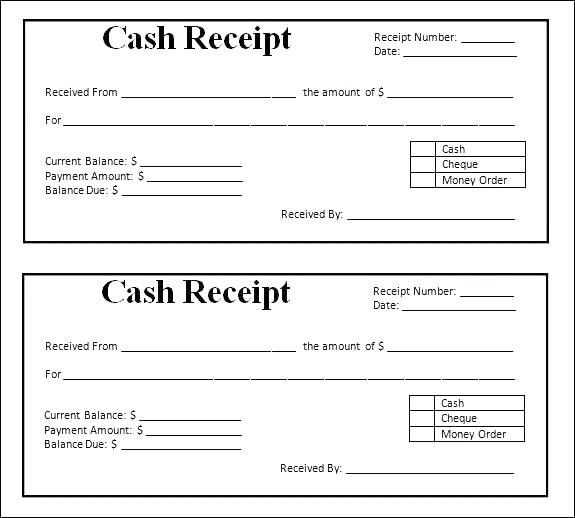

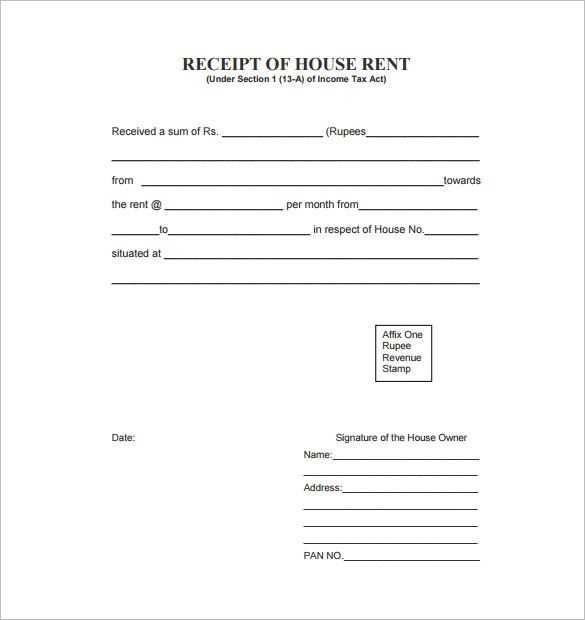

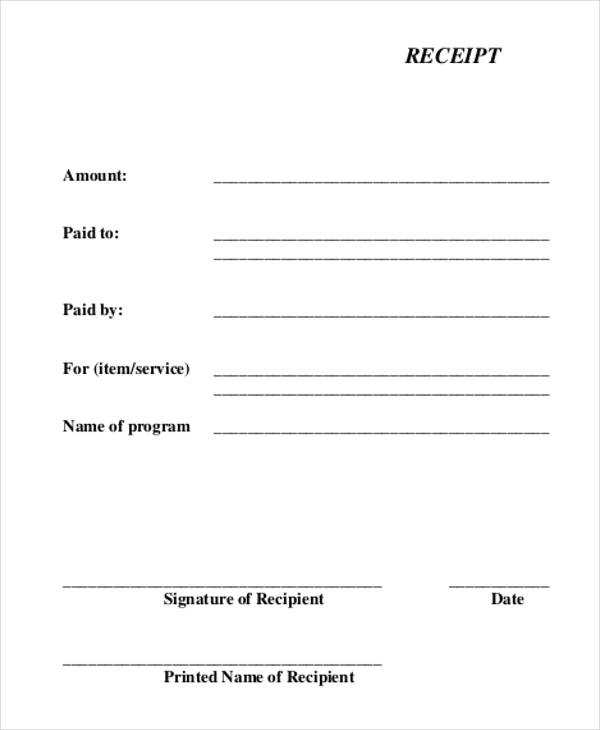

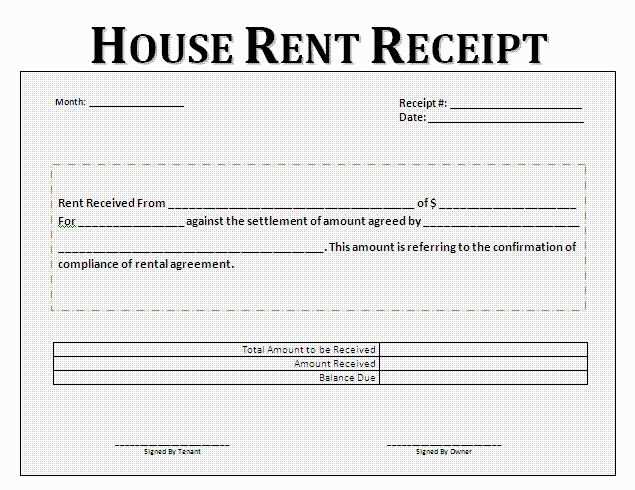

A well-structured settlement receipt ensures transparency in financial transactions and serves as proof of payment for both parties. Include the date of settlement, names of involved parties, and total amount paid. Specify the payment method, whether cash, bank transfer, or another form, to avoid disputes.

Clearly outline the reason for payment. If it covers multiple items or services, break them down with corresponding amounts. Adding a section for signatures strengthens the document’s validity, especially for large transactions.

Use a standardized format to maintain consistency across records. A clean layout with labeled fields enhances readability and minimizes errors. Digital templates simplify the process by allowing easy modifications and electronic signatures.

Retain copies for reference. Businesses should store receipts securely for tax purposes, while individuals may need them for legal protection. A well-prepared receipt eliminates uncertainty and safeguards financial agreements.

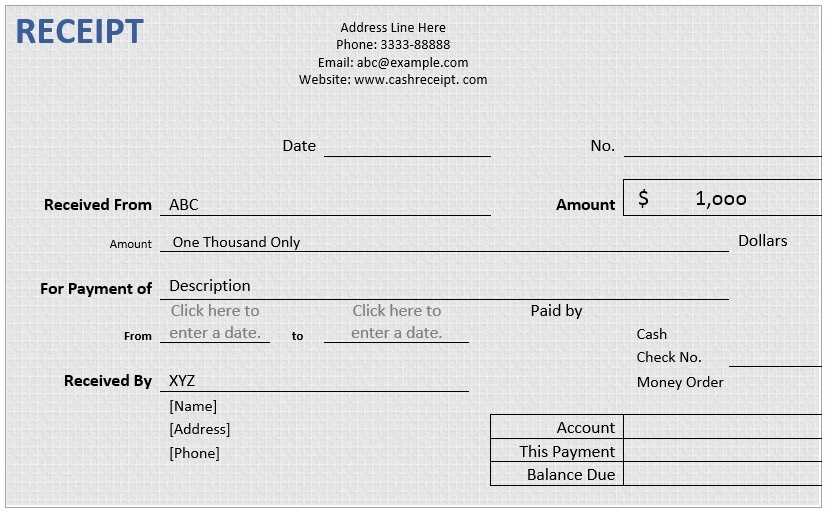

Settlement Receipt Template

Ensure every transaction is properly documented by structuring your receipt with clear, essential details. Start with the recipient’s name, payment date, and the total amount received. Specify the payment method, whether cash, check, or electronic transfer, to avoid disputes.

Break down the transaction with itemized sections, listing products, services, or settlement terms. If deductions or additional charges apply, display them separately to maintain transparency. Include a unique receipt number for tracking and future reference.

At the bottom, provide a section for signatures or electronic confirmations. This adds credibility and legal validity. Store copies securely for record-keeping and compliance purposes. A well-structured receipt ensures clarity, protects both parties, and simplifies financial management.

Structuring Key Information Fields in a Receipt

Include the date at the top to ensure clear record-keeping. Use a standard format like YYYY-MM-DD to avoid ambiguity.

List the payer and payee details next. Full names, addresses, and contact information help prevent misunderstandings and streamline future reference.

Assign a unique receipt number. This aids tracking and simplifies retrieval in accounting systems.

Clearly state the amount received. Break it down into subtotal, taxes, and total if applicable. Specify the currency to eliminate confusion in international transactions.

Provide a brief description of the transaction. Mention item names, services rendered, or other relevant details for clarity.

Specify the payment method. Indicate whether cash, credit card, bank transfer, or another option was used.

Add a signature or company stamp if necessary. This verifies authenticity and reinforces trust between parties.

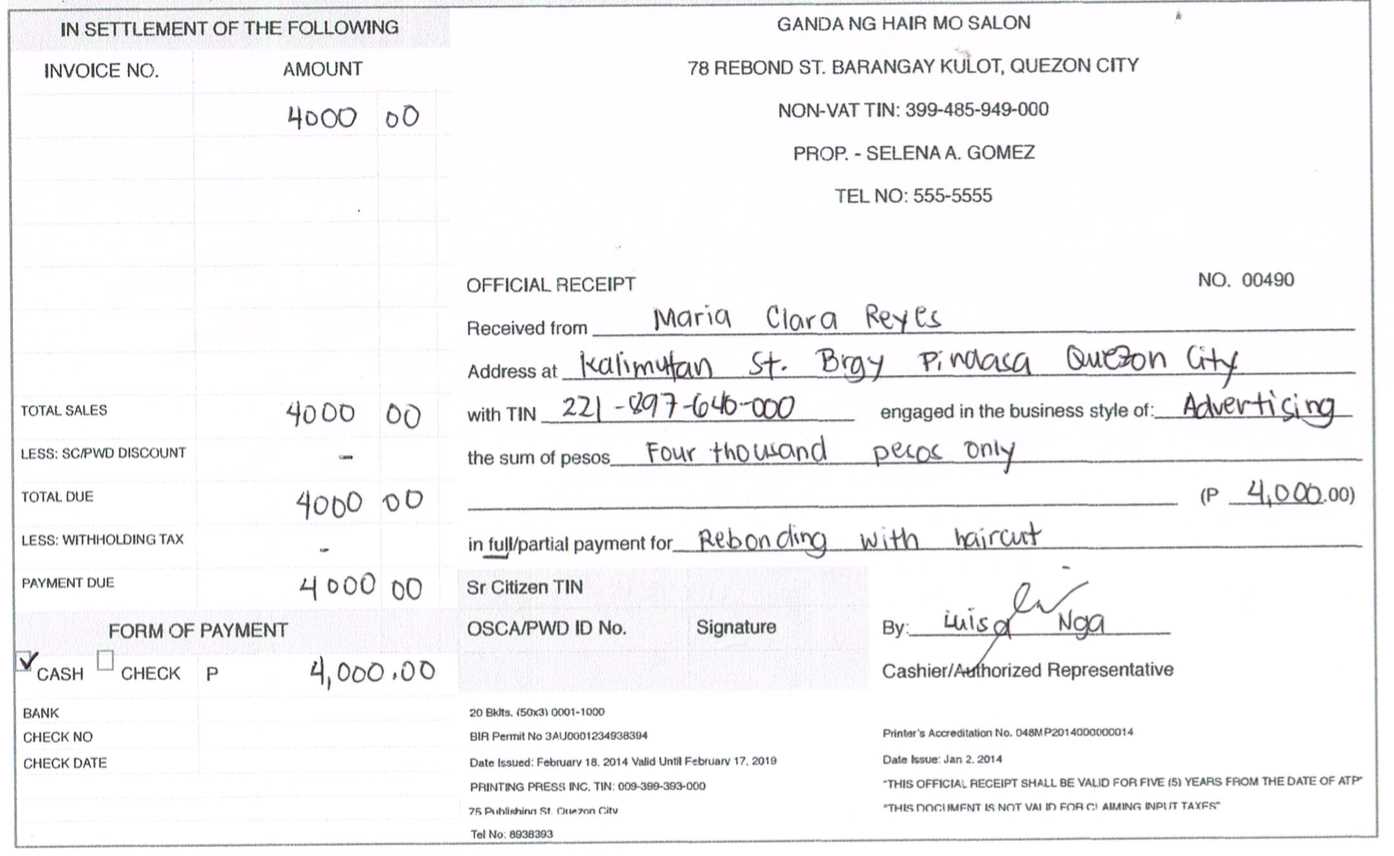

Legal and Accounting Considerations for Receipt Templates

Ensure that every receipt includes legally required details such as the seller’s name, business address, tax identification number, date of transaction, itemized list of goods or services, total amount, and applicable taxes. Omitting these details may lead to compliance issues and potential fines.

Tax Compliance and Record-Keeping

Receipts serve as key financial records for tax reporting. Include a breakdown of taxable and non-taxable items to simplify audits. Store copies digitally and physically for a period specified by local tax authorities, typically ranging from three to seven years.

Fraud Prevention and Accuracy

Avoid legal risks by ensuring receipts are accurate and tamper-proof. Sequential numbering helps track transactions, while digital signatures or QR codes enhance authenticity. Errors in financial documentation can lead to disputes or penalties, so verify all details before issuing a receipt.

Customizing Layouts for Various Business Needs

Adapt the settlement receipt format by aligning it with your transaction details and branding. Focus on clarity and structure to enhance usability.

- Itemized Breakdown: Ensure each charge, tax, and discount appears in a structured table. Label sections clearly to avoid confusion.

- Brand Consistency: Add a company logo, adjust fonts, and apply a color scheme matching your official documents.

- Dynamic Fields: Use placeholders for invoice numbers, payment methods, and customer details to streamline automation.

- Space Optimization: Balance white space and content density to keep receipts concise without omitting key details.

- Industry-Specific Modifications: Service-based businesses may highlight labor costs, while retailers might prioritize product descriptions.

Test different formats on various devices to confirm readability and adjust column widths for better print alignment.