Use a running balance receipt template to track payments and ensure accuracy in your transactions. It allows you to monitor both incoming and outgoing funds, with each entry automatically updating the balance, making it easier to avoid errors. This template is perfect for businesses or individuals who need to keep precise records of their financial activity without the hassle of manual calculations.

To get started, fill in the receipt details such as date, description, amount, and transaction type. The running balance will update as you enter each new entry, helping you stay organized and on top of your finances. By using this template, you can easily spot discrepancies, track outstanding amounts, and maintain an up-to-date financial overview.

Ensure that your template includes columns for the transaction reference, balance before and after the payment, and any applicable notes. This simple structure guarantees that you’ll have all the key information at your fingertips. For convenience, adjust the template to suit your specific needs, whether you’re managing personal expenses or running a business.

Here’s the corrected version:

When designing a running balance receipt template, focus on clear, concise formatting. The template should start with the basic details like date, transaction ID, and description for easy tracking. The balance section should update automatically after each transaction to show the current total. This helps eliminate errors in manual calculations and ensures accuracy throughout.

Key Features of the Template

Include columns for the date of transaction, transaction type (debit or credit), description, and the running balance. It’s also useful to have a starting balance at the top for quick reference. The running balance should be calculated automatically, updating after each transaction is entered.

Tips for Effective Use

Ensure your columns are clearly labeled. Users should be able to easily identify each part of the transaction at a glance. Consider adding simple formulas to calculate totals or balances directly in your spreadsheet to minimize human error. You can also format the running balance column to highlight negative balances in red, making discrepancies easy to spot.

Lastly, keep the design simple–avoid clutter and unnecessary elements that might distract from the core purpose of the template. This makes it much easier to maintain and use over time.

- Running Balance Receipt Template

A Running Balance Receipt Template provides a streamlined way to track ongoing transactions and maintain a clear financial record. It allows both businesses and individuals to document payments, debits, and credits in real time, ensuring all balances are up-to-date. Using such a template can simplify cash flow management and provide immediate insight into the financial status of a transaction or account.

Key Features

The template should include the following key components to ensure accuracy:

- Date – Clearly indicate when the transaction took place.

- Description – A brief note explaining the nature of the transaction.

- Amount – Specify the value of the transaction, whether a payment, deposit, or withdrawal.

- Running Balance – This is a dynamic field that automatically updates after each transaction to reflect the current balance.

- Transaction Type – Indicate whether the transaction is a credit or debit to avoid confusion.

How to Use It

Fill in the transaction details as they occur. After each entry, the template should automatically update the running balance, providing a real-time snapshot of your financial standing. This process helps you quickly identify discrepancies, manage your funds efficiently, and avoid errors that can arise from manual record-keeping.

For businesses, a Running Balance Receipt Template can simplify invoicing, track payments, and assist in generating financial reports. For personal use, it helps in monitoring your personal budget and keeping track of spending. Whether you’re managing a large portfolio or tracking everyday expenses, this template can be a valuable tool for staying organized and financially aware.

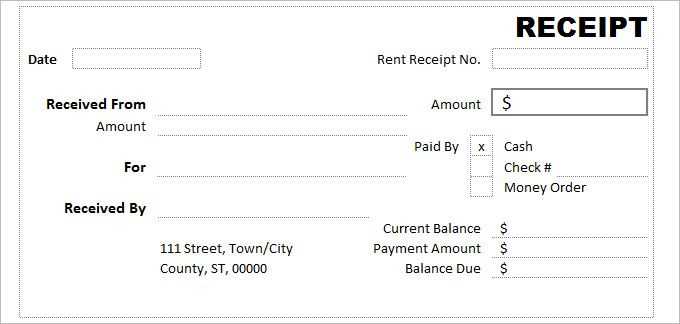

To set up a running balance, start by listing each transaction with its corresponding amount in the receipt. After each entry, subtract or add the transaction value to the current balance. Ensure each entry is clear and accurate, showing both the transaction amount and the updated balance.

For example, if a customer makes a payment of $50, subtract $50 from the previous balance. If they make a purchase for $30, add $30. Display the new balance next to each transaction. This method helps both you and the customer keep track of the current total at any point during the transaction.

Incorporate a “Total Balance” section at the bottom of the receipt to confirm the final amount. This ensures clarity and avoids confusion. Adjust the running balance for any discounts, taxes, or additional fees that may apply during the transaction.

Keep the format consistent for easy readability. Whether you list the running balance in a column or a separate section, maintain a simple structure that avoids unnecessary complexity.

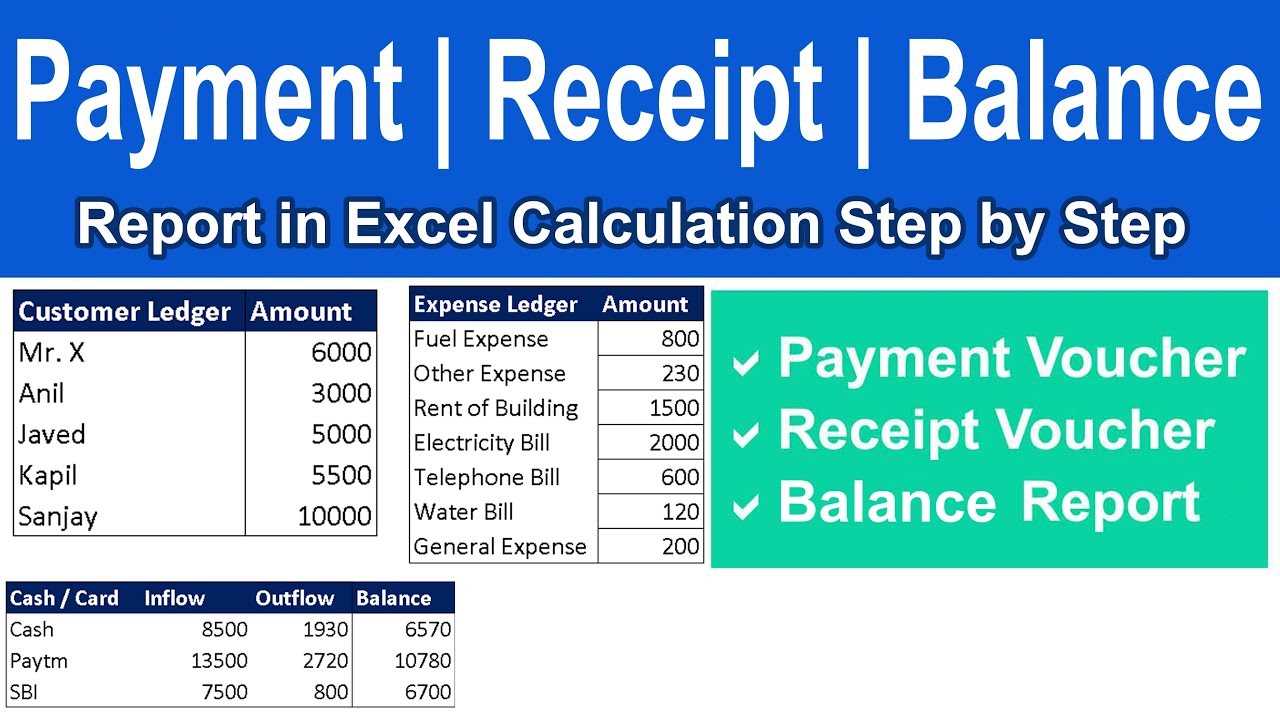

Linking running balances directly with invoices or payment systems streamlines your financial tracking and enhances payment management. This integration allows businesses to automatically update outstanding balances in real time, reducing the need for manual calculations and errors.

Key Benefits

- Real-Time Updates: Payments or adjustments reflect immediately on outstanding balances, ensuring up-to-date financial data.

- Improved Accuracy: By automating balance updates, you reduce the risk of errors commonly associated with manual entries.

- Efficient Payment Tracking: Integration allows for seamless tracking of paid and pending amounts, minimizing confusion and delays.

How to Integrate Running Balances

- Choose Compatible Software: Ensure the payment system or invoicing software you use supports balance integration, such as accounting software with invoicing features.

- Automate Payment Records: Set up automatic synchronization between payments received and running balance updates to keep records aligned.

- Enable Notifications: Configure alerts for when payments are made or balance thresholds are met, ensuring proactive management.

- Ensure Data Consistency: Regularly check for discrepancies between running balances and payment records to maintain accuracy.

Common Mistakes to Avoid When Using Running Balance Templates

One major mistake is failing to update the running balance after each transaction. Skipping this step can cause discrepancies that will compound over time, making the final balance inaccurate. Always ensure you adjust the balance with every new entry.

Another error is not clearly distinguishing between credits and debits. Confusing these categories can lead to a mixed-up balance. Label each entry correctly and double-check for consistency before finalizing the record.

Neglecting to verify initial balances is another issue. If the starting point is incorrect, everything that follows will be skewed. Always double-check the initial balance before entering any transactions.

Inconsistent formatting is also a problem. In some cases, users may mix different date formats or transaction descriptions. Keeping everything uniform makes it easier to track progress and avoids confusion.

Using the template inconsistently can create errors. Every time you update your records, follow the same steps. Inconsistencies can lead to missing data or a mismatch between the current balance and the last recorded one.

Lastly, leaving out additional details like transaction references or notes can cause misunderstandings. Provide enough information so others can understand the context of the entries without further explanation.

Running Balance Receipt Template

A well-structured template for tracking transactions helps ensure clarity and transparency. Focus on capturing key details in a straightforward format to avoid clutter and confusion.

Key Components of a Template

The template should include fields for transaction dates, amounts, and the balance after each entry. Ensure that the calculations are automatic where possible to minimize errors and save time.

Design Tips

Opt for a simple, clean design with distinct sections for incoming and outgoing funds. This structure makes it easy to follow the flow of transactions and quickly assess the remaining balance.

| Date | Description | Amount | Balance |

|---|---|---|---|

| 02/10/2025 | Payment Received | $500 | $2,500 |

| 02/15/2025 | Purchase Made | -$200 | $2,300 |

| 02/20/2025 | Refund Issued | $150 | $2,450 |

With these simple additions, the template becomes a valuable tool to keep track of the ongoing balance with each new transaction. Regular updates and clear labeling will maintain its usefulness over time.