When organizing a fundraiser, providing a receipt is a must for maintaining transparency and building trust with donors. A fundraiser receipt template ensures consistency in documentation and makes the process of issuing receipts quicker and easier for everyone involved. By using a standardized format, you can include all necessary details while saving time and avoiding errors.

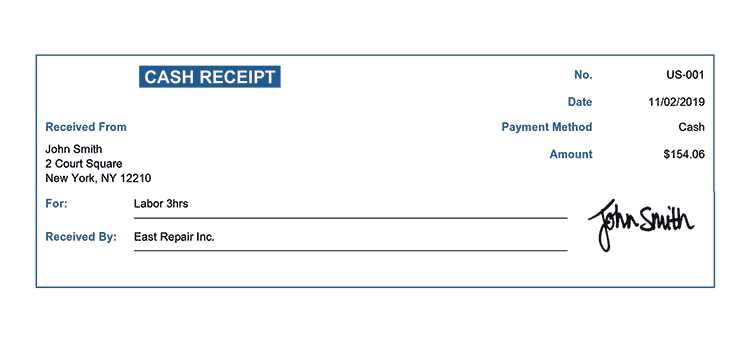

A well-designed receipt template should clearly state the amount donated, the date of the donation, and any relevant details like the donor’s contact information and the fundraiser’s purpose. Including a unique identifier for each donation can further streamline tracking and reporting.

Choose a template that accommodates both online and offline donations. If you’re working with digital platforms, ensure that the template aligns with their requirements for tax reporting purposes. By offering clear, concise receipts, you help your donors feel confident that their contributions are being handled professionally and with care.

Here are the corrected lines:

Start with a clear heading that includes the name of the fundraiser and the date of the donation. This sets the context immediately for the receipt. For example, “Receipt for Donation to [Fundraiser Name] on [Date].”

Details to Include

Make sure to specify the donor’s name and address, as well as the amount donated. This can be a fixed or variable field, depending on your system. Include the payment method used (credit card, bank transfer, etc.) to ensure transparency.

Include the tax-deductible status of the donation, if applicable. You can include a short note like, “This donation is tax-deductible to the extent permitted by law.” If no tax deduction applies, clearly state that as well.

Formatting Considerations

Avoid clutter in your receipt. Use clean, simple formatting: clearly define sections for donor information, donation details, and legal disclaimers. Stick to a logical order so it’s easy to read and reference later.

Lastly, don’t forget to include your organization’s contact information. This should be at the bottom, with an email or phone number in case the donor needs further assistance. This shows professionalism and transparency.

- Turn Fundraiser Receipt Template: A Practical Guide

To create a functional fundraiser receipt template, focus on including the details necessary for both the donor and your organization. A clear, concise format ensures transparency and builds trust. Here are the key elements you need:

1. Donation Details

Start with the donor’s full name, contact information, and the amount donated. If the donation was in-kind, specify the item or service donated along with an estimated value. Clearly state whether the donation is a one-time or recurring contribution.

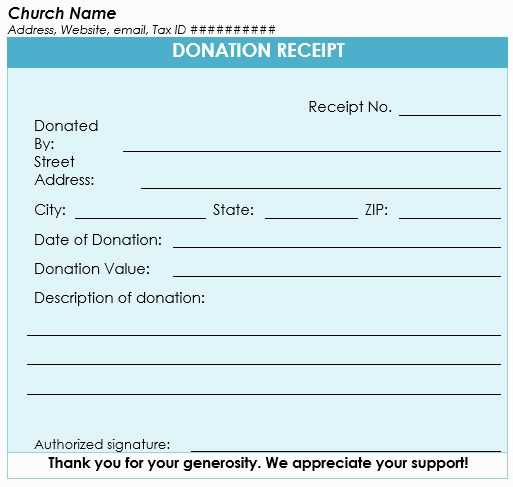

2. Organization Information

Include the full name of your organization, address, and tax ID number. If applicable, add your charity’s registration number and the designation (e.g., nonprofit, 501(c)(3)). This helps verify the legitimacy of your organization.

For tax purposes, make sure to include a statement like: “No goods or services were provided in exchange for this donation,” unless the donor received something in return (e.g., event tickets or gifts). In that case, you need to itemize the value of those goods/services.

Conclude with the date of the donation and any relevant notes. A clean, easy-to-read format is critical for both record-keeping and donor relations.

Include the necessary legal details, such as your nonprofit’s name, address, and tax-exempt status. This makes the receipt valid for tax deductions. Ensure the donor’s information is accurate, including their name and the donation amount.

Key Elements to Include

Ensure the following information is clearly listed on each receipt:

- Organization name, address, and tax-exempt status.

- Donor’s name and address (if applicable).

- Donation amount and date.

- A statement that no goods or services were provided in exchange for the contribution, if applicable.

- Donor’s acknowledgment of the donation.

Customizing Your Template

Make sure the receipt is easily recognizable with your organization’s branding–add a logo or custom colors. This adds professionalism and helps to maintain consistency across all your documentation.

| Donation Type | Details |

|---|---|

| Monetary | Exact amount donated, e.g., $50 |

| Non-monetary | Description of goods or services donated, along with their fair market value (if possible). |

| Recurring | Provide information on the donation schedule (e.g., monthly payments). |

Check the IRS guidelines for any additional tax-related information that may need to be included, based on the donation’s specifics. Providing clear, accurate receipts helps donors easily claim their deductions and ensures compliance with tax regulations.

Ensure the receipt contains the following details to keep it clear and accurate:

- Donor’s Information: Include the full name of the donor and their contact details (address, email, or phone number) for record-keeping and future communication.

- Organization’s Information: List the legal name, address, and contact information of the nonprofit or organization receiving the donation. This helps validate the receipt and confirm its legitimacy.

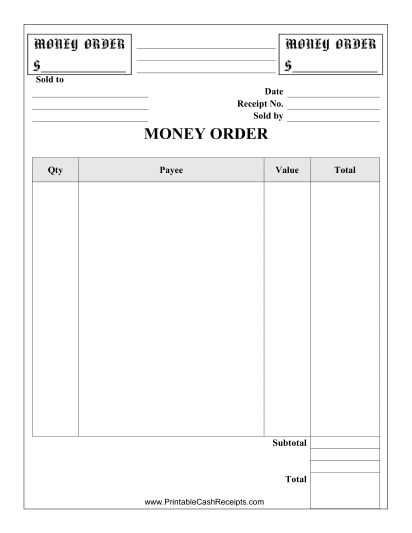

- Donation Amount: Clearly specify the total amount of the donation. If it’s a non-monetary donation (like goods or services), provide a detailed description and an estimated value.

- Date of Donation: Mention the exact date the donation was made. This helps both the donor and organization keep track of contributions for tax purposes.

- Receipt Number: Assign a unique receipt number for better record organization. This allows easy tracking of multiple donations and helps avoid confusion in case of any disputes.

- Tax-Exempt Status: Indicate if the donation is tax-deductible. If your organization is tax-exempt, include a statement such as “This donation is tax-deductible to the extent allowed by law.”

- Type of Donation: Specify whether the donation is monetary, in-kind (goods/services), or both. In-kind donations should include a detailed list of items donated, with their estimated fair market value.

- Additional Notes: If applicable, include any specific details regarding the donation (e.g., designated fund or campaign) to ensure there’s no confusion later on.

- Signature or Confirmation: While not always necessary, it can be helpful to include an authorized signature or a confirmation of receipt, especially for larger donations or corporate contributions.

Send receipts as soon as possible after a donation is made. Delaying this can confuse donors and cause unnecessary follow-up. A quick receipt builds trust and shows appreciation for their contribution.

Personalize the Acknowledgment

Always personalize the receipt. Include the donor’s name, the donation amount, and the purpose of the contribution. A simple message like “Thank you for supporting our cause” adds a personal touch and strengthens the connection.

Choose the Right Format

Offer receipts in both digital and physical formats. While email receipts are cost-effective and eco-friendly, some donors may prefer a printed copy for their records. Providing both options allows flexibility and ensures no donor is left out.

Keep the receipt clear and concise. Include all required legal details, like your organization’s tax identification number, donation date, and the value of non-cash gifts, if applicable. Avoid unnecessary jargon that could confuse the donor.

All key points are preserved, but word repetitions have been minimized.

Ensure that each receipt is clear and concise. Begin by including the donation amount, the donor’s name, and the date of the transaction. Make sure the receipt also specifies whether the contribution was one-time or recurring. Use consistent language and avoid redundant details to maintain clarity.

Provide a brief but detailed description of the fundraising purpose. This helps the donor understand the impact of their contribution without overcrowding the document with unnecessary information. Avoid repeating terms like “donation” or “support” multiple times throughout the text.

Summarize the tax-related information in a straightforward manner. Include a statement about tax deductibility and the organization’s registration details. This should be clear, to the point, and not be repeated throughout the receipt.

Finally, ensure the tone is professional yet approachable. Keep the text easy to read while maintaining accuracy. By eliminating unnecessary repetition, the receipt will remain both informative and simple.