Use this template to create a simple and clear rent receipt that complies with LDS standards. This document serves as proof of payment, outlining both the tenant’s and landlord’s information, the amount paid, and the rental period. Keeping your records organized will help ensure smooth transactions and avoid potential misunderstandings.

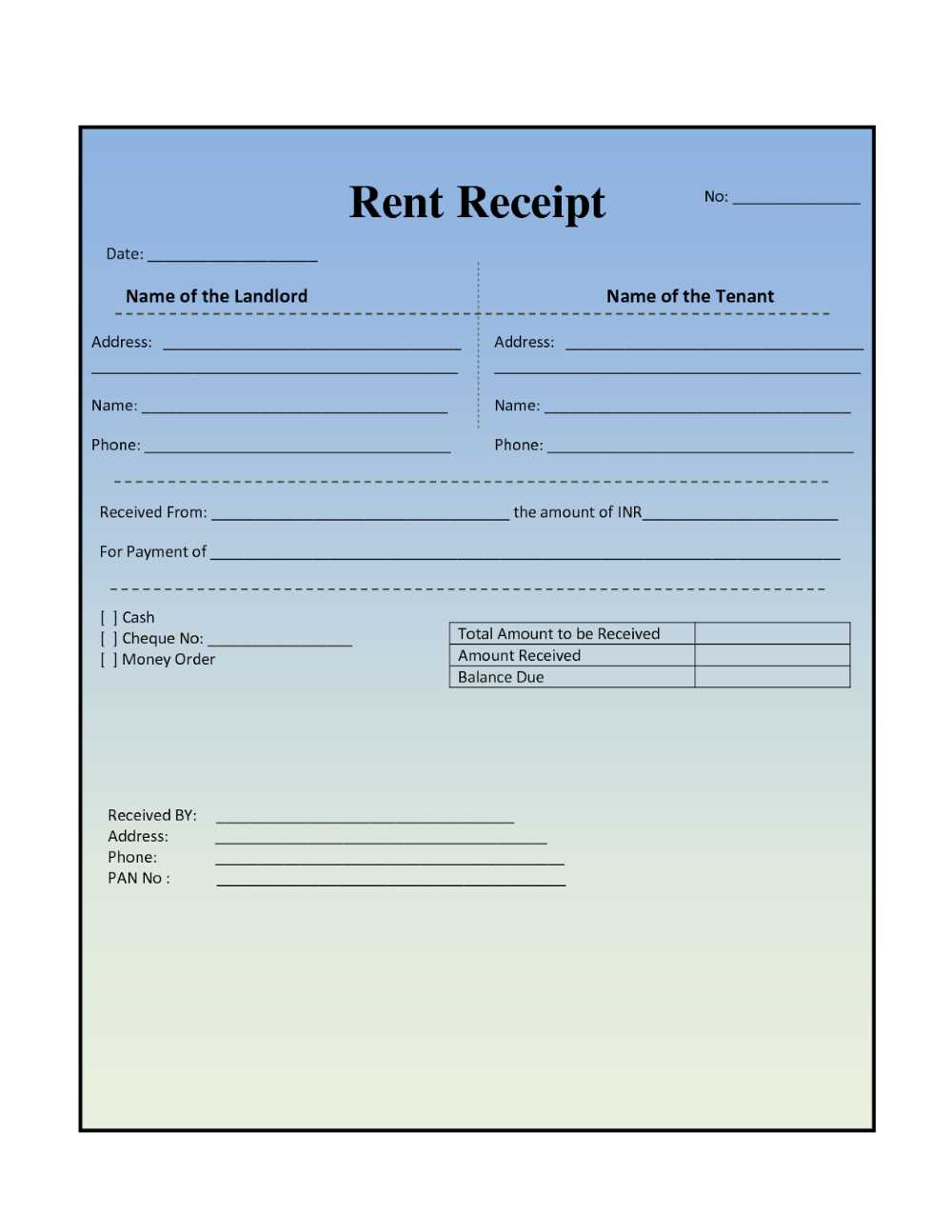

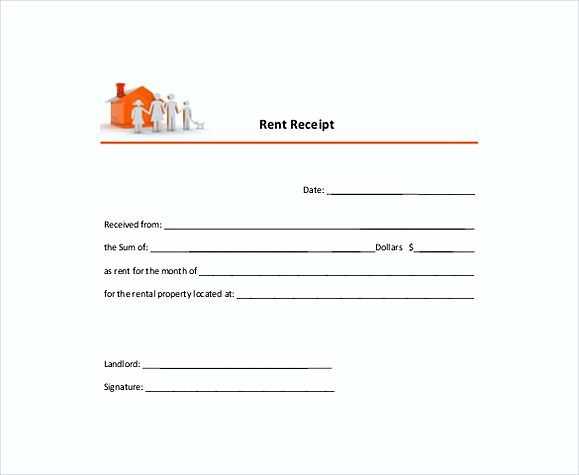

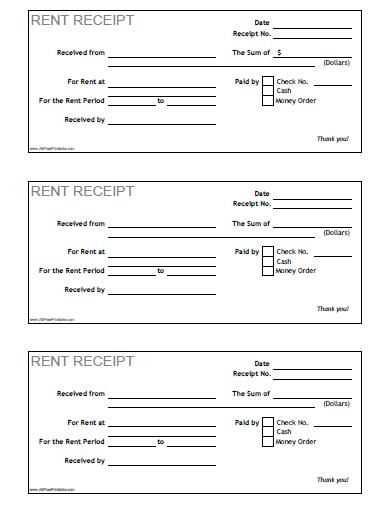

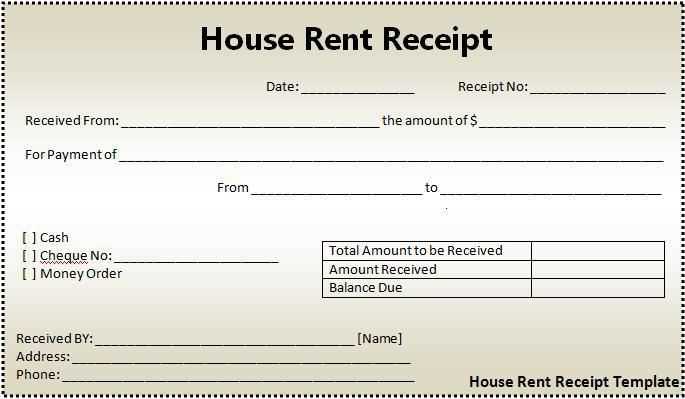

Template Overview: Include the tenant’s name, address, and contact details. The receipt should list the payment date, the amount received, and the rental period it covers. A clear statement about the method of payment (e.g., cash, check, bank transfer) is also necessary. Make sure to include both the landlord’s name and signature for verification.

What to Include: The rental agreement terms, payment method, and specific date range for which the payment applies should be clearly stated. Additionally, it’s a good practice to add a receipt number for easy reference in case of future queries or disputes.

Here are the corrected lines based on your request:

Ensure that the header includes the full name of the landlord and the tenant. This will help with legal clarity and avoid confusion. Double-check that the rental amount and payment dates match the lease agreement to ensure consistency.

Clarification of Payment Terms

Make sure that the payment method is specified. Whether it’s via bank transfer, check, or another method, clearly stating this ensures no misunderstandings in the future.

Additional Details for Accuracy

Verify that the address listed is accurate. Sometimes small details, like suite or apartment numbers, can be overlooked. Always include any additional charges, such as maintenance fees, to provide a complete record of the rental payment.

- Understanding the LDS Rent Receipt Template

The LDS rent receipt template should include key information that makes tracking rent payments straightforward. Begin with the tenant’s name and the rental property’s address. The receipt must list the amount paid, the payment method (e.g., cash, check, or bank transfer), and the date the payment was received. Also, a receipt number is helpful for reference and organization.

Critical Elements of the Template

- Tenant Name: Include the full name of the person making the payment.

- Rental Property Address: List the full address where the rent applies.

- Amount Paid: Clearly state the rent amount that was received.

- Payment Method: Mention how the payment was made, whether by cash, cheque, or online transfer.

- Payment Date: Ensure the date of the payment is included.

- Receipt Number: Assign a unique number for each receipt issued.

Benefits of Using the Template

Using a detailed receipt template simplifies rent tracking and helps with record-keeping. It makes future reference easy, whether for confirming payment history or resolving disputes. This also provides tenants with official documentation, which can be useful for tax or legal purposes.

Adjust the date range for each rent period based on the agreement. If the rent period is monthly, specify the start and end dates clearly. For a weekly rent period, update the dates to reflect the weekly intervals. For tenants with a quarterly arrangement, set the dates to match each quarter. Make sure these dates align with the payment cycle to avoid confusion.

Ensure the rent amount corresponds to the exact period specified. For monthly periods, the rent will typically be one flat rate, while weekly or quarterly periods may require dividing the total amount by the appropriate number of weeks or months to show the accurate payment amount. This will help both parties keep track of the payments made and due.

Finally, adjust the “next due date” field. For a monthly lease, the next payment will fall on the same date the following month. For weekly or quarterly agreements, ensure the next payment date reflects the correct interval. Always confirm the terms of the lease to avoid any misunderstandings.

Ensure that the rent receipt includes the following details to meet legal requirements:

1. Tenant and Landlord Information

The receipt should list the names of both the tenant and the landlord. This establishes clear identification of the parties involved in the transaction. Include the full name and, if applicable, the address of both parties for additional clarity.

2. Rent Payment Details

Clearly state the amount of rent paid, the period it covers (e.g., monthly, quarterly), and the date of payment. This confirms the transaction and provides a reference for both parties. Specify the method of payment, whether cash, check, or bank transfer, for transparency.

3. Property Details

Include a description of the rental property, including the address and unit number if applicable. This helps in identifying the property being rented, especially when a landlord manages multiple properties.

4. Receipt Number and Signature

A unique receipt number should be included to help both the tenant and landlord track payments. Additionally, the landlord’s signature is required to verify the authenticity of the receipt.

If a rent receipt contains incorrect information, such as the wrong tenant name or payment amount, it is essential to review the receipt and cross-check it with the original lease agreement and payment records. If you notice discrepancies, contact the landlord or management office immediately to request an updated, accurate receipt.

Another common issue is the absence of required details, like the rental period or property address. To resolve this, make sure every receipt includes the full address of the rented property, the specific dates of the rent payment, and the amount paid. If any details are missing, request a new receipt with the complete information.

In some cases, landlords may fail to provide receipts in a timely manner. If this occurs, reach out to the landlord or management team to politely remind them of their obligation to provide receipts promptly. Keep a record of your communications to ensure follow-up if necessary.

Errors in payment method or date on the receipt are also not uncommon. Always verify that the payment method listed matches what you used and that the date reflects the actual date of payment. If mistakes are found, ask for a correction or a new receipt with the accurate information.

Optimizing Rent Receipt Clarity

To enhance the clarity of your rent receipt template, focus on eliminating unnecessary repetition while maintaining essential details. This ensures a streamlined document that is both professional and easy to understand. Here are a few tips to improve your template:

- Use concise descriptions for payment amounts. Instead of repeating terms like “total amount” or “balance due,” opt for straightforward phrasing like “Amount Paid” and “Remaining Balance.”

- Avoid redundant references to the landlord and tenant. Instead of restating their roles in each sentence, clearly identify them once and use pronouns afterward.

- In payment breakdowns, simplify explanations. For example, instead of saying “payment for rent amount,” just state “Rent Payment.”

Eliminating Repetition in Payment Details

Ensure that your payment breakdown remains concise. If you list multiple payments, make each line item distinct without repeating the same language. Use clear categories such as “Rent,” “Late Fee,” and “Other Charges” to avoid redundancy while conveying all necessary information.