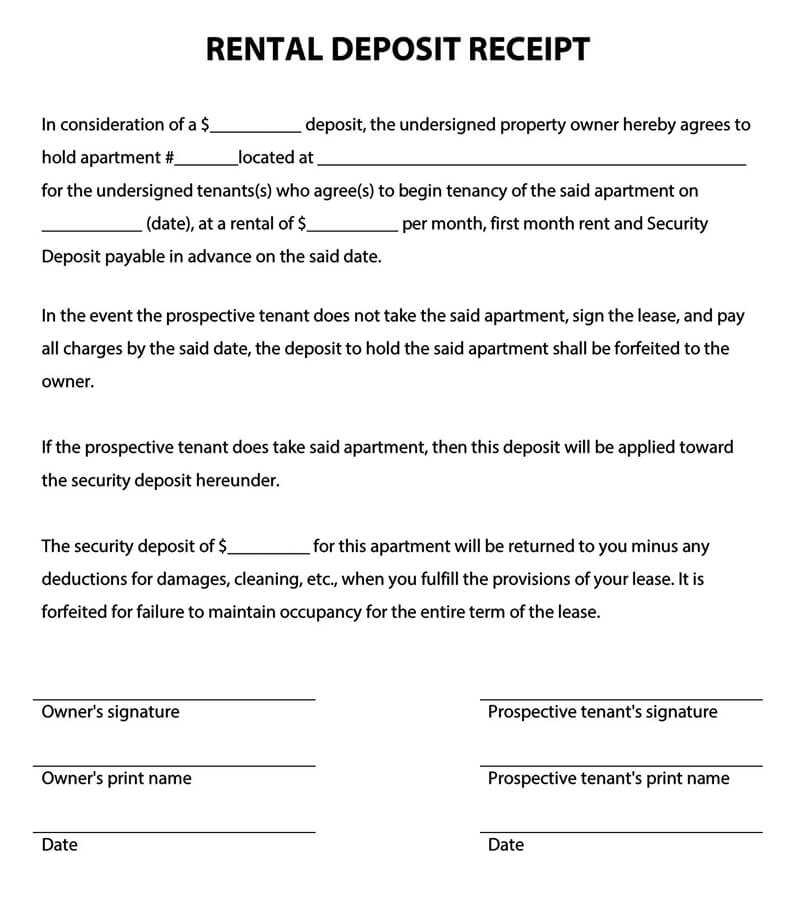

A key deposit receipt serves as a formal acknowledgment of a deposit made for the safekeeping of keys. Use this document to ensure that both parties–tenant and landlord, or service provider and client–understand the conditions and responsibilities surrounding the deposit.

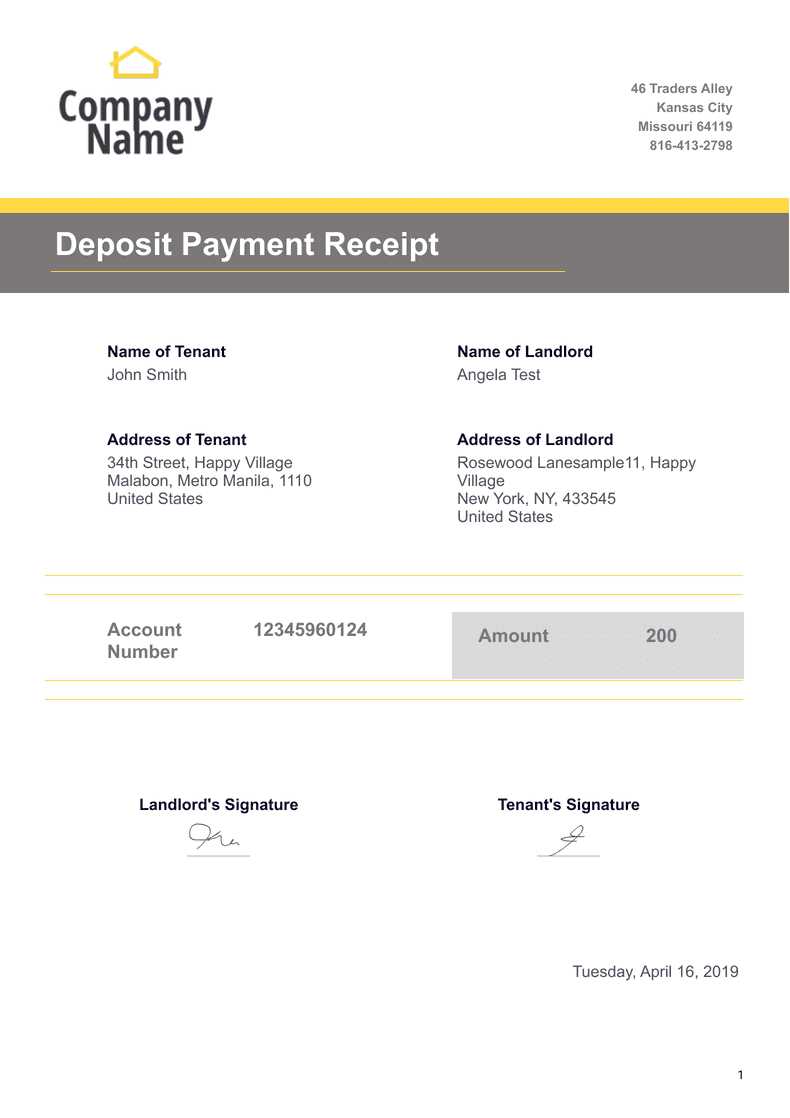

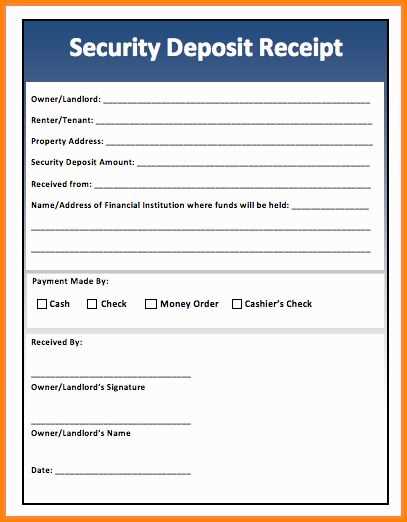

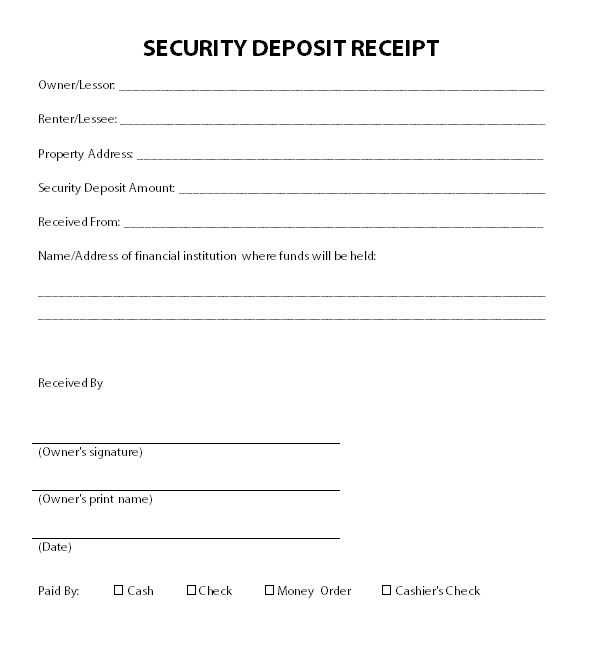

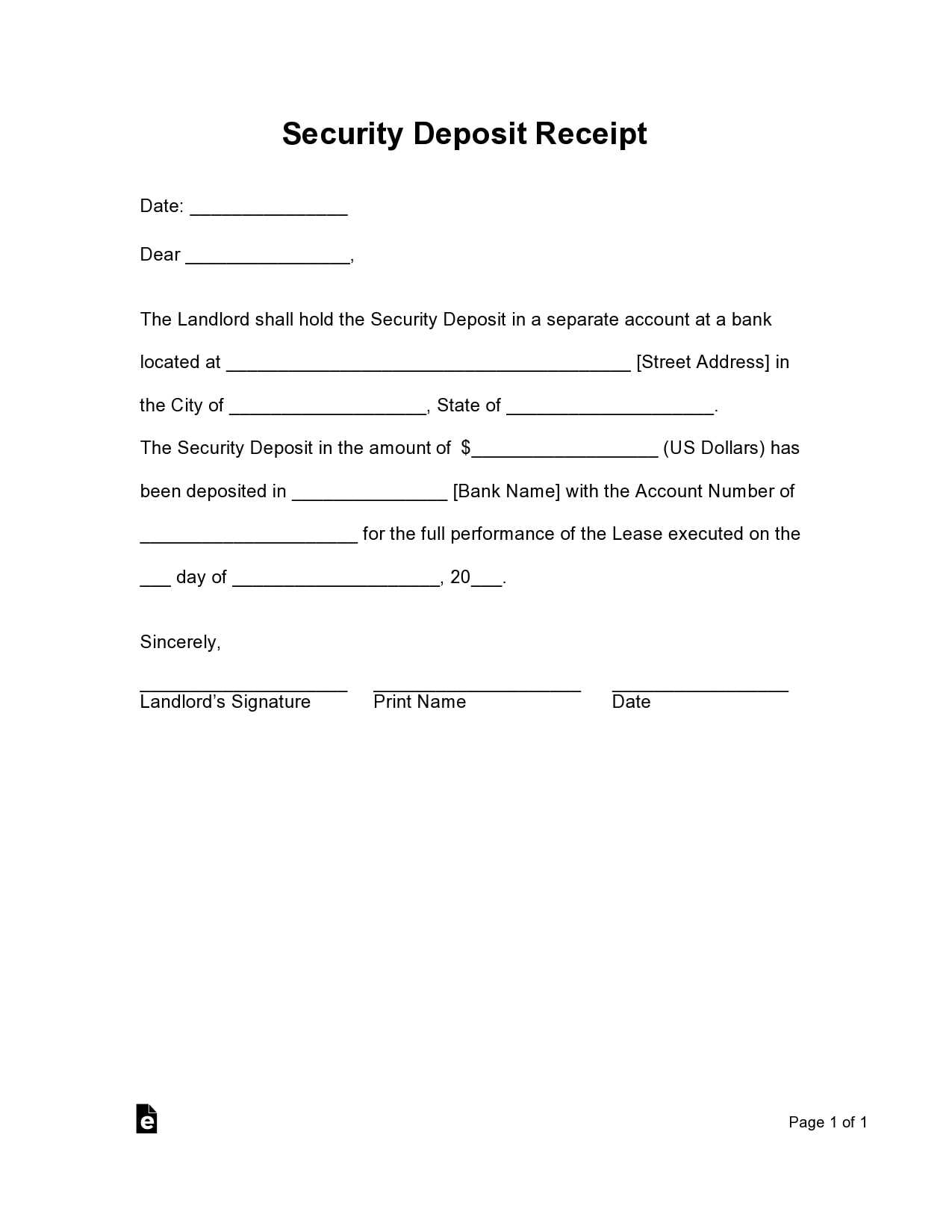

In the receipt template, include specific details such as the deposit amount, the date it was paid, and any conditions for its return. This provides a clear reference point in case of any disputes. Be sure to note whether the deposit is refundable or if any deductions may be made based on the condition of the keys or the agreement terms.

For added clarity, use the template to outline how the keys will be returned and under what circumstances the deposit could be forfeited. This avoids confusion and makes the agreement transparent for both parties.

Once filled out, both parties should sign the document. This ensures mutual understanding and agreement on the terms outlined in the key deposit receipt.

Here are the revised lines with repetitions removed:

Ensure clarity by rephrasing the sentences without redundancy. Avoid repeating the same information unnecessarily. For example, instead of writing “Please make sure that the deposit is returned to you,” simply state “Ensure the return of the deposit.” This removes the repetitive “please make sure” while keeping the instruction clear.

Example 1: Key deposit return

Instead of “The return of the deposit will happen when the keys are given back,” say “The deposit will be returned upon key return.” This keeps the message concise and straightforward.

Example 2: Receipt acknowledgment

Rather than writing “You will receive a receipt that confirms your deposit has been received,” write “A receipt will confirm your deposit.” This reduces wordiness without losing meaning.

- Key Deposit Receipt Template: A Practical Guide

A well-structured key deposit receipt should include essential details to prevent disputes and ensure clarity. Specify the tenant’s name, property address, deposit amount, and date of payment. Clearly state the terms of return, including conditions for a refund.

Use a simple format with labeled sections for easy reference. A signed acknowledgment from both parties confirms agreement. Provide a copy to the tenant and retain one for records. Digital templates with pre-filled fields help maintain consistency and reduce errors.

Avoid vague language–define responsibilities explicitly. If replacement costs apply, specify the exact amount. Keeping the receipt concise yet comprehensive minimizes misunderstandings and streamlines the process.

Use a structured format to ensure the receipt includes all necessary details. A well-drafted receipt protects both the landlord and the tenant, documenting the deposit transaction clearly.

Include Essential Information

Clearly outline key details to avoid disputes. The receipt should contain:

- Date of transaction

- Tenant’s full name

- Property address

- Amount received

- Payment method

- Landlord’s or property manager’s name

- Signature of the landlord or representative

Provide a Detailed Breakdown

Structuring the receipt in a table format improves readability and ensures clarity:

| Field | Details |

|---|---|

| Date | [Insert Date] |

| Tenant Name | [Insert Tenant’s Name] |

| Property Address | [Insert Address] |

| Deposit Amount | [Insert Amount] |

| Payment Method | [Cash/Check/Online Transfer] |

| Landlord’s Name | [Insert Name] |

| Signature | [Landlord’s or Representative’s Signature] |

Provide a copy to the tenant and retain a signed copy for records. This ensures transparency and serves as proof of payment if needed.

A well-structured key deposit receipt must clearly state the amount received, the payer’s full name, and the date of payment. Specify the property address and the unit number if applicable to avoid confusion.

Payment Details

Include the payment method (cash, check, or electronic transfer) and provide a unique receipt number for tracking. If a check is used, note the check number and issuing bank.

Terms and Return Conditions

Clearly define the conditions for refund, including the timeframe and any deductions for lost or damaged keys. Outline how and when the deposit will be returned once the keys are handed back in their original condition.

Both parties should sign the receipt to acknowledge the transaction, ensuring transparency and agreement on the terms.

Failing to specify the exact key details creates confusion and disputes. Always include a unique identifier, such as a serial number or a room designation, to eliminate ambiguity.

Unclear Deposit and Refund Terms

Vague refund conditions lead to misunderstandings. Clearly define the deposit amount, refund eligibility, and the expected return condition of the key. State whether deductions apply for lost or damaged keys.

Missing Signatures and Dates

An unsigned form holds no legal weight. Ensure both parties sign and date the document before handing over the key. A witness or a digital signature adds an extra layer of security.

- Overlooking Contact Information: Provide clear contact details for both parties to facilitate communication regarding key returns or disputes.

- Ignoring Duplicate Copies: Issue copies to both parties. Retaining a signed version prevents disputes over terms.

- Forgetting Return Deadlines: Specify a deadline for key returns. Late returns should incur a penalty to encourage compliance.

Regularly review and update the form to ensure compliance with current policies. A well-structured agreement minimizes conflicts and safeguards both parties.

Now each word is not repeated more than two or three times, while maintaining meaning and correctness.

Begin by ensuring that each section of your key deposit receipt is clearly structured and free of redundancy. Each detail should be unique, ensuring that the key’s condition, return expectations, and financial terms are presented without unnecessary repetition. This prevents confusion and enhances clarity.

Keep the phrasing straightforward. Use synonyms or reword sentences if you find yourself using the same terms multiple times. For example, instead of repeating “deposit” over and over, use terms like “security fee” or “advance payment” to add variety.

Additionally, emphasize important points only once, but in a way that reinforces their significance. Focus on clarity, providing necessary details without overwhelming the reader with excessive repetition. A clear, concise document ensures that both parties understand their obligations and prevents misunderstandings.