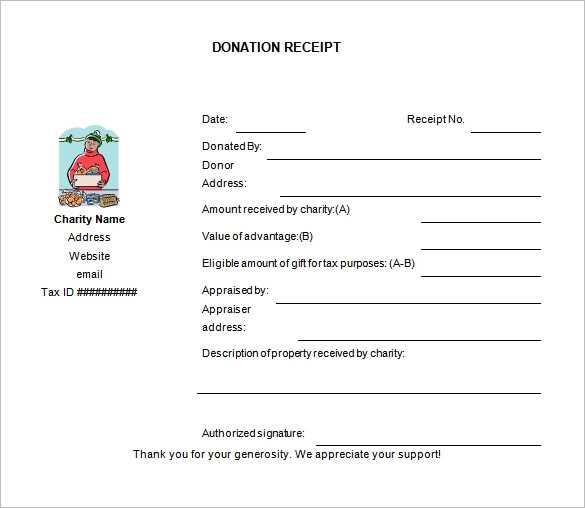

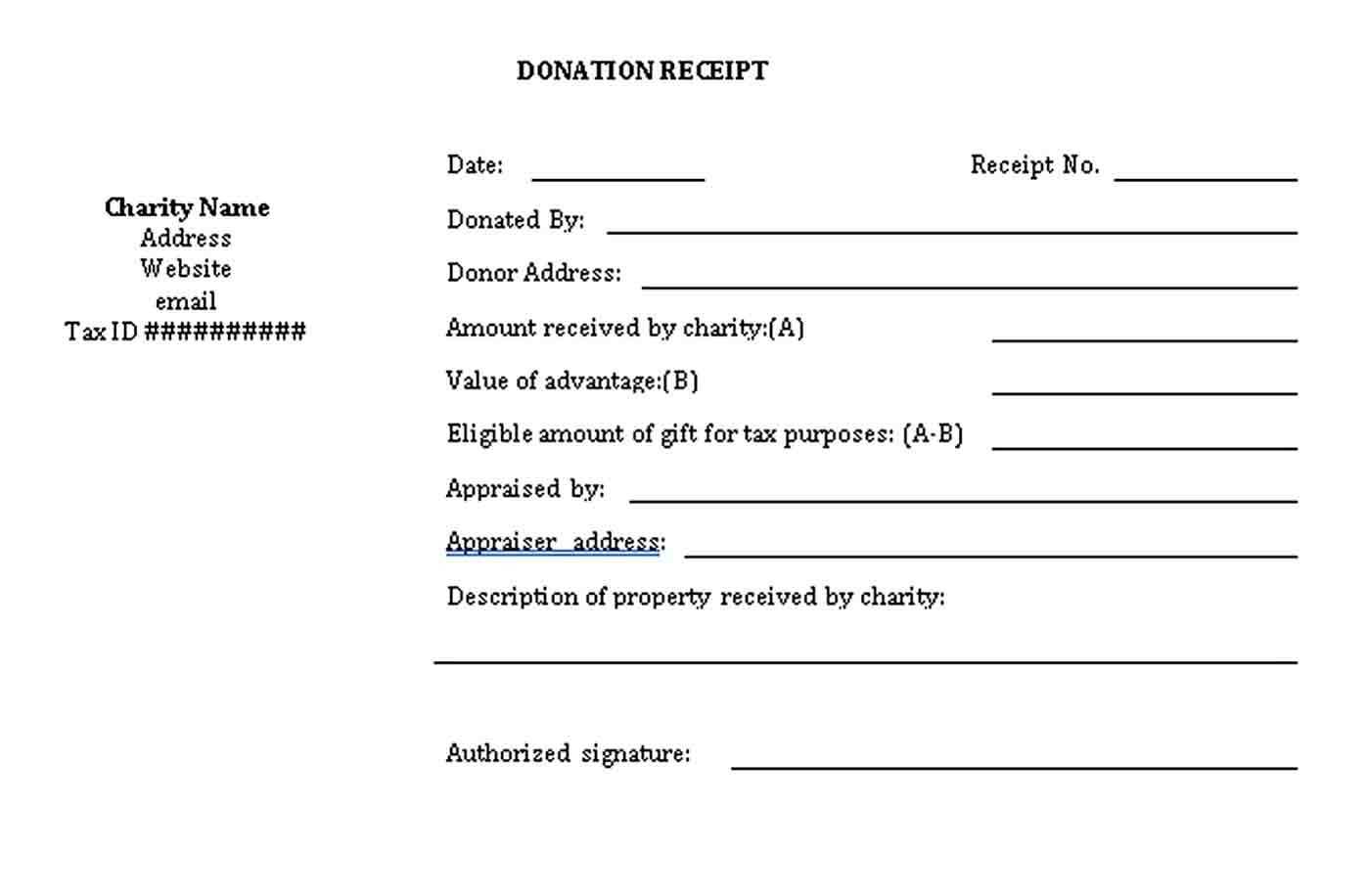

A well-structured donation receipt ensures compliance with tax regulations and provides transparency for both donors and organizations. To create a clear and legally valid document, include key details such as the donor’s name, contribution amount, and date of the donation.

Essential Components: The receipt should state whether the donation is monetary or non-monetary. If goods or services were exchanged, their fair market value must be specified. For tax-deductible contributions, include a statement confirming that no goods or services were provided in return.

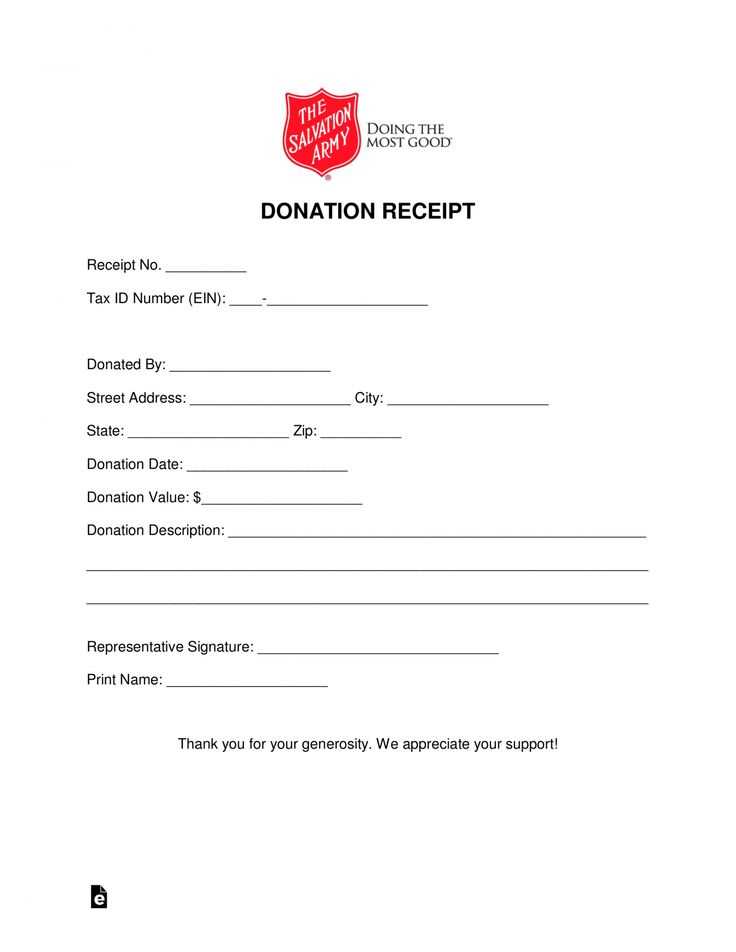

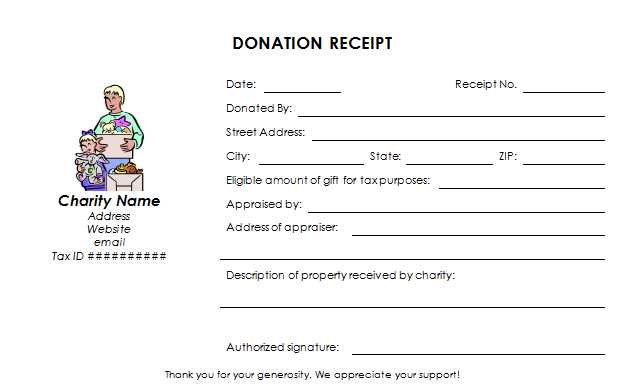

Formatting Recommendations: Use a professional yet simple layout, ensuring all details are easy to read. Adding the organization’s name, contact information, and tax-exempt status strengthens credibility. If issuing digital receipts, a unique reference number can help track records efficiently.

Providing accurate and organized receipts benefits both parties by streamlining tax reporting and maintaining trust. A well-prepared template saves time and ensures consistency in documentation.

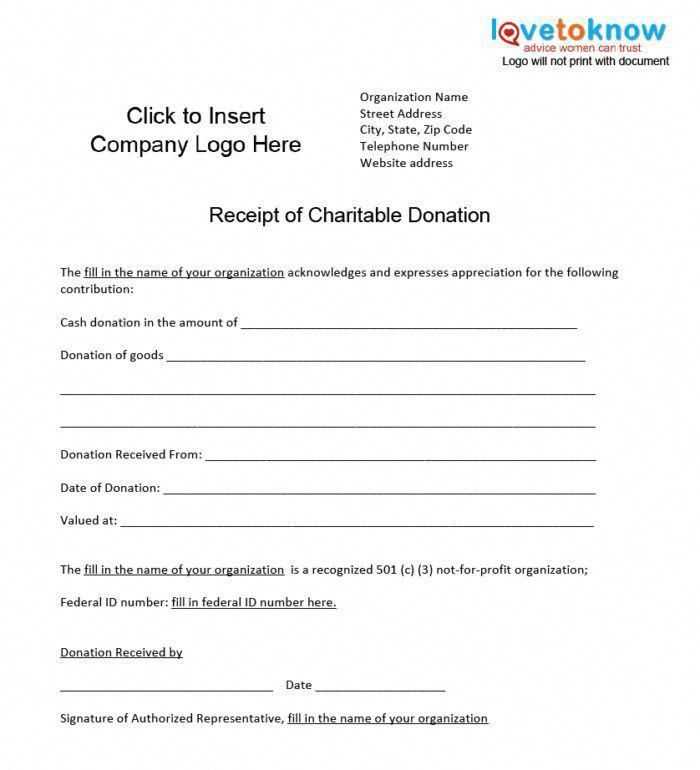

Receipt for Charitable Donation Template

A well-structured receipt should include key details to ensure transparency and compliance with tax regulations. Begin with the donor’s full name and contact information, followed by the organization’s name, address, and tax identification number.

Key Elements to Include

Specify the donation amount or describe non-monetary contributions with estimated value. If applicable, include a statement confirming no goods or services were exchanged for the donation. Add the date of the contribution and an authorized signature from the organization.

Formatting for Clarity

Use a clear layout with bold labels for each section. A simple table can enhance readability. Provide a copy in both printed and digital formats for convenience. Ensure records are retained for future reference.

Key Information to Include in a Donation Receipt

Include the donor’s full name and address to ensure accurate record-keeping. Without this, the receipt may not serve its intended purpose for tax reporting.

Donation Details

- Amount or Value: Clearly state the monetary amount or, for non-cash gifts, a brief description of the donated items.

- Date of Contribution: Provide the exact date to confirm when the donation was made.

- Method of Donation: Indicate whether the contribution was made via cash, check, credit card, or other means.

Organization’s Information

- Name and Address: Ensure the organization’s legal name and physical address are included.

- Tax-Exempt Status: Mention the organization’s tax-exempt designation (e.g., 501(c)(3) in the U.S.) to validate the receipt for tax purposes.

If no goods or services were provided in return, include a statement confirming that. If any benefits were received, detail their fair market value to determine the deductible portion of the contribution.

Legal and Tax Compliance Considerations

Ensure that every receipt includes the donor’s name, contribution amount, and the organization’s official details. For non-cash gifts, describe the donation but avoid assigning a value–this is the donor’s responsibility.

Required Disclosures

Receipts must confirm whether the donor received goods or services in return. If benefits were provided, specify their estimated value. Donations exceeding $250 require a written acknowledgment from the organization.

Record-Keeping and Deadlines

Organizations should retain copies of receipts for audit purposes. Donors must receive documentation by January 31st of the following year to claim deductions. Electronic receipts are valid if they meet content requirements.

Adhere to IRS or relevant tax authority guidelines to avoid compliance issues. Consult a tax professional for specific legal obligations.

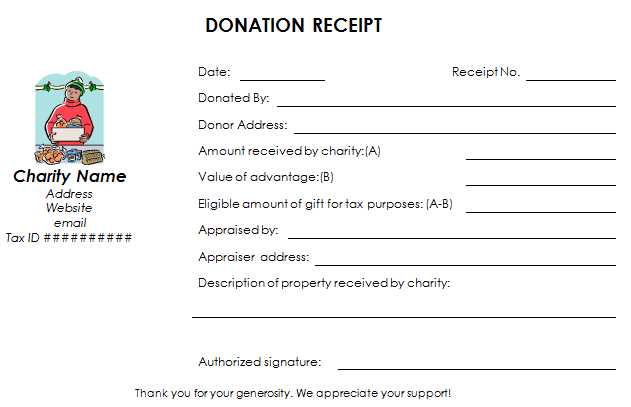

Customizing the Template for Different Donation Types

Adapt the template to match the type of contribution by adjusting key details. Clearly specify whether the donation is monetary, in-kind, or a service. Each category requires distinct elements to ensure compliance and clarity for donors.

Monetary Contributions

Include the exact amount, payment method, and transaction date. If applicable, note any recurring donations and reference numbers for tracking. Adding a thank-you message reinforces appreciation and strengthens donor relationships.

Non-Cash Donations

For donated goods or services, describe the item, condition, and estimated value. If services were provided, detail the nature of assistance without assigning a dollar amount, as tax regulations may differ. Attach supporting documents, such as receipts or appraisal letters, when necessary.

Ensure each receipt aligns with legal requirements and donor expectations. A well-structured document enhances transparency and simplifies record-keeping for both parties.