Downloadable Paycheck Receipt Template

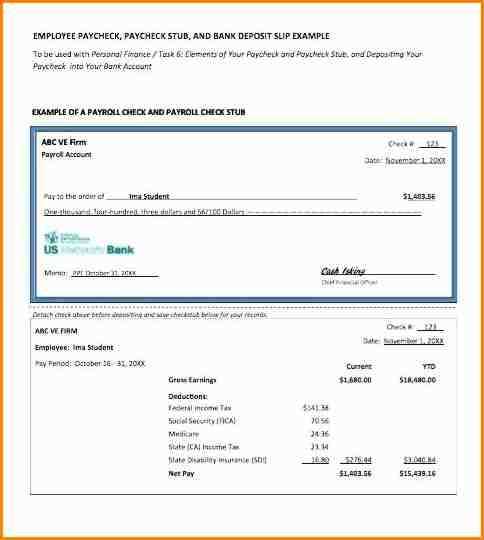

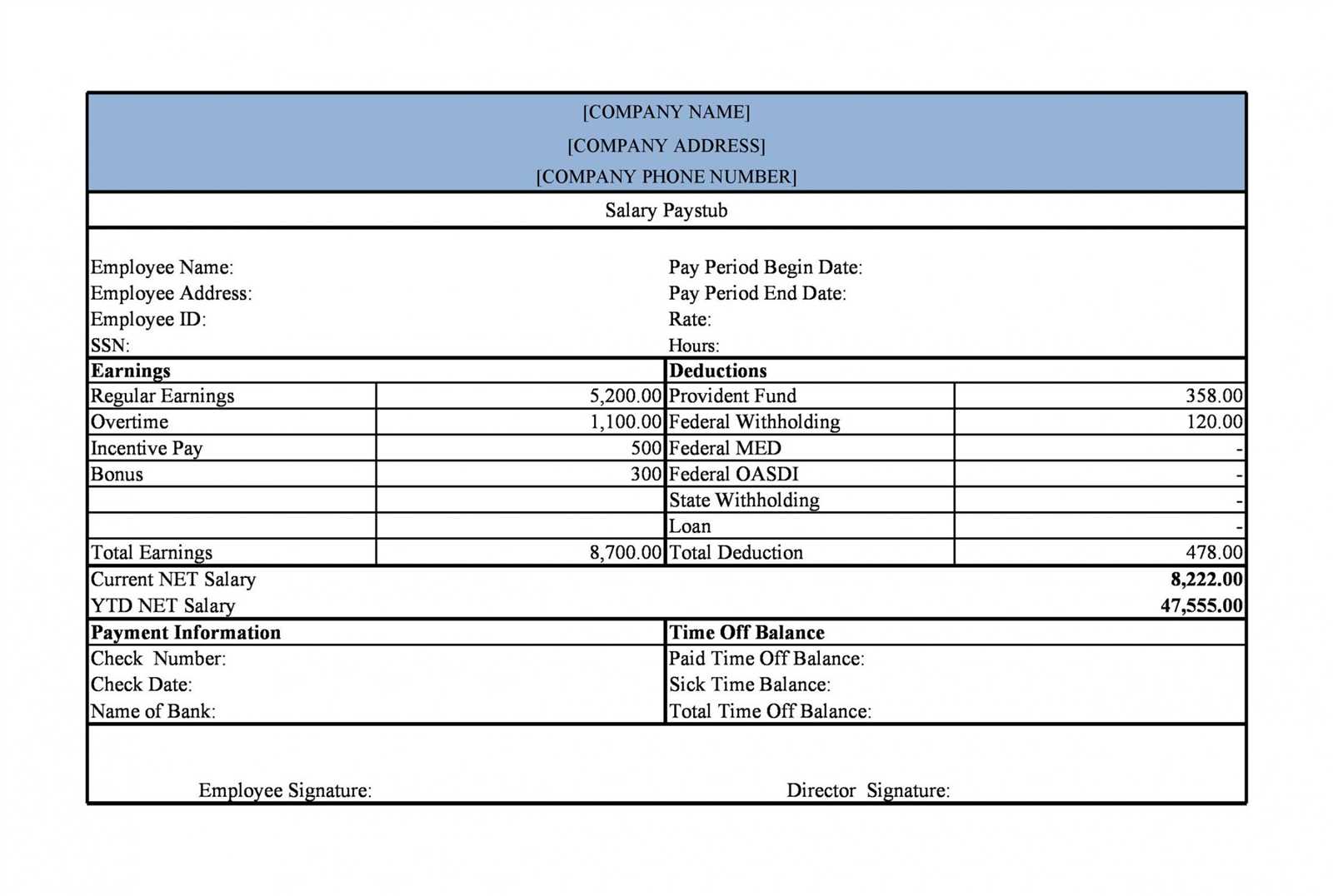

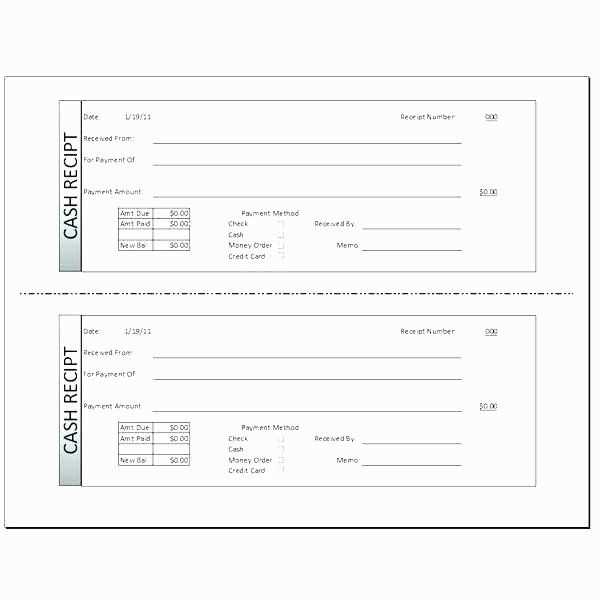

A well-structured paycheck receipt ensures employees and employers have clear financial records. Use this template to generate detailed pay stubs with essential data such as gross pay, deductions, and net pay.

- Employee Details: Full name, address, and employee ID.

- Pay Period: Start and end date of the payment cycle.

- Gross Pay: Total earnings before deductions.

- Taxes & Deductions: Federal, state, and other withholdings.

- Net Pay: Amount received after deductions.

How to Customize Your Paycheck Receipt

Adjust the template to match your business requirements:

- Use a Spreadsheet: Modify fields in Excel or Google Sheets for automated calculations.

- Add Company Branding: Insert your logo and adjust fonts for a professional look.

- Ensure Compliance: Verify local tax laws and include necessary deductions.

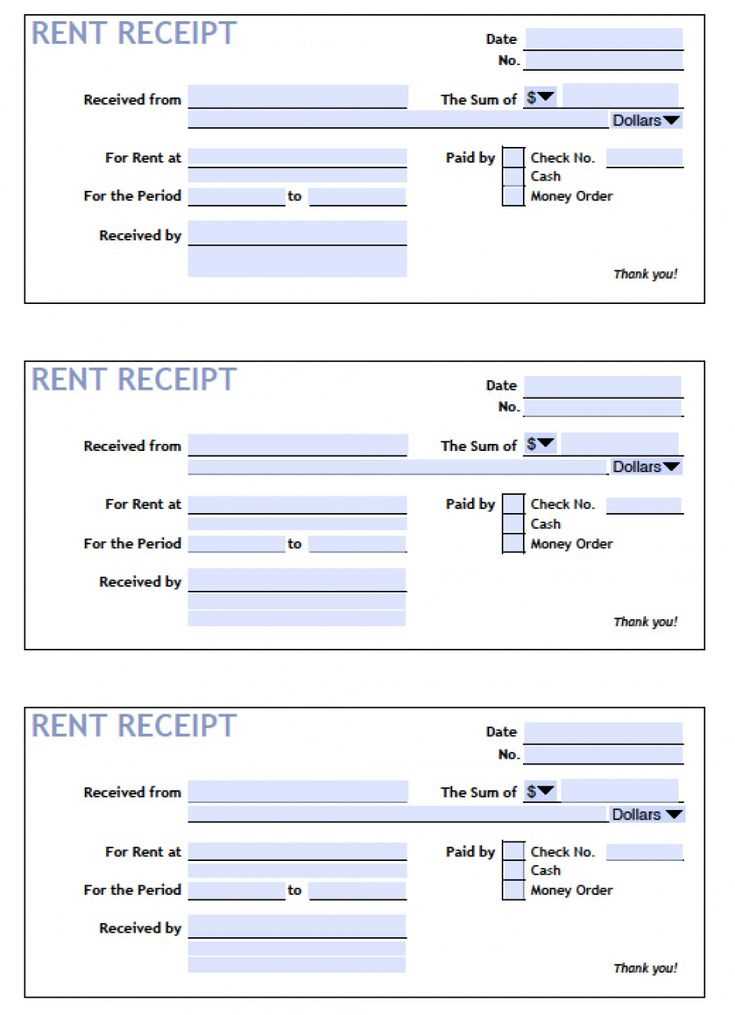

- Provide Digital & Paper Copies: Save as PDF or print for employee records.

Benefits of Using a Paycheck Receipt Template

A structured template reduces errors, saves time, and ensures accurate payroll documentation. Employers can maintain compliance, while employees gain transparency in their earnings.

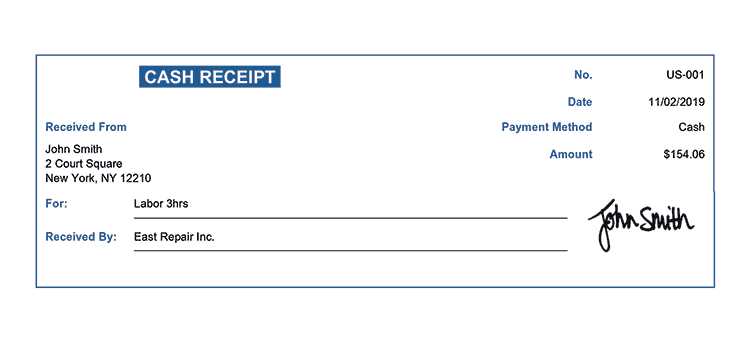

Paycheck Receipt Template

Key Elements to Include in a Payroll Receipt Template

How to Format a Salary Receipt for Clarity and Compliance

Common Mistakes to Avoid When Designing a Wage Receipt

Include the employee’s full name, unique identification number, and pay period to ensure accurate record-keeping. Specify gross earnings, deductions, and net pay to provide transparency.

Use a structured layout with clear section headers. Align figures properly and avoid clutter. Ensure all required tax details, including federal and state withholdings, are legible.

Avoid missing essential components such as payment date, employer details, and year-to-date earnings. Double-check calculations to prevent discrepancies and compliance issues.