A rental receipt for a vacation home should be clear, concise, and easy for both parties to understand. It’s a crucial document for confirming payments and finalizing transactions. When creating your template, include all relevant details such as the property name, rental dates, amount paid, and the terms of the agreement. Make sure the template is structured logically to avoid confusion later on.

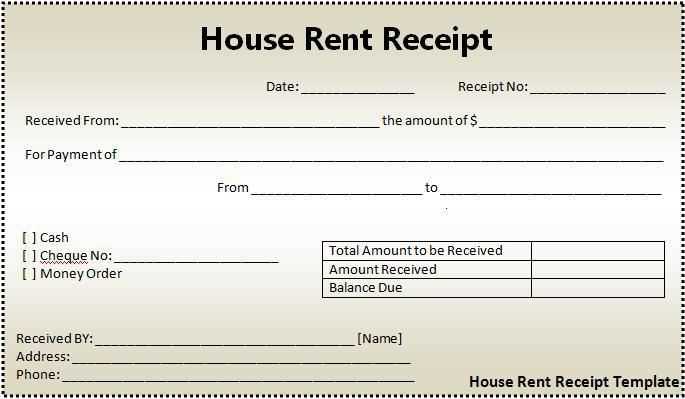

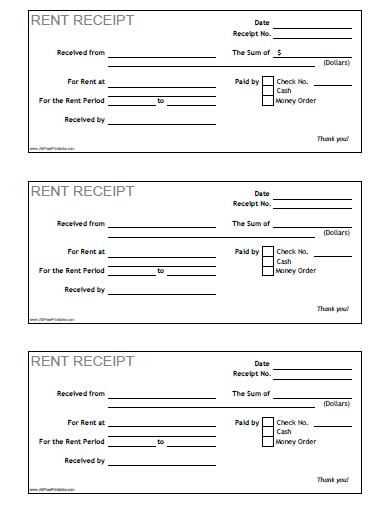

The template should begin with basic information like the guest’s name, check-in and check-out dates, and the total cost of the stay. It’s also wise to include the payment method used, whether it was by credit card, bank transfer, or another method. This transparency helps both the property owner and guest keep track of the payment process.

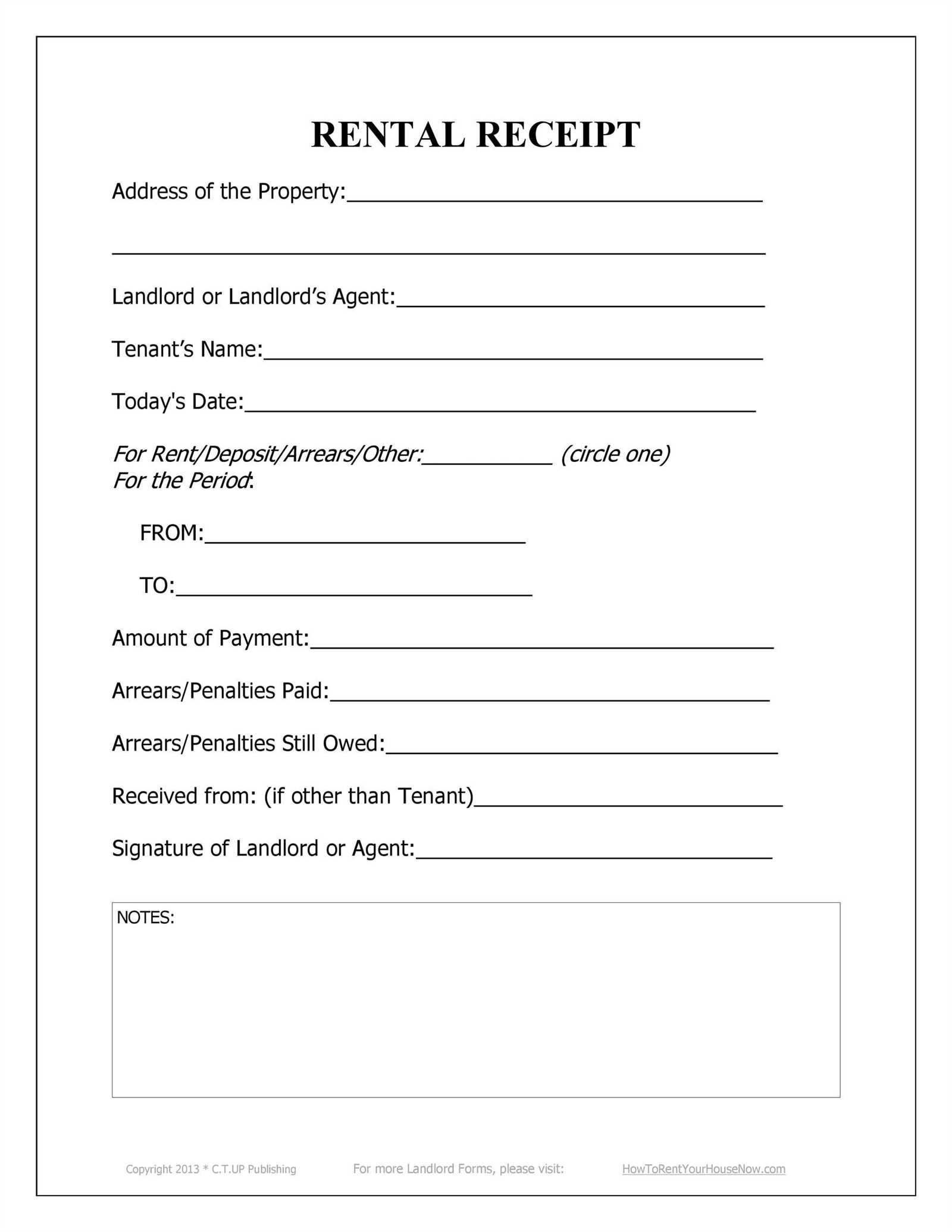

Additional features to include: tax rates, any additional fees (e.g., cleaning or security deposit), and whether the amount paid covers all services or if there will be extra charges later. Always ensure the receipt includes a section for the host’s signature and the date of issuance. This adds an extra layer of legitimacy to the document.

Finally, be mindful of the formatting. A clean and professional design will help reinforce trust between you and your guests. Using an organized template helps save time and avoids any misunderstandings. Keep it straightforward, and you’ll have a document that serves both as a receipt and a reference for future bookings.

Here’s a detailed plan for an informational article on “Vacation Home Rental Receipt Template” with three distinct headings in HTML format:

To create a well-structured vacation home rental receipt template, begin by including key information such as the rental property details, dates of stay, total amount paid, and payment method. Be clear and concise, ensuring all necessary fields are covered. It’s also helpful to include a space for any additional fees or discounts applied during the rental period.

Rental Property and Guest Information

Provide a section to record the guest’s name, address, and contact information. Add fields for the vacation home’s address and rental identification details. This ensures clarity about the specific property being rented and the person making the payment.

Payment Breakdown

Detail the costs of the rental, including the base rate, cleaning fees, and any other charges. Include a line for taxes, if applicable, and make sure to specify the payment method. This breakdown helps both the renter and the property owner maintain accurate records.

Terms and Conditions

Offer a space to list any terms regarding cancellations, deposits, or additional fees. This section can also highlight the rental’s security deposit if one was collected. Providing clear terms helps both parties understand their obligations.

- How to Structure a Vacation Rental Receipt

Begin by clearly listing the rental property details. Include the name and address of the vacation home, as well as the dates of the stay. This will provide the renter with context for the transaction.

1. Payment Breakdown

- Base Rent: List the total amount for the stay before taxes and fees.

- Additional Fees: Specify any cleaning fees, security deposits, or other charges added to the base rent.

- Taxes: Include applicable local or state taxes on the rental.

2. Payment Method

- Detail the payment method used by the guest, such as credit card, bank transfer, or another option.

- If applicable, note the payment reference number for tracking purposes.

3. Total Amount

Clearly state the final total, which includes base rent, additional fees, and taxes. This amount should match what the guest paid.

4. Receipt Number

- Assign a unique receipt number to each transaction for easy tracking and reference.

5. Contact Information

- Include the host’s contact information (email, phone number) for any follow-up questions or clarifications.

Wrap up with a confirmation of the payment, stating that the transaction is complete, and the rental is confirmed for the specified dates.

A vacation rental receipt must accurately reflect the transaction between the landlord and the guest, and comply with local tax laws. Always include the rental property address, check-in and check-out dates, rental amount, and any additional fees such as cleaning or service charges. These details are crucial for legal purposes, especially in case of disputes or audits.

Ensure that your receipt clearly states whether it is for the full amount paid or just a deposit. If taxes are applied, itemize the tax rate and total amount collected. Depending on your location, you may be required to provide a specific tax identification number or other registration details.

For long-term rentals, receipts may need to comply with different regulations, such as those governing rental agreements. Keep in mind that providing an accurate receipt helps avoid potential issues with consumer protection laws, which could arise if the terms of the rental are disputed later.

Finally, store all rental receipts for a specified period, as required by your local regulations. This is important not only for tax reporting but also to ensure transparency and prevent any complications if legal claims are made against the rental property.

Adjust your receipt template by including the rental property’s name, address, and contact information to make it personalized for your guests. This ensures clarity and professionalism for both you and your customers.

Key Details to Add

Incorporate the rental period with the check-in and check-out dates, as well as the number of guests. This provides a clear record of the service rendered. You may also choose to add a breakdown of the rental fees, including cleaning costs or taxes, so that everything is transparent for the guest.

Designing for Clarity

Choose a layout that is easy to read. Use clean, simple fonts and keep your text size consistent. Avoid cluttering the document with too many details. The receipt should highlight only what is necessary–payment information, rental details, and your terms. Make sure all amounts are clearly labeled.

Key Elements in a Vacation Home Rental Receipt Template

A well-structured template provides clarity for both the property owner and guest. It should include the rental amount, payment method, dates of stay, and any additional fees or discounts. Ensure the receipt includes a clear breakdown of the costs to avoid misunderstandings.

Breakdown of Costs

Ensure your receipt separates the base rental price from any supplementary charges. These could include cleaning fees, security deposits, or taxes. A detailed breakdown helps guests understand where their payment is going, promoting transparency.

| Item | Amount |

|---|---|

| Base Rental | $200 |

| Cleaning Fee | $50 |

| Security Deposit | $100 |

| Taxes | $20 |

| Total | $370 |

Payment Confirmation

Include the payment method, transaction ID, and the payment date. This helps confirm that the reservation has been secured and avoids confusion later on.