For businesses and individuals managing transactions online, having a structured template for payment receipts is key to keeping records organized. A well-crafted receipt template ensures that all relevant payment details are captured in a consistent format. This not only helps in verifying transactions but also builds trust with clients by providing them with clear documentation of their payments.

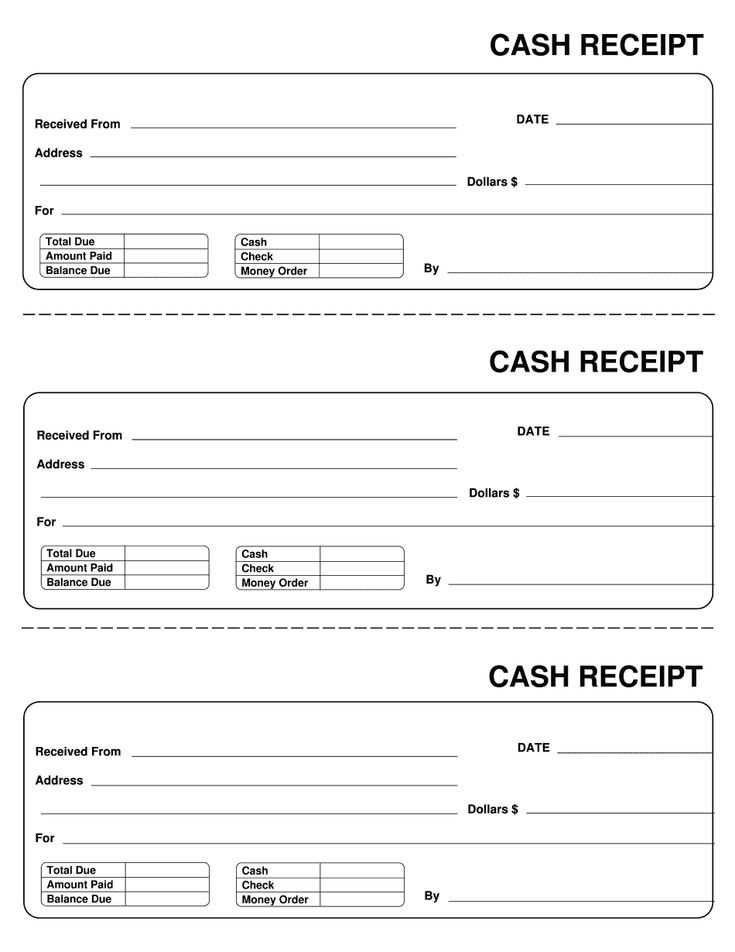

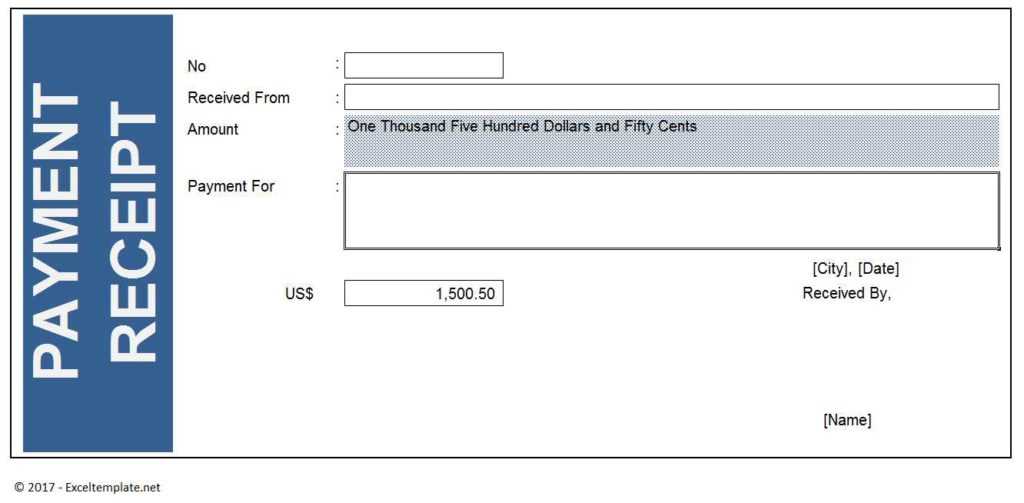

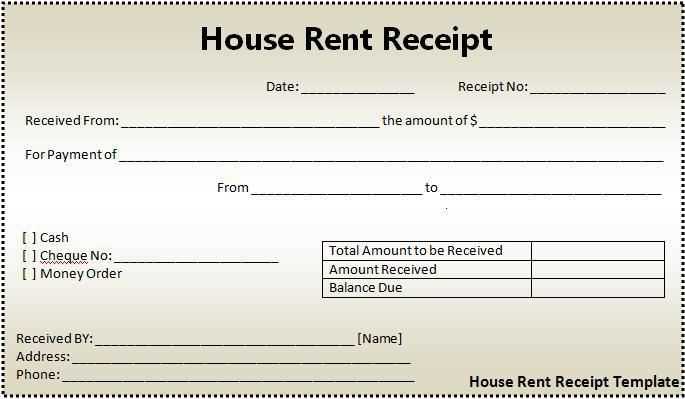

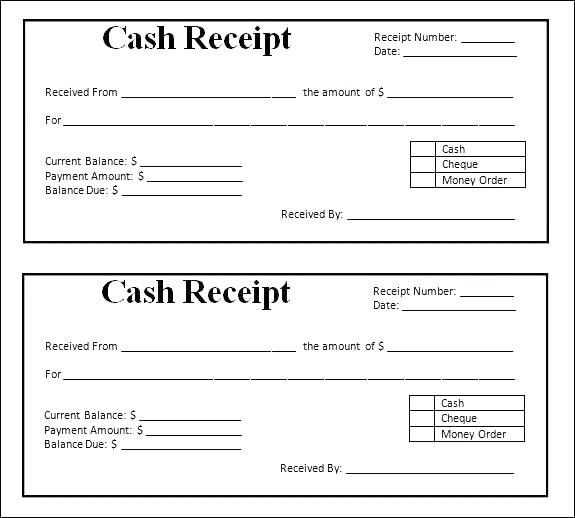

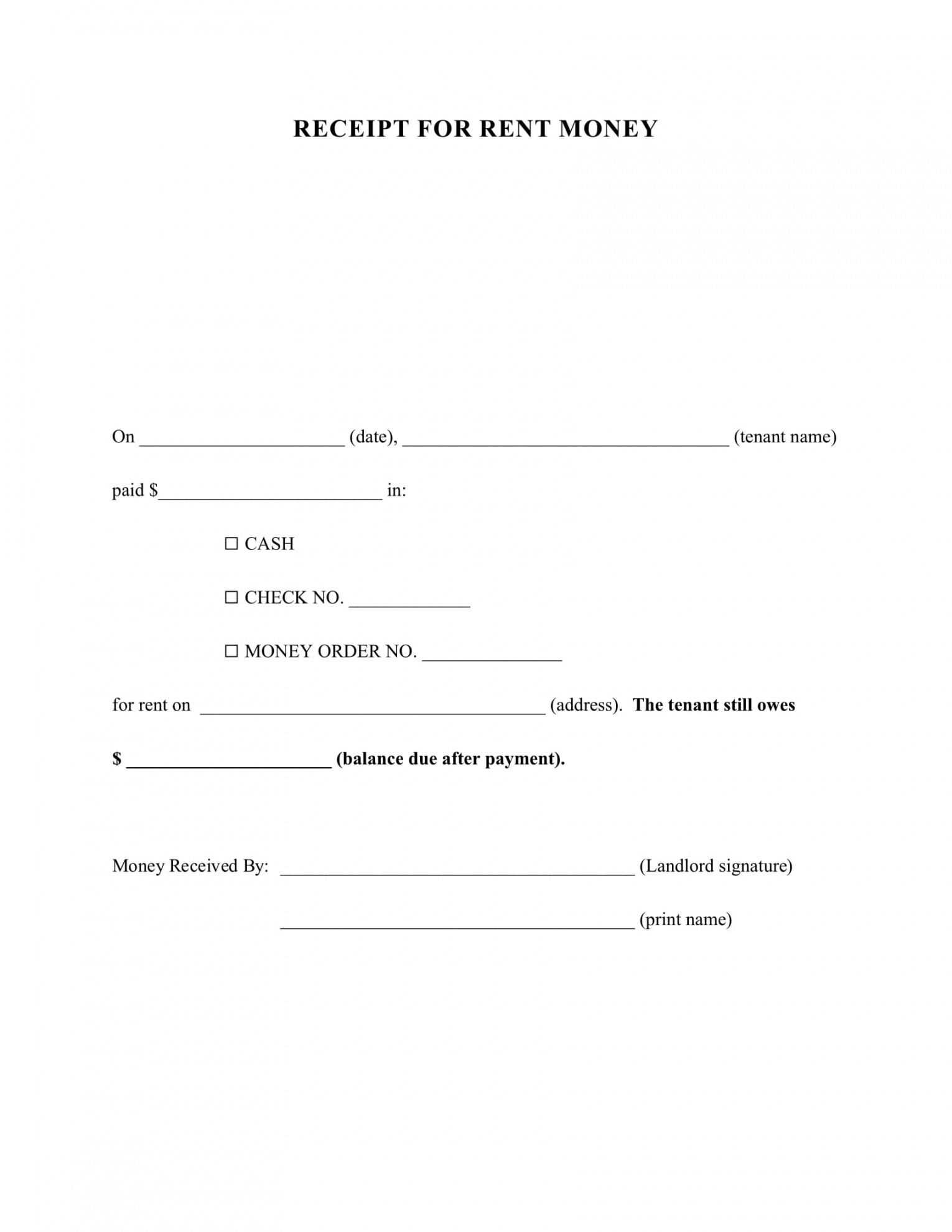

Choose a template that includes all necessary fields, such as the payer’s name, payment amount, date, and method of payment. Make sure to include unique identifiers like a transaction number or receipt ID. These elements streamline the process of tracking payments and reduce the chances of errors when managing multiple transactions.

Customize your template to align with your business needs. Depending on the nature of your transactions, you might want to add extra fields like itemized descriptions, tax details, or service charges. Keep the format simple yet detailed, allowing space for any special notes or terms related to the payment.

Lastly, ensure that your receipt is easily accessible after payment. Offering downloadable versions or automatic email confirmations gives recipients immediate access to proof of payment. Whether for personal use or business transactions, a template that integrates these elements is a reliable tool for maintaining transparent and accurate records.

Here’s the corrected version:

To improve the accuracy of payment receipt templates, ensure that each field is clearly labeled and matches the payment details precisely. Include the payment date, payer’s name, amount paid, and transaction method. Avoid ambiguous terms and instead focus on providing specific data points. Always format the receipt in a consistent and professional manner, making it easy for both the payer and the recipient to understand. For added clarity, use simple language and direct statements to minimize confusion.

Additionally, consider incorporating a unique reference number for each transaction to avoid potential errors. A well-structured layout will make it easier for both parties to verify the information. Double-check that all figures match with the actual payment received, ensuring no discrepancies.

Finally, test the template with various payment scenarios to ensure all fields adapt properly to different payment methods. This guarantees that the template works efficiently across all use cases and remains reliable for future transactions.

- Online Template for Payment Receipt

An online payment receipt template provides a streamlined method for issuing receipts after a payment has been made. The template should include key payment details such as the payer’s information, payment amount, payment method, date of transaction, and transaction ID. This helps ensure that both the payer and the recipient have a clear record of the transaction.

Choose a simple and clean layout that ensures readability. The template should be easy to fill out and customizable based on specific transaction details. Avoid cluttered sections and focus on presenting only relevant data. This makes the template user-friendly and professional.

Incorporate fields for the name or business name of the payer, along with the payment amount and currency. Providing these fields allows for the accurate capture of financial data, which can be stored for reference or accounting purposes.

Ensure the inclusion of a unique transaction number or ID to help track payments and resolve any disputes. The receipt should also clearly list the payment method, whether it’s through credit card, bank transfer, or online payment services.

Finally, add a section for a thank-you note or any additional instructions, which can be customized based on the specific business or service provided. This creates a positive impression and ensures a professional appearance for your receipts.

Pick a platform with intuitive design features to simplify the creation process. Look for customizable templates that allow you to adjust fields like date, amount, and buyer details. Ensure the platform integrates seamlessly with your payment system, allowing for automatic updates of payment details in the template. Consider whether the platform offers cloud storage for easy access and sharing. Check if it includes options for branding your receipts with your logo or company colors. Lastly, assess whether the platform offers security features to protect sensitive transaction data and ensure compliance with relevant financial regulations.

Tailor your payment receipt template based on the type of transaction you’re processing. For a one-time payment, include fields for transaction ID, payment method, and product or service description. Ensure the total amount is clearly visible, along with any taxes or fees applied. If the payment is a subscription, highlight the recurring nature of the payment, including billing cycle details and next payment date. For refunds, include the original transaction details, refunded amount, and reason for the refund, if applicable. This clarity helps avoid confusion for both you and the customer.

For invoices related to bulk or wholesale orders, be sure to list individual item prices, quantity, and discounts, if any. It helps customers confirm the details of their purchase. In cases of international transactions, ensure you account for currency conversions and include the applicable exchange rate and payment method used. Each type of transaction demands a specific layout that highlights the relevant information and minimizes ambiguity.

Incorporate branding elements to maintain consistency across different transaction types. This includes logos, color schemes, and clear typography. Customization ensures that the template serves its function while aligning with your business identity. Adjusting the layout for clarity and ease of understanding will enhance your professional image and customer experience.

Securing Payment Data and Ensuring Compliance with Legal Standards

Use encryption protocols such as TLS/SSL to protect payment data during transmission. This ensures that sensitive information remains secure from potential breaches. Always store sensitive data in encrypted formats and limit access to authorized personnel only.

Follow the Payment Card Industry Data Security Standard (PCI DSS) to meet legal and security requirements for handling payment information. Implement strong authentication methods, such as multi-factor authentication (MFA), to verify users during payment transactions.

Regularly conduct security audits to assess potential vulnerabilities. Keep your systems up to date by patching known security flaws and using up-to-date anti-malware software.

Comply with regional data protection laws, such as the GDPR in Europe or CCPA in California. Understand and adhere to the regulations related to data storage, user consent, and data access rights.

Implement a clear privacy policy that outlines how payment data is collected, processed, and stored. Provide users with easy access to their data and the ability to request its deletion when needed.

- Encrypt sensitive data during both storage and transmission.

- Ensure PCI DSS compliance to meet industry standards for payment security.

- Adhere to regional data protection laws and regulations.

- Regularly test systems for vulnerabilities through audits and penetration tests.

- Use strong authentication methods like MFA for user verification.

Use a payment receipt template to ensure consistency and accuracy in documenting transactions. Start by choosing a template that matches your specific needs–whether it’s for online purchases, services, or physical goods. This helps keep all essential details in place, such as the payment date, amount, and payer information.

Key Fields to Include

Make sure to include fields for the payer’s name, payment method, amount paid, and a unique receipt number. Adding a brief description of the service or product provided clarifies the purpose of the payment, reducing potential disputes. Also, provide your business contact details for easy follow-up if necessary.

Automation and Customization

For efficiency, consider automating receipt generation with tools that support template customization. This allows you to personalize the template with your logo, branding colors, and digital signatures. Automation minimizes manual errors and speeds up the process, ensuring receipts are issued promptly.