Creating a clear and professional vacation rental receipt is a simple yet powerful step for both hosts and guests. It helps avoid confusion about payment details and serves as an official record for both parties. A well-organized receipt ensures guests have all the information they need for their records, while also giving hosts a way to track their rental income accurately.

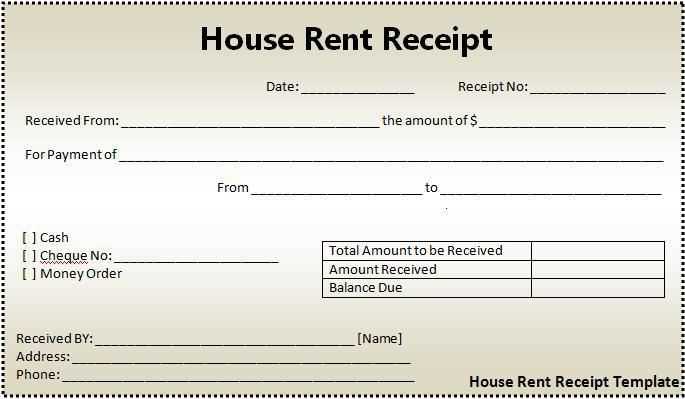

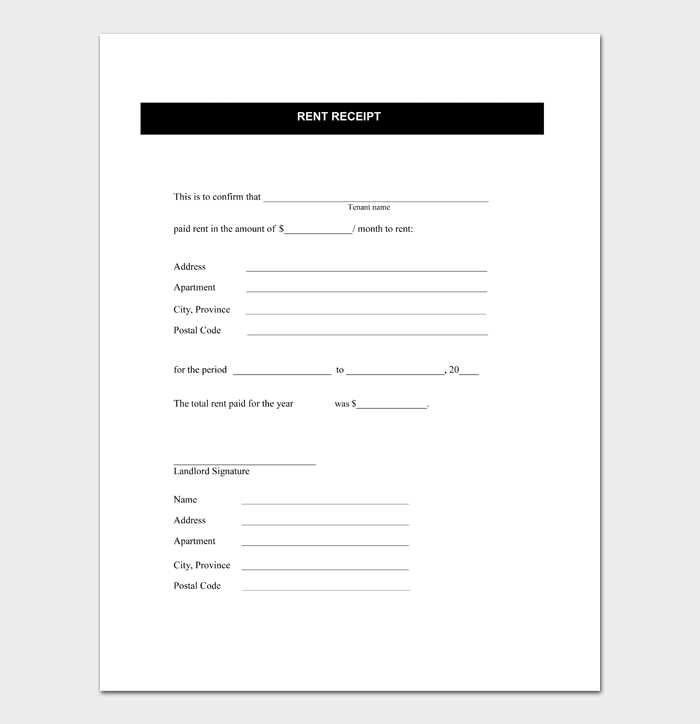

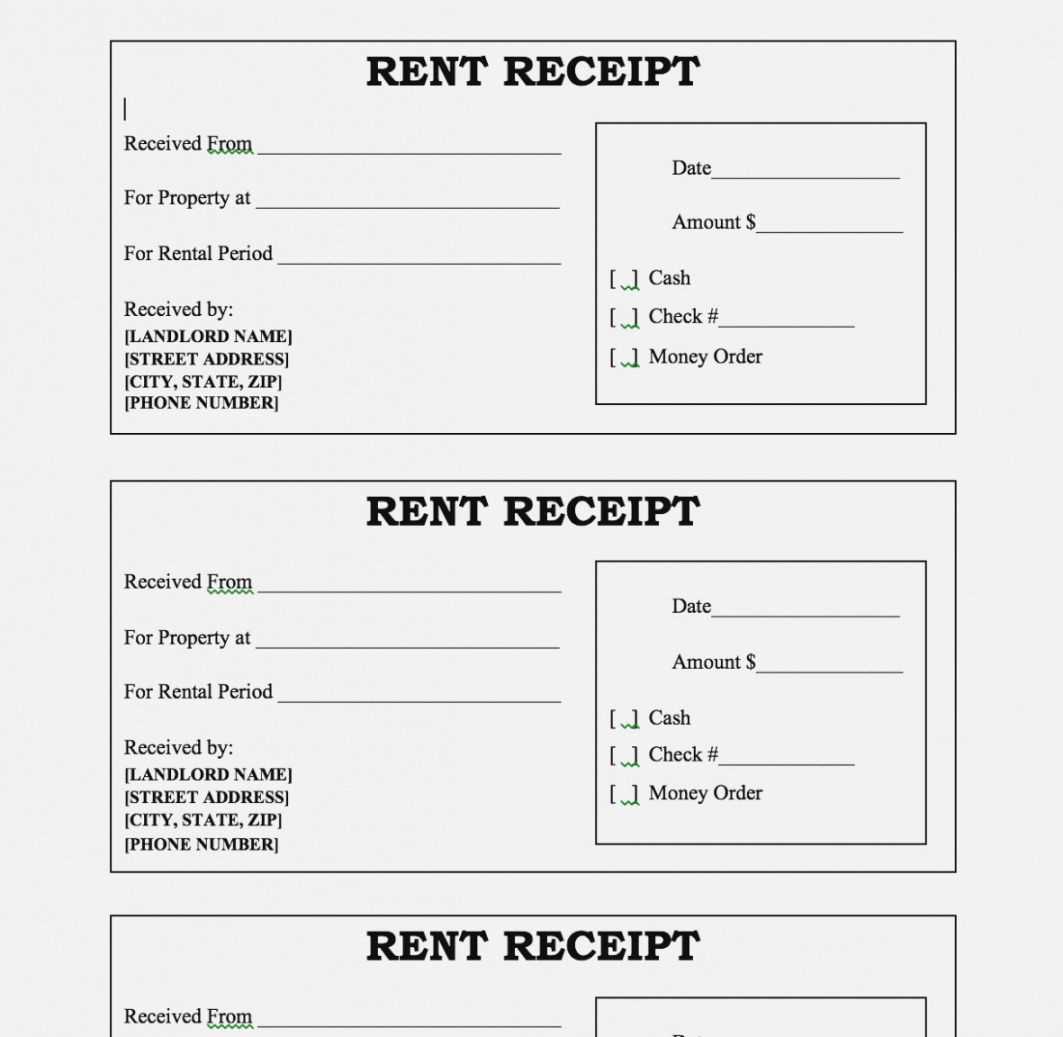

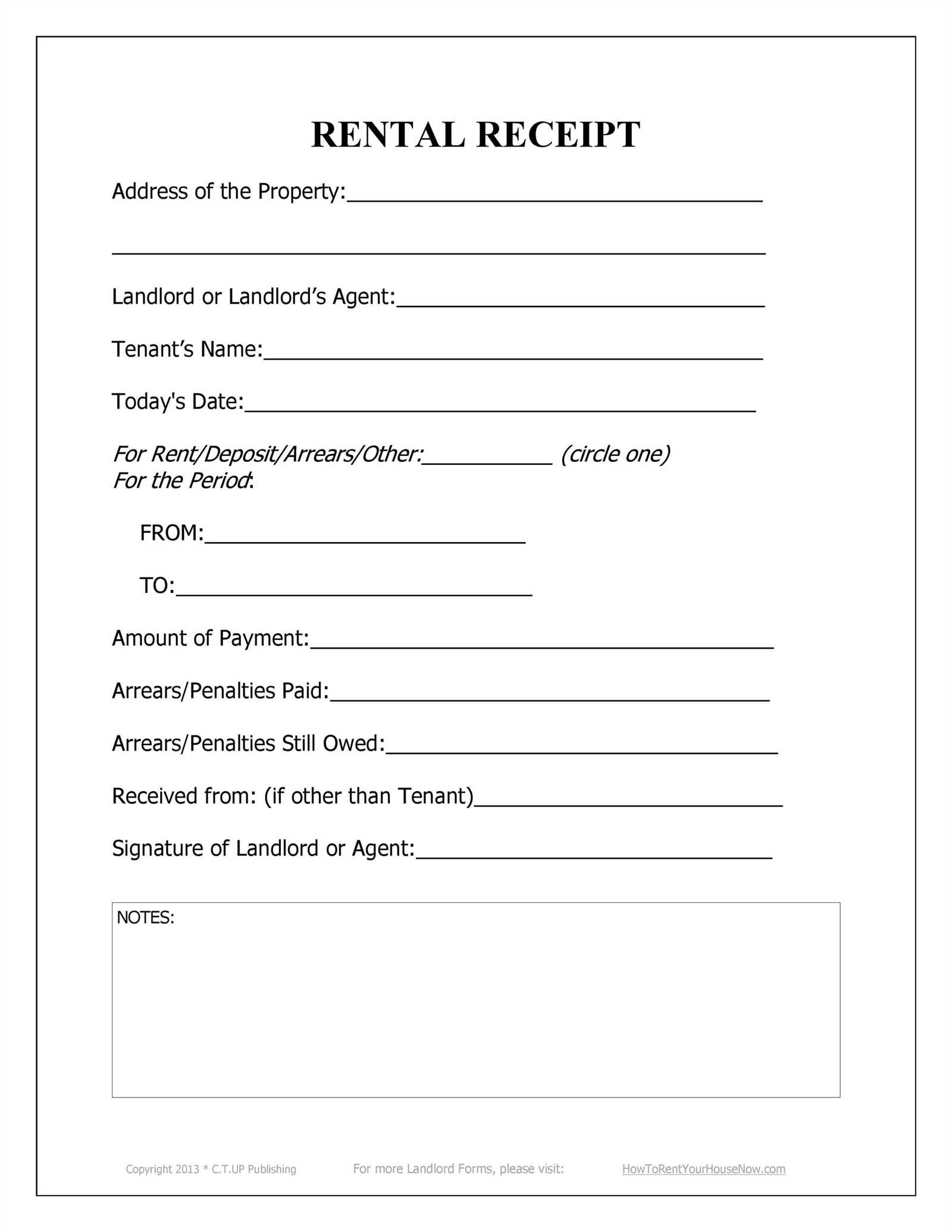

Start by including basic information like the rental property address, the guest’s name, check-in and check-out dates, and the total amount paid. Make sure to list any additional charges, such as cleaning fees or taxes. This makes it easy for both parties to confirm that everything matches up with the original booking agreement.

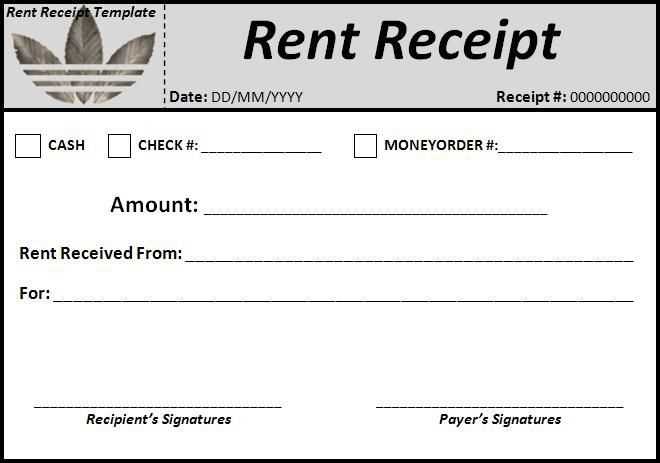

For added clarity, include a breakdown of any discounts or promotions applied, as well as the payment method used. This transparency builds trust and can prevent future disputes over billing. A section for both the host’s and the guest’s contact information will also make the receipt more useful in case of follow-up communication.

Use a clean, easy-to-read layout with clear headings for each section. A well-designed receipt makes the process smoother and adds a level of professionalism that can leave a lasting impression on guests.

Here are the corrected lines with redundancies removed:

To make your vacation rental receipt clearer and more concise, eliminate unnecessary repetitions. Here’s how you can adjust your template:

1. Streamline the Property Description

- Instead of repeating the property type multiple times, use it once in the header or first line.

- Keep the address clear and short. You can avoid restating location details more than once.

2. Simplify Payment Details

- Remove redundant payment methods. List only the methods used in the transaction.

- Instead of “amount paid” and “total paid,” just state the “total payment” and include taxes or fees as separate line items if necessary.

By making these changes, your receipt will be easier to read and provide all necessary information without being repetitive.

- Vacation Rental Receipt Template

A vacation rental receipt template should include specific details to ensure transparency and record-keeping. Include the rental property name, address, and contact information at the top. Clearly state the rental period, including check-in and check-out dates. List the amount paid, including any taxes or fees, with a breakdown of each component. Include the method of payment, such as credit card, bank transfer, or cash. It’s also helpful to have a space for the guest’s name and contact information.

Ensure the template has a unique receipt number for reference. This helps both you and the guest track payments. If any security deposit was paid, make sure to mention it along with the refund status if applicable. Providing a thank-you message or confirming the stay’s completion adds a personal touch.

For added clarity, offer a section to note any outstanding balance or future payments if the booking was only partially paid. If you provide additional services, like cleaning or excursions, list them separately to avoid confusion.

To create a rental receipt for vacation properties, start by including key transaction details. This should cover the guest’s full name, rental property address, check-in and check-out dates, and the total amount paid. Make sure the receipt clearly shows any deposits, taxes, or additional fees, such as cleaning charges or security deposits.

1. Include Contact Details

Provide your contact details, including business name, address, and phone number. This makes it easy for guests to reach you with any questions or concerns after the transaction.

2. Provide a Breakdown of Charges

Break down the total payment into categories. For example, list the rental fee, any cleaning fee, and applicable taxes. This transparency builds trust with the guest and ensures clarity on all charges.

To wrap it up, create a simple receipt template in a word processor or spreadsheet for easy customization. Use clear, concise language and make sure to keep it professional while highlighting important information for the guest’s reference.

A vacation rental receipt should be clear and detailed to avoid any confusion. Make sure to include these key elements:

1. Property Information

List the address of the rental property, including any unit or apartment numbers. This helps identify exactly where the guest stayed.

2. Rental Period

Specify the exact dates of the booking–check-in and check-out times. This shows the duration of the stay and helps clarify any potential disputes over booking periods.

3. Payment Breakdown

Detail the total amount charged, including rental fees, taxes, cleaning fees, security deposits, and any additional charges like late check-out fees. This transparency avoids misunderstandings.

4. Guest Details

Include the name(s) of the guest(s) who made the booking, along with their contact information. This ensures both parties are on the same page regarding the reservation.

5. Payment Method

Note how the payment was made–whether by credit card, bank transfer, or another method. This helps keep track of payments and can be useful for future reference.

6. Booking Reference Number

If the booking was made through a platform (like Airbnb or Booking.com), include the booking reference or confirmation number. This links the receipt to the reservation details on the platform.

7. Host Contact Information

Provide the contact information for the host or property manager. This ensures the guest can reach out in case of any issues during or after their stay.

To accommodate different payment methods, update your receipt template with clear references to each method used by guests. Include distinct sections or fields for cash, credit card, bank transfers, and online payment systems like PayPal or Stripe. This ensures transparency and avoids confusion about how the payment was processed.

For Credit Card Payments

List the last four digits of the credit card number for identification purposes. If necessary, include the card type (Visa, MasterCard, etc.) and the transaction ID. This allows guests to easily cross-reference their receipts with their bank statements.

For Cash Payments

If the guest paid with cash, specify the amount in both numerical and written form. You might also want to add a note stating whether the payment was made in full or partially.

For payments via online platforms, include the transaction ID or reference number. Some platforms may also allow you to display the payment confirmation status (e.g., “Payment Received” or “Payment Pending”). Keep this information accurate and aligned with the guest’s payment method to maintain clear records.

Lastly, include a disclaimer or note if any processing fees apply based on the payment method. This will help guests understand how their payment was processed and what additional charges, if any, were added.

How to Structure a Vacation Rental Receipt

When creating a vacation rental receipt, it’s important to include all the necessary details to ensure transparency and clarity for both the guest and the host. This not only helps in tracking payments but also prevents misunderstandings. Here’s how you can format it:

Key Components to Include

The receipt should contain the following key sections:

- Rental Property Information: Name and address of the property should be clear and easy to find.

- Guest Details: Include the guest’s name, contact information, and booking reference number.

- Payment Breakdown: List the amount paid for rent, cleaning fees, security deposits, taxes, and any additional charges. Be specific with the date of payment.

- Payment Method: Specify how the payment was made (credit card, bank transfer, etc.) and any relevant transaction numbers.

- Rental Dates: Clearly state the check-in and check-out dates, as well as the duration of stay.

Best Practices

Provide guests with a copy of the receipt after the payment is processed. Ensure the information is correct before issuing it, especially for the payment amount and method. You can send the receipt via email or provide it in print if requested. Additionally, keeping a digital copy of the receipt is a good way to stay organized for tax purposes or future disputes.