Finding the right receipt template for County of Henrico transactions saves time and ensures compliance with local requirements. Whether you need a receipt for tax payments, business transactions, or official records, having a structured template simplifies the process.

Templates should include key details such as payer and recipient names, transaction dates, amounts, and a clear description of services or goods provided. Including official seals or approval sections may be necessary for legal documents.

For businesses operating in Henrico County, using a standardized format helps maintain accurate financial records. Digital templates allow for easy customization, ensuring each receipt meets specific needs while maintaining consistency across multiple transactions.

Below, you’ll find essential elements to include in a receipt template and recommendations for structuring them effectively.

County of Henrico Receipt Templates

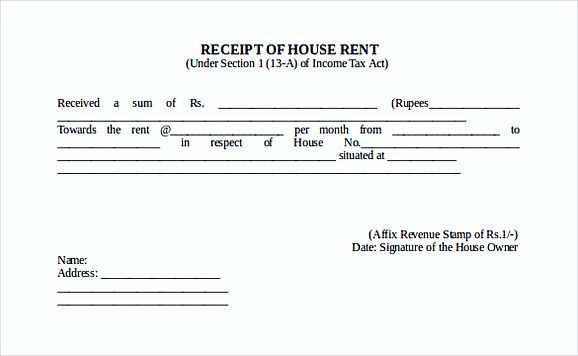

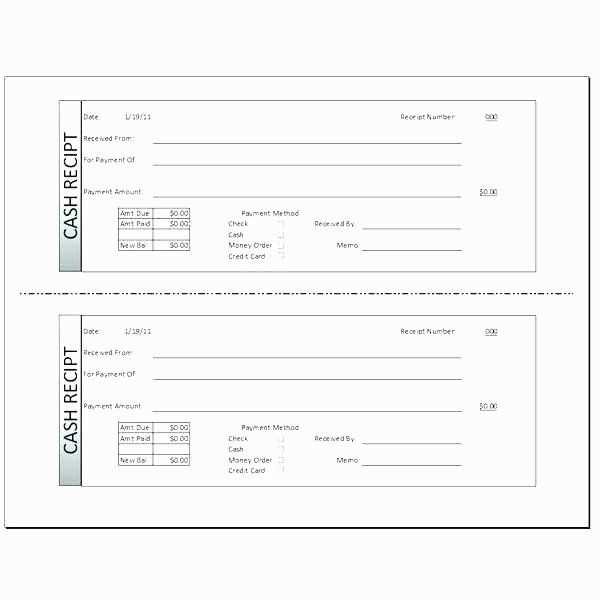

Use standardized receipt templates to ensure accuracy and compliance with local financial regulations. Each receipt should include the payer’s name, transaction date, amount paid, payment method, and a unique receipt number for tracking purposes.

Essential Fields for Henrico Receipts

Include the official County of Henrico logo and contact details for authenticity. Clearly label each section, such as “Payment Received From” and “Description of Services.” Ensure tax calculations, if applicable, are displayed correctly.

Customizing for Specific Transactions

Modify templates to reflect different payment types, such as property taxes, permits, or fines. Digital receipts should feature QR codes or unique confirmation numbers for verification. Always save copies for record-keeping and audits.

Customization Options for Official Receipts

Adjusting receipt templates ensures clarity, compliance, and a professional appearance. Focus on key elements to enhance readability and efficiency.

- Logo and Branding: Add an official logo, tagline, or color scheme to reinforce credibility.

- Sequential Numbering: Implement automated numbering for tracking and auditing.

- Custom Fields: Include specific details like department codes, payment methods, or approval signatures.

- Tax and Legal Compliance: Ensure receipts display tax rates, exemptions, and required disclaimers.

- Multi-Format Support: Offer PDF, email, or printed versions with consistent formatting.

- Dynamic Date and Time: Auto-generate timestamps to reflect transaction accuracy.

Streamline the customization process by using editable templates or integrating with accounting software. Precise formatting and structured data improve record-keeping and user experience.

Formatting Guidelines for Compliance

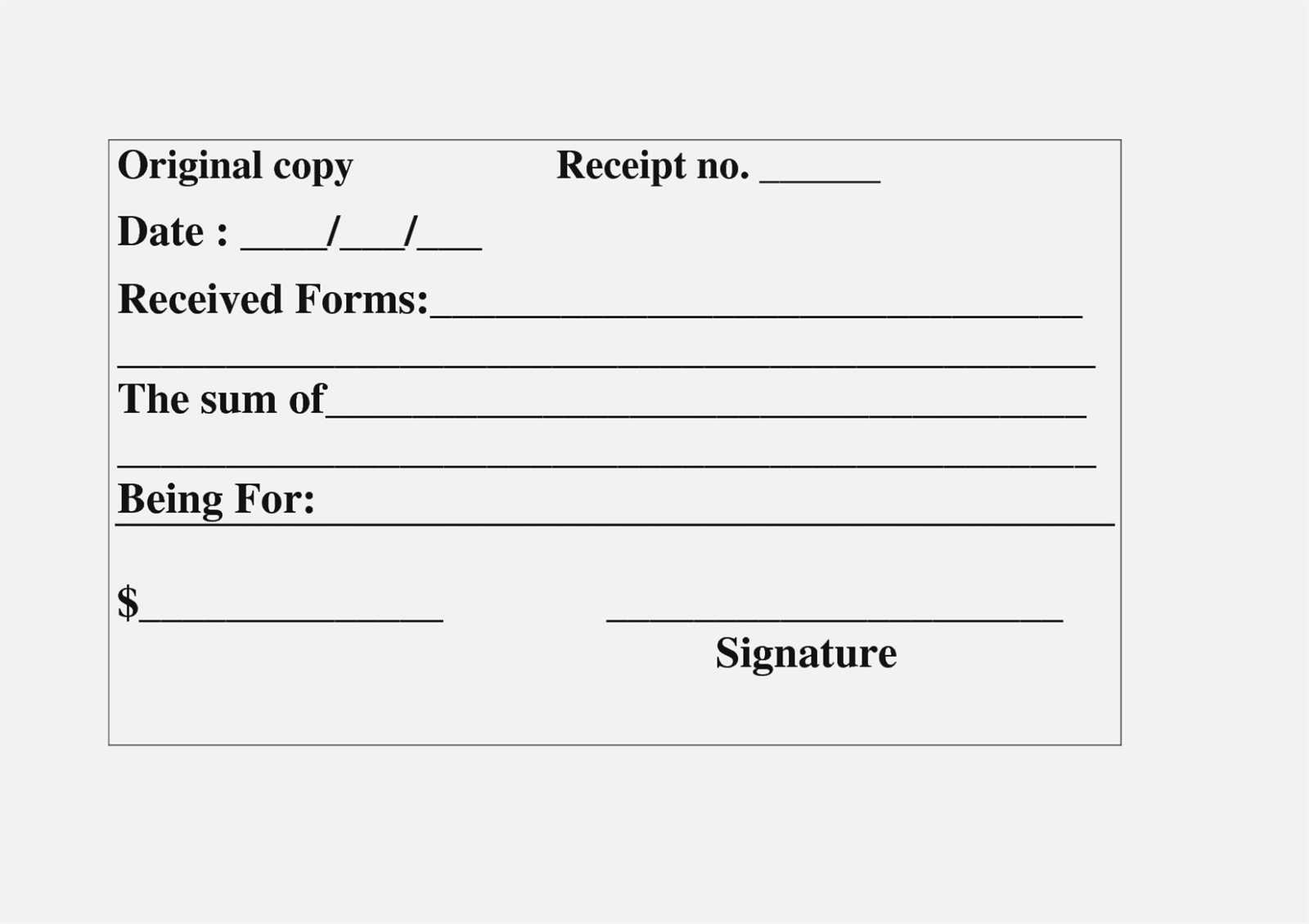

Use a Standardized Layout: Ensure all receipts follow a consistent structure. Include sections for payment details, payer and payee information, transaction ID, and date. Maintain uniform spacing and alignment for clarity.

Include Mandatory Legal Disclosures: County of Henrico receipts must display tax details, refund policies, and applicable disclaimers. Place this information in a clearly visible section, using legible font size.

Ensure Readability: Use a sans-serif font with a minimum size of 10pt. Avoid excessive bolding or italics. Key information, such as the total amount and payment method, should be highlighted but not overwhelming.

Provide a Unique Identifier: Assign a receipt number that follows a structured format (e.g., YYYYMMDD-XXXX). This simplifies record-keeping and prevents duplication.

Support Digital and Printed Formats: Design receipts to be printable on standard letter-sized paper (8.5″ x 11″) while ensuring digital versions remain easy to read on mobile and desktop devices.

Ensure Compliance with Data Protection Standards: Mask sensitive details, such as full credit card numbers, displaying only the last four digits. Clearly state how customer data is handled and stored.

Digital and Printable Receipt Solutions

Choose a receipt format based on the method of transaction and record-keeping needs. Digital receipts reduce paper waste and integrate seamlessly with accounting software, while printable receipts remain essential for in-person transactions and official documentation.

Advantages of Digital Receipts

Email receipts provide instant access and eliminate storage issues. Many platforms offer automated receipt generation with built-in tracking. Cloud-based systems allow quick retrieval and reduce risks associated with lost paper copies.

Printable Receipt Considerations

For legal and compliance purposes, some institutions require printed receipts. Thermal printers offer fast, ink-free printing, while laser printers ensure durability for long-term records. Consider using templates to maintain consistency across transactions.

| Feature | Digital Receipts | Printable Receipts |

|---|---|---|

| Storage | Cloud-based, unlimited | Physical files, space required |

| Accessibility | Instant, searchable | Manual retrieval |

| Environmental Impact | Paperless | Resource consumption |

| Compliance | Accepted for most online transactions | Required in some official processes |

For businesses, offering both options ensures customer convenience. Digital receipts streamline operations, while printed copies remain a reliable backup.