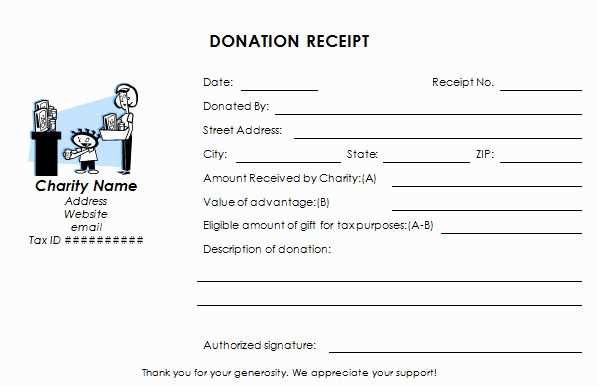

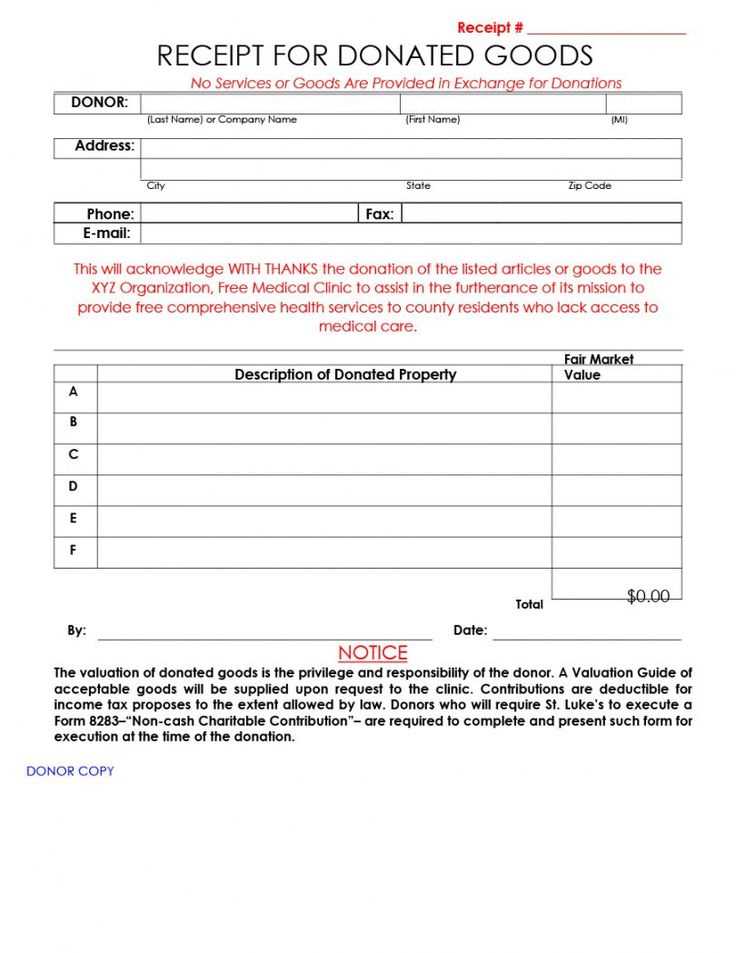

Use a clear and concise noncash donation receipt template to properly document in-kind contributions. This receipt serves as proof for both the donor and the charity. Ensure it includes the donor’s name, description of the donated items, and the fair market value of those items. Avoid vague descriptions; list each item with enough detail to demonstrate its value.

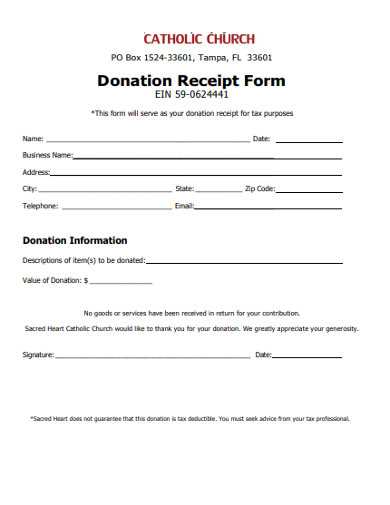

Make sure to indicate that no goods or services were exchanged for the donation. This simple statement keeps your receipt compliant with IRS regulations. Use a format that includes spaces for the donor’s contact details, donation date, and the signature of an authorized representative from your organization.

For donors, keeping a well-organized record of noncash donations is crucial for tax purposes. It’s recommended to add a section where both parties can agree on the value of the donated goods. This will reduce potential disputes and ensure transparency. By using an accurate, well-structured template, you help streamline the donation process and build trust with contributors.

Here are the revised lines with duplicates removed:

Ensure clarity and avoid redundancy in noncash donation receipts. When listing donated items, each entry should be unique. For example, instead of repeating “One used laptop,” simply state “Laptop” once. This approach prevents confusion and streamlines the record-keeping process.

List the donor’s information only once in the header section. If the receipt includes multiple items, avoid repeating the donor’s name for each item. It should appear once, followed by the donation details.

In descriptions, remove repetitive terms. For instance, rather than saying “donated an old laptop and an old desktop computer,” simplify it to “donated a used laptop and desktop computer.” This makes the receipt concise and professional.

When describing the condition of items, use varied language instead of repeating the same adjectives. Instead of saying “used and old,” consider “used” and “in good condition” or similar alternatives.

- Noncash Donation Receipt Template

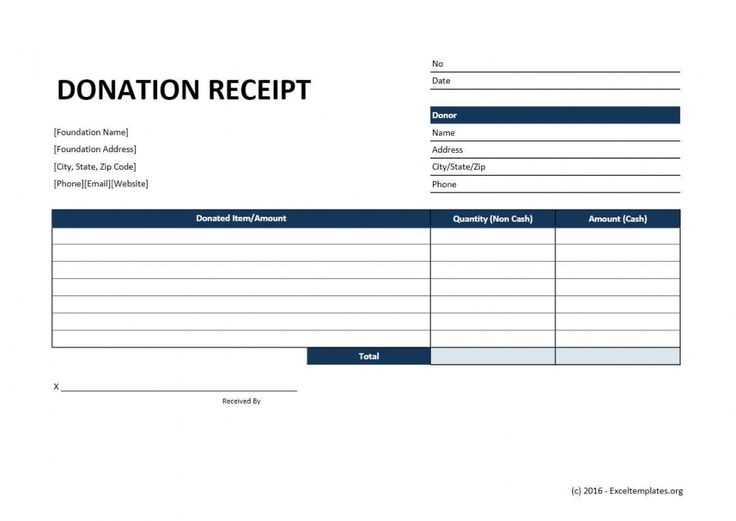

A noncash donation receipt should include specific details to ensure both the donor and the receiving organization comply with tax requirements. The following template includes essential sections that make the process smooth for all parties.

Key Information for a Noncash Donation Receipt

The receipt must list the following key details:

- Donor’s name and address

- Date of the donation

- Detailed description of the items donated (e.g., clothing, electronics, etc.)

- The fair market value of the donated items

- Statement confirming that no goods or services were provided in exchange for the donation (if applicable)

- The name and address of the nonprofit organization

- The organization’s tax-exempt status or EIN (Employer Identification Number)

Template Example

Below is an example of a basic noncash donation receipt template:

| Section | Details |

|---|---|

| Donor Information | [Donor’s Name] [Donor’s Address] |

| Date of Donation | [Date] |

| Donation Description | [Description of Donated Items] |

| Fair Market Value | [Value of Donated Items] |

| Tax-Exempt Organization | [Organization Name] [EIN Number] |

| Statement | We confirm that no goods or services were provided in exchange for this donation. |

By using this template, both the donor and the organization can ensure accurate documentation for tax purposes and facilitate the donation process.

To create a legally compliant receipt for noncash donations, include the following details:

1. A clear description of the donated items. Specify what was donated, avoiding generic terms like “clothes” or “furniture.” Instead, list the items specifically, such as “two used sofas” or “five boxes of books.” Include the condition of the items as well, especially if they are in less-than-new condition, which impacts their fair market value.

2. Date of the donation. Make sure the receipt notes the exact date the donation was made. This is crucial for both the donor’s records and tax purposes.

3. Donor’s information. Include the name and contact details of the donor, ensuring it’s legible and complete. If the donor is a business, use the business name and relevant tax ID number.

4. A statement regarding goods or services provided. If the donor received anything in exchange for the donation (such as a thank-you gift or membership), you must provide the fair market value of those goods or services. This helps the donor determine how much of the donation is tax-deductible.

5. The organization’s details. Include your nonprofit’s name, address, and tax-exempt status (e.g., IRS 501(c)(3) status), as this will confirm that the organization is eligible to receive tax-deductible donations.

6. A declaration of no goods or services received (if applicable). If the donation was entirely in-kind with no goods or services exchanged, include a statement such as: “No goods or services were provided in exchange for this donation.”

7. Signature of an authorized representative. While not always legally required, adding a signature from a person authorized by the organization can lend credibility and ensure the receipt is seen as an official document.

By including these specific details, you help donors maintain accurate records for tax purposes and protect your nonprofit’s compliance with IRS regulations. Make sure the language you use is clear and precise to avoid misunderstandings or errors in reporting donations.

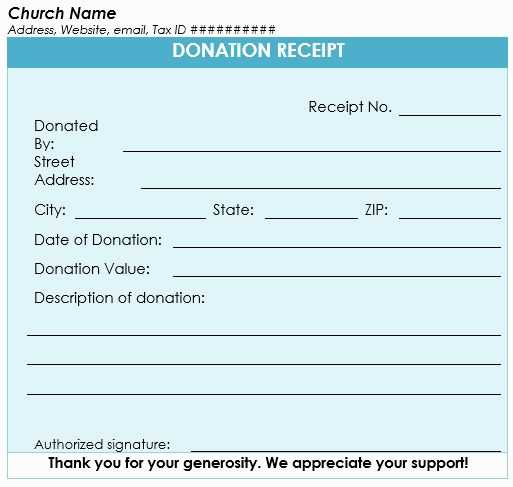

A noncash donation receipt should be clear and contain specific details for proper documentation. Include the following elements to ensure completeness and compliance:

1. Donor Information

Provide the donor’s name, address, and contact information. This helps identify the giver and ensures they receive the correct tax documentation. If the donor is an organization, use the official name as registered.

2. Description of the Donated Items

Offer a brief but detailed description of each item. Be clear and avoid vague terms. For example, instead of “clothes,” specify “two pairs of gently used winter coats.” If the donor provides a list, include it directly or as an attachment.

3. Date of Donation

The date on which the donation was received is important for record-keeping and for the donor to claim any deductions on their taxes. Ensure it reflects the actual donation day.

4. Acknowledgment of No Goods or Services

If no goods or services were provided in exchange for the donation, state this clearly. This is crucial for tax purposes. For example, “No goods or services were exchanged for this donation.”

5. Estimated Value of the Donation

Provide an estimate of the value of the items donated. If the donor is responsible for providing this valuation, include a statement like “The value of the items was determined by the donor.” Avoid offering an appraisal unless required by law.

6. Organization Information

List the organization’s legal name, tax identification number (EIN), and address. This helps confirm that the donation went to a registered nonprofit and provides the necessary information for the donor’s tax return.

7. Signature of Authorized Person

Include the signature of a representative from the nonprofit organization. This validates the receipt and confirms that the donation was processed by the organization.

Issue receipts as soon as possible after receiving noncash donations to maintain transparency and build trust with your donors.

- Provide a detailed description of the donated items, including quantity, condition, and general value, if possible.

- Ensure that each receipt includes the donor’s name, address, and the date of donation to comply with tax regulations.

- Do not assign a monetary value to the donated goods unless you have expert knowledge to do so. If uncertain, encourage the donor to appraise their items.

- State clearly that the donor received no goods or services in exchange for the donation, which is necessary for tax deduction purposes.

- For higher-value items, suggest the donor seek professional appraisal or provide any relevant supporting documentation to ensure accuracy.

- Track and document all noncash donations thoroughly for internal record-keeping and audits. This is key for compliance with the IRS or other tax authorities.

- Provide an acknowledgment statement on the receipt, thanking the donor for their contribution and reinforcing your organization’s mission.

By following these guidelines, you ensure that your organization remains compliant and that donors feel valued and recognized for their contributions.

Adjusting the Donation Receipt Details

If you need to make any further adjustments or clarifications, don’t hesitate to reach out. You can easily modify the text in the donation receipt template to fit the specifics of your donation. Whether you need to add or change the donor’s information, item description, or values, it’s important to ensure all fields are accurate for both the donor and the organization. If you’d like to provide additional information, such as the method of donation or a thank-you note, these can be added as well to make the receipt more personalized.

Common Updates

Often, the most frequent changes involve updating the itemized list of donated goods or including new details about the donor. For example, if an item’s condition is being acknowledged or a particular valuation needs to be noted, it’s easy to include a brief description or clarification. Make sure the receipt reflects any specifics, as that ensures transparency for tax deduction purposes.

Formatting Adjustments

In some cases, you might prefer to change the layout or the font to match your organization’s branding. Adjusting the structure is simple, but ensure all required information remains clear and accessible for both the donor and your team. Keep the format clean and organized to avoid any confusion when the receipt is presented to the donor.