Clear and Accurate Payment Records

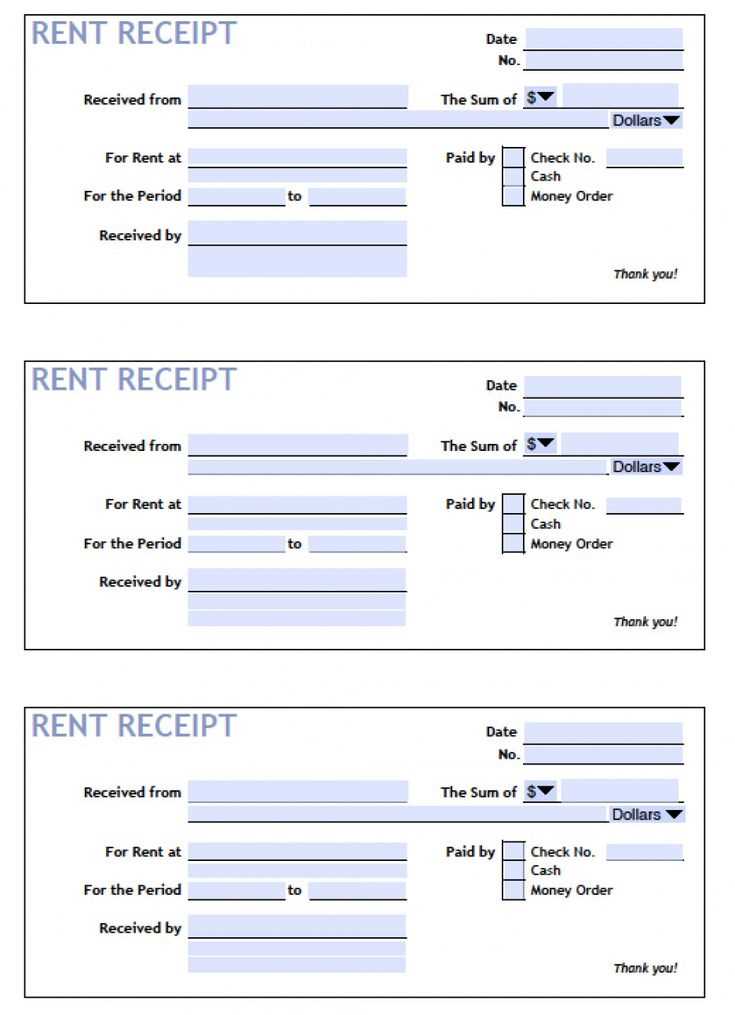

A well-structured payment receipt helps contractors and clients track transactions, prevent disputes, and maintain financial transparency. Use a template that includes all necessary details to ensure clarity.

Key Information to Include

- Receipt Number: Assign a unique identifier for tracking.

- Date of Payment: Specify when the payment was received.

- Contractor Details: Include business name, address, and contact information.

- Client Information: List the name and address of the payer.

- Project Description: Briefly describe the work completed.

- Payment Amount: Clearly state the total paid, including taxes if applicable.

- Payment Method: Indicate cash, check, credit card, or bank transfer.

- Authorized Signature: Have the contractor sign to confirm receipt.

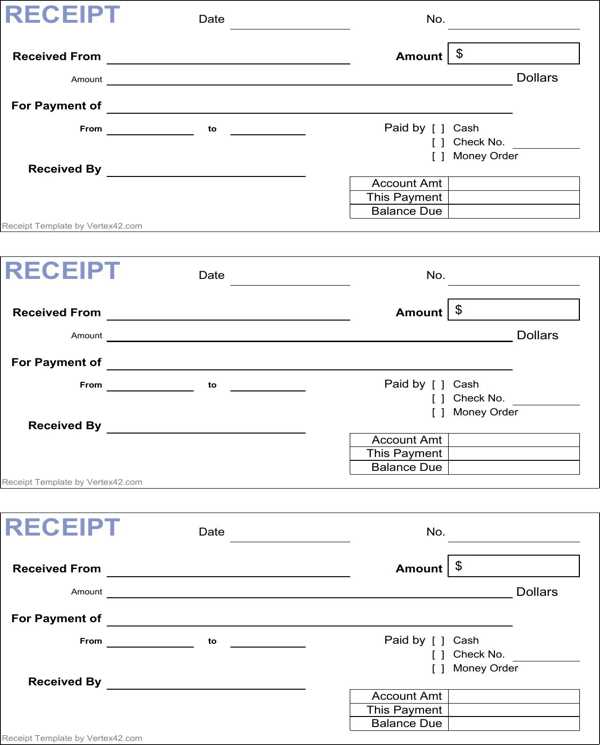

Simple Template Format

For convenience, use this basic format to generate professional receipts:

General Contractor Payment Receipt Receipt No: [Unique Number] Date: [MM/DD/YYYY] Received From: [Client Name] Address: [Client Address] Received By: [Contractor Name] Business Name: [Company Name] Address: [Business Address] Contact: [Phone/Email] Project Description: [Brief Description] Amount Received: $[Total Amount] Payment Method: [Cash/Check/Bank Transfer] Signature: _______________ Date: _______________

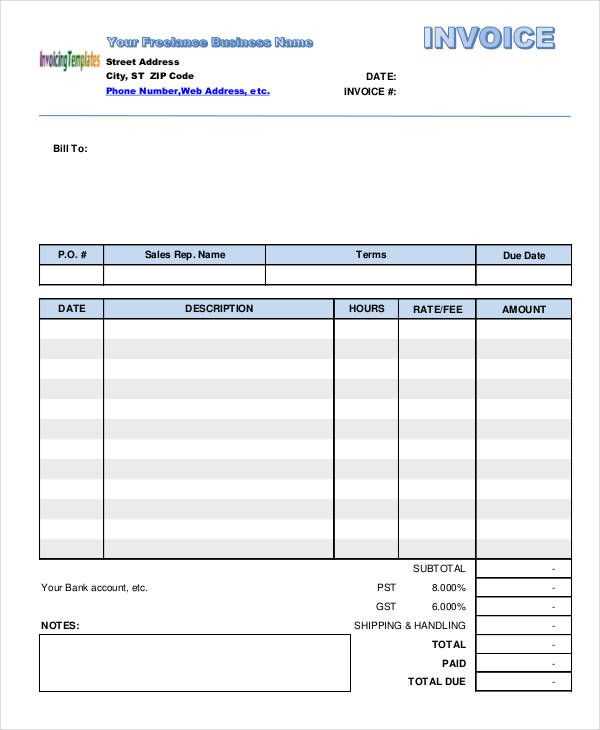

Why Use a Template?

Using a standardized template ensures consistency, reduces errors, and simplifies record-keeping. Digital versions can be customized with logos and branding for a professional appearance.

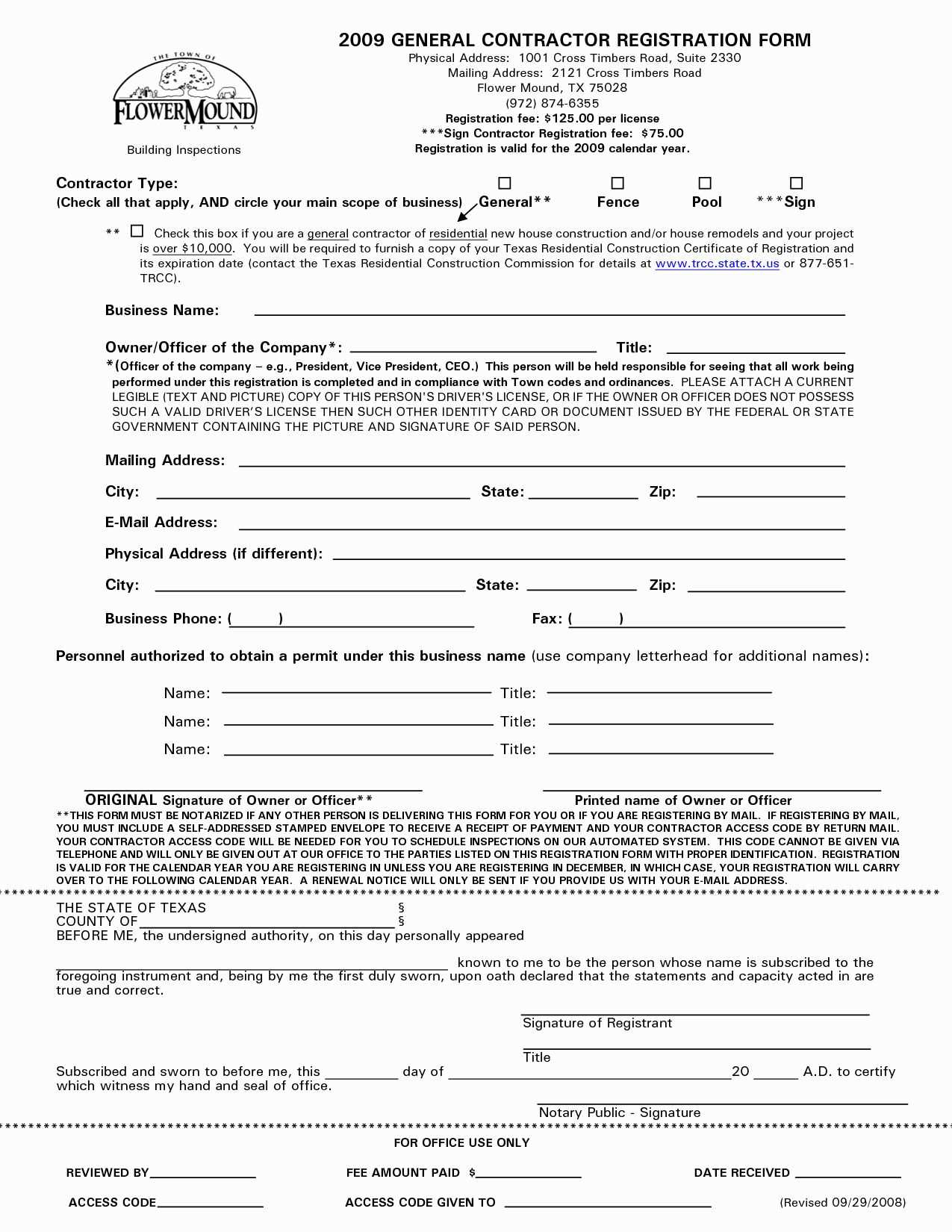

General Contractor Payment Receipt Template

Key Elements to Include in a Contractor Receipt

How to Format a Receipt for Legal and Tax Purposes

Customizing a Template for Different Project Types

Include contractor and client details: Full names, addresses, and contact information ensure transparency and legal clarity.

Specify payment details: Clearly list the amount, payment method, and date. For checks or electronic transfers, include reference numbers.

Describe the work performed: Itemize services or materials provided. Use clear terms to avoid disputes.

Ensure tax compliance: If applicable, include tax breakdowns, business tax ID, and any deductions.

Use a structured format: Organize sections logically, keeping totals, signatures, and terms easy to find.

Customize for project types: Large-scale projects may require milestone payments, while small jobs may use a single final receipt.