Organizations and individuals donating food in California should provide a properly formatted receipt to comply with tax regulations and maintain clear records. A well-structured receipt includes key details such as the donor’s name, the recipient organization, a description of the donated items, and the estimated value. This documentation is especially important for tax deductions and financial transparency.

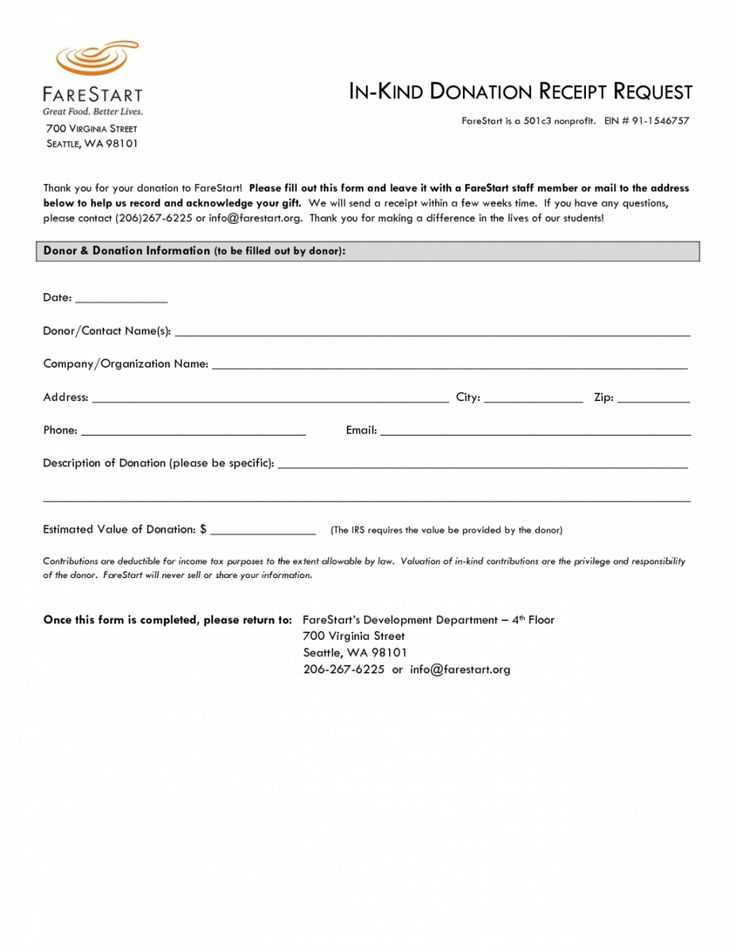

California follows IRS guidelines for charitable contributions, requiring receipts for donations exceeding $250. While monetary valuation is the donor’s responsibility, the recipient organization should confirm receipt of the items. If the donation exceeds $500, additional IRS forms may be necessary. Keeping a detailed record helps both donors and nonprofit organizations streamline tax reporting and maintain compliance with state and federal laws.

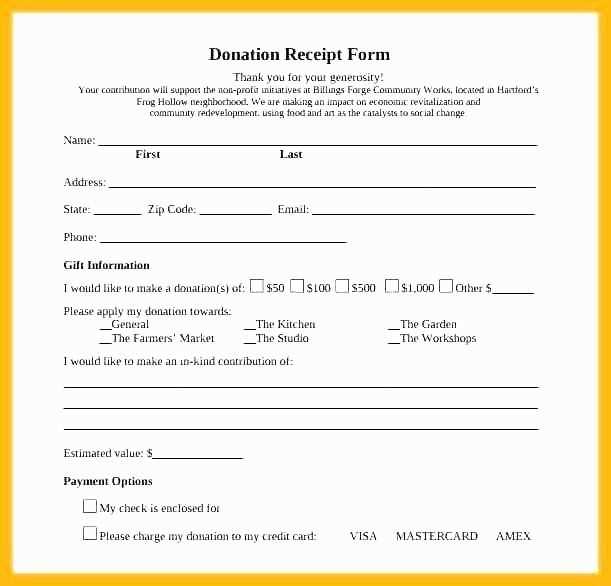

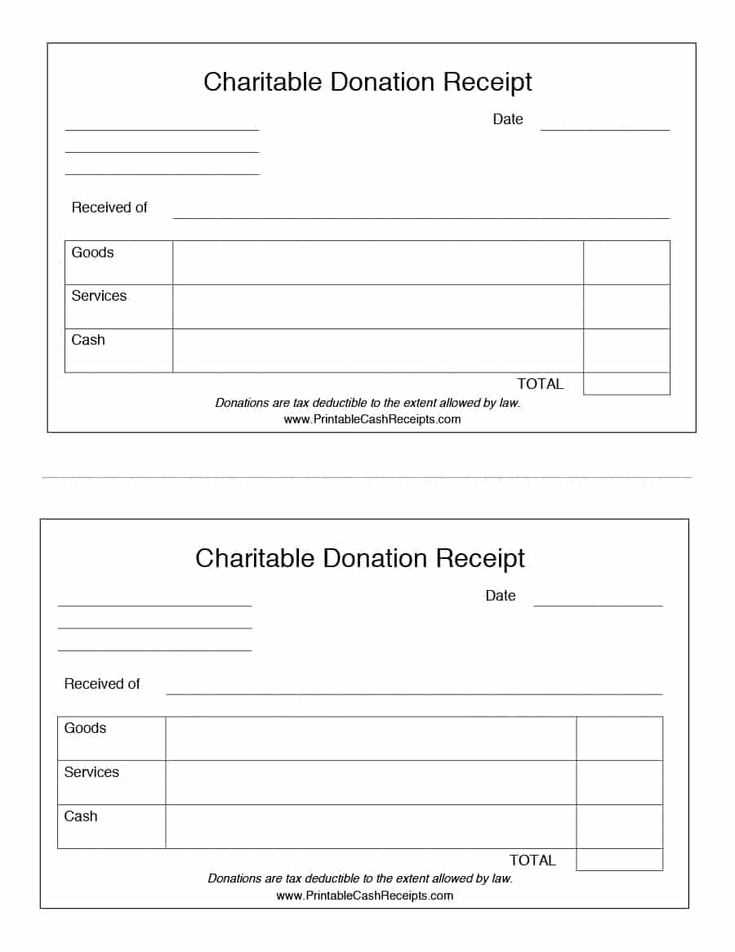

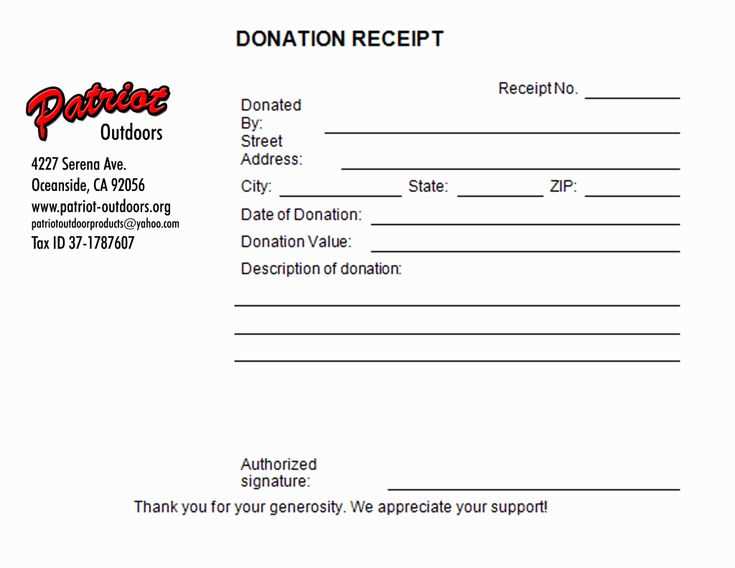

To simplify this process, a standardized food donation receipt template ensures all necessary fields are covered. This template should include sections for donor and recipient information, a detailed list of donated items, and a signature line for verification. Digital or printed formats are both acceptable, as long as they contain the required details for legal and tax purposes.

Here’s a version without unnecessary repetitions:

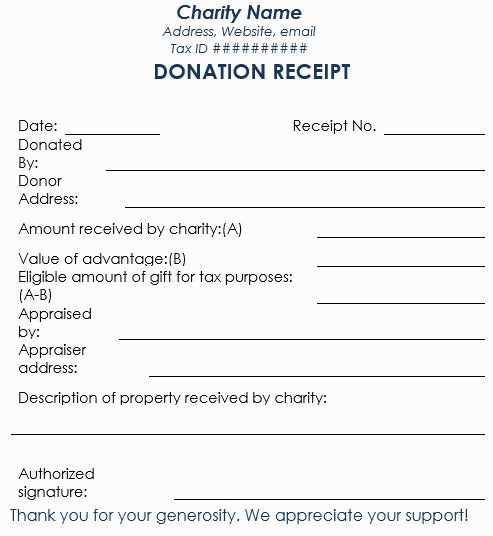

When creating a food donation receipt in California, include the following details:

- Donor’s Name and Address: Ensure both the full name and address of the donor are listed.

- Organization Information: Clearly state the charity or organization receiving the donation, including its name and address.

- Date of Donation: Record the specific date the donation was made.

- Item Description: List the donated items, including quantities or approximate value where applicable.

- Estimated Fair Market Value: Provide an estimate of the fair market value of the items donated, if possible.

- Signature of Authorized Representative: Have someone from the receiving organization sign the receipt.

Use the following table format for better clarity:

| Item Description | Quantity | Value |

|---|---|---|

| Non-perishable food items | 3 boxes | $30 |

| Canned vegetables | 10 cans | $20 |

This structure helps keep the donation receipt clear and compliant with California’s regulations.

- Food Donation Receipt Template California

In California, a food donation receipt is necessary for both donors and recipients for record-keeping and tax purposes. The template should include key information such as the date of donation, donor’s name and contact details, description of the donated items, estimated value, and the name of the receiving organization. The IRS requires that non-cash donations, including food, be documented accurately to qualify for tax deductions.

Key Elements to Include

The receipt should include the following fields:

- Donor Information: Full name, address, and contact details of the person or organization making the donation.

- Organization Details: The name, address, and contact information of the charitable organization receiving the donation.

- Date of Donation: The exact date when the food donation was made.

- Description of Items Donated: A detailed list of the food items, including quantities and conditions (e.g., fresh, frozen, canned).

- Estimated Value of Donation: While the charitable organization cannot assign a monetary value to the donation, it is important for donors to estimate the fair market value of the items donated. This is useful for tax reporting purposes.

- Statement of Non-Compensation: A declaration stating that the donor did not receive any goods or services in exchange for the donation.

Tax Considerations

Donors can claim tax deductions for food donations made to qualified charitable organizations. It’s important to keep a copy of the receipt for IRS purposes. The IRS provides guidelines for valuing non-cash donations, including food, and it is recommended to use recognized valuation methods, such as those outlined in IRS Publication 561.

To ensure a food donation receipt complies with California regulations, include the donor’s name, the date of the donation, and a detailed description of the items donated. Specify the quantity and nature of the food, ensuring it is clear whether the donation is perishable or non-perishable. Avoid placing a value on the food; donors must determine the fair market value themselves for tax purposes.

The receipt should include the name and address of the receiving organization, along with a statement confirming that no goods or services were provided in exchange for the donation. This is important for tax deduction purposes. Keep the receipt simple, clear, and professional.

Ensure the receipt is signed by an authorized representative of the organization. If the donation is large or unusual in nature, it may be helpful to include any additional details that could clarify the donation’s value or scope for both parties.

Retain a copy of the receipt for your records and provide one to the donor. This helps maintain transparency and meets California’s legal requirements for food donation documentation.

The receipt should include the name and address of the charitable organization receiving the donation. This ensures both parties have clear records for tax purposes. Include the date of the donation to establish a timeline for tax deductions. If possible, specify the type and quantity of food donated, as it may impact the valuation for tax purposes. The value of the donation must be either estimated by the donor or determined by the charity, depending on its policy. It is also helpful to mention whether the donation was made in cash, goods, or services, to provide transparency.

If the food donation was non-cash, include a statement that no goods or services were provided in exchange for the donation. If any goods or services were exchanged, their value should be listed. For the donor’s convenience, the receipt should include a clear statement of the charity’s tax-exempt status under IRS Section 501(c)(3), ensuring the donor can claim their tax deduction. Lastly, a unique receipt number is useful for tracking donations across the charity’s records.

California offers tax incentives for individuals and businesses that donate food to qualified organizations. By using a food donation receipt, donors can claim a charitable deduction, reducing their taxable income. The process can lead to significant savings depending on the size of the donation and the donor’s tax bracket.

Claiming Charitable Deductions

Donors who provide food to eligible organizations in California can receive tax deductions under the IRS guidelines. The food must be donated to a nonprofit, such as a food bank, that uses it to feed people in need. Ensure the organization is registered as a 501(c)(3) entity, as only donations to these groups are eligible for deductions.

Determining the Value of the Donation

The value of donated food is based on its fair market value (FMV) at the time of the donation. Donors should refer to IRS Publication 526 for guidance on how to assess the FMV of food. It’s recommended to keep a detailed inventory of donated goods and their estimated market value to ensure an accurate deduction.

- Food donations must be in good condition and suitable for human consumption.

- Donors can deduct the cost of the food or, in some cases, the actual selling price if it is lower than the FMV.

- For larger donations, a qualified appraiser may be needed to establish the FMV.

Food donation receipts provide the necessary documentation to claim these deductions on your taxes. The receipt should include specific information such as the name of the organization, the date of the donation, and a description of the items donated. Donors should retain this receipt as proof when filing taxes.

State-Specific Considerations

California offers additional benefits for food donations. Under the California Tax Credit for charitable donations, some taxpayers may be eligible for state-specific deductions. It’s important to consult a tax professional to understand how these state credits could complement federal deductions for food donations.

- Check eligibility for state tax credits that may apply to your donation.

- Keep records of any tax credit programs applied for food donations.

Meaning is preserved, and redundant repetitions are minimized.

In California, food donation receipts should clearly reflect the items donated, the date of donation, and the value of the goods, while ensuring that only necessary details are included. Avoid repeating information, such as listing item quantities multiple times. Keep descriptions concise and direct to enhance readability.

Each receipt should list the name of the donor, the charity or organization receiving the donation, and their respective addresses. Don’t overcomplicate the format–use bullet points or simple tables for clarity.

Tip: If a donor is giving non-perishable items, include a brief category like “Canned Goods” instead of specifying every item individually. This minimizes clutter while providing clear information about the donation.

Keep the total value of the donation straightforward. If applicable, include estimated fair market values for each item donated, but avoid listing the same value multiple times. Instead, provide a summary of the donation’s overall worth at the end of the receipt.

Remember, the receipt should serve its purpose without unnecessary details. Focus on the essentials to keep the document clean and easy to understand.