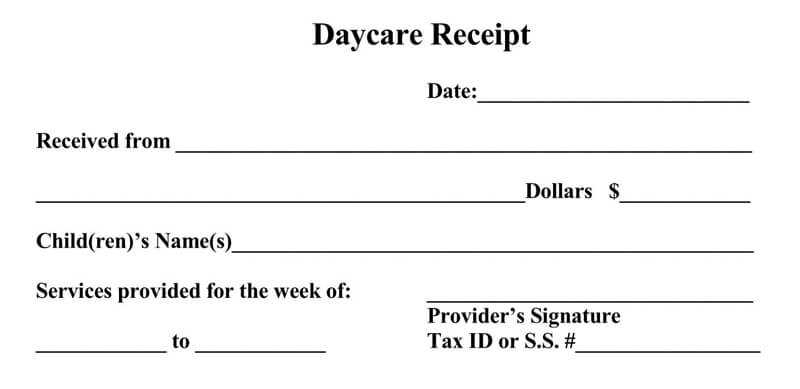

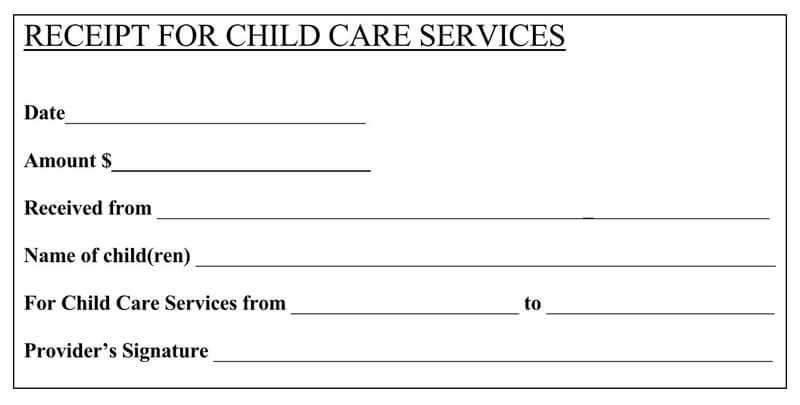

Provide parents with clear and professional receipts for payments related to childcare, tutoring, or extracurricular activities. A structured receipt ensures transparency, simplifies record-keeping, and helps parents track expenses for tax or reimbursement purposes.

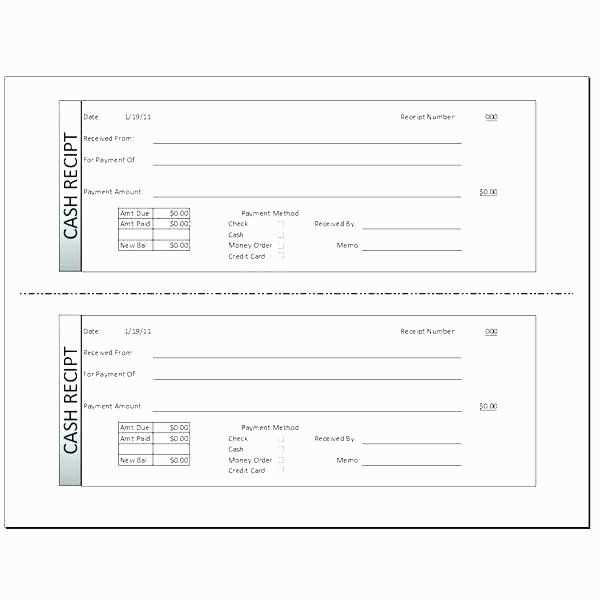

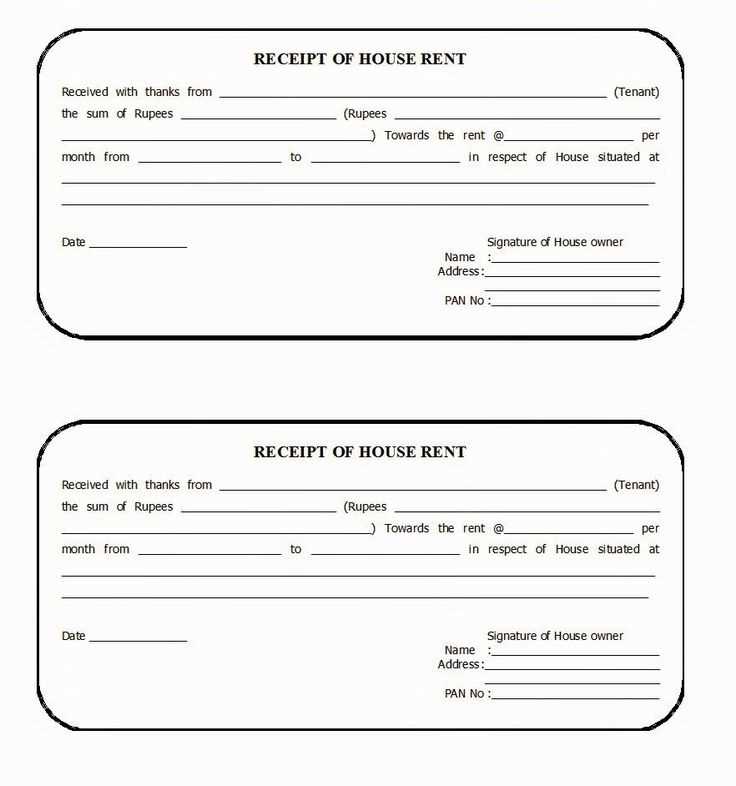

Include essential details such as the date of payment, parent’s name, child’s name, and amount paid. Specify the payment method (cash, check, bank transfer) and describe the service provided. A well-organized layout prevents misunderstandings and reduces follow-up inquiries.

A receipt should always feature a business or provider name, contact information, and a unique receipt number for easy reference. If applicable, add tax identification details or a signature to make the document more official.

Using a consistent receipt template saves time and ensures all payments are documented correctly. Whether issuing receipts by hand or digitally, clarity and completeness are key to maintaining trust and professionalism.

Receipt Template to Give to Parents

Provide a clear, itemized receipt that includes essential details: date, parent’s name, child’s name, payment amount, service period, and a brief description of services. Ensure the format is easy to read and consistent every time.

Key Elements to Include

- Header: Business or caregiver name, contact details.

- Date & Receipt Number: Helps with tracking payments.

- Parent & Child Information: Full names for record accuracy.

- Payment Breakdown: Amount paid, service details, and duration.

- Payment Method: Cash, check, bank transfer, or other.

- Signature Line: Space for confirmation, if required.

Formatting Tips for Clarity

Use a simple table layout for easy reading. Keep fonts professional and avoid excessive design elements. If sending digitally, provide both PDF and editable formats for convenience.

Key Information to Include in a Parent Receipt

Include the date of payment to confirm when the transaction occurred. Use a clear format, such as MM/DD/YYYY, to avoid confusion.

List the parent’s full name and contact details, along with the child’s name. This ensures proper record-keeping and prevents mix-ups.

Specify the amount paid and the payment method (cash, check, or electronic transfer). If applicable, mention any remaining balance.

Describe the services covered by the payment, such as tuition, meals, or extracurricular activities. Be precise to eliminate misunderstandings.

Provide the name and contact details of the institution or caregiver issuing the receipt. This adds credibility and makes it easier to address any concerns.

Include a unique receipt number for tracking purposes. This helps both parties reference the payment if needed.

Add a note confirming that the payment was received and processed. If offering refunds or credits, mention the relevant policy.

If the receipt is for tax or reimbursement purposes, state whether the payment is tax-deductible and provide any necessary tax identification details.

Design and Layout Considerations for Readability

Use a clean, legible font such as Arial, Helvetica, or Times New Roman in at least 12-point size. Avoid decorative typefaces that reduce clarity, especially for older parents who may have difficulty reading small or stylized text.

Spacing and Alignment

- Set margins of at least 0.5 inches to prevent overcrowding.

- Use left-aligned text for easier tracking from line to line.

- Ensure line spacing is at least 1.15 to improve readability.

Structuring Information

- Use bold headers to separate key sections such as “Date,” “Amount Paid,” and “Balance Due.”

- Apply bullet points or tables for lists instead of dense paragraphs.

- Highlight total amounts using a larger font or bold text to make them stand out.

Ensure all critical details remain visible when printed in black and white. High contrast between text and background prevents readability issues, so black text on a white background is the safest option.

Best Practices for Record-Keeping and Compliance

Use a standardized receipt format that includes the date, parent’s name, payment amount, service details, and your contact information. This ensures consistency and simplifies audits.

Store digital and physical copies of receipts for at least five years. Cloud storage with automatic backups prevents data loss, while a locked filing cabinet protects printed copies.

Label receipts clearly with unique identifiers, such as invoice numbers or child names, to make retrieval quick and avoid duplication.

Regularly reconcile receipts with bank statements to detect discrepancies early. Automate this process with accounting software to reduce errors.

Follow tax regulations by categorizing receipts properly. Consult a financial professional to confirm deductible expenses and required documentation.

Ensure data privacy by limiting access to financial records. Use password protection and encryption for digital files to prevent unauthorized viewing.

Review record-keeping policies annually and update practices based on legal requirements. Staying proactive helps maintain compliance and avoids penalties.