Key Elements of a Donation Receipt

A well-structured donation receipt should include all necessary details to ensure compliance with tax regulations and provide transparency for donors. The following elements are essential:

- Donor Information: Full name and contact details.

- Organization Details: Legal name, address, and tax identification number.

- Donation Amount: Specify the value of the contribution.

- Date of Donation: Helps with record-keeping and tax documentation.

- Description of Donation: Clarify if it was monetary or non-monetary.

- Statement of No Goods or Services: Confirm that nothing of value was exchanged unless applicable.

- Authorized Signature: An official representative should sign the receipt.

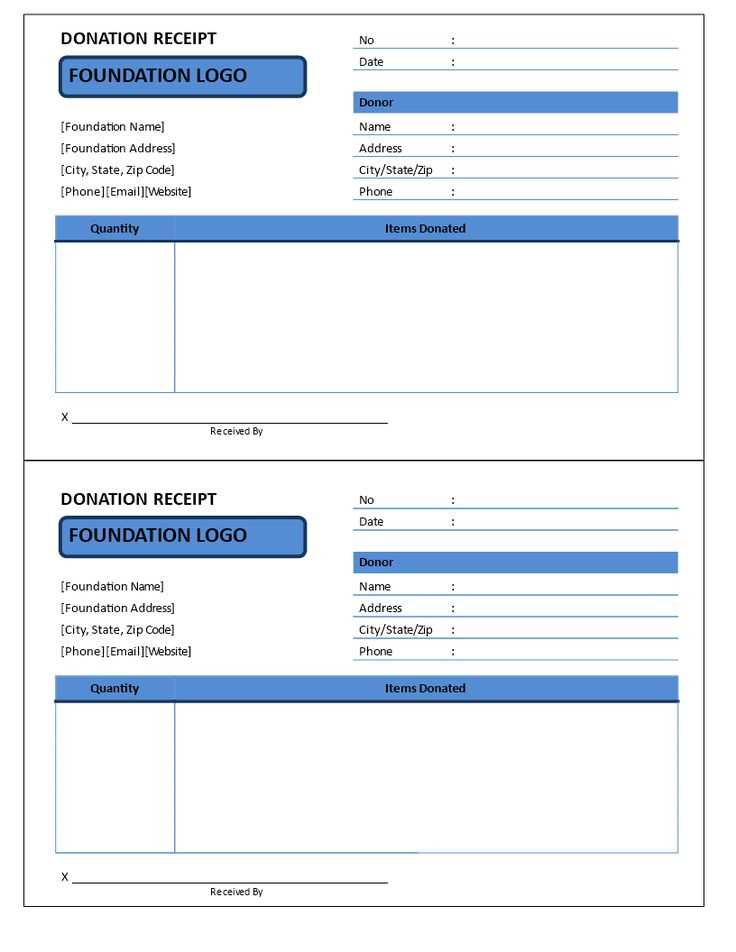

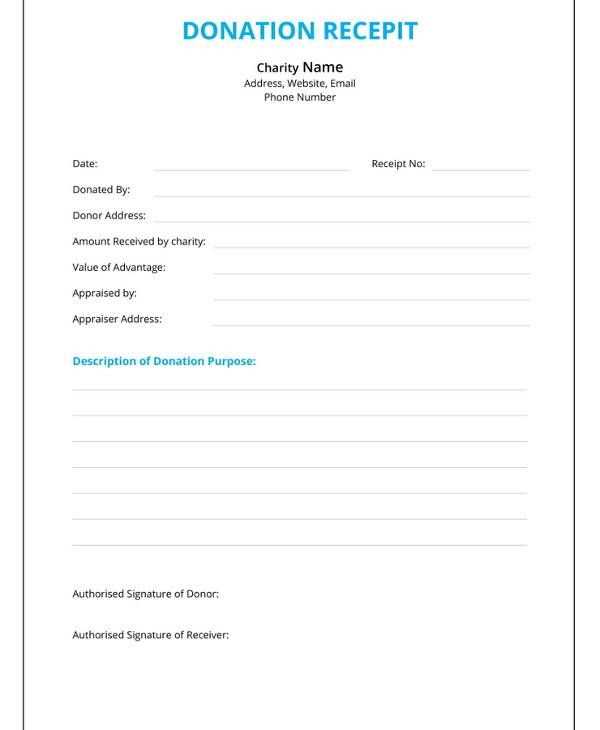

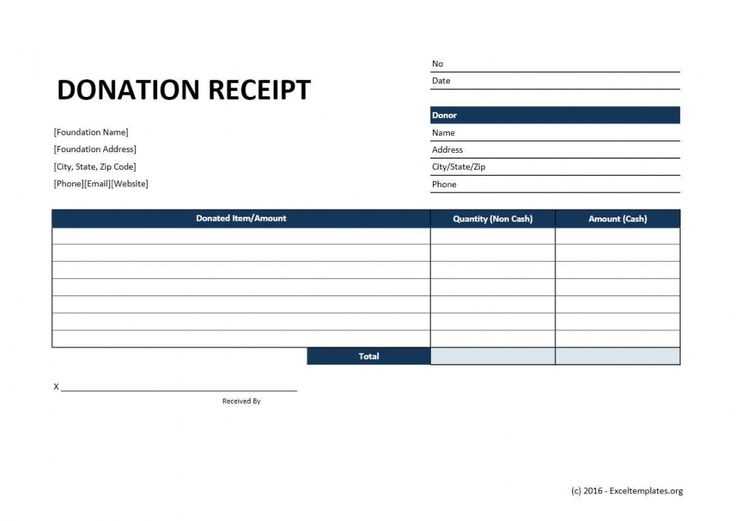

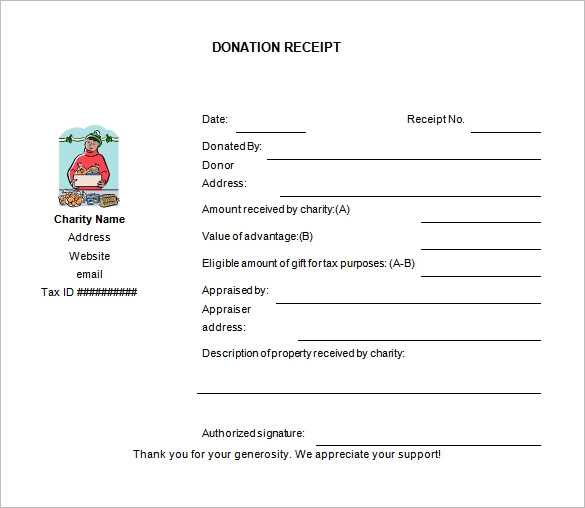

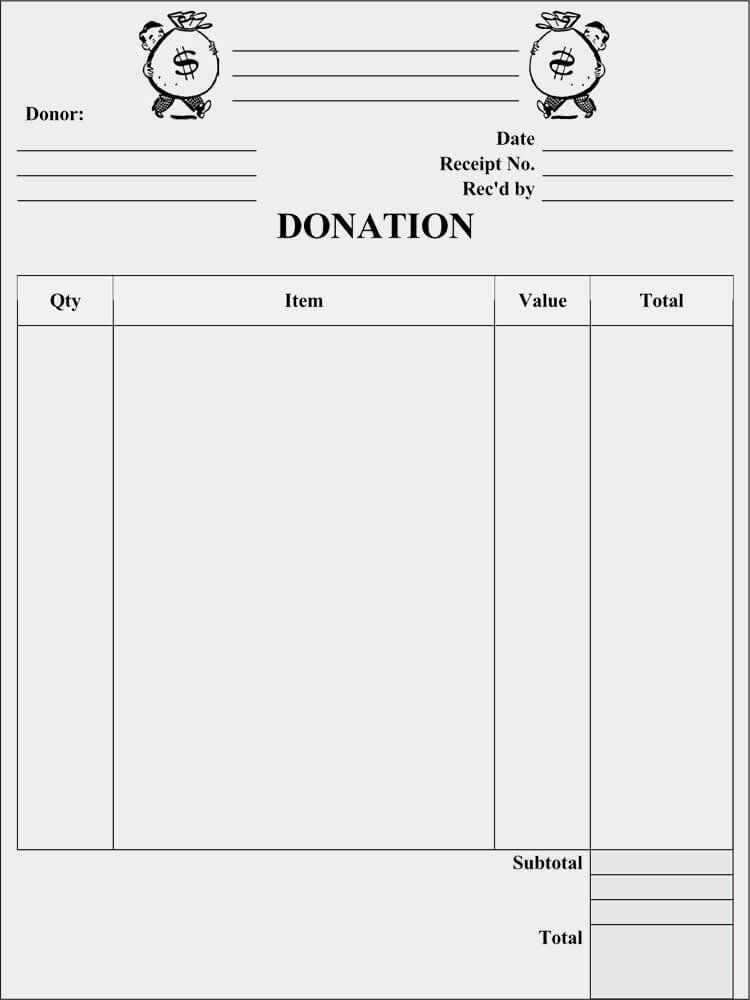

Example Donation Receipt Template

Here is a structured template that can be used for issuing donation receipts:

[Organization Name]

[Organization Address]

[City, State, ZIP Code]

[Tax Identification Number]

[Email Address] | [Phone Number]

Donation Receipt

Date: [MM/DD/YYYY]

Donor Information:

Name: [Donor’s Full Name]

Address: [Donor’s Address]

Donation Details:

Amount: $[Donation Amount]

Type: [Monetary / In-Kind Item]

Description: [Brief Description of the Donation]

No goods or services were provided in exchange for this donation. This contribution is tax-deductible to the extent allowed by law.

Authorized Signature:

[Representative’s Name] | [Title]

Best Practices for Issuing Receipts

- Provide receipts promptly to maintain donor trust.

- Use a standardized format for consistency.

- Ensure digital copies are available for record-keeping.

- Verify that all required information is included before sending.

Template for Donation Receipts

Key Legal and Tax Requirements for Contribution Records

Essential Elements to Include in a Receipt Template

Customizing Donation Records for Various Contribution Types

Ensure every donation receipt complies with tax regulations by including the donor’s full name, contribution amount, and date. Nonprofit organizations must also provide their legal name and tax identification number.

Required Details for Compliance

The IRS mandates that receipts for donations of $250 or more include a statement confirming whether goods or services were provided in exchange. If applicable, the fair market value of any benefits received must be disclosed.

Formatting for Different Donation Types

For cash donations, specify the payment method (e.g., check, credit card). In-kind donations require a detailed description of donated items but should not assign a value–donors determine this for tax purposes. Recurring donations should reflect the total contributions within the reporting period.