If you need a template for a monthly rent receipt in Ontario, use a straightforward format that includes the essential details: landlord’s name, tenant’s name, property address, payment date, and amount paid. Make sure the document clearly states that the payment was for rent, specifying the rental period covered by the payment. A well-structured receipt helps both parties track payments and avoids any future disputes.

To make things easy, consider creating a customizable template where you can plug in the specific information each month. Include the payment method (e.g., cash, cheque, e-transfer) and leave space for a signature if necessary. A simple format ensures clarity and saves you time in the long run.

Additionally, be mindful of the rules outlined in the Ontario Residential Tenancies Act. Rent receipts are required upon request, so having a reliable template can ensure compliance and offer tenants reassurance. With this template, both landlord and tenant can keep accurate records of payments made throughout the year.

Here are the corrected lines:

To ensure the rent receipt template for Ontario complies with legal standards, update the “Date” field to specify the exact day rent is paid each month. Additionally, make sure the “Tenant’s Name” section is clear and includes full legal names, avoiding abbreviations or nicknames.

Clarifying the Payment Period

Modify the “Payment Period” to reflect the start and end dates accurately, such as “From January 1, 2025, to January 31, 2025.” Avoid using vague terms like “current month” or “last month” to prevent confusion.

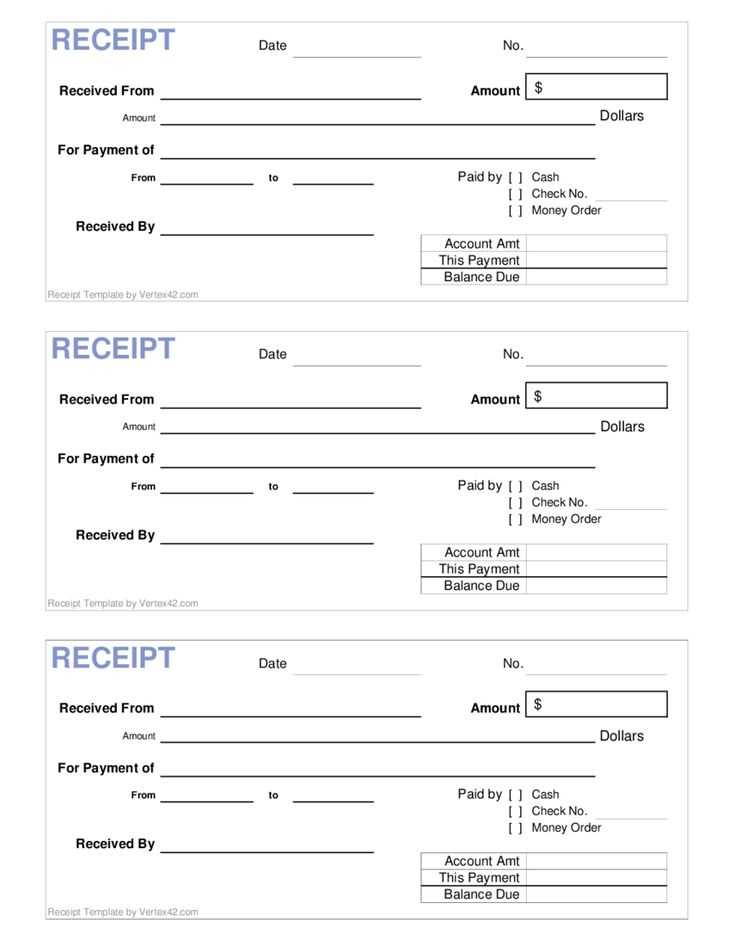

Amount and Method of Payment

Update the “Amount Paid” section to clearly show the total rent amount. Include a line for “Payment Method,” where tenants can specify how the payment was made (e.g., cheque, e-transfer, or cash). This keeps records transparent and ensures no ambiguity about the transaction.

Ensure the “Landlord’s Contact Information” section is complete, including the full address and phone number, so tenants can reach out easily if needed.

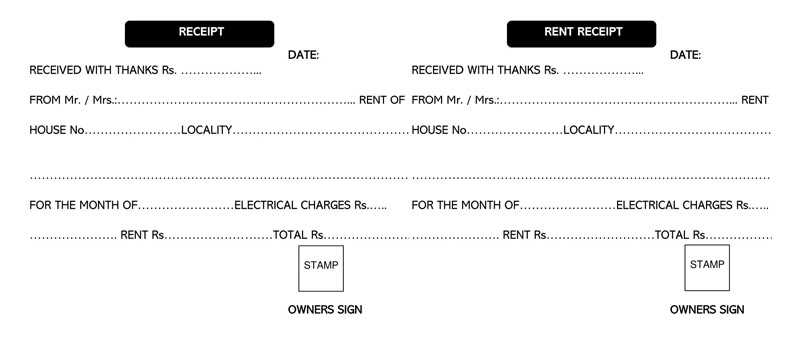

- Monthly Rent Receipt Template Ontario

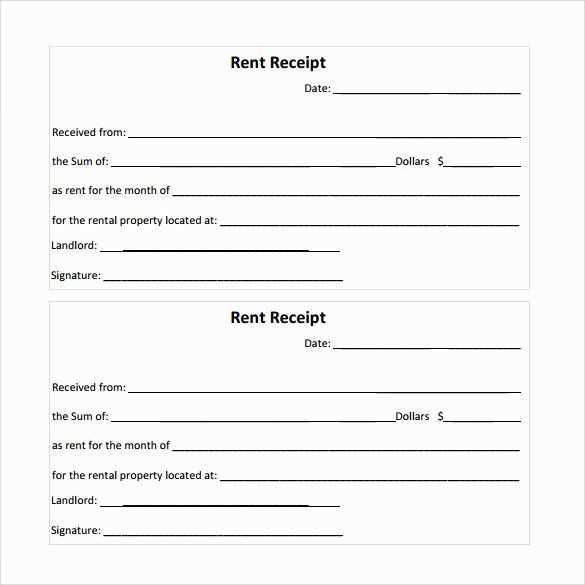

For landlords in Ontario, providing a monthly rent receipt is important for both record-keeping and compliance with the Residential Tenancies Act. A rent receipt should clearly document the date, amount, and payment method for each transaction. Make sure to include the tenant’s full name, the rental property address, and the payment period covered by the receipt.

A typical rent receipt should contain the following fields:

- Landlord’s Name: The person or entity receiving the rent payment.

- Tenant’s Name: The person making the payment.

- Property Address: The location of the rental unit.

- Payment Date: The date the payment was made.

- Amount Paid: The total amount of rent paid, including any additional charges if applicable.

- Payment Method: Cash, cheque, e-transfer, etc.

- Receipt Number: An identifier for each receipt for record-keeping purposes.

Make sure to provide a copy of the receipt to the tenant for their records. You may also want to keep a duplicate for your own tracking purposes. Offering these receipts helps maintain a transparent and professional rental process, and it can also prevent disputes in the future.

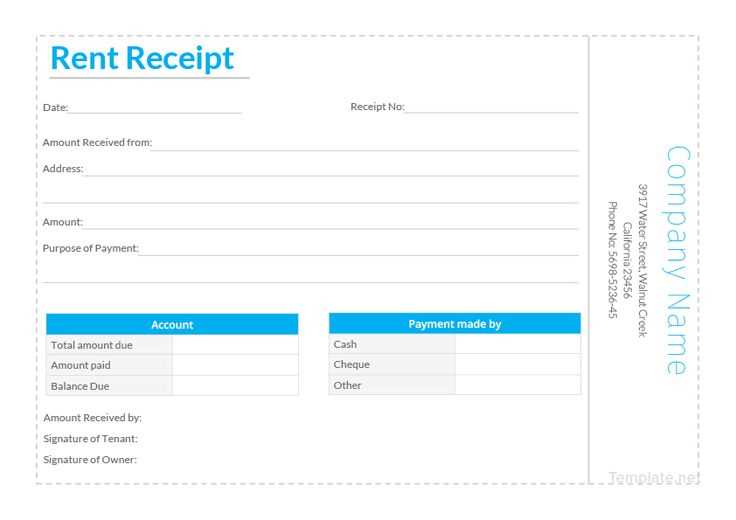

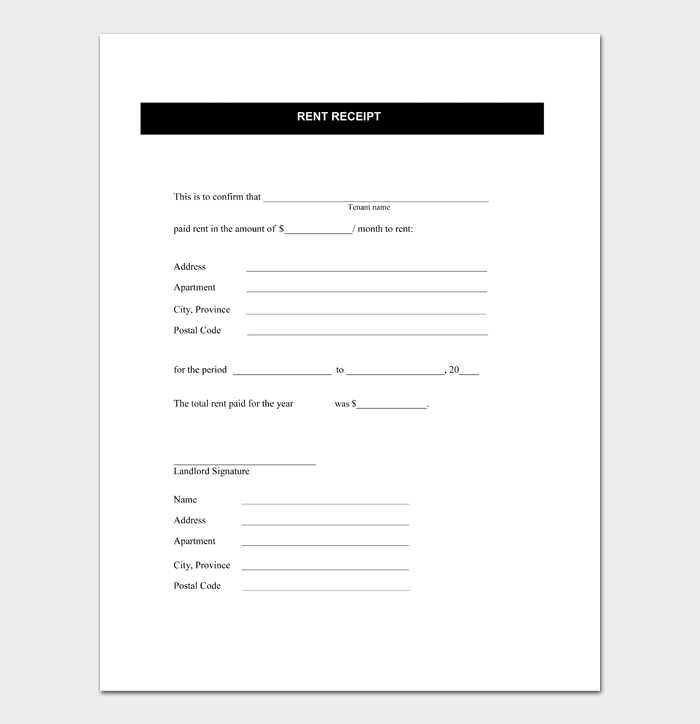

To create a straightforward rent receipt for Ontario, include the following key details:

1. Tenant and Landlord Information

Start by adding the tenant’s full name and address. Then, include the landlord’s full name, address, and contact information. This ensures both parties can be easily identified in case of any future inquiries.

2. Rental Details

Specify the rental amount paid, the rental period covered (e.g., month and year), and the payment method used. This provides clarity on the transaction. If applicable, note any additional charges such as late fees or parking fees.

3. Date of Payment

Clearly mention the date the payment was made. This helps confirm when the rent was received and provides a record for both the tenant and the landlord.

4. Rent Receipt Number

Assign a unique number to each receipt. This is helpful for record-keeping and tracking past payments.

5. Signature and Date

Both parties should sign and date the receipt to validate the transaction. This adds legal weight to the document.

Key Information to Include in a Receipt for Ontario Tenants

To ensure clarity and avoid disputes, include these key details in a rent receipt for Ontario tenants:

1. Tenant and Landlord Information

Clearly state both the tenant’s and landlord’s names. Include the landlord’s full name or company name and the tenant’s full name. This makes it easy to identify both parties in case of any future inquiries.

2. Property Address

Specify the address of the rental property, including the unit number, street, city, and postal code. This eliminates any confusion, especially in multi-unit buildings.

3. Payment Date and Rent Period

Record the exact date the rent payment was made. Additionally, indicate the rent period covered by the payment, such as “January 1–31, 2025,” so it’s clear what time frame the rent applies to.

4. Rent Amount

State the total rent amount paid. If there are any adjustments, such as prorated rent or discounts, clearly mention them to avoid any misunderstandings.

5. Payment Method

Note the payment method used, such as cheque, cash, bank transfer, or online payment. This provides a clear audit trail for both the tenant and landlord.

6. Additional Charges (If Applicable)

If the tenant has paid any additional charges, such as for utilities or parking, these should be itemized separately. Ensure that each charge is listed with a clear description.

7. Receipt Number

Assign a unique receipt number for easy reference. This is particularly useful for record-keeping and addressing any future payment queries.

8. Landlord’s Signature

Include the landlord’s signature or an electronic equivalent to confirm receipt of payment. This provides formal acknowledgment of the transaction.

Example Rent Receipt Table

| Tenant Name | Property Address | Payment Date | Rent Period | Amount Paid | Payment Method | Additional Charges | Receipt Number | Landlord’s Signature |

|---|---|---|---|---|---|---|---|---|

| John Doe | 123 Main St, Apt 4B, Toronto, ON M5H 2N2 | February 5, 2025 | February 1–28, 2025 | $1,200 | Bank Transfer | $50 (Parking) | #20250205 | John Smith |

In Ontario, landlords must provide tenants with a rent receipt if requested. The receipt must include specific details to be legally valid. A rent receipt must contain the following information:

Required Information on a Rent Receipt

The receipt should list the tenant’s name, the address of the rental property, and the amount of rent paid. It must also include the date of payment and the payment method used (e.g., cheque, cash, or e-transfer). The landlord’s name and signature are optional, but it is highly recommended to include them for clarity.

Rent Receipts for Cash Payments

If rent is paid in cash, landlords are legally required to provide a receipt. This ensures both parties have a clear record of the transaction. Without a receipt, tenants may struggle to prove payment in case of disputes.

Monthly Rent Receipt Template for Ontario

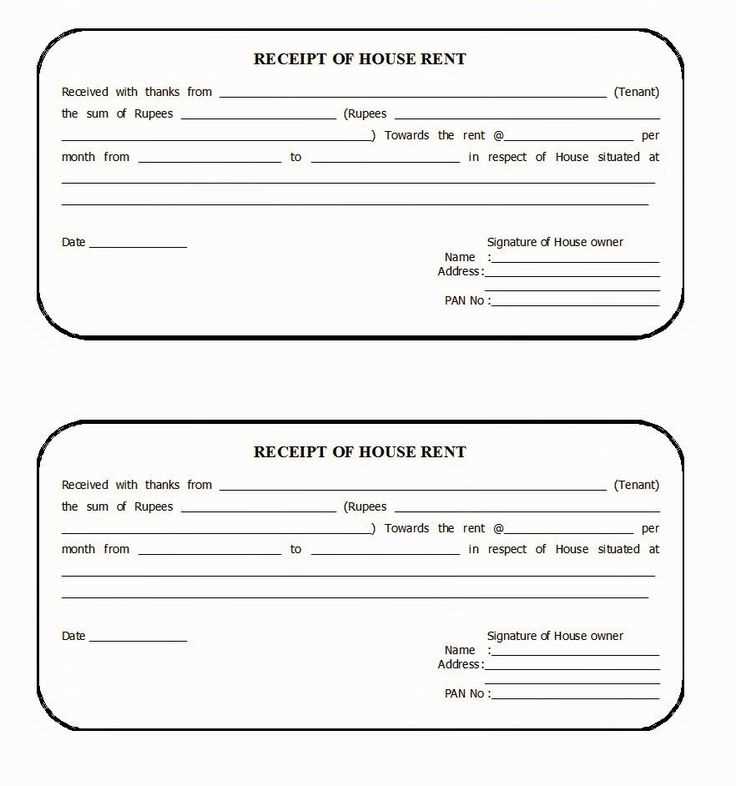

Ensure that your rent receipt template for Ontario includes the following key elements to meet legal requirements:

- Landlord’s Name and Address: Clearly state the landlord’s full name and address.

- Tenant’s Name: Include the tenant’s full name, as specified in the rental agreement.

- Rental Property Address: The address of the property being rented must be listed.

- Receipt Date: Mention the date on which the rent payment was received.

- Amount Paid: Specify the amount paid for the rent in both numerical and written forms.

- Payment Period: Indicate the period covered by the rent payment (e.g., from January 1 to January 31).

- Payment Method: Note how the rent was paid (e.g., cheque, cash, bank transfer).

- Signature: The landlord’s signature or a statement indicating that the receipt is generated electronically should be included.

Additional Tips

- Use a clear and professional format to make the document easy to read.

- If there are any special agreements, such as rent discounts or additional charges, mention them in the receipt.

- Ensure that both parties retain a copy of the receipt for future reference.

By following these steps, your rent receipt template will be compliant with Ontario’s rental regulations, offering clarity and protection for both landlords and tenants.