Rent template receipts are useful tools for landlords and tenants alike. These documents simplify the transaction process by providing clear details of rent payments. With a well-organized template, you can efficiently track and confirm rental payments.

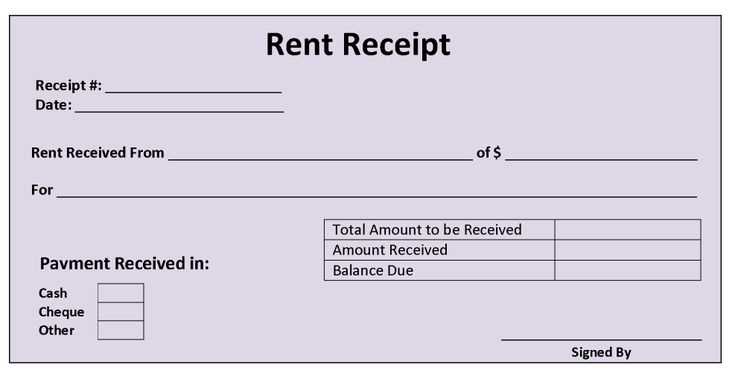

By using a rent receipt template, landlords can avoid confusion and ensure transparency in their dealings with tenants. A good template will include the rental period, payment amount, tenant’s name, and payment method. Customizing it to suit specific needs can save both parties time and effort when documenting payments.

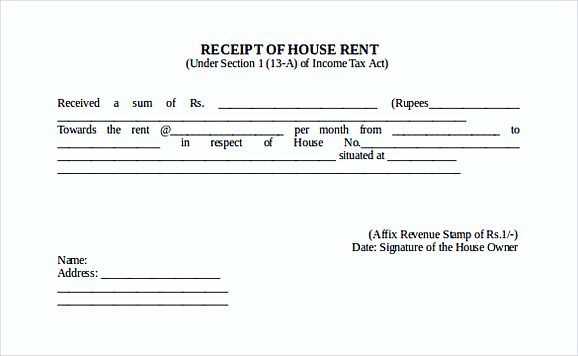

Using a standardized format also helps tenants keep accurate records for personal budgeting and tax purposes. For landlords, it ensures compliance with local regulations and serves as proof of transaction in case of disputes. A simple, easy-to-understand template can go a long way in maintaining positive landlord-tenant relationships.

Here are the corrected lines:

Ensure the date format is consistent across all receipts. Use the format YYYY-MM-DD for clarity and standardization.

Update the rental period section to reflect the exact start and end dates. Avoid abbreviations and provide full details to prevent confusion.

For the amount section, verify that taxes are clearly separated from the base amount. Include any applicable fees as line items for transparency.

Ensure the tenant’s name and address are accurately listed, matching the details provided during the rental process. Double-check for spelling errors.

If offering a discount or promotion, specify the exact percentage or amount, and include the terms under which it applies.

Review payment methods for accuracy, ensuring that credit card details or bank transfer information are correctly listed, without ambiguity.

Clarify any deposit requirements by specifying the amount and the return policy. Include the expected timeframe for deposit refunds if applicable.

Recheck the signature section to make sure that both parties’ signatures are included, confirming the validity of the rental agreement.

Ensure that all fields are filled completely and legibly to avoid issues during audits or disputes.

- Rent Template Receipt

To create a clear and accurate rent receipt, include the following details:

Landlord and Tenant Information

List the full name and contact details of both the landlord and the tenant. Include the rental property address to specify the location of the rental agreement.

Payment Details

State the amount paid, the method of payment (e.g., cash, cheque, bank transfer), and the payment date. Specify if the payment is for a partial or full rental period. Any additional charges, like late fees, should be listed separately for transparency.

End the receipt by acknowledging that both parties agree to the terms. A signature from both landlord and tenant adds confirmation to the transaction.

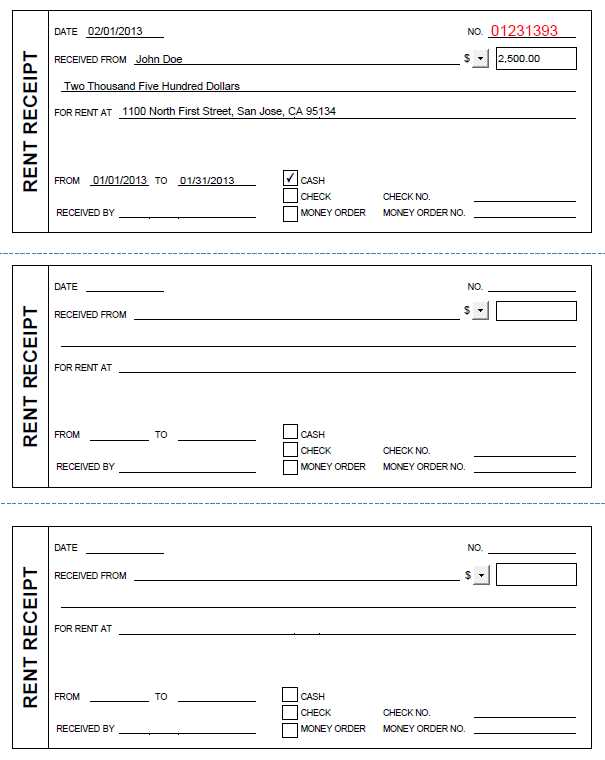

For landlords, having a clear and professional receipt template is a smart way to keep rental transactions organized. Follow these steps to build a functional receipt template that suits your needs:

- Include Property Details: Start by listing the property address, unit number, and tenant’s name. This ensures clarity and prevents confusion when reviewing past transactions.

- Specify Payment Information: Clearly state the payment amount, due date, and the payment method. This helps both parties track financial records accurately.

- List the Rent Period: Make sure the period covered by the payment is noted (e.g., January 1st – January 31st). This clarifies the timeframe for both landlord and tenant.

- Provide a Receipt Number: Assign a unique number for each receipt. This will make it easier to reference specific payments in the future.

- State the Payment Status: Indicate whether the payment was full or partial. For partial payments, include the remaining balance.

- Include a Signature Line: Allow space for both the landlord and tenant to sign, confirming the transaction was completed. This adds an extra layer of accountability.

- Add Optional Notes: Include any other relevant information such as late fees, discounts, or reminders. These details can help clarify special circumstances and prevent misunderstandings.

With these components in place, you can create a streamlined receipt template that covers all necessary details while maintaining professionalism. Save this template for future use and adjust as needed based on specific rental agreements.

Avoid using templates without adjusting them to match your specific needs. Using a generic template without personalization can lead to an impersonal, unprofessional final product. Make sure to update the placeholders, change the fonts, and adapt the structure to fit your brand or context.

Don’t ignore the template’s limitations. Some templates may not offer the flexibility required for your content. Before starting, test the template’s compatibility with your specific needs. If it’s too rigid, consider adjusting the layout or even selecting a more versatile option.

Overloading templates with unnecessary content can make them look cluttered. Stick to the key information and avoid adding too many elements that might distract or confuse the reader. Simplify and prioritize clarity over excessive detail.

Ensure consistency across all your documents or receipts. Using different templates for different purposes can cause inconsistency in branding, design, or structure. If you’re working on multiple documents, try to maintain a unified style across all of them.

Failing to proofread the content before finalizing it is another common mistake. Even the best templates can be spoiled by overlooked errors. Always review your text, check for typos, and ensure accuracy in all details before using the final version.

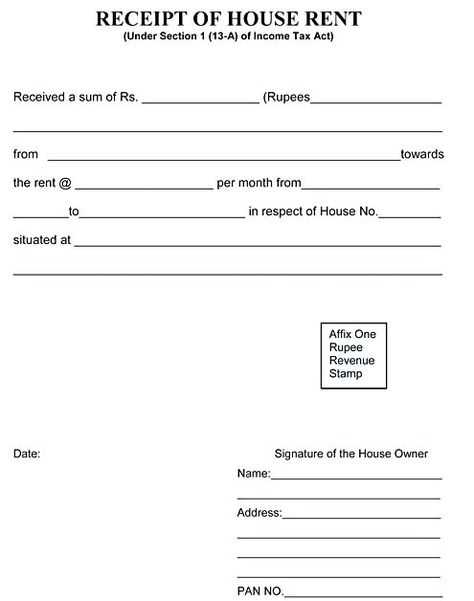

To ensure your receipt meets legal requirements, include all necessary details such as the seller’s name, business address, and tax identification number. Ensure the transaction date is clearly displayed, along with an itemized list of products or services purchased, including quantities and prices.

Make sure the total amount charged, including applicable taxes, is easy to identify. For receipts involving VAT or sales tax, the tax rate and the amount of tax applied must be clearly stated. If you’re issuing electronic receipts, ensure they adhere to local regulations regarding digital documentation and signatures.

Check that your receipt includes any terms related to warranties or return policies, as required by consumer protection laws. Keep a copy for record-keeping and be sure it matches the transaction details to avoid discrepancies.

Use a clear structure to make your receipt template easy to read and understand. Begin by including the basic details like the recipient’s name, rental amount, and date of transaction. Ensure that the rental period is also listed, specifying the start and end dates. Adding payment method details will help clarify the transaction and ensure that both parties are aligned.

Here is a sample template layout:

| Item | Details |

|---|---|

| Recipient Name | John Doe |

| Rental Amount | $500 |

| Rental Period | Feb 1, 2025 – Feb 10, 2025 |

| Payment Method | Credit Card |

| Transaction Date | Feb 10, 2025 |

Be sure to also include a note about any security deposit or other related terms. This will clarify whether or not any additional payments are expected. If applicable, add a space for the customer’s signature to acknowledge the terms.