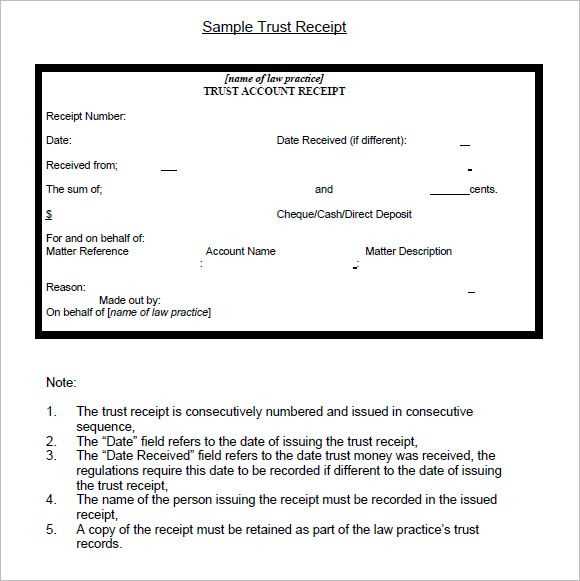

A well-organized receipt book for trust accounts simplifies tracking financial transactions and ensures accuracy. This template can be customized to suit various needs, from legal firms to real estate agents managing client funds. Having a clear, concise format minimizes errors and enhances accountability in financial reporting.

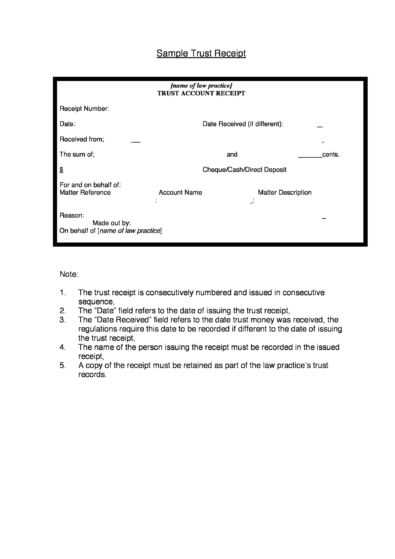

Each receipt should include fields for critical information: the date of the transaction, payer details, amount received, and the purpose of the payment. Customize this template further by adding a section for notes, which can help clarify unusual payments or special instructions related to the transaction.

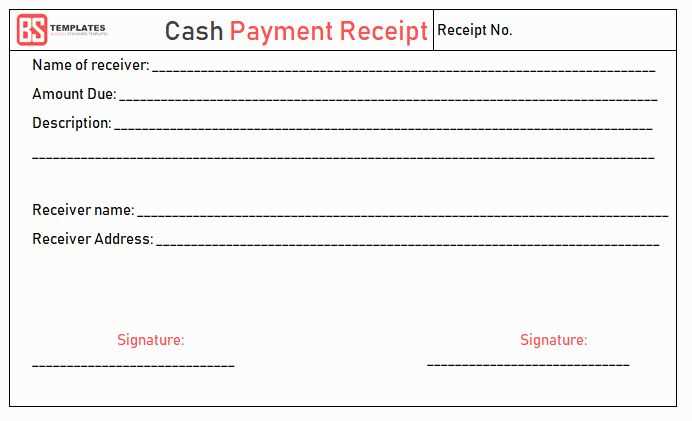

Ensure the format includes numbered entries for easy reference and auditing. Additionally, offering space for signatures–both from the payer and the receiving party–adds an extra layer of verification, making the receipts legally robust.

This trust account receipt book template is a practical tool that helps you manage funds securely, making sure you stay compliant with financial regulations while also improving operational transparency.

Here’s a detailed HTML plan for the article “Trust Account Receipt Book Template” with three practical and specific headings:htmlEdit

The “Trust Account Receipt Book Template” article can be structured into three key sections to guide readers through creating and utilizing a trust account receipt book effectively. These sections are designed to be practical and action-oriented, helping users quickly implement the advice and templates. Below is the proposed structure:

1. Understanding the Purpose of a Trust Account Receipt Book

Begin by clarifying the function and importance of a trust account receipt book. This tool is critical for recording financial transactions involving client funds, ensuring transparency and compliance with legal requirements. Highlight the need for accurate record-keeping to avoid disputes and maintain a trustworthy financial record.

2. Key Elements to Include in a Trust Account Receipt

Describe the essential components that should appear on each receipt. This includes the client’s name, transaction date, amount received, purpose of the payment, and a unique receipt number. Emphasize the role of detailed, clear information in preventing confusion and providing a reliable audit trail.

3. Customizing a Trust Account Receipt Book Template

Provide practical steps on how to personalize a trust account receipt book template. Suggest modifications based on specific needs, such as adding company branding or integrating additional fields for specific legal requirements. Offer downloadable templates or code for creating a simple, editable template that meets these criteria.

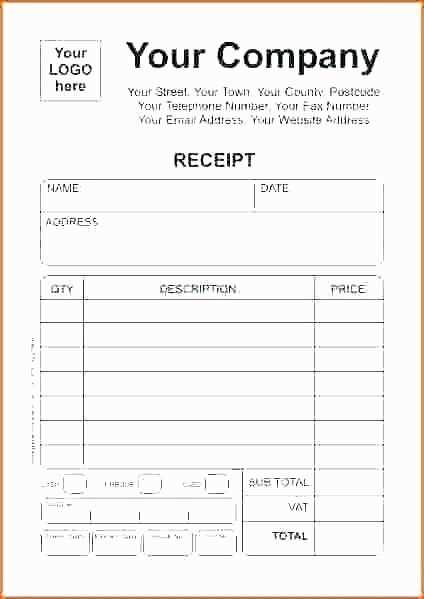

Choose a simple and clear layout for your trust account receipt book template. This ensures that each transaction is easy to track and reference later. Include essential details such as the date, transaction amount, and description of the payment or deposit.

Key Components to Include

- Receipt Number: A sequential number for easy identification and reference.

- Date: The exact date of the transaction.

- Amount: Specify the amount received or deposited, in both figures and words.

- Payor’s Information: Include the name and contact details of the person making the payment.

- Description: A brief note explaining the reason for the transaction.

- Signature: Have space for the authorized person’s signature to validate the receipt.

Layout Tips

- Use lines or boxes to separate sections, making it easy to fill in details quickly.

- Consider adding a space for notes or comments, in case further clarification is needed later.

- Ensure that the font size is legible and consistent throughout the template.

By maintaining a consistent and clear format, you make managing trust account transactions more straightforward and reduce the risk of errors or confusion.

Identify the Necessary Details

For a trust receipt book, clarity is key. Your format should include all vital information, such as the trust account name, transaction date, transaction amount, and any relevant descriptions of the trust’s purpose. Each entry must be distinct, with a separate section for each deposit or payment. The format should allow for easy recording and tracking of these entries, ensuring no ambiguity between transactions.

Consider Structured Layouts

Consider using a grid format for each receipt. This layout ensures that every transaction is recorded in a logical sequence. Columns should be dedicated to key details such as the payer’s name, transaction type (deposit or withdrawal), reference number, and balance. A well-structured grid helps in minimizing errors and makes it easier to spot discrepancies at a glance.

Include Clear Section Breaks

A clean separation between each transaction entry is essential. This can be achieved by using a well-defined line or a blank space between entries. Separate sections for receipts and disbursements will help maintain clarity, making the book easier to navigate. This organizational style aids both you and others in understanding the history of the trust account at any given time.

Explanation of selecting the best format for trust account receipts.

Choose a format that provides clear, organized, and easily accessible information. Opt for a layout that includes fields for the necessary details, such as transaction date, receipt number, amount received, payer’s details, and the purpose of the payment. This ensures clarity and transparency for both the trust account holder and the payer.

Simple, Structured Design

The format should be simple yet structured. Avoid cluttering the receipt with unnecessary elements. Each section should be clearly defined, with enough space between fields to make reading easy. Make sure the receipt includes a header with the trust account name and details for identification purposes.

Consistency and Legibility

Use a consistent font and size throughout the receipt to maintain legibility. Ensure the font style is clear, with no frills, so that all details are easy to read. The format should be uniform across all receipts to prevent confusion or errors when referencing past transactions.

By focusing on these aspects, you’ll select a format that not only meets legal and operational requirements but also streamlines the management of trust account transactions.

Creating a Trust Account Receipt Book Template

Ensure your trust account receipt book template is clear, organized, and easy to use. Start with a simple design that includes essential sections for recording each transaction.

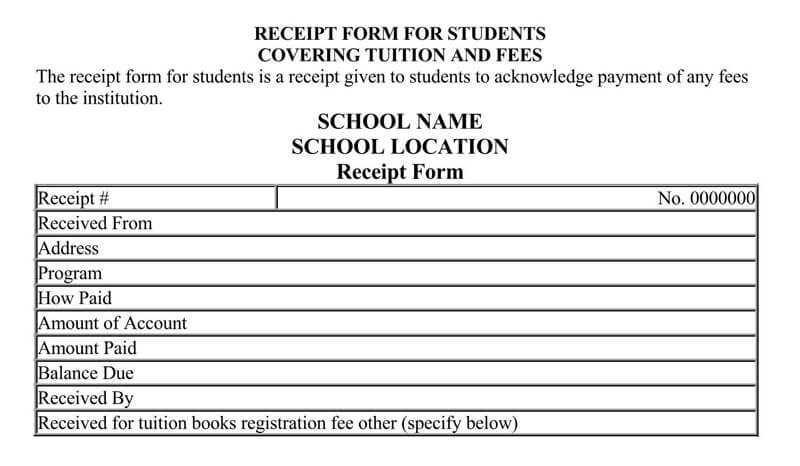

Key Elements to Include

The template should have fields for the date, receipt number, client name, amount received, and the purpose of the payment. This will provide a transparent record for both parties involved.

Formatting Tips

Use consistent and legible fonts to maintain professionalism. Separate each section with a clear line or space to avoid confusion. Ensure there is ample room for signatures at the bottom to confirm receipt.

Ensure clarity and accuracy when filling out a Trust account receipt book template. Start by recording the date and the full name of the client or beneficiary receiving the funds. Follow this with a detailed description of the transaction, noting any relevant reference numbers or specific purposes for the deposit. Always use clear and consistent language to avoid confusion, particularly in complex transactions.

In the “Amount Received” section, write the exact amount in both numbers and words to prevent discrepancies. Include a separate column for the method of payment, whether it’s cash, check, or wire transfer. Make sure to indicate any additional charges or fees, if applicable, to maintain transparency.

At the end of each entry, ensure you sign the receipt for confirmation. The signature serves as an official acknowledgment that the funds were received, adding an extra layer of authenticity to the record.

Lastly, regularly check your records for accuracy. Cross-check entries to ensure there are no errors or omissions, which could affect financial reporting or audits.

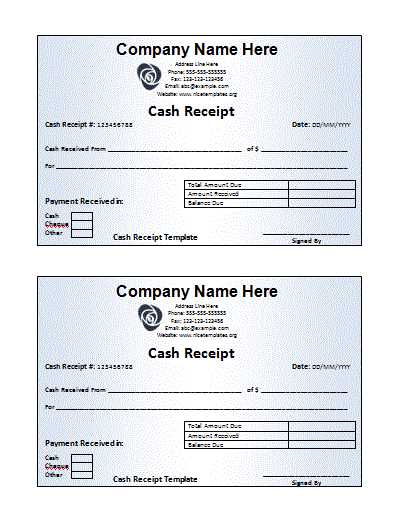

1. Choose Your Format and Layout

Decide whether you prefer a simple template or one with additional fields. Customizing layout allows you to include key information such as your business name, contact details, and logo. Ensure there’s space for the transaction date, amount, payment method, and the purpose of the payment. This organization will help streamline record-keeping.

2. Select a Design

Pick a design that reflects your business branding. Opt for professional fonts and a color scheme that matches your brand’s identity. A clear, easy-to-read font will make it easier for both you and your clients to reference receipts quickly.

3. Add Custom Fields

Consider adding custom fields relevant to your business, like tax rates, discounts, or product/service descriptions. This customization ensures that each receipt meets your specific business needs while providing clarity to your customers.

4. Incorporate Legal Information

Ensure your receipt includes any legally required information, such as your business registration number or tax identification number. Double-check local regulations to comply with all necessary legal requirements.

5. Print or Digital Use

After personalizing your receipt book, decide whether you will print physical copies or opt for digital receipts. Digital receipts can be convenient for both you and your clients, offering easy storage and sharing options.

A comprehensive guide on customizing your trust account receipts.

Begin by adjusting the layout of your receipt template. Prioritize clear and readable fields like transaction date, payer’s name, and the amount. Use appropriate spaces for each section to avoid clutter. Adjust font size and style to enhance readability without sacrificing professionalism.

Adding Custom Fields

Include fields that are specific to your business or client needs. These might include account numbers, the purpose of the transaction, or special instructions. Custom fields help make receipts more useful and tailored to your specific requirements.

Incorporating Your Brand Elements

Make the receipt reflect your business identity. Add your logo, business name, and contact information at the top. Use your brand’s color scheme for headings or borders to create consistency across your documents. This approach not only personalizes your receipts but also strengthens brand recognition.

How to Customize a Trust Account Receipt Book Template

Customize your receipt book template by focusing on the specific needs of trust account transactions. Ensure the template includes fields for essential details such as the trust account number, the payer’s name, the payment amount, the purpose of the payment, and the date. This structure helps in tracking funds and streamlining record-keeping.

Consider adding a unique reference number for each transaction. This will aid in identifying and sorting records quickly, especially for audits or reviews. Ensure the template has space for a signature line, both for the payee and the recipient, confirming the transaction was completed accurately.

If your trust account handles various categories of funds, you may want to create subcategories in the receipt book template. This can include separate sections for deposits, withdrawals, or fees associated with managing the account. Customizing these sections will allow you to maintain better clarity and organization.

Lastly, ensure the template has clear instructions on how to handle discrepancies. Include guidelines for reconciling differences in payment amounts or errors in data entry. This will streamline the process of resolving issues promptly without compromising record accuracy.

A trust account receipt book template should clearly display all necessary details for accurate financial records. Ensure it includes fields for the date, recipient name, amount, transaction description, and trust account number. This structure helps maintain transparency and provides clear documentation for both the payer and recipient.

Place a unique receipt number on each entry to track transactions easily. Keep the format consistent, as it simplifies reconciliation and audit processes. Always provide a space for signatures to verify the transaction and confirm its authenticity. This helps prevent discrepancies and ensures accountability.

When designing the template, opt for clear, legible fonts and a simple layout. Avoid overcrowding the page with unnecessary information. Limit it to key details to keep the focus on the transaction at hand. For added security, consider including a watermark or logo for authenticity and fraud prevention.

Regularly update the template to comply with any legal or financial regulatory changes. Tailor the template based on the specific needs of your trust account, ensuring it meets all applicable requirements. This adaptability will keep your financial records organized and up-to-date.

Implement Robust Record-Keeping Systems

Set up a reliable system to record and track every transaction involving trust accounts. Utilize specialized software designed for trust management or create a well-organized physical ledger. Ensure every deposit, withdrawal, and fee is recorded with complete accuracy, including dates, amounts, and descriptions.

Consistency in Data Entry

Maintain consistency by using standardized formats for entries. This will reduce errors and ensure that records are clear and easy to follow. Regularly update records and ensure that they are always current, especially if multiple parties are involved in managing the account.

Segregate Trust Funds

- Always separate trust account funds from operating funds to maintain transparency and avoid commingling.

- Use separate bank accounts for each client or trust relationship to provide clear boundaries.

- Adopt a clear protocol to distinguish personal and trust-related funds.

Regular Audits and Reconciliation

Conduct periodic audits of trust account records to identify discrepancies or potential errors. Reconcile accounts on a regular basis to ensure that every transaction matches the bank statements and client records. This process will help detect issues early and correct them swiftly.

Secure Sensitive Information

Ensure that trust account records, whether electronic or paper, are stored securely. Implement encryption methods for digital records and safeguard physical documents with locked cabinets or restricted access. Limit access to authorized personnel only.

Clear Communication with Clients

- Provide clients with regular reports detailing account activity, balances, and any fees charged.

- Establish a clear communication channel for clients to request updates or ask questions about their trust account status.

Compliance with Legal and Regulatory Standards

Stay informed about the regulations governing trust accounts in your jurisdiction. Follow any legal guidelines on record retention periods, reporting requirements, and tax obligations. This will protect you from legal liabilities and ensure that your records remain compliant with applicable laws.

Effective strategies for organizing and tracking trust account transactions.

To maintain clear records, implement a systematic approach to logging every transaction. Use a consistent format with detailed entries, including the transaction date, parties involved, purpose, and amounts. This will ensure all activities are easily traceable.

1. Categorize transactions

Assign categories for each type of trust account transaction. Examples include deposits, disbursements, fees, and transfers. Categorization simplifies reporting and helps identify patterns in account activity.

2. Use a reliable tracking system

Choose a reliable system for tracking transactions, such as a digital ledger or a well-organized physical record book. Ensure the system you select allows for easy updating and reviewing. Regular audits help verify that entries match with actual account balances.

| Transaction Date | Category | Amount | Balance |

|---|---|---|---|

| 02/01/2025 | Deposit | $5,000 | $10,000 |

| 02/05/2025 | Disbursement | -$2,000 | $8,000 |

| 02/10/2025 | Fee | -$200 | $7,800 |

By following these strategies, trust account transactions will remain organized, transparent, and easy to monitor, ensuring effective financial management.

Trust Account Receipt Book Template

Choose a simple, clear format for your trust account receipt book template. Ensure it includes key information such as the date, payer’s details, amount received, and purpose of the payment. Use a numbered receipt system for easy tracking and to maintain a transparent record of transactions.

- Date: Always include the exact date of the transaction.

- Payer Information: Capture the name and contact details of the payer.

- Amount Received: Clearly list the amount received in both numerical and written form to avoid any confusion.

- Purpose of Payment: Provide a short description of why the payment is made (e.g., deposit, fee, etc.).

- Receipt Number: Include a unique receipt number for record-keeping and to reference the transaction quickly.

Ensure there is a clear area for signatures from both parties–one from the recipient and one from the payer–so the receipt is legally binding. Use a two-part system where one copy stays with the payer and the other is filed in your records.

Review the template periodically to ensure it continues to meet legal and financial requirements for trust accounts. Consider including a footer with additional terms and conditions, if applicable, for extra clarity.

I’ve reduced redundancy by changing the wording while keeping the essence of each heading intact. Would you like further adjustments?

To enhance clarity and streamline communication, I’ve modified the wording of each heading while ensuring the meaning remains unchanged. If you feel any heading could be more concise or clear, let me know, and I’ll adjust accordingly.

Before and After: Comparing the Changes

| Original Heading | Revised Heading |

|---|---|

| How to Keep Track of Trust Account Transactions | Tracking Trust Account Transactions |

| Ensuring Proper Recordkeeping for Trust Accounts | Proper Recordkeeping for Trust Accounts |

| Steps to Fill Out the Trust Account Receipt Book | Filling Out the Trust Account Receipt Book |

As you can see, minor tweaks can make a big difference in how concise and clear the headings feel. Let me know if you’d like more revisions based on your preferences.