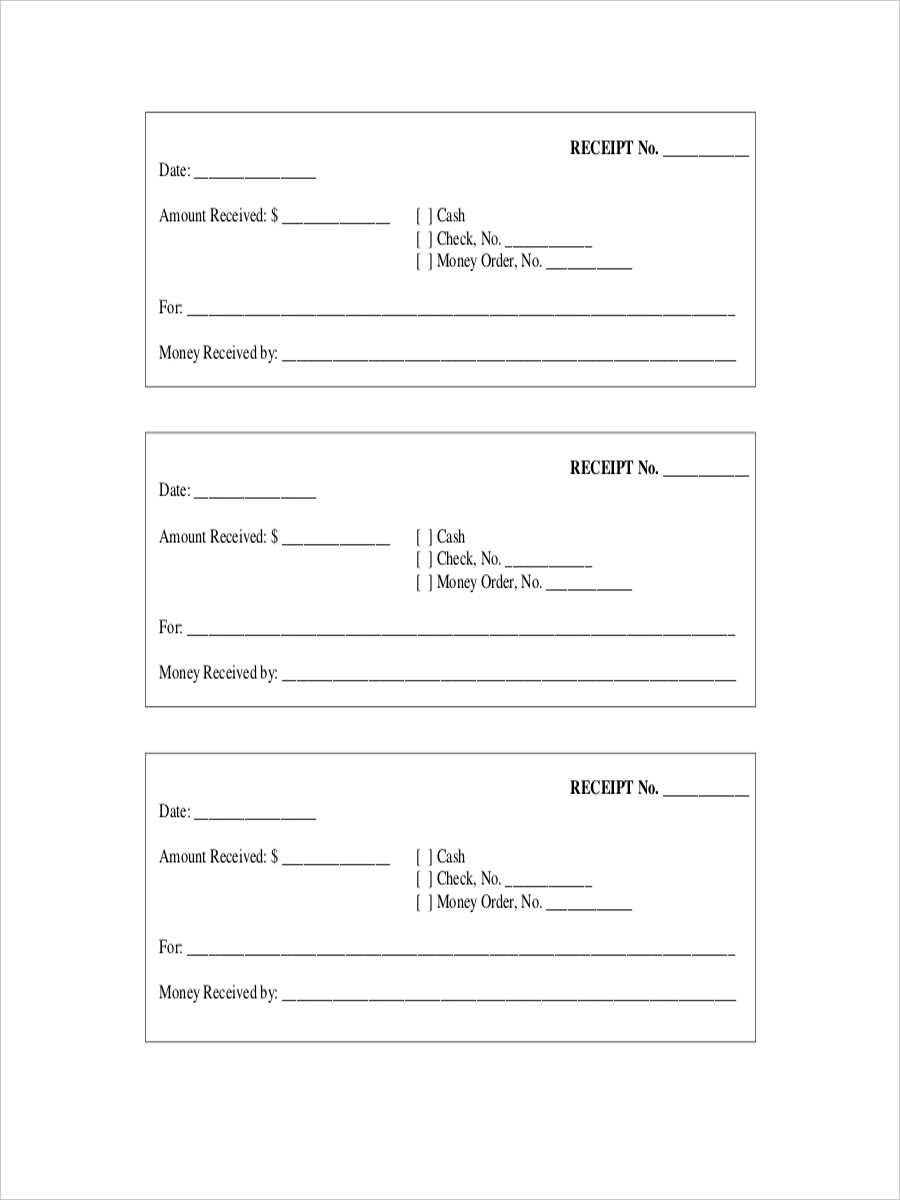

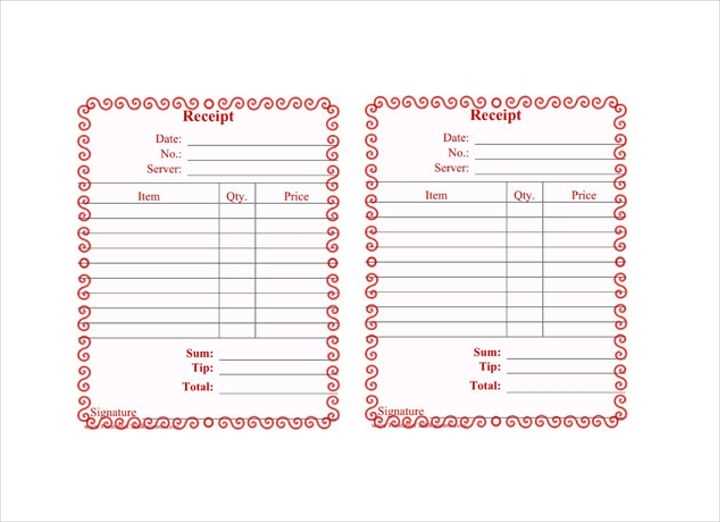

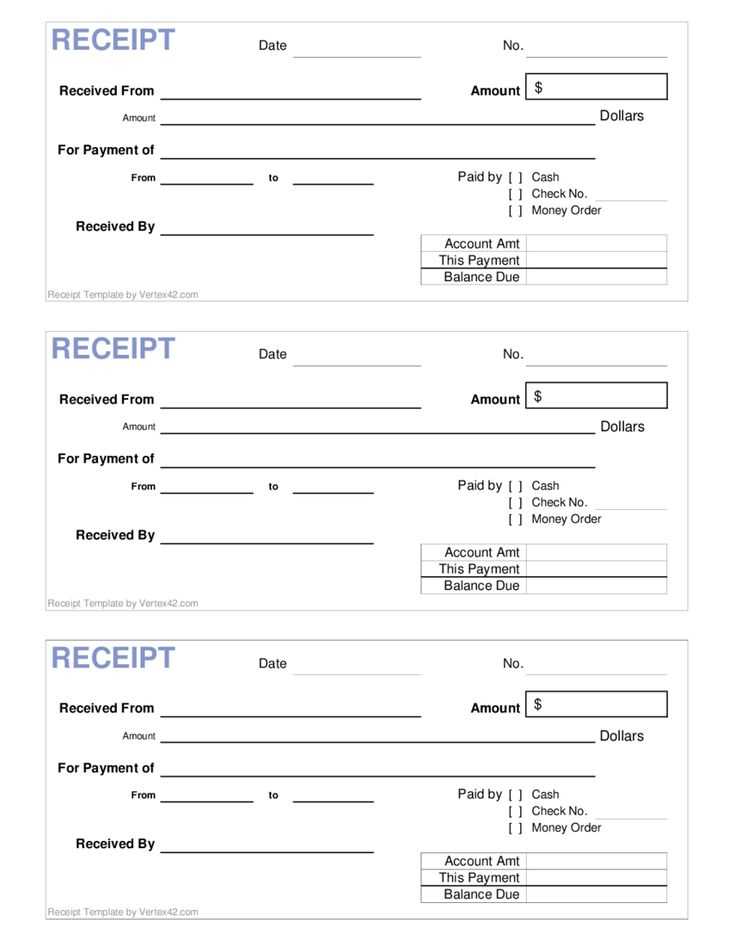

When designing a blank restaurant receipt template, incorporating a dedicated space for signatures is key for maintaining professionalism and clarity. A well-placed signature area confirms the transaction, ensuring both the customer and the establishment are on the same page regarding services rendered or agreements made. It’s important that the signature section is easy to locate and includes sufficient space for the person’s full name, title (if applicable), and the date.

Ensure that the signature field is clearly labeled to avoid any confusion during payment processing. By simply marking it as “Customer Signature” or “Authorized Representative Signature,” the customer knows exactly where to sign. The inclusion of a space for the date further ensures transparency by recording when the transaction took place.

Consider designing the signature area with a clean line or box to keep it neat and professional. This small yet effective addition enhances the document’s visual appeal while preventing any unnecessary clutter around the key details. Additionally, using a minimalist approach allows the template to remain versatile for different business needs.

How to Customize the Signature Section of a Receipt Template

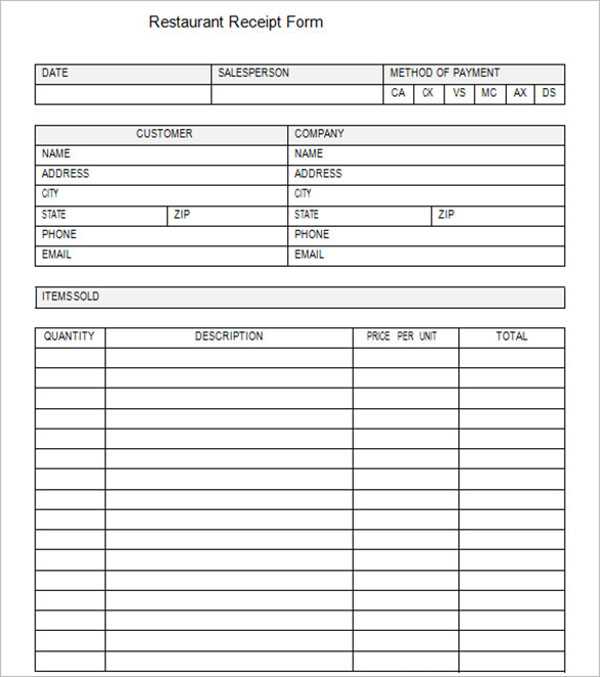

To modify the signature section of your receipt template, focus on the layout and font selection. Start by adjusting the space available for signatures to ensure it’s large enough for the required details. You can use a line or a box to represent where signatures should go. Adjust the alignment based on the template’s design, ensuring it’s visually balanced with other sections.

Choosing the Right Font

Select a font that matches the overall style of your receipt. Keep it simple and readable, such as using sans-serif fonts. Avoid overly decorative fonts, which can make the signature section appear cluttered or unprofessional. Make sure the font size is appropriate for the space, neither too large nor too small.

Adding Signature Labels

If you want to include a label next to the signature line (e.g., “Customer Signature” or “Authorized Signature”), use a slightly smaller font size. Position the label clearly above or beside the signature line, ensuring it’s easy for the signer to identify. Make sure the label doesn’t crowd the signature area.

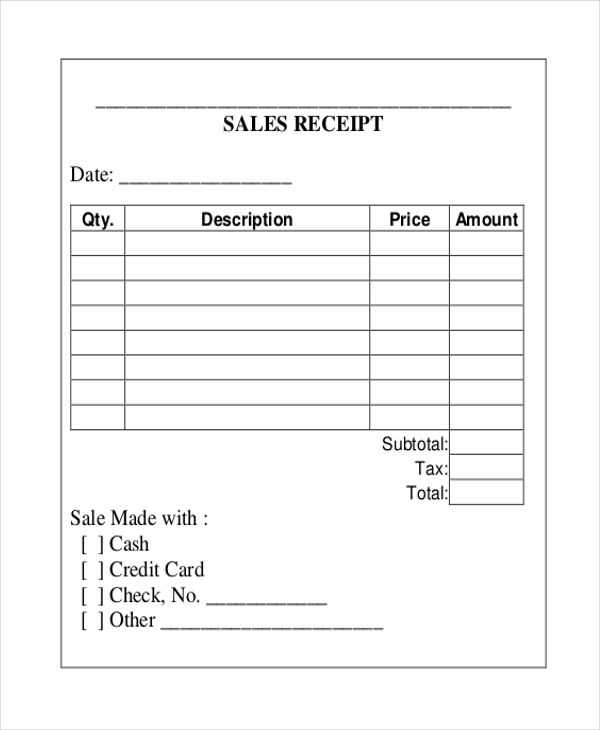

Common Mistakes to Avoid When Creating a Signature Field

Ensure the signature field is clearly labeled. A vague label can confuse users, making them unsure whether it’s meant for a signature or another type of input. Use direct terms like “Signature” or “Sign here” for clarity.

1. Not Setting a Proper Size for the Field

A signature field that’s too small can frustrate users. Make sure the space is large enough for a signature to fit comfortably without feeling cramped. It should also allow for some variation in signature size while remaining readable.

2. Lack of Field Validation

Don’t overlook validation. Ensure that the field checks for a signature before submission. Without validation, users could skip the field or submit incomplete forms, causing delays and errors in processing.

Make sure the signature field is positioned logically. Place it at the end of the form to follow a natural flow and ensure users know exactly where to sign without having to search for the space.

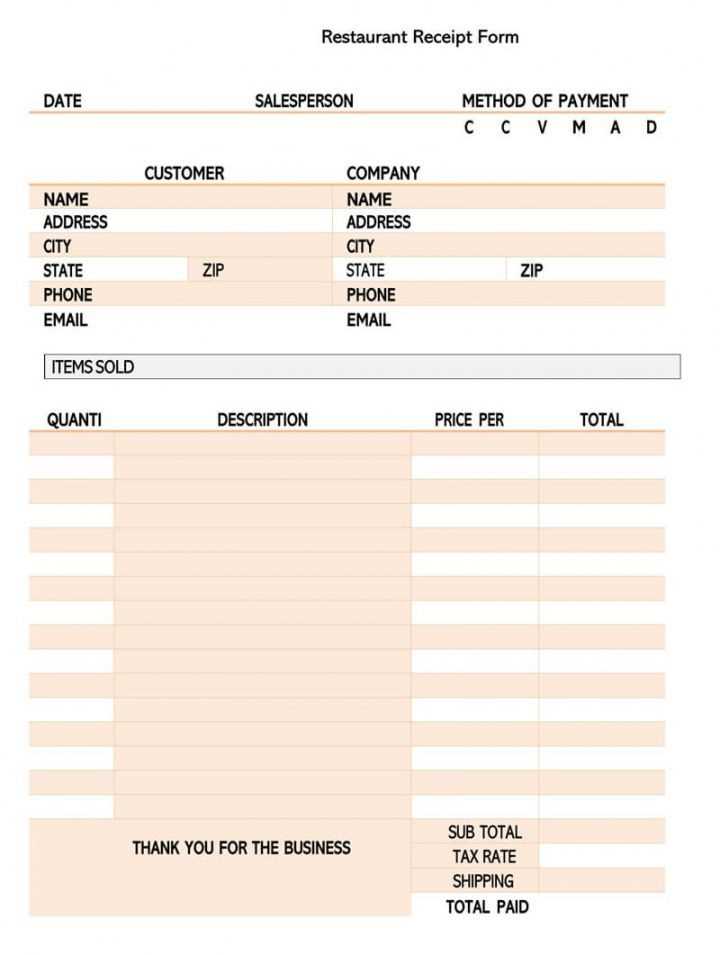

Best Practices for Securing and Authenticating Receipt Signatures

Ensure that signatures on receipts are captured digitally for added security and easier verification. Using digital signature pads or secure mobile apps helps eliminate the risk of manipulation, making the process more reliable. Digital signatures offer encryption that prevents unauthorized access or alteration.

To authenticate signatures, incorporate multi-factor verification methods. Request additional proof of identity, such as a personal identification number (PIN) or biometric verification, to further strengthen the authentication process. This reduces the chance of fraud and guarantees that the person signing is indeed the authorized party.

For added security, store signed receipts in encrypted formats. Cloud-based systems with robust security protocols ensure that digital signatures are kept safe from unauthorized access. Regularly update security measures and monitor access logs to detect any suspicious activity.

Train staff members to verify signatures carefully, especially when dealing with large transactions. A simple check against the cardholder’s signature or an ID can go a long way in preventing fraudulent claims.

Consider implementing a time-stamping mechanism for each signed receipt. This verifies the exact moment the transaction took place, offering an additional layer of proof in case of disputes. Time-stamped digital receipts can also be cross-referenced with transaction logs for easy validation.