A clear and professional property management receipt is a must-have for tracking payments, rental deposits, or maintenance charges. Using a reliable template saves time, ensures accuracy, and keeps both landlords and tenants on the same page. A properly formatted receipt can prevent confusion, provide legal clarity, and create a solid record of transactions. Here’s a step-by-step guide on what to include in a property management receipt template to make the process as seamless as possible.

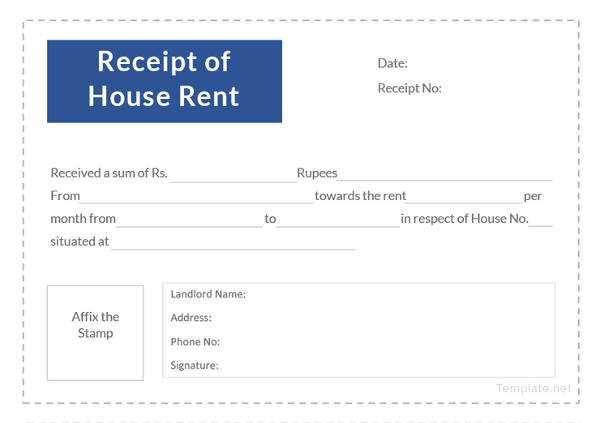

Start with a header that includes the property management company’s name, contact details, and the property address. This ensures both parties know which property the receipt refers to. The date of the payment should always be clearly stated, as it serves as a reference point for both landlords and tenants.

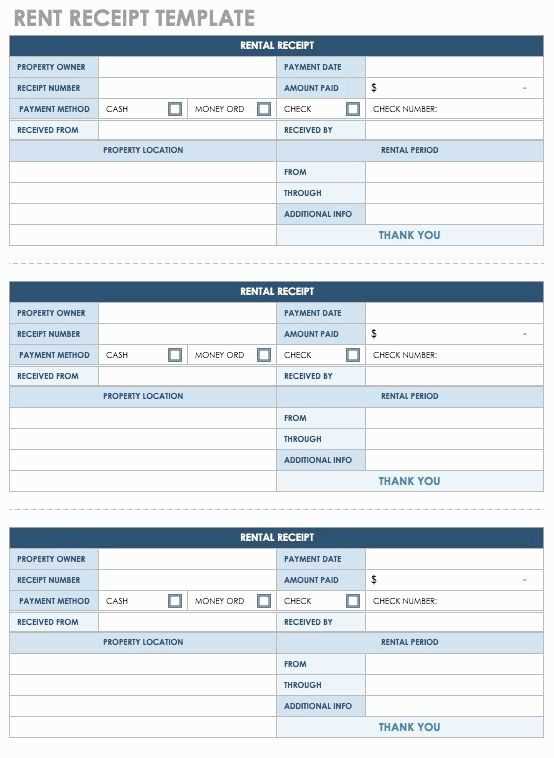

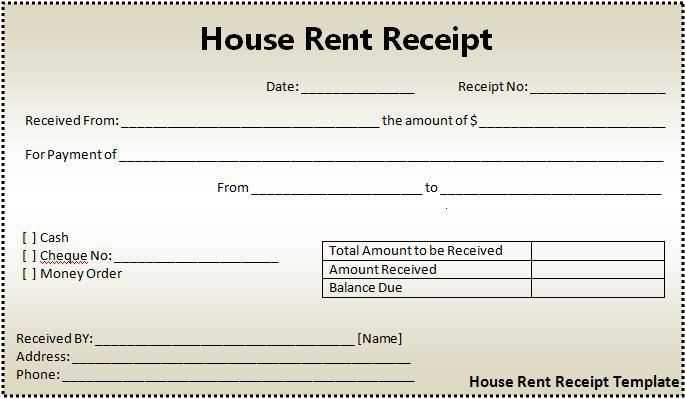

Next, include the tenant’s name and a description of the payment, such as rent, late fees, or a security deposit. It’s also important to clearly show the payment method, whether it was made via check, bank transfer, or cash. The receipt should also include the amount paid, as well as any balance remaining if applicable. This keeps everything transparent and avoids any misunderstandings down the line.

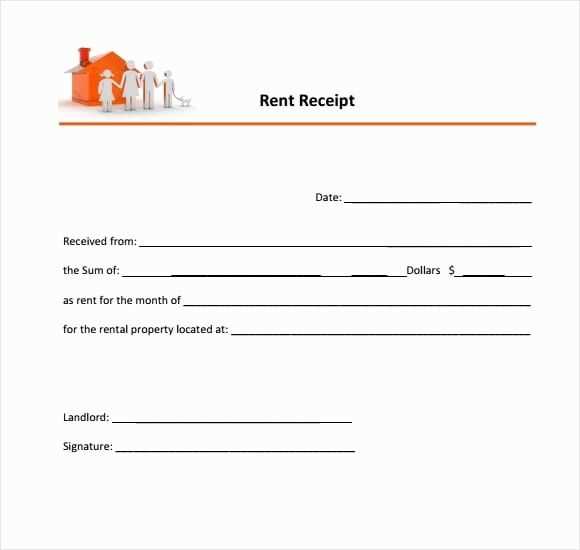

Finally, make room for a signature field at the bottom of the receipt, allowing both parties to acknowledge and confirm the transaction. This not only adds professionalism to the document but also provides both tenant and landlord with a tangible record of the exchange.

Here’s the revised version without repetition:

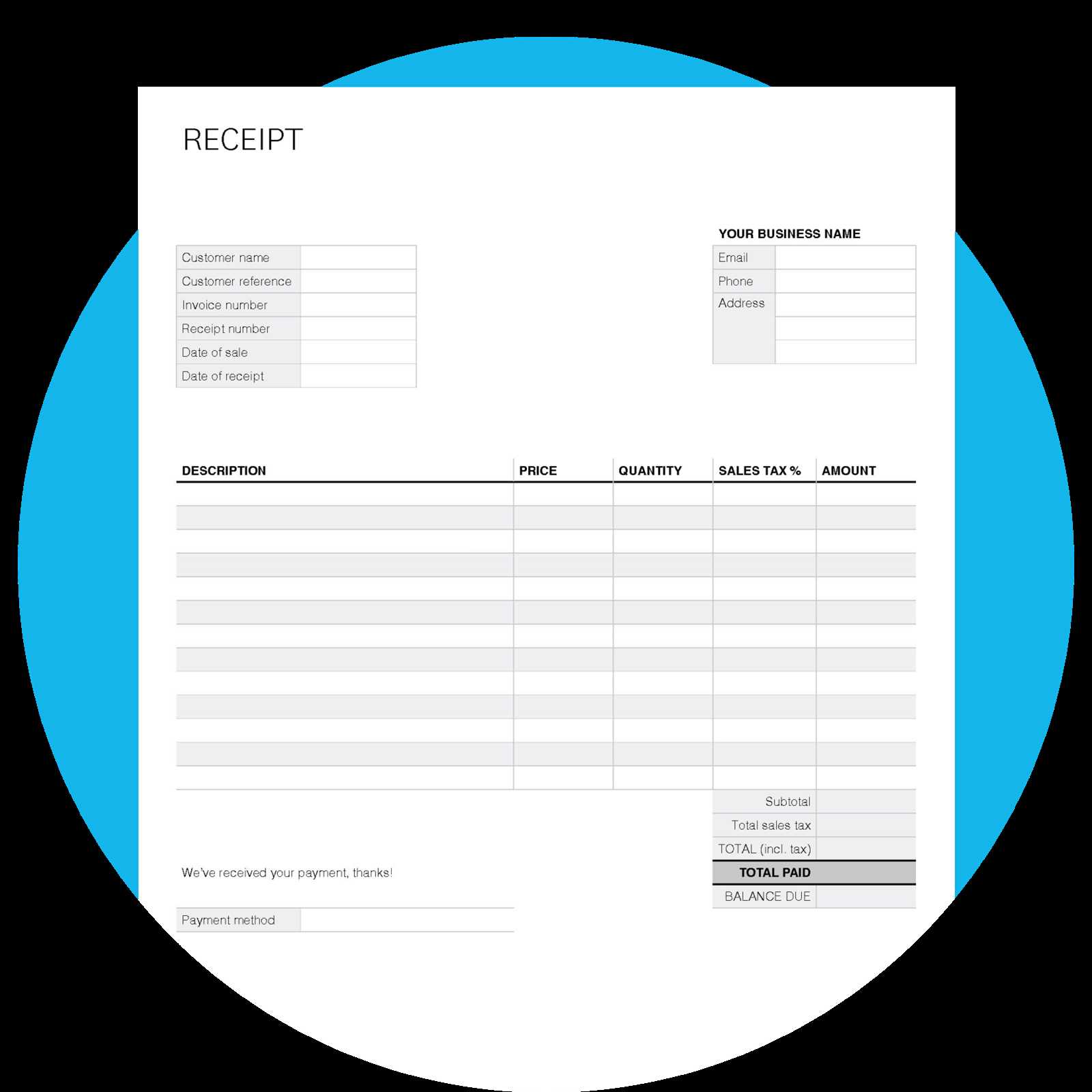

To create a clean and concise property management receipt template, ensure you include only the necessary details. Start with the property address, followed by the tenant’s name and the receipt date. Always list the rental period covered by the payment. Include a breakdown of the payment details, such as rent amount, late fees (if applicable), and any other charges. A summary of the total paid and the payment method will provide clarity.

| Field | Description |

|---|---|

| Property Address | Enter the full address of the rental property. |

| Tenant’s Name | Include the full name of the tenant making the payment. |

| Receipt Date | Specify the exact date the payment was received. |

| Rental Period | State the start and end dates for the rental period covered by this payment. |

| Charges Breakdown | List individual charges such as rent, late fees, and any additional fees. |

| Total Paid | Summarize the total amount received. |

| Payment Method | Specify how the payment was made (e.g., bank transfer, check, cash). |

By structuring the template this way, you ensure that each receipt is clear, easy to understand, and free of unnecessary details. It helps both the tenant and landlord maintain a transparent record of payments.

- Property Management Receipt Template

Ensure your property management receipt includes key details to maintain transparency and clarity. Start with the property address at the top, followed by the tenant’s name and payment date. Specify the rent period covered by the payment. Clearly state the amount paid, whether it’s for rent, utilities, or other charges. Break down the payment details if necessary, listing individual amounts for each service or fee. Also, include any balance remaining, if applicable. Add your contact information and a unique receipt number for easy reference.

Incorporate payment methods such as check, cash, or online transfer, along with relevant transaction details. If a late fee or discount applies, make that clear too. Make sure the document is signed by the property manager or authorized agent. This helps ensure both parties have an accurate record. Finally, consider a section for any additional notes or reminders, such as maintenance schedules or upcoming rent increases.

Design your rent payment receipt template to include key details that confirm the transaction, protect both parties, and ensure smooth record-keeping. A well-organized receipt avoids confusion and supports transparency.

Key Information to Include

Your receipt template should have the following details:

- Tenant Name: Clearly display the tenant’s full name or business name.

- Property Address: Specify the rental property address to which the payment relates.

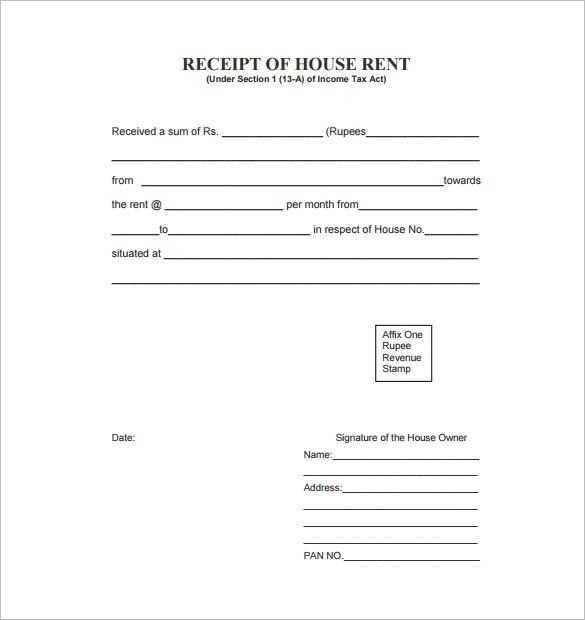

- Payment Amount: State the exact amount received in both numeric and written form.

- Payment Date: Record the date on which the payment was made.

- Payment Method: Indicate how the payment was made (e.g., bank transfer, check, cash).

- Lease Period: Include the rental period for which the payment was made (e.g., January 1 – January 31).

- Balance Due: Show any remaining balance after the payment, if applicable.

- Receipt Number: Assign a unique receipt number for easy tracking and reference.

How to Format the Template

Use a clean, professional layout with labeled sections for each piece of information. Group payment details in a clear, easy-to-read format. Ensure the font is legible and the document is simple yet organized. Make the receipt look official by including your property management business name and contact information at the top.

Once the template is designed, save it in a format that is easy to customize for each transaction. Having a digital version makes it easier to track payments and issue receipts quickly.

Key Elements to Include in Your Property Management Receipt

Include the tenant’s full name and address to ensure the receipt is correctly attributed. This helps avoid confusion and maintains clear records of transactions. Additionally, mention the property address to specify which rental property the payment is associated with, especially if managing multiple properties.

Clearly state the payment amount. Specify the rent or service fee amount, including any additional charges such as late fees or maintenance costs. Break down these charges for transparency and to avoid misunderstandings later.

Detail the payment method. Whether it’s cash, cheque, credit card, or bank transfer, note this information to provide a clear record of how the payment was made. This also helps resolve any potential disputes over payment methods.

Include the payment date. This helps track payments and align with the lease agreement, which often has specific due dates for rent. It is crucial for keeping accurate financial records and for verifying that payments were made on time.

Provide a receipt number. A unique identifier for each transaction simplifies tracking and referencing. This can be especially useful for both the tenant and property manager when dealing with any future issues related to payments.

Note the rental period. Specify the dates for which the payment covers, such as “from January 1st to January 31st.” This clarifies which period the payment corresponds to and can prevent confusion over payments for different months or services.

Lastly, include a brief description or reason for the payment. This could be something like “monthly rent” or “maintenance fee,” so there’s no ambiguity about what the payment covers.

Customize your receipt template based on the specific details of the property you’re managing. Each property type, whether residential, commercial, or vacation rental, will require adjustments in the information displayed on the receipt.

Residential Properties

- Include tenant names, unit numbers, and rental periods. This makes it clear who the payment is for and what service it pertains to.

- List rent breakdowns (e.g., base rent, maintenance fees, utilities) to ensure transparency.

- Ensure the payment method is specified, such as cash, check, or bank transfer.

Commercial Properties

- Incorporate business names and contact details along with the leasing period and specific spaces rented (e.g., office, warehouse).

- Include additional fees that may apply to commercial tenants, such as parking fees, cleaning services, or equipment usage.

- Track deposits or pre-payments for long-term leases as a separate line item.

Vacation Rentals

- Feature the property address, booking dates, and any special conditions or policies (e.g., check-in time, cleaning fees).

- Consider adding a section for the number of guests and the total cost for their stay.

- For seasonal properties, show a breakdown of pricing based on the time of year.

By adjusting your template to reflect these unique needs, you can make sure that every receipt is clear, professional, and suited to the property in question.

Include a detailed breakdown of charges in the property management receipt to avoid confusion. List each item separately, such as rent, maintenance fees, utilities, or additional services provided. This clarity helps tenants understand exactly what they are paying for.

For better tracking, include the payment method used (e.g., cash, credit card, bank transfer) and a unique reference number for each transaction. This makes it easier for both property managers and tenants to trace any issues in the future.

Ensure the date of payment and the due date are clearly stated to avoid misunderstandings about late fees or missed payments. Also, confirm the tenant’s details and the property address to match the transaction to the correct account.

Keep the format consistent across receipts. This creates a standard that is easy to follow and ensures all necessary information is included without omissions. Use bullet points or tables for better readability.