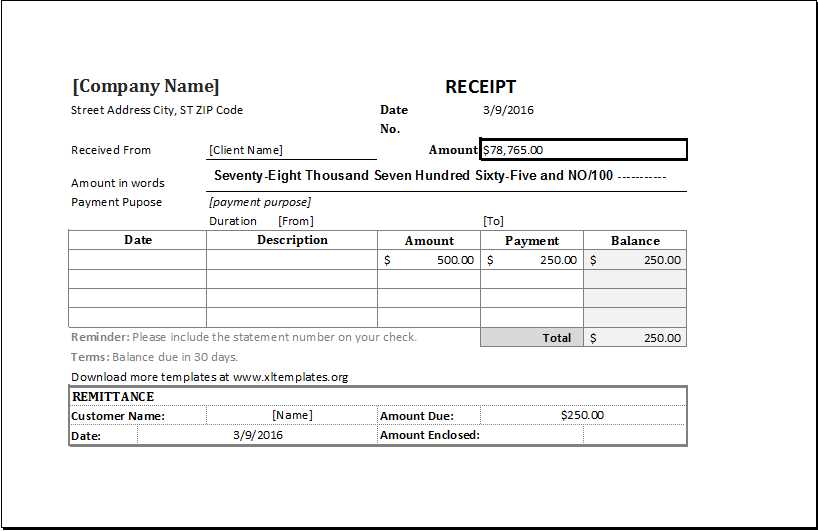

If you need a cheque receipt template in DOC format, it’s easy to create one that fits your specific needs. Start with the basic structure of a receipt, including key elements such as the date, payer’s details, cheque number, amount, and purpose of payment. Customize it to match your business requirements, ensuring clarity and accuracy in every transaction.

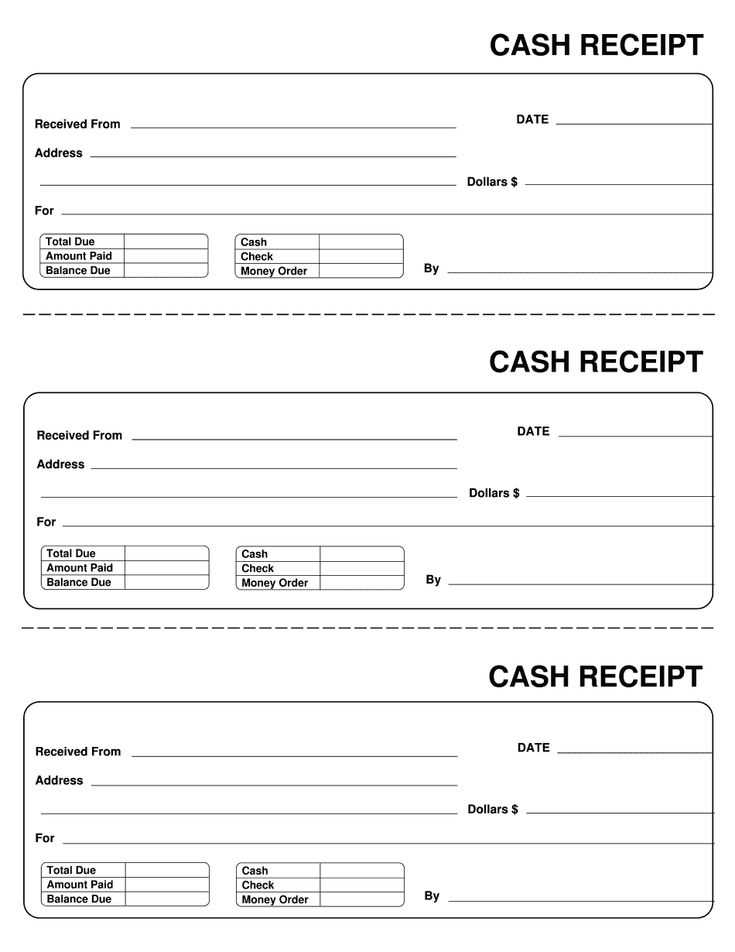

For a clear and functional receipt, include the following sections:

- Date: Make sure to record the date the cheque was received.

- Payer Information: Include the name, address, and contact details of the person or company issuing the cheque.

- Cheque Details: Mention the cheque number and the bank it’s drawn from.

- Amount: Clearly state the amount in both words and figures to avoid confusion.

- Purpose: Briefly describe the reason for the payment to maintain transparency.

- Signature: Leave space for both the receiver’s and payer’s signatures to validate the transaction.

Make sure to save the document as a DOC file so it can be easily edited and printed as needed. This format allows for flexibility, enabling you to tailor the template for any future payments without starting from scratch each time.

By following these steps, you can ensure that your cheque receipts are clear, professional, and easily reproducible for any future transactions. This method streamlines your payment documentation and provides a standardized approach for all parties involved.

Here’s the corrected text:

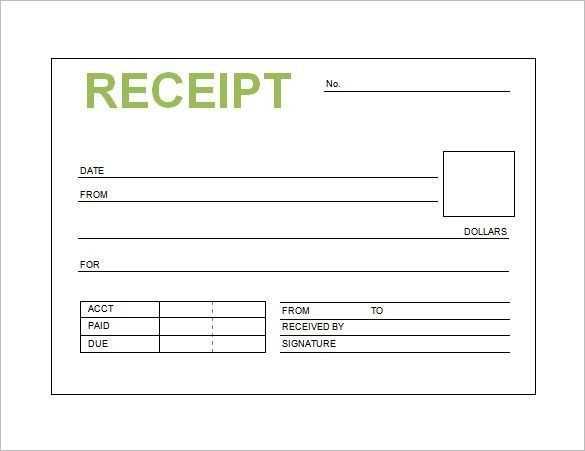

For a clean and professional cheque receipt, ensure to include the following elements in your template:

1. Sender and Receiver Information

Clearly specify the names and addresses of both the sender and the recipient. Make sure this data is accurate to avoid confusion later on.

2. Date and Amount

State the exact date the cheque was issued. Also, include the exact amount in both words and numbers, ensuring they match to prevent any discrepancies.

Include a reference or receipt number for record-keeping. This helps to track the transaction in case of future inquiries.

Make sure to leave enough space for the cheque details to be written clearly, and ensure that each section is well-organized for easy reading and processing.

- Cheque Receipt Template DOC

Use a cheque receipt template to create a clean, professional record of payments. A simple document can help ensure accuracy and clarity in financial transactions. Ensure your template includes fields for the cheque number, payer details, amount, date, and a brief description of the transaction. A well-structured template helps both the receiver and the payer track payments without confusion. Tailor the design to your specific needs, such as adding your company logo or customizing the footer for additional legal information.

The DOC format offers flexibility in editing and printing, making it suitable for both digital and hard-copy use. Consider adding a section for the cheque’s bank details to maintain a clear record for future reference. Ensure the layout is easy to fill out and visually clear, avoiding unnecessary clutter. This approach streamlines payment documentation, making record-keeping more organized and reducing the chances of errors.

Begin by opening your receipt template in a word processing software, such as Microsoft Word. Once the template is open, you can easily modify the fields and design to fit your needs. Here’s a step-by-step guide to customizing your DOC receipt template:

- Modify Text Fields: Click on any text placeholder in the template to edit it. Replace generic terms with your company name, transaction details, and other specifics relevant to the receipt.

- Change Fonts and Styles: Highlight the text you want to change, and adjust the font style, size, and color through the toolbar options. This helps in creating a professional look tailored to your branding.

- Add or Remove Sections: Depending on your business needs, you can add extra fields (like discounts or tax breakdown) by inserting text boxes, tables, or extra rows. To remove unnecessary sections, simply highlight the section and delete it.

- Insert Logo or Images: To personalize your receipt further, insert your company logo or any relevant images. Go to the “Insert” tab, select “Pictures,” and upload your image. Resize it to fit the header or footer of the receipt.

- Update Dates and Currency: If the template includes default dates or currency, make sure to adjust these fields to reflect the transaction details. Use placeholders like [Date] or [Amount] that you can easily update with each new receipt.

Once you’ve made all the adjustments, save the customized template as a new DOC file for future use. This ensures that you can quickly generate receipts without having to start from scratch each time.

Include the date of the transaction. This confirms when the payment was made, providing a clear timeline for both parties.

Include the name and contact details of the business or individual issuing the receipt. This helps in case there is any need for follow-up or clarification.

Provide a unique receipt number. This helps track each transaction and ensures there are no mix-ups with other records.

Clearly state the amount paid. Ensure this is listed in both words and numbers for accuracy, avoiding any potential confusion.

Describe the product or service that was purchased. Include specific details such as quantity, unit price, and any applicable taxes or discounts.

Include the payment method used. Whether it’s cash, cheque, or credit card, this adds transparency and clarity to the transaction.

Specify any outstanding balance, if applicable. This is important if the payment was partial or if any additional charges are expected in the future.

Provide signatures if necessary. Both parties may sign to confirm that the transaction details are accurate and agreed upon.

Ensure the date is entered correctly. Incorrect or missing dates can lead to confusion, especially for financial records. Always verify the date before finalizing the receipt.

Incorrect Formatting

Failure to properly format the receipt can cause errors. Maintain consistent font size and spacing. Avoid overcrowding the template with unnecessary details, as this can make the receipt harder to read.

Missing Required Details

Omitting critical information such as the receipt number, seller’s contact information, or payment method can render the receipt incomplete. Always double-check that all necessary fields are filled in before issuing the receipt.

| Common Mistake | Recommendation |

|---|---|

| Incorrect Date | Verify the date before generating the receipt. |

| Improper Formatting | Maintain consistent font size and spacing. |

| Missing Details | Ensure all necessary fields are filled in. |

To create a clear and professional cheque receipt template, focus on simplicity and accuracy. Include the essential details: the cheque number, date, payer’s name, amount received, and the recipient’s name. Each of these fields should be clearly labeled for quick reference.

Ensure the cheque number is prominently displayed at the top for easy tracking. This helps in identifying the transaction quickly and avoids confusion with other receipts. Below that, include the date the cheque was received to maintain a clear timeline of transactions.

The payer’s name should appear next to the amount section, making it easier to link the cheque to the sender. The amount should be clearly written in both words and figures, reducing the risk of errors. The recipient’s name should be placed at the bottom of the receipt, signifying who received the payment.

Consider adding a section for additional notes or reference, like payment purpose or a confirmation number. This can be especially helpful for record-keeping purposes.

Lastly, include a signature line for the recipient. This confirms that the cheque was received and processed, adding an extra layer of accountability.