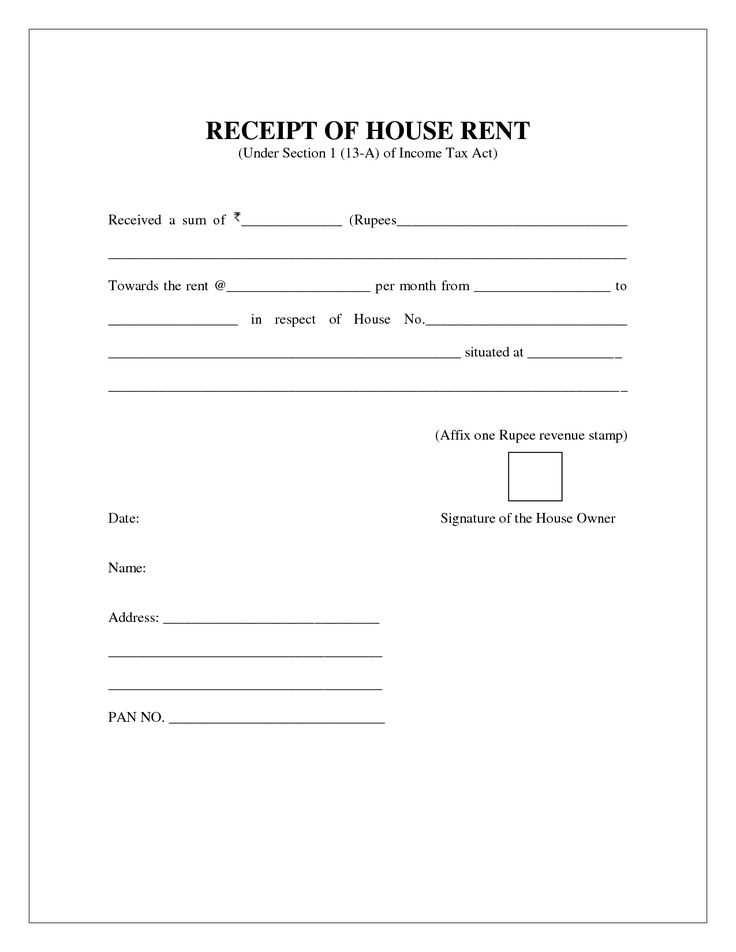

To claim House Rent Allowance (HRA) or maintain proper records, a well-structured rent receipt is essential. A valid rent receipt should include the tenant’s and landlord’s details, rent amount, payment date, rental period, and landlord’s signature. Many employers and tax authorities require receipts with revenue stamps for payments above ₹5,000 per month.

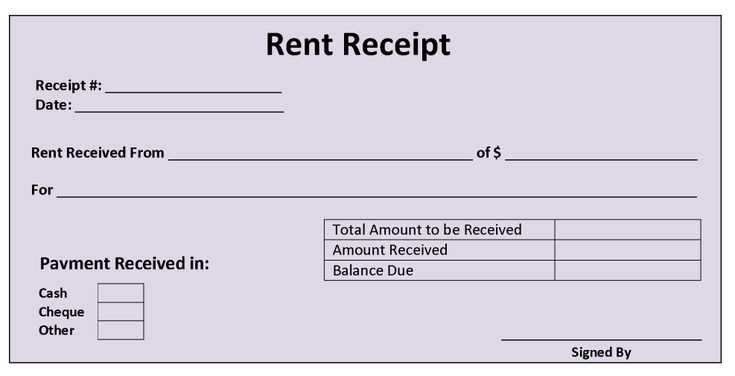

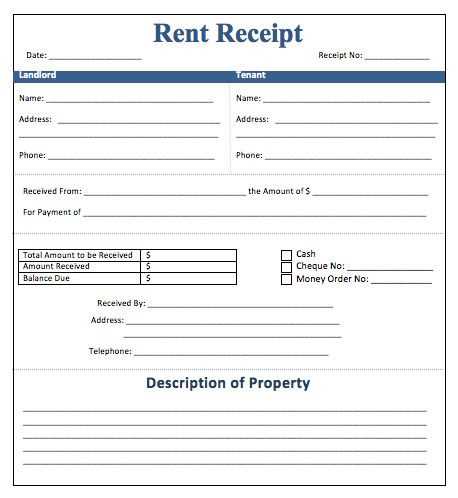

Key elements of a rent receipt:

– Tenant’s full name

– Landlord’s full name and address

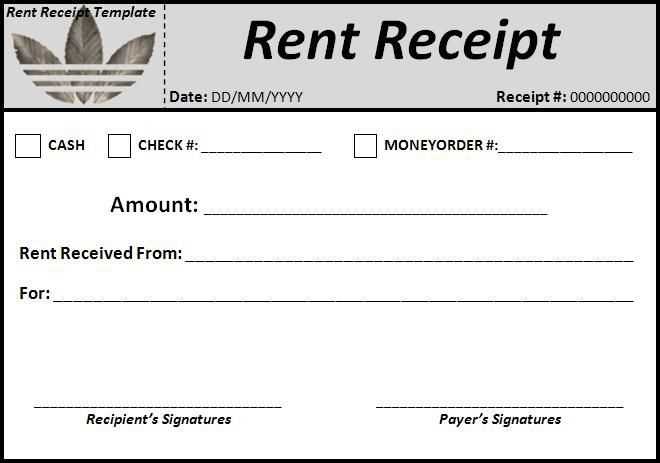

– Monthly rent amount and payment mode

– Rental period covered

– Date of payment and revenue stamp (if applicable)

– Landlord’s signature

Using a pre-formatted rent receipt template saves time and ensures compliance with HRA claims. Digital templates in Word, Excel, and PDF formats allow quick customization. Some templates also include an auto-calculation feature, reducing errors in rental transactions.

For tenants paying rent in cash, a stamped and signed receipt is mandatory for HRA exemption. If paying through bank transfer, landlords may issue digital receipts with an acknowledgment of payment. Always store copies for future reference.

Download a customizable rent receipt template to streamline documentation and avoid last-minute hassles during tax filing or employer verification.

Here’s the revised version without unnecessary repetition:

To create a rent receipt in India, use a template that includes all necessary details without redundancy. Start by listing the tenant’s name, address, and the landlord’s information. Include the rent amount, due date, and payment date. If the rent is paid through cheque or online transfer, mention the payment mode and reference number.

Be clear and concise when noting the rental period and the payment’s purpose. The receipt should also include a clear statement confirming the amount received and any adjustments like previous payments or late fees. Ensure the document has both the landlord’s and tenant’s signatures to make it legally valid.

Avoid clutter by limiting text to only what’s required for a clear transaction record. This prevents confusion and ensures the receipt serves its intended purpose efficiently.

- Rent Receipt Templates in India

Using a rent receipt template in India simplifies rent payment documentation for both landlords and tenants. These templates can be easily customized to include the necessary details and ensure that the transaction is properly recorded.

Key Elements to Include

A typical rent receipt should include the following details:

- Tenant’s Name: Full name of the tenant.

- Landlord’s Name: Full name of the landlord.

- Property Address: The full address of the rented property.

- Rent Amount: The amount paid for rent during the specified period.

- Payment Date: The date when the rent payment was made.

- Receipt Number: A unique identifier for each payment.

- Payment Mode: Whether the payment was made by cash, cheque, or bank transfer.

- Signature: Signatures of both the landlord and tenant.

Where to Find Templates

Many online platforms offer free downloadable rent receipt templates that comply with Indian standards. You can find them in both Word and PDF formats. Simply ensure that the template includes all the necessary fields as mentioned above to avoid any confusion.

In India, rental receipts are critical for both landlords and tenants. It is important to ensure that the receipt includes accurate and legally required details to prevent disputes. A rental receipt must contain the following mandatory information:

- Tenant’s and landlord’s names: Full names of both parties should be mentioned clearly.

- Property details: The address of the rented property should be listed correctly.

- Rent amount: The amount paid by the tenant must be mentioned without ambiguity.

- Date of payment: The date on which the rent is paid should be included.

- Signature: The landlord’s signature is essential for validation of the receipt.

In cases where the rent exceeds Rs. 1,00,000 per year, tenants may also require a rent agreement that is stamped and signed according to state regulations. Without a proper rental receipt, tenants may face difficulties claiming deductions on taxes or proving payment history.

In addition to these basic elements, the receipt should specify the period for which rent is paid, such as monthly or quarterly payments. If rent is paid in advance, this should also be mentioned explicitly. Ensure that both parties retain copies for their records to avoid any legal complications later.

A well-structured rent receipt template should include the following key elements to ensure clarity and accuracy for both tenants and landlords:

1. Date of Payment

The rent receipt should clearly state the date when the rent was paid. This helps in documenting payment history and can be useful for future reference or disputes.

2. Tenant and Landlord Details

Include the full name, address, and contact details of both the tenant and the landlord. This establishes clear ownership of the transaction and eliminates any confusion about the parties involved.

3. Rent Amount

The exact amount of rent paid should be mentioned, specifying the currency. This ensures that both parties are on the same page regarding the rent amount for that particular period.

4. Rent Period

Clearly indicate the start and end date of the rent period for which the payment was made. This provides transparency on what time frame the payment covers.

5. Payment Method

It’s important to note the method of payment used–whether it’s cash, cheque, or bank transfer. This helps in confirming the mode of transaction and can be useful for future audits.

6. Property Details

Provide a brief description of the rented property, including the address or unit number. This confirms the specific location for which the rent payment is made.

7. Signature

The signature of the landlord or the authorized person who received the payment serves as confirmation of the transaction. This adds authenticity to the receipt.

By including these key elements, you ensure that the rent receipt serves its purpose as an official record for both tenant and landlord.

Choose the right rent receipt format based on convenience and your specific needs. Here’s a breakdown of the pros and cons of both printable and digital formats.

- Printable Rent Receipts:

- Pros:

- Physical copies provide a tangible record that can be stored easily in files or folders.

- Some tenants or landlords prefer them for legal purposes, especially when the receipt needs to be physically signed.

- Can be handed over immediately after rent is paid, with no need for tech or internet access.

- Cons:

- Printing and paper costs may accumulate, especially if receipts are issued frequently.

- More prone to being misplaced or damaged compared to digital copies.

- Not ideal for tenants or landlords who need access to records on the go or in different locations.

- Digital Rent Receipts:

- Pros:

- Easy to store and access on any device, making it convenient for tracking payments.

- Eco-friendly, as no paper is wasted.

- Can be emailed instantly, allowing for faster and more efficient record-keeping.

- Cons:

- Relies on technology, so issues like connectivity or device malfunctions may hinder access.

- Some tenants may not be familiar with digital receipts, leading to confusion or mistrust.

- Requires proper backup and security measures to prevent data loss or unauthorized access.

Both options have their benefits, but choosing one depends on your preference for convenience, environmental impact, and long-term record-keeping.

When preparing rent receipts in India, it is vital to include the following details for clarity and legal compliance:

| Detail | Description |

|---|---|

| Tenant’s Name | Include the full name of the tenant who made the payment. |

| Landlord’s Name | Provide the full name of the landlord receiving the rent. |

| Property Address | Specify the address of the rental property to avoid any confusion. |

| Rent Amount | State the exact amount of rent paid, including the currency. |

| Date of Payment | Record the exact date the rent was received. |

| Payment Mode | Indicate whether the rent was paid in cash, cheque, bank transfer, or another method. |

| Rent Period | Clarify the time period covered by the rent payment (e.g., January 1 – January 31). |

| Signature | Both tenant and landlord should sign the receipt to verify its authenticity. |

Make sure all information is accurate. This document can be used for tax purposes and helps maintain transparency in rental transactions.