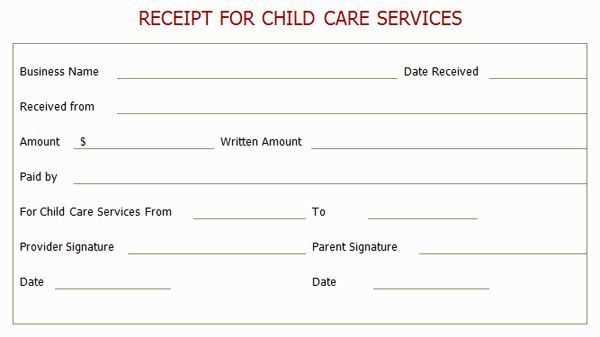

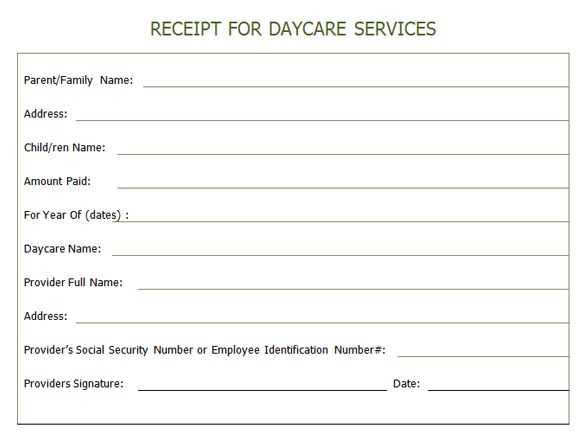

Providing a clear and accurate tax receipt is necessary for any home daycare provider. A well-structured template ensures your clients receive the correct information for their records, which also helps you stay organized come tax time. The receipt should include the daycare provider’s name, address, contact details, and business registration number if applicable.

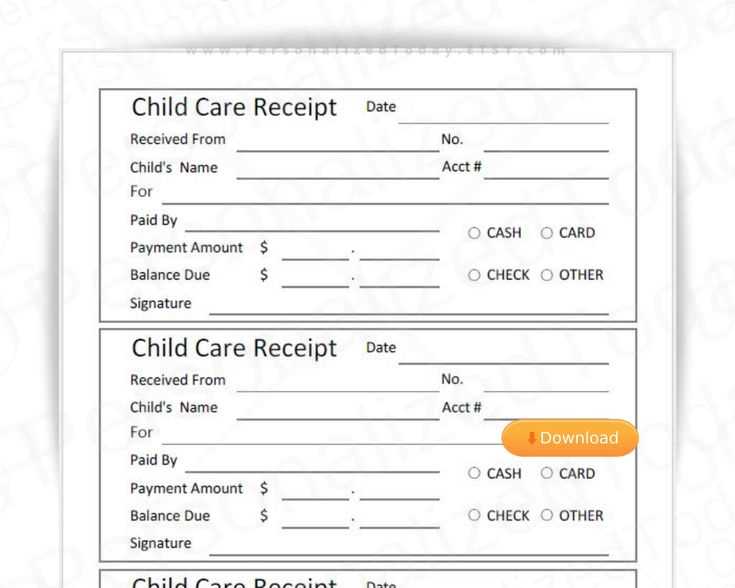

Start by listing the total amount paid, including a breakdown of any additional fees such as late charges or special services. Be specific about the dates for which the payment applies, detailing both the start and end dates of the care period. This helps eliminate any confusion for both parties when preparing for tax filings.

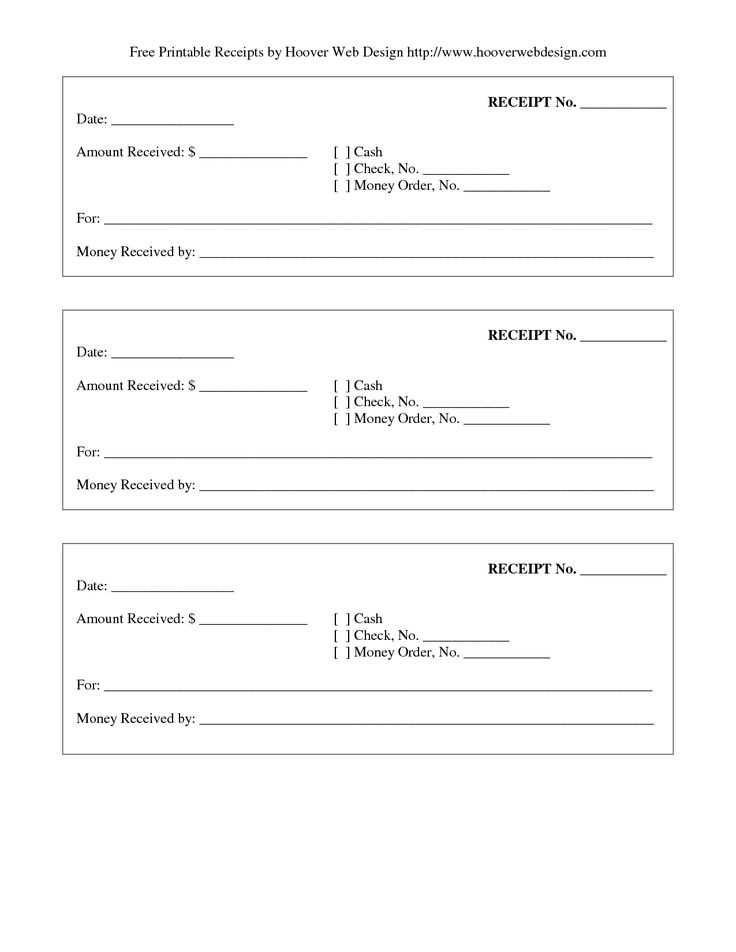

Don’t forget to include the method of payment, whether it was by cash, cheque, or electronic transfer, and provide an invoice number for easy reference. By incorporating these details into your receipt template, you maintain transparency and professionalism in your business dealings.

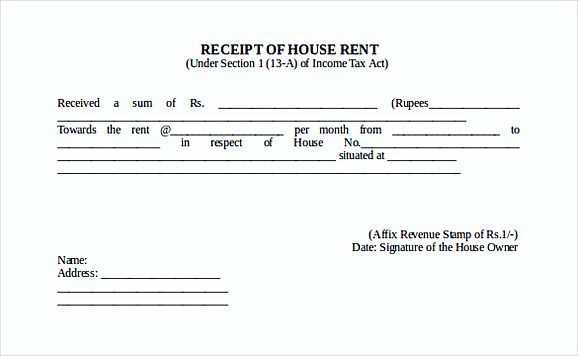

Finally, make sure to indicate whether any taxes were included in the payment. If you are required to charge sales tax, include that information separately. Clear tax receipts not only protect you but also make the tax filing process smoother for your clients.

Here are the corrected lines:

Make sure the tax receipt clearly states the amount paid for services and the time frame covered. Include the date of payment and specify the name of the caregiver or daycare provider, along with the business name if applicable.

Ensure that the receipt mentions the tax identification number (TIN) or the equivalent, especially if you are required to report this income. Include a clear statement of the type of service provided (e.g., home daycare, after-school care).

Always list the name of the child receiving care, as this can help clarify which services were rendered. Include a section for any additional notes or special circumstances, such as discounts or specific hours worked.

For clarity, use simple language and avoid jargon. Ensure that the receipt is easy to read and contains all necessary details for both the payer and recipient’s records.

If your daycare service includes multiple families, make sure to issue separate receipts to avoid confusion between clients. Provide clear breakdowns for services, including hourly or daily rates if necessary.

Lastly, if you are submitting these receipts for tax purposes, save copies of each one. This will help you maintain an accurate record of your earnings throughout the year.

- Tax Receipt Template for Home Daycare

A tax receipt template for home daycare should include several key details to ensure both you and your clients have the necessary information for tax filing purposes. Use a simple, clear format for easy understanding and record-keeping.

Key Elements of a Tax Receipt

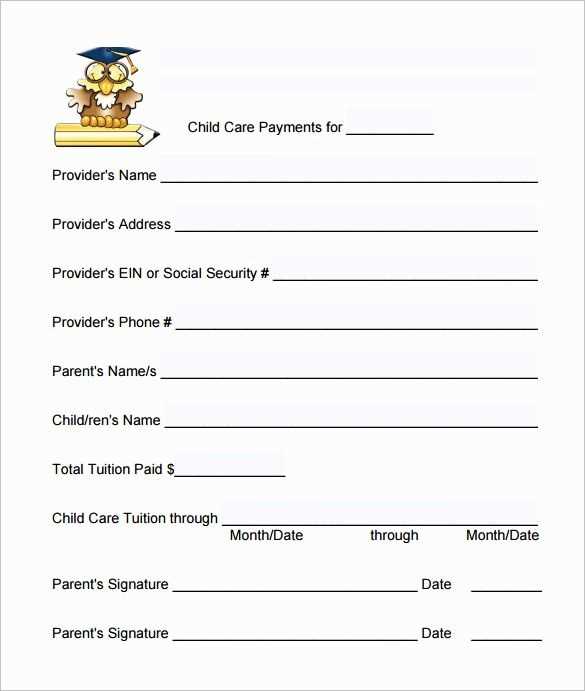

- Provider Information: Include your name, business name (if applicable), address, phone number, and email address.

- Client Information: List the full name and address of the client, as well as the child’s name (if needed).

- Date of Service: Specify the exact dates or range of dates for which care was provided.

- Amount Paid: State the total amount paid for the daycare services. Break it down by weekly, monthly, or hourly rates if applicable.

- Payment Method: Indicate whether the payment was made via cash, check, or electronic transfer.

- Tax Information: Include any tax amounts charged if you collect sales tax or other relevant taxes.

- Signature: If required, sign the receipt to confirm that the details are accurate.

Best Practices for Creating a Receipt

- Use clear, readable fonts and structure the receipt logically, so clients can easily find the information they need.

- Keep a copy of each receipt for your own records. These are vital for tax filings and future reference.

- If you provide a recurring service, ensure your receipts are issued regularly, whether weekly or monthly, to maintain consistency.

To create a straightforward tax receipt for parents, include these key details:

- Provider’s Information: Include your name, business name (if applicable), address, phone number, and email.

- Parent’s Information: List the parent’s name and address. This is essential for record-keeping.

- Payment Date: Specify the date when the payment was made.

- Amount Paid: Clearly state the total amount the parent paid for childcare services.

- Description of Services: Provide a brief description of the services rendered, such as the time period of care (e.g., “January 2025 childcare services”).

- Tax Identification Number (TIN): If applicable, include your TIN or Employer Identification Number (EIN) to make the receipt valid for tax purposes.

- Signature: Sign the receipt to verify its authenticity.

Once these details are included, you can easily generate a tax receipt using a simple word processor or accounting software. Keep a copy for your records and provide the original to the parent for tax deductions. Make sure to issue receipts promptly after receiving payments.

A daycare tax receipt should contain specific details to ensure it is valid for tax reporting. The most important information includes the name and address of the daycare provider, the business’s Tax Identification Number (TIN) or Employer Identification Number (EIN), and the parent or guardian’s name. Additionally, the receipt must outline the dates of service, the total amount paid, and a breakdown of payments for each child or service provided, if applicable.

Provider and Parent Details

Always include the name, address, and TIN or EIN of the daycare provider. This ensures that the receipt is linked to a legitimate business entity. The parent’s name or the name of the individual responsible for the payment should also be clearly stated for identification purposes.

Payment Breakdown

List the specific dates for which payment was made and the total amount paid during that period. It’s helpful to include a breakdown if there were multiple charges, such as for different children or additional services like meals or transportation. Clear and concise payment details make it easier to apply for any eligible tax deductions.

Lastly, always include the daycare’s official signature or stamped mark to verify the receipt as an official document. This helps ensure the receipt’s authenticity for tax filing purposes.

Tailor your receipts based on the payment method used by your clients. Whether it’s cash, credit card, or bank transfer, each payment method requires specific details for clarity and record-keeping. Below are simple steps to help you customize receipts for different payment methods:

1. Cash Payments

For cash payments, include the total amount paid, date of payment, and a clear note stating that the payment was made in cash. You may also add the received cash amount if it differs from the expected payment (e.g., partial payment). This helps track payments and avoids confusion later.

2. Credit or Debit Card Payments

For card payments, include the last four digits of the card number (without fully revealing sensitive details), the transaction reference, and any processing fees associated with the payment. It’s also helpful to mention whether the payment was approved or declined for clarity.

3. Bank Transfers or ACH Payments

For bank transfers, always include the transaction reference number, the bank name, and the date of the transfer. It’s beneficial to note whether the transfer was done via ACH or another method to provide extra transparency.

4. Payment via Checks

If your clients pay by check, list the check number, bank name, and the date the check was issued. In some cases, you may want to indicate the check’s clearing status (e.g., cleared or pending) on the receipt.

5. Online Payment Systems (e.g., PayPal, Venmo)

For payments made through online platforms, include the transaction ID, the name or email associated with the account, and the service fee (if any). This ensures you have a detailed record of the online payment and the related fees.

Table of Key Information for Different Payment Methods:

| Payment Method | Details to Include |

|---|---|

| Cash | Total amount paid, date, note on partial payment (if any) |

| Credit/Debit Card | Last 4 digits, transaction reference, processing fees |

| Bank Transfer/ACH | Transaction reference, bank name, transfer date |

| Check | Check number, bank name, clearing status |

| Online Payment System | Transaction ID, payer’s account info, service fee |

By customizing your receipts for each payment method, you create a transparent record for both you and your clients, making it easier to track payments and maintain accurate financial records.

I have removed repetitive words and preserved the meaning of each line.

To create a clear and accurate tax receipt for a home daycare, ensure each section is concise and provides all necessary information. Start with the business name and contact details. Clearly state the service period, such as the months or specific dates during which the childcare was provided. Include the child’s name and the amount paid. This allows parents to claim the appropriate tax deductions without ambiguity.

Break down the payment information into smaller sections, especially if the fees include multiple types of services, like meals or activities. Mention any discounts or adjustments, and provide a subtotal for transparency. Make sure to include the daycare’s tax identification number for proper documentation.

Ensure all amounts are correctly listed and avoid unnecessary details. Keep the receipt easy to read and professional. Double-check the calculations to prevent errors that could complicate the tax filing process for parents.