Download a Ready-to-Use Refund Receipt

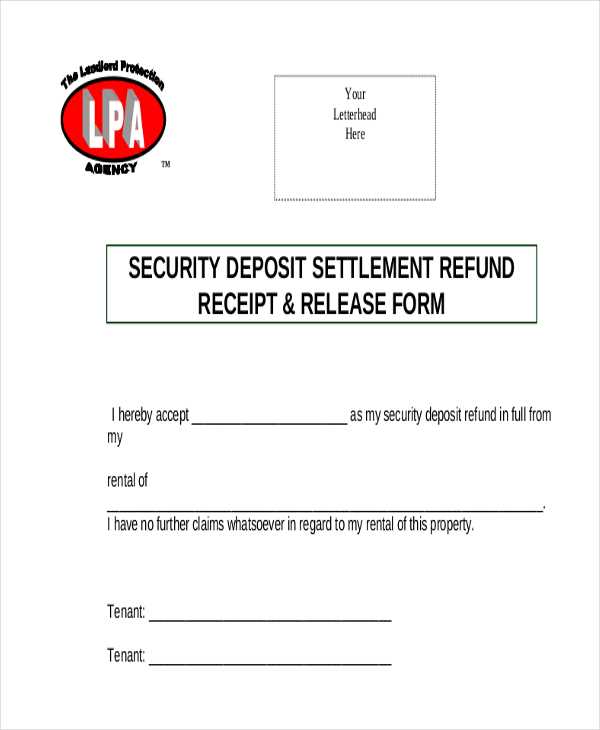

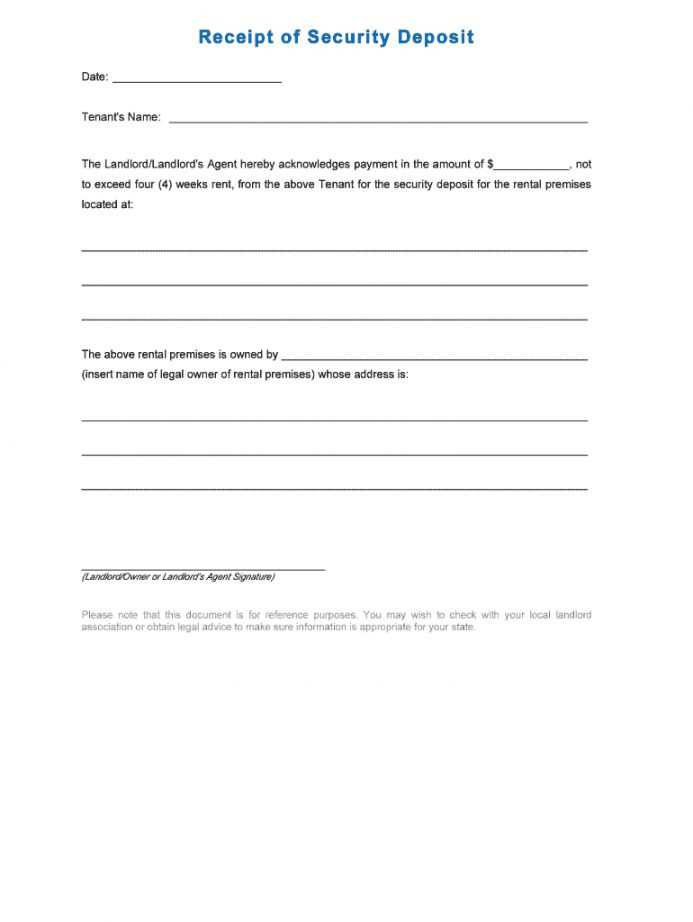

A well-structured security deposit refund receipt ensures clarity for both landlords and tenants. This document serves as proof of the refunded amount, reducing disputes and providing legal protection. Use the template below to streamline the process.

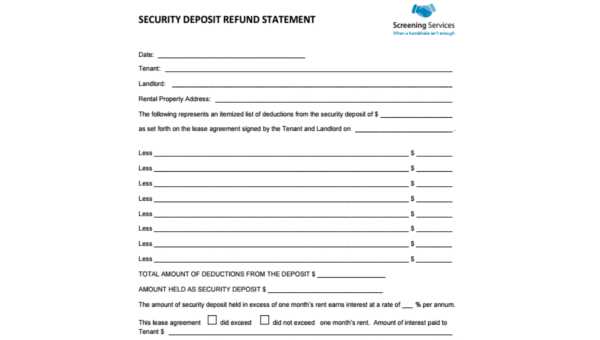

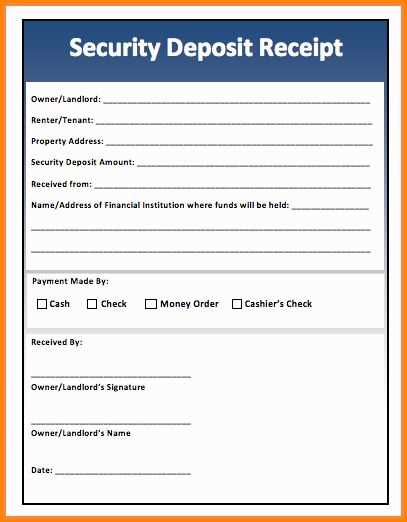

Key Elements to Include

- Tenant and Landlord Information: Full names and contact details.

- Property Address: The rented unit’s complete address.

- Refund Details: Amount returned, deductions (if any), and explanation.

- Payment Method: Check number, bank transfer details, or cash confirmation.

- Signatures: Both parties should sign for mutual acknowledgment.

Editable Template

Copy and customize this format as needed:

[Landlord’s Name] [Landlord’s Address] [Landlord’s Contact] Date: [MM/DD/YYYY] Received from: [Tenant’s Name] Property Address: [Full Address] Refunded Amount: $[Amount] Deductions (if applicable): $[Amount] Reason for Deductions: [Brief Explanation] Payment Method: [Cash/Check/Wire Transfer] Check/Wire Reference: [Transaction Details] Landlord’s Signature: ___________ Tenant’s Signature: ___________

Best Practices for Handling Deposit Refunds

Follow these steps to ensure a smooth refund process:

- Inspect the property and document any damages with photos.

- Calculate deductions fairly, referencing the lease agreement.

- Communicate refund details with the tenant before issuing payment.

- Provide a copy of the signed receipt for both parties.

Using a structured receipt simplifies record-keeping and helps avoid misunderstandings. Ensure all details are accurate before finalizing the document.

Free Security Deposit Refund Template

Key Elements to Include in a Reimbursement Receipt

A valid reimbursement receipt must contain specific details to avoid disputes. Include the tenant’s full name, rental address, refund amount, payment date, and method used for repayment. Specify any deductions with a brief explanation. Both parties should sign the document for verification.

How to Format a Legally Valid Document

Use a clear, structured layout with labeled sections. The document should be typed, not handwritten, to ensure legibility. A standard format includes a title, recipient details, breakdown of refunded and deducted amounts, and a closing statement confirming the transaction. Ensure compliance with local regulations to prevent legal issues.

Common Mistakes to Avoid When Providing a Repayment Proof

Omitting key details like the reason for deductions or the exact date of refund can lead to disputes. Avoid vague language–specify exact amounts and justifications. Never use informal wording; keep the document professional. Skipping signatures may result in unenforceability. Double-check all figures to prevent errors.