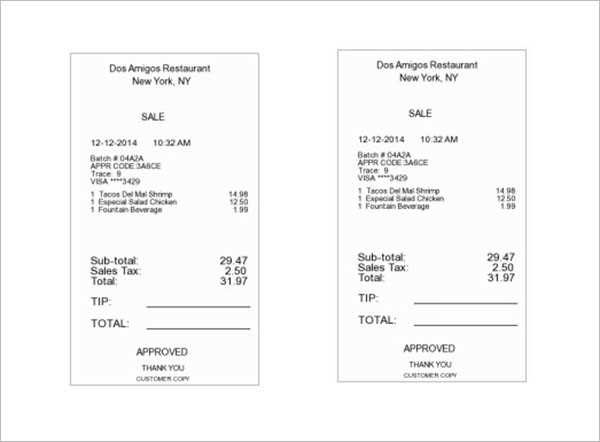

Keep itemized information organized. List products with their names, quantities, and prices in separate columns. Align these elements neatly to create a structured, easy-to-follow receipt. Include taxes and total costs clearly at the bottom, using bold text for totals.

Consider adding payment method and transaction ID. This information provides additional context for customers and can help with tracking purchases. For receipts that might need to be returned or exchanged, include a return policy note at the bottom for customer convenience.

Avoid overcomplicating the layout with too much information. Keep it simple, legible, and professional. This approach will improve the user experience and ensure your receipts are both functional and aesthetically pleasing.

Barneys Receipt Template: A Practical Guide

How to Create a Custom Barneys Receipt Template for Your Business

Understanding the Legal and Tax Requirements for Receipts

Designing a User-Friendly Receipt Template for Customers

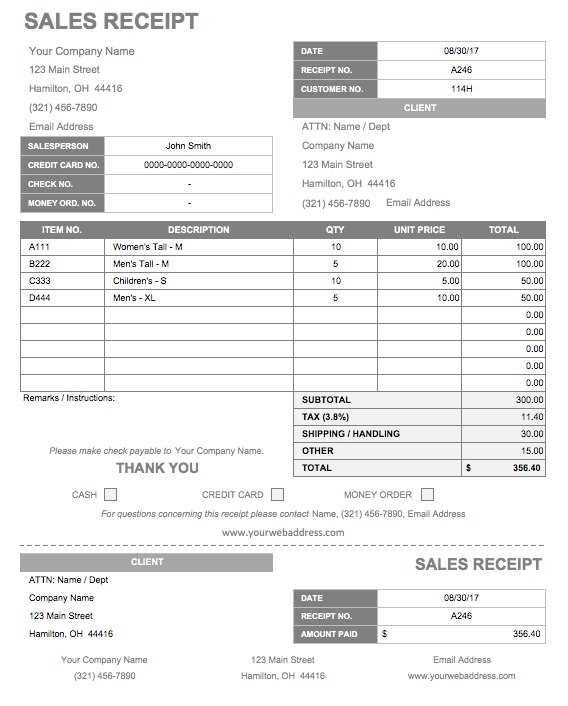

To create a Barneys receipt template that suits your business needs, start by including the necessary details. Ensure that it displays the store name, address, phone number, and tax identification number (TIN). This is the basic structure for any receipt, and will provide customers with the information they need to contact you or verify transactions.

Next, organize transaction details clearly. Include the date and time of purchase, item descriptions, quantities, unit prices, and total amounts. Each item should be presented in an easily readable format. Clearly indicate any discounts, taxes, or shipping fees applied to the transaction, as well as the final total amount due or paid.

Legal and tax requirements vary by jurisdiction, but receipts often need to meet specific criteria. Ensure that your template includes the relevant tax information, such as the sales tax rate and the total tax amount for each transaction. Some regions may require additional details, such as business registration numbers or VAT numbers, so check local regulations to avoid missing any critical details.

Design your receipt template with customer experience in mind. Use a simple, readable font and appropriate spacing to make the information easy to read. Avoid cluttering the receipt with unnecessary details. Make sure the text is legible and the format remains clean, especially on smaller or mobile-friendly devices. A clean design will also reflect well on your business and improve customer satisfaction.

Finally, test your receipt template regularly to ensure it meets legal, tax, and user expectations. If your business grows or you expand to new locations, be prepared to adjust your receipt template accordingly to maintain compliance with local laws and tax regulations.