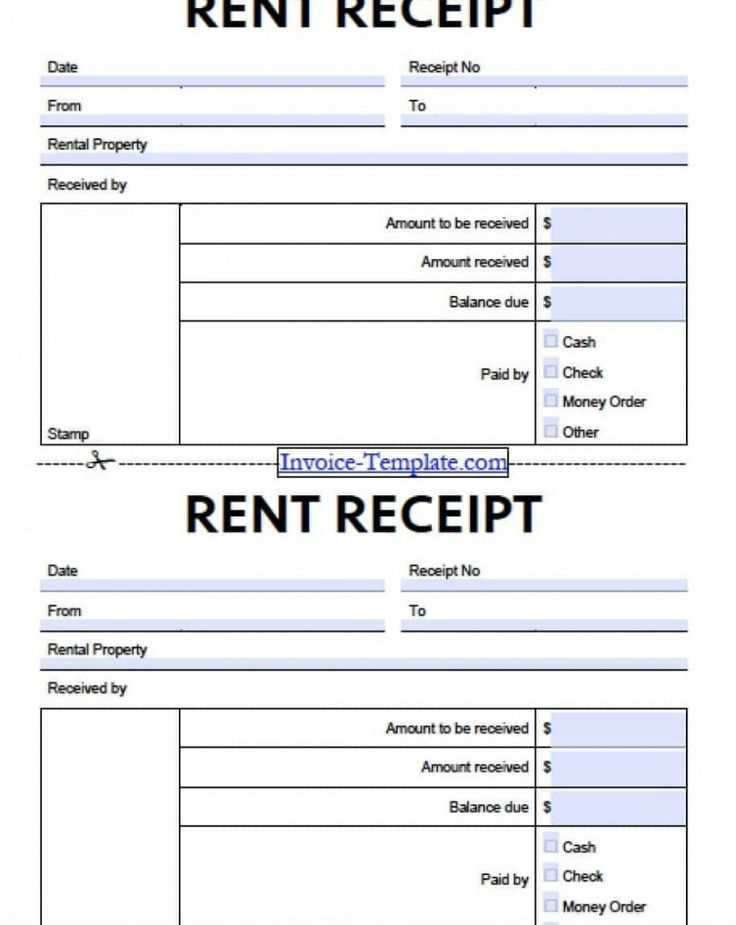

To ensure clarity and avoid any disputes, create a structured receipt whenever making payments to a vendor. A receipt provides a clear record of the transaction, confirming that both parties are aligned on the terms and amounts paid.

Start with basic transaction details, such as the payment date, vendor’s name, and contact information. Include the payment method (whether it’s via check, bank transfer, or cash) and ensure it matches the terms previously agreed upon. Clear references to the specific goods or services purchased will make the receipt more transparent.

List all items or services purchased along with their respective prices. If applicable, include any taxes or discounts that were applied to the total amount. This allows both you and the vendor to verify the final amount paid without confusion.

To complete the receipt, include a unique identifier, such as an invoice number or transaction ID. This reference ensures that both parties can easily track and reconcile the payment for future inquiries.

Finally, always provide space for the vendor’s signature or a confirmation of receipt, which can be used as proof of payment in case of future disputes or audits.

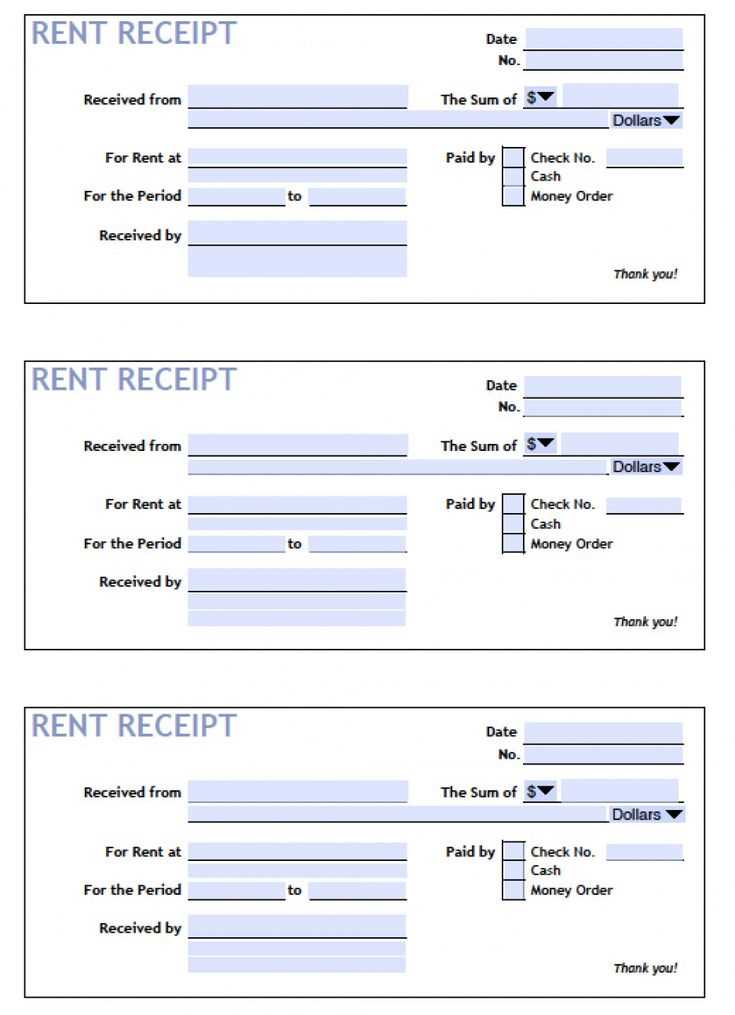

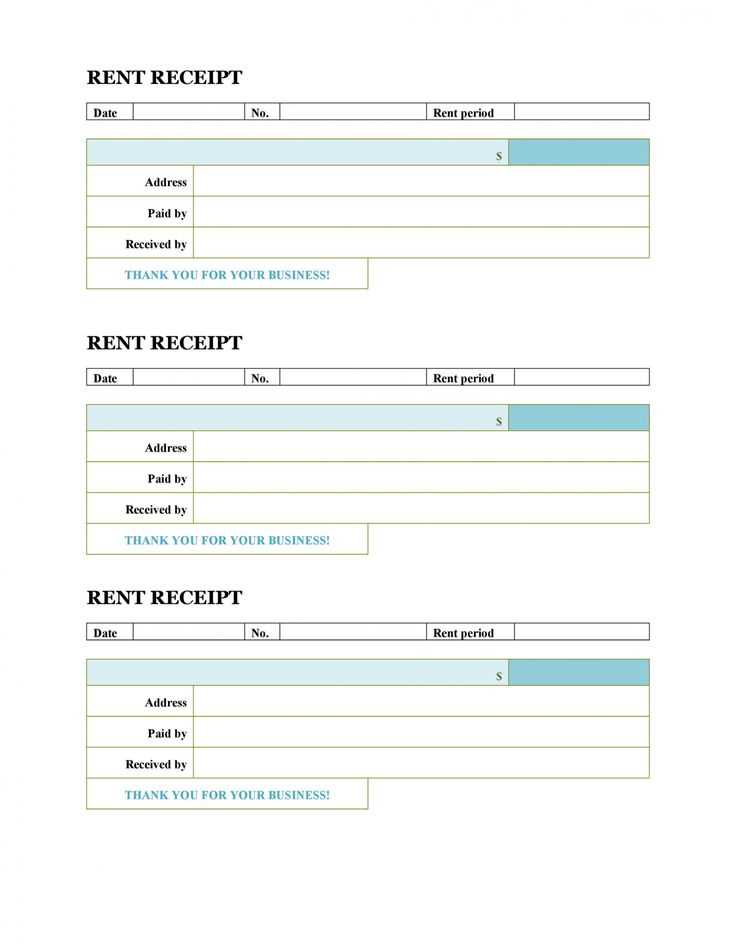

Receipt Template for Paying Vendor

A receipt template for paying a vendor should clearly outline the transaction details. Include the vendor’s name, payment amount, the service or goods provided, and the payment date. These elements confirm the payment and provide a reliable record for both parties.

Required Sections for the Receipt

The template should contain the following:

- Vendor Information: Name, address, and contact information.

- Payment Details: Amount paid, payment method, and reference number (if available).

- Description of Goods/Services: List of products or services received, including individual costs.

- Date of Payment: Exact date the payment was made.

- Signature: Area for both parties to sign, confirming the payment.

Design Tips

Ensure the layout is straightforward. Use bold headers for each section and provide enough space for details. A unique invoice number will help with tracking payments. Keep the design clean and organized for clarity.

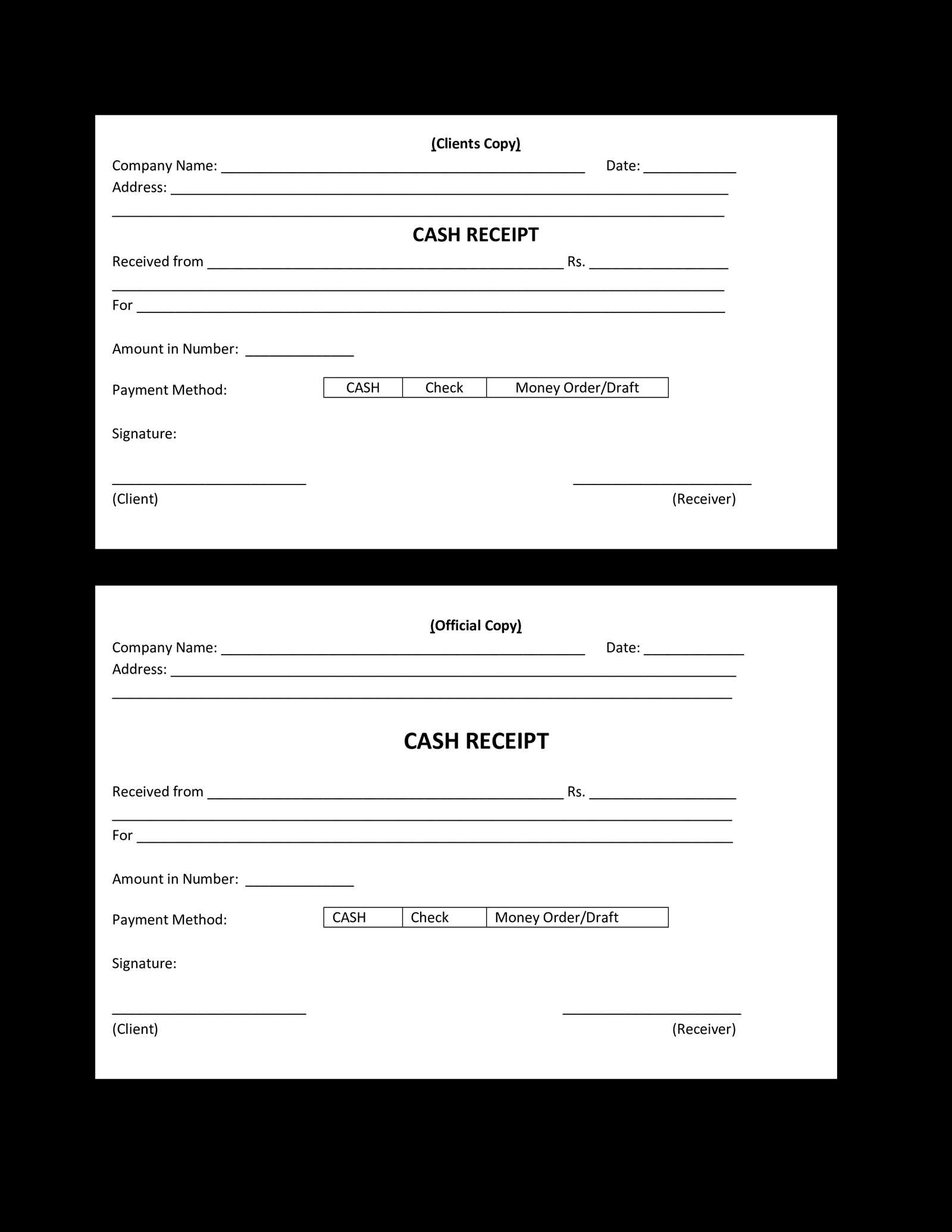

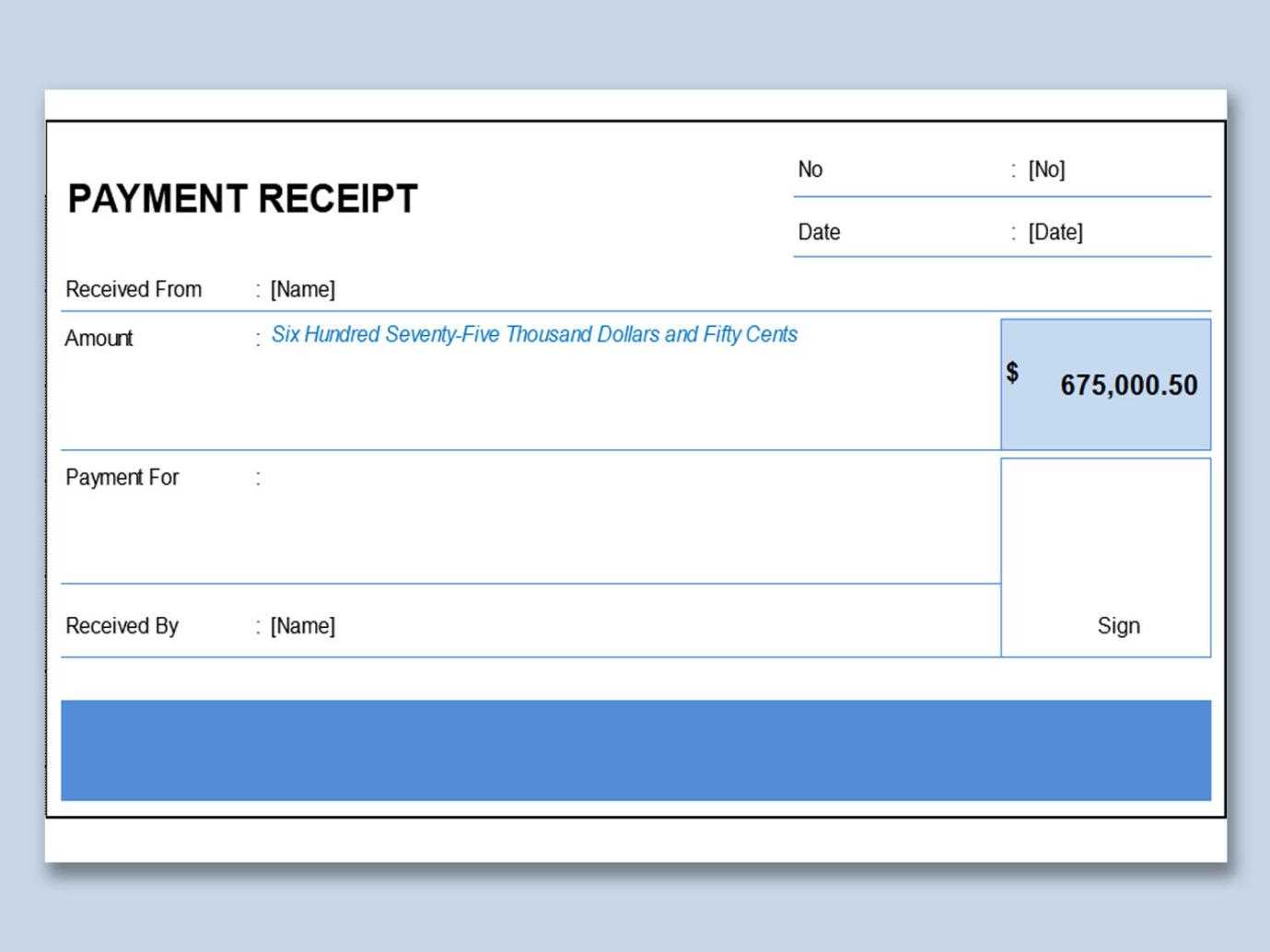

How to Structure Payment Details in a Receipt

Provide clear and concise payment information to ensure both parties understand the transaction. Follow this structure for clarity and transparency.

1. Payment Method

- Specify the method used, such as credit card, bank transfer, or cash.

- Include transaction details if applicable (e.g., card type, bank name, or transfer ID).

- For electronic payments, mention the payment gateway or platform used.

2. Payment Amount

- State the exact amount paid in both numbers and words to avoid confusion.

- If applicable, break down the total (e.g., item cost, taxes, discounts).

- Include any currency symbols or codes to confirm the currency used.

3. Date and Time

- Clearly state the payment date and time to confirm the transaction occurred.

- Ensure the format is consistent with local standards (e.g., MM/DD/YYYY or DD/MM/YYYY).

4. Receipt Number

- Assign a unique receipt number to easily reference the transaction.

- Include any additional identifiers (e.g., order number or invoice number) for better record-keeping.

5. Vendor Information

- List the vendor’s name, business name, and contact details.

- Include the vendor’s tax ID or registration number if required for tax purposes.

Key Information to Include for Vendor Identification

Include the vendor’s full legal business name, business address, and tax identification number (TIN) on the receipt. This ensures the accuracy of the transaction and allows for proper record-keeping and tax reporting.

Vendor Name and Address

Write the official business name of the vendor, as it appears in registration documents. This avoids any confusion with trade names or aliases. Additionally, include the vendor’s full business address, including the street, city, state, and ZIP code, to verify their location for both billing and shipping purposes.

Tax Identification Number (TIN)

Include the vendor’s tax identification number, such as their Employer Identification Number (EIN) or Social Security Number (SSN), depending on the type of business. This is required for tax reporting and ensures that the vendor’s identity is properly linked to the transaction.

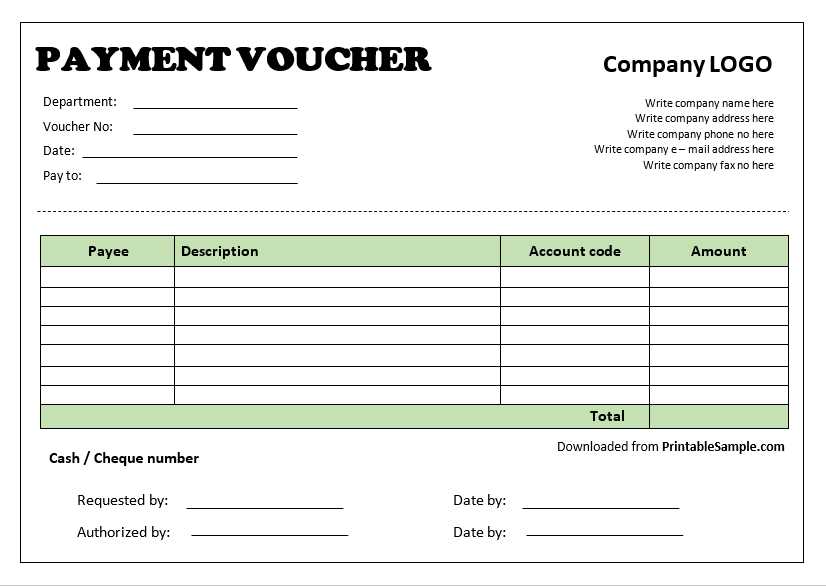

Steps to Ensure Proper Documentation of Payment Methods

Document each payment method used with clear, accurate details. For every transaction, record the payment type, amount, and date to avoid confusion. Include the payment reference or transaction number and the vendor’s name or business identifier. If you use a digital payment platform, capture the payment confirmation and save any related receipts or invoices for later reference.

Store documentation in an organized system. Whether physical or digital, ensure that all receipts are easily accessible and categorized. You can use folders for physical receipts or create specific folders within a file management system for digital copies.

Verify the payment method’s details before finalizing the transaction. Double-check the payment amount, transaction number, and recipient’s information. Any discrepancies should be resolved promptly to prevent future issues.

Use standardized templates or forms when recording payments. Consistency helps avoid errors and makes it easier to cross-check payments later. Include space for all necessary information, such as payment date, method, vendor information, and transaction details.

Review your payment records regularly. Regular audits help ensure your documentation is complete and accurate. Any missing or incorrect information should be addressed immediately to maintain transparency and accountability.

Finally, back up your records. Store digital files in secure cloud storage or external drives. For physical receipts, make photocopies or scans to preserve the information in case the originals are lost or damaged.