Clear and Concise Receipt Format

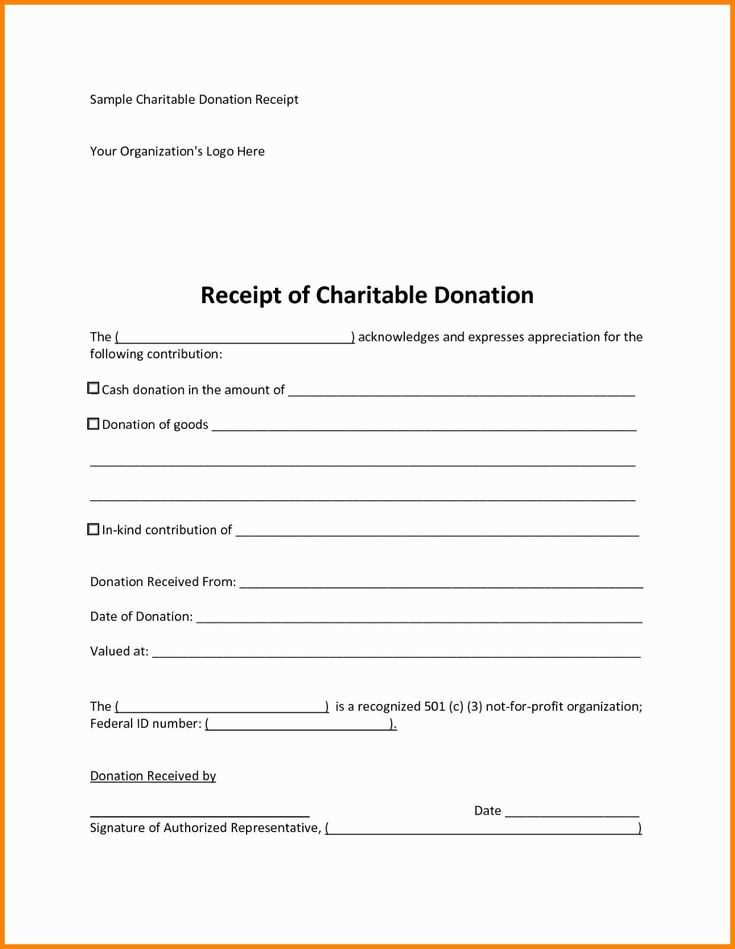

Provide a well-structured receipt that includes all necessary details to help donors with tax deductions and record-keeping. Ensure clarity by following this format:

- Organization Name and Details: Include your nonprofit’s official name, address, and tax ID.

- Donor’s Name and Contact Information: Clearly state the donor’s details for record purposes.

- Description of the Donated Item: Provide a brief but specific description without assigning a monetary value.

- Date of Donation: State the exact date the donation was received.

- Tax Exemption Statement: Include a statement confirming the organization’s tax-exempt status and that no goods or services were provided in exchange.

- Signature and Contact: An authorized representative should sign the receipt, and a contact number should be included for any donor inquiries.

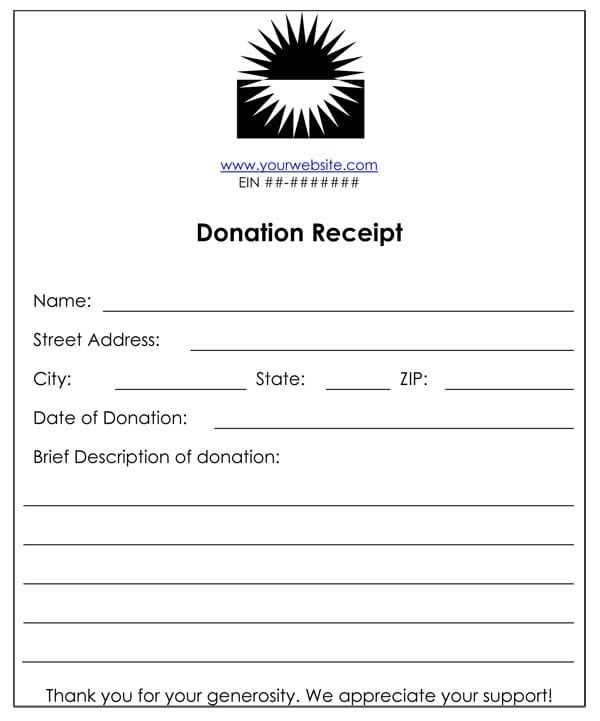

Example Receipt Template

Use this template to create a professional and legally compliant donation receipt:

[Your Organization’s Name] [Address] [City, State, ZIP] [Phone Number] [Tax ID] Date: [MM/DD/YYYY] Donor Information: [Donor’s Name] [Donor’s Address] Donation Description: [Item Description] – Received on [Date] Tax Disclaimer: [Your Organization’s Name] is a registered 501(c)(3) nonprofit organization. No goods or services were provided in exchange for this donation. Please retain this receipt for tax purposes. Authorized Signature: ___________________

Best Practices for Issuing Receipts

- Send receipts promptly after receiving donations.

- Keep digital and physical copies for record-keeping.

- Ensure compliance with IRS guidelines to maintain tax-exempt status.

Providing a well-structured receipt builds donor trust and helps ensure smooth tax reporting. Use the template above to create a professional acknowledgment of silent auction donations.

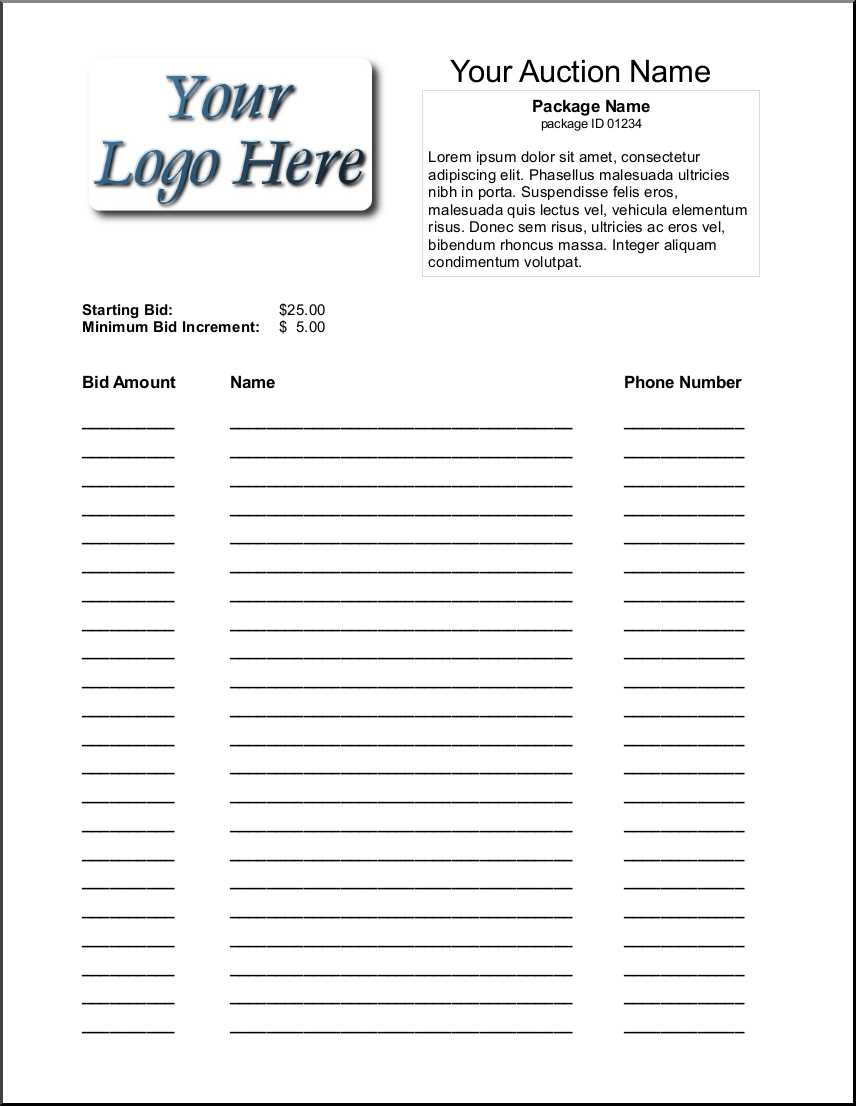

Silent Auction Donation Receipt Template

Key Elements to Include in a Donation Receipt

Legal and Tax Considerations for Receipts

Customizing a Donation Receipt for Your Organization

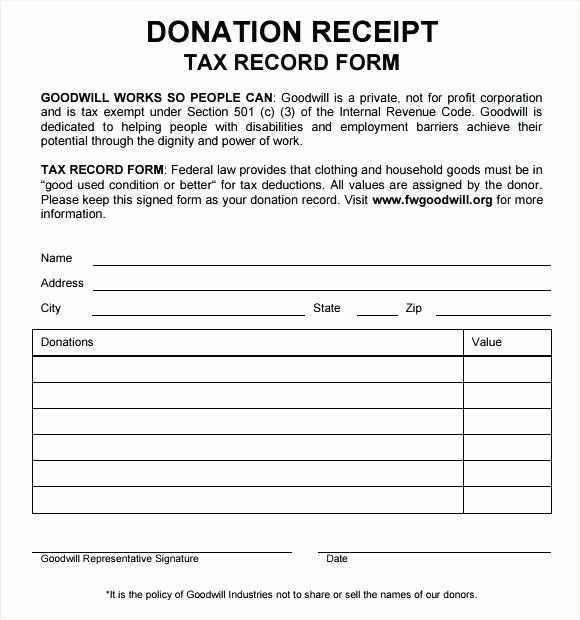

A silent auction donation receipt must clearly state the donor’s name, the organization’s name, and the date of the contribution. Include a detailed description of the donated item without assigning a monetary value, as IRS regulations require the donor to determine the fair market value.

For tax compliance, ensure the receipt contains a statement confirming whether any goods or services were provided in return for the donation. If applicable, specify the estimated value of any benefits received. Nonprofit organizations should also include their tax-exempt status and EIN to verify legitimacy.

Customize receipts by adding your organization’s logo and contact details. Digital receipts can improve efficiency, and a personalized thank-you message can strengthen donor relationships. For high-value donations, consider a separate acknowledgment letter with additional documentation.