Essential Components of a Receipt

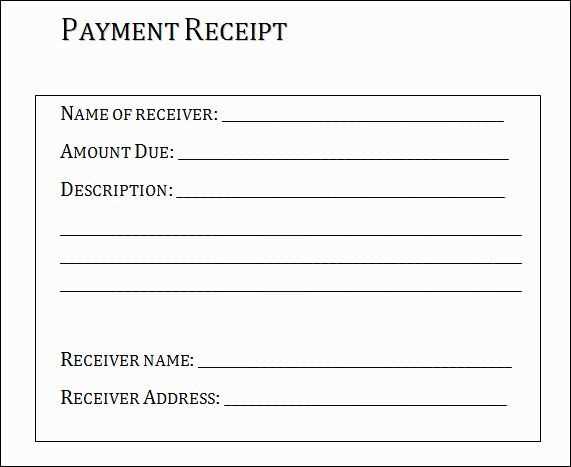

A well-structured receipt ensures clarity for both the seller and the buyer. Include the following elements:

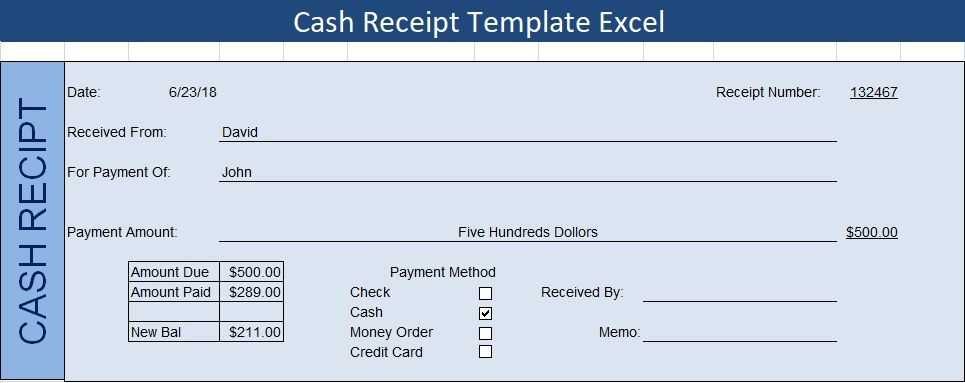

- Date and Time: Record the exact moment of the transaction.

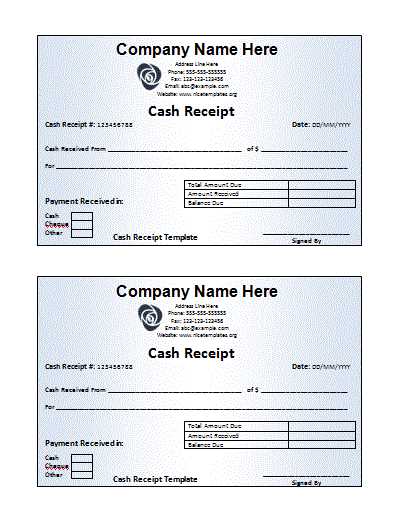

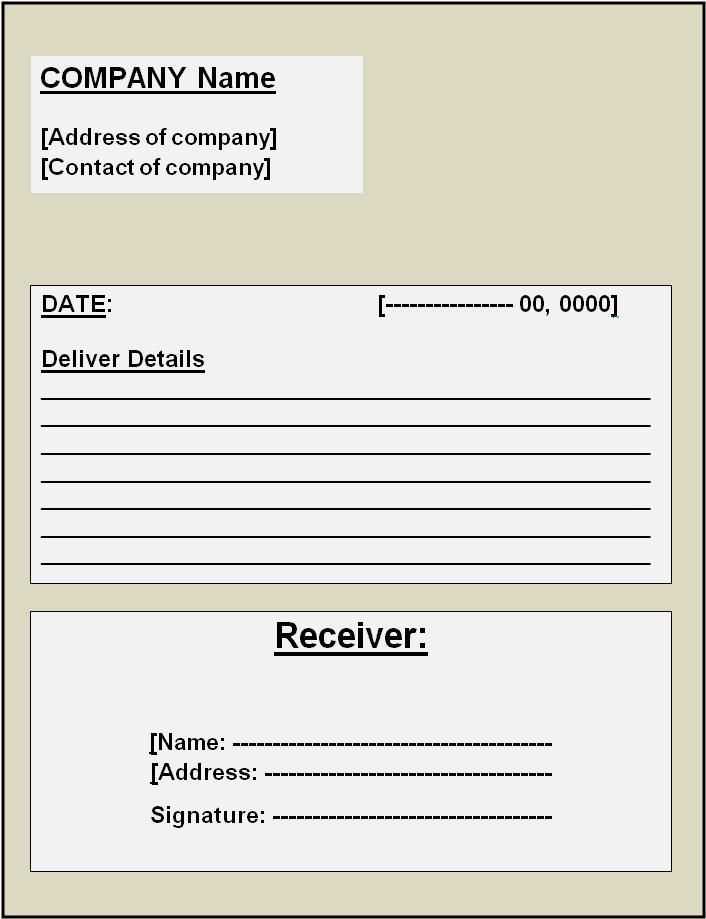

- Business Information: List the company name, address, and contact details.

- Buyer Details: If applicable, include the customer’s name and contact information.

- Transaction ID: Assign a unique reference number for tracking.

- Itemized List: Describe purchased items, including quantity, unit price, and total cost.

- Payment Method: Specify whether the payment was made by cash, card, or digital transfer.

- Taxes and Discounts: Clearly state any applicable taxes or reductions.

- Grand Total: Provide the final amount paid.

- Return Policy: Outline any terms related to refunds or exchanges.

Practical Formatting Tips

Use clear fonts and logical spacing to improve readability. Structure the content into distinct sections with labels for quick reference. If the receipt is digital, ensure it is in a widely accepted format such as PDF or JPEG.

Automation and Customization

Modern receipt templates allow businesses to automate generation and integrate branding elements. Add a company logo, choose appropriate fonts, and adjust the layout to align with business aesthetics. Many software tools offer customization without requiring technical expertise.

Legal and Compliance Considerations

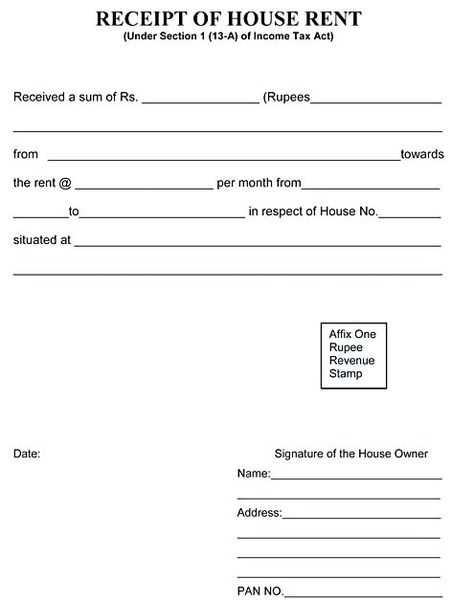

Ensure the template adheres to local regulations, particularly regarding tax compliance and data privacy. Keep digital copies for record-keeping and customer support.

Common Mistakes to Avoid

- Omitting key transaction details, leading to disputes.

- Using inconsistent formatting, making the receipt difficult to read.

- Failing to provide contact details for post-sale support.

A well-designed receipt enhances professionalism and simplifies financial tracking. Whether for personal or business use, maintaining a structured template saves time and prevents misunderstandings.

Original Receipt Template: Essential Considerations

Structuring for Clear Record-Keeping

Each receipt must include a unique identifier, such as a sequential number or timestamp, to prevent duplication and ensure proper tracking. Use a structured format with clearly labeled sections for transaction details, including date, amount, payment method, and itemized purchases. Consistent alignment of data fields improves readability and simplifies audits.

Legal and Tax Compliance in Design

Include mandatory business information, such as company name, address, and tax identification number. If applicable, display VAT or sales tax breakdowns separately to comply with regional regulations. Digital receipts should follow electronic documentation standards, ensuring format compatibility for official records.

Customizing for Various Business Needs

Adjust receipt templates based on industry requirements. Retail businesses may prioritize product descriptions and return policies, while service providers might highlight labor charges and service periods. Custom branding, including logos and contact details, reinforces business identity and enhances professionalism.