Creating a donation receipt template for your church at year-end is a great way to ensure that donors receive accurate, organized documentation for tax purposes. This can simplify both the church’s accounting process and the donor’s tax filing. A well-structured receipt helps maintain transparency and builds trust with your congregation.

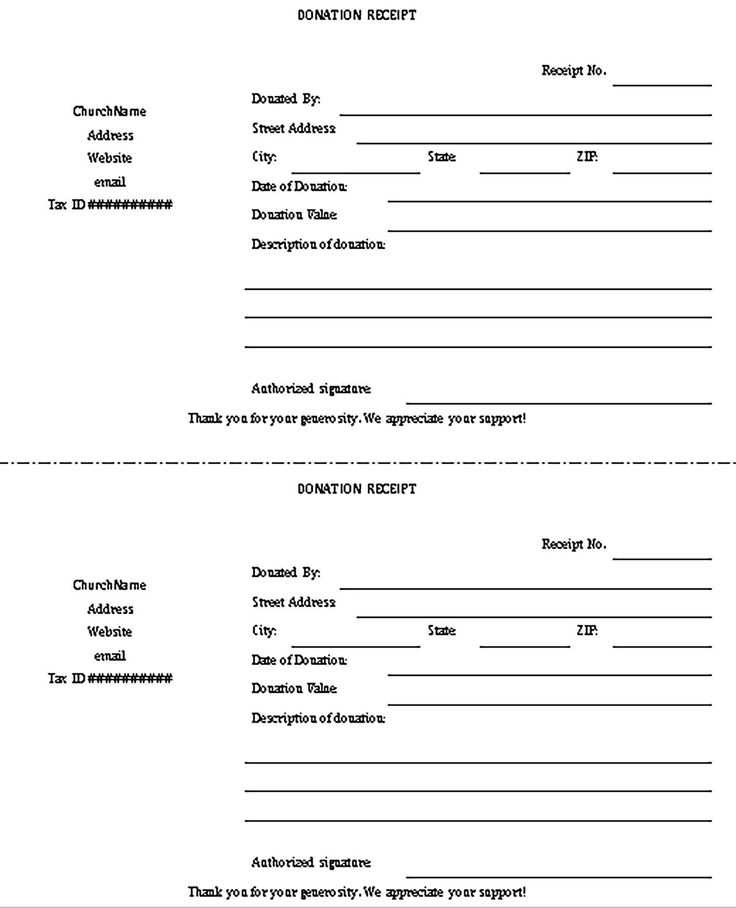

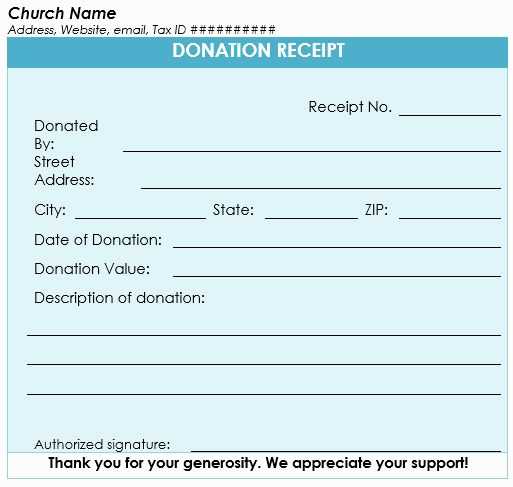

Start with clear donor details. Include the donor’s full name, address, and donation amount. It’s helpful to specify the type of contribution, whether it’s cash, checks, or non-monetary items. This way, donors know exactly what their receipt reflects.

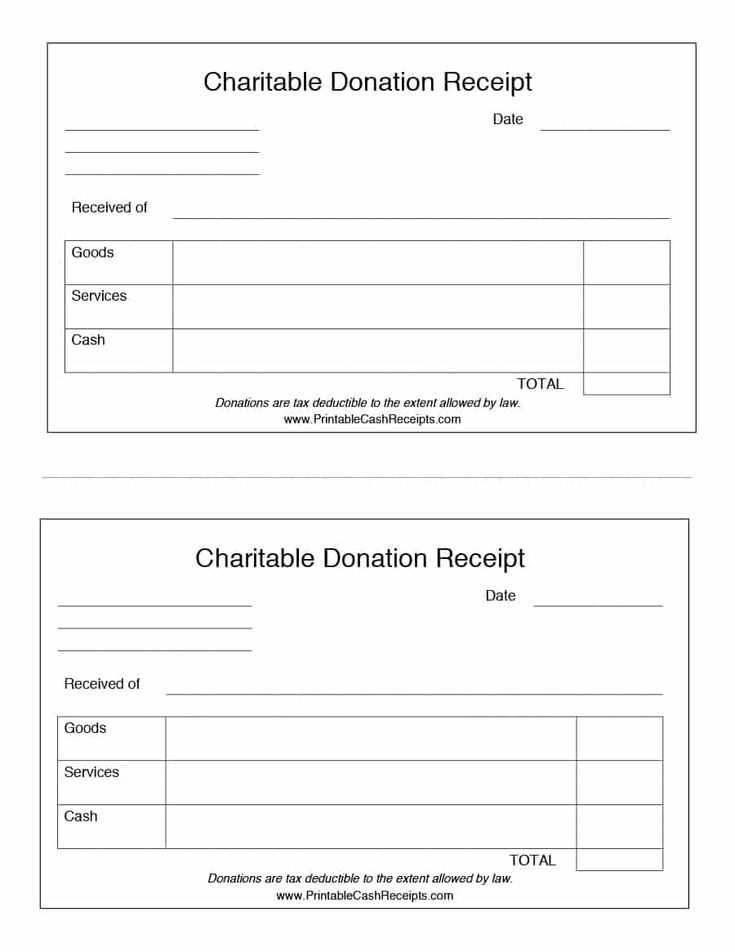

Include a statement about the goods or services provided. If a donor received anything in return for their contribution, this should be stated on the receipt. For example, tickets to an event or a special gift must be clearly listed to ensure tax deductions are applied properly.

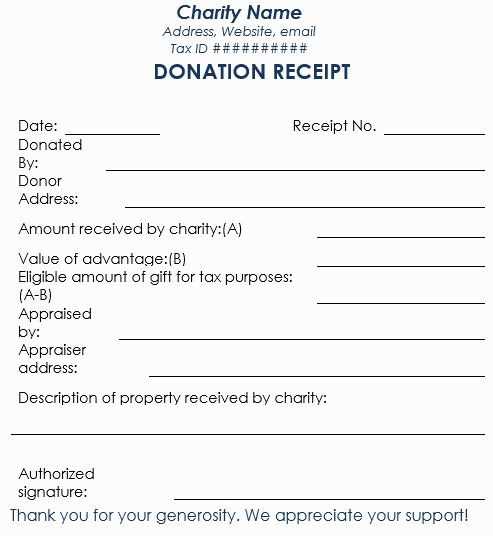

Finally, be sure to add your church’s name, address, and tax identification number. This makes the receipt an official document for tax filing and assures the donor that the church complies with all necessary regulations.

Year End Church Donation Receipt Template

For a streamlined year-end donation process, create a clear and accurate receipt. Ensure the template includes the church’s name, address, and tax ID number. Clearly state the donor’s name, donation date, and the amount given. If donations include items, describe them briefly with estimated values, but avoid overstating any values. Indicate whether the donation was cash or non-cash, and specify if any goods or services were provided in exchange for the gift. Make sure the receipt includes a statement that no goods or services were provided, if that is the case.

To keep everything organized, use a standard template format that simplifies entry for both the donor and the church staff. Ensure that the receipt is easy to read, with clear sections for donor information, donation details, and legal disclaimers. Use this as a tool for accurate record-keeping for both tax purposes and internal reporting. Update this template yearly to account for any changes in tax laws or church policies.

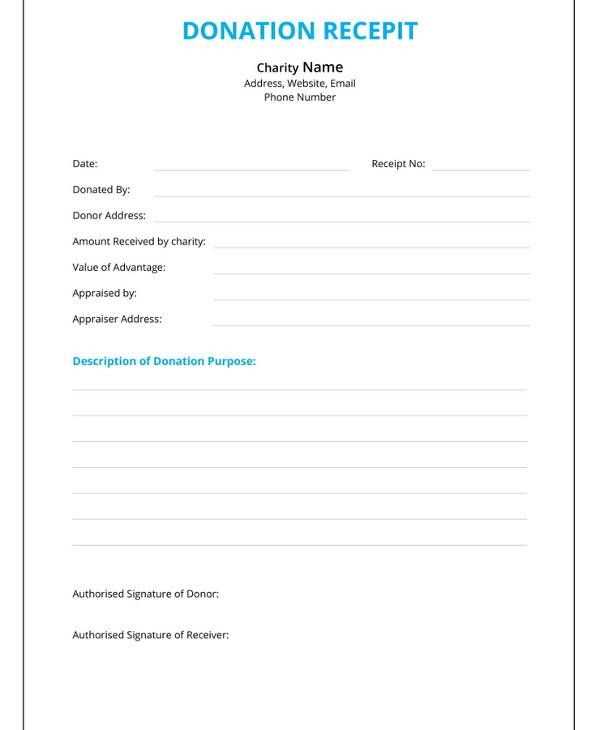

Customizing the Template for Different Donation Types

Adapt your receipt template based on the donation type to ensure accurate and clear documentation. For each type of donation, update the details to reflect the specific nature of the contribution.

- Monetary Donations: Include the total amount donated, the date, and the donor’s full name. Optionally, add a note if the donation is recurring or one-time.

- Non-Cash Donations: Specify the item description, estimated value, and condition. Make sure to note that the church does not appraise the value of the goods.

- Volunteer Hours: Mention the number of hours worked, the rate of compensation (if applicable), and the total value of the contribution. This helps in offering accurate tax-related information.

- Event Ticket Purchases: If tickets are purchased as a form of donation, list the event, date, and ticket amount. Clarify if it is a direct donation or a payment for a service.

Each of these categories requires tailored information, making the donation receipt more specific and meaningful to both the donor and the church. Adjust the language in your template accordingly to prevent confusion and to make the receipt more user-friendly.

Legal Requirements for Donation Receipts

Donation receipts must contain specific information to comply with tax regulations. The receipt should include the name of the organization, its tax-exempt status, and the donor’s name. A description of the donated item or cash amount is necessary, along with the date of the donation. For non-cash donations, a statement of whether any goods or services were provided in exchange for the donation must be included.

Key Information on Donation Receipts

The IRS requires that the receipt clearly state whether the donor received any benefits in exchange for their gift. This helps donors understand what portion of their donation is tax-deductible. For cash donations, a simple monetary value is sufficient. For non-cash donations, a description of the item or property is necessary, and it is helpful if the organization can provide an estimated value for the item.

Recordkeeping Requirements

Both the donor and the organization should keep records of donations for at least three years. The donor needs the receipt to support their tax return, while the organization must keep records to prove compliance during potential audits. Organizations should ensure that receipts are issued promptly to maintain good recordkeeping practices.

Tips for Organizing and Distributing Receipts

Use a reliable tracking system to manage donation records. Consider spreadsheet software to input donor details and amounts, ensuring data accuracy and easy access. Label each donation by date, amount, and donor name for quick reference when preparing receipts.

Group Donations by Type

Segment donations by categories such as one-time gifts and recurring contributions. This classification will help you customize the receipts and reduce the chance of errors when generating reports or sending out receipts.

Automate Distribution

Leverage tools that automate the generation and distribution of receipts. Many software programs can quickly generate personalized receipts, saving time and reducing manual work. Set up an automated email system to send receipts to donors as soon as donations are recorded.

Ensure each receipt contains all required information, such as donor name, date, donation amount, and church tax identification number, to comply with regulations. Double-check the information before sending out to avoid any discrepancies.

For physical receipts, organize them in alphabetical order or by donation amount to streamline the distribution process. Store completed receipts in a secure and easily accessible location, keeping backups for future reference.