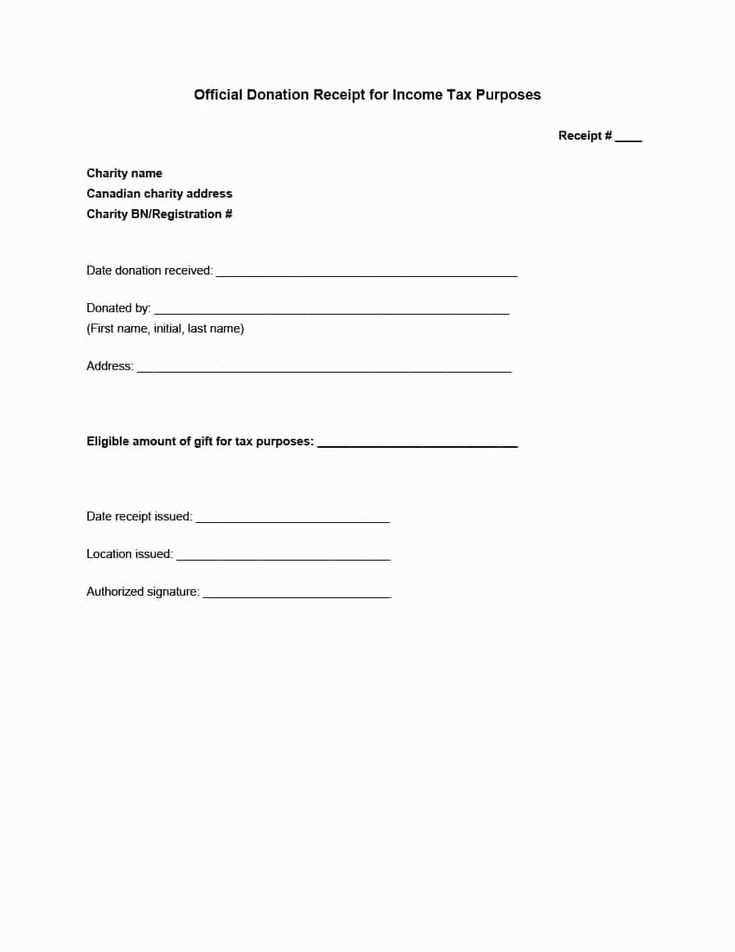

When creating a cash donation receipt for your non-profit organization, accuracy and transparency are key. This template should include all necessary details to comply with tax regulations and provide clear documentation to your donors. Be sure to outline the donation amount, date, and the donor’s name. Including the non-profit’s name, address, and tax-exempt status will make it easier for your donors to use the receipt for tax purposes.

Ensure the receipt contains a statement confirming that the donation was made in cash and that no goods or services were exchanged for it. This is important for the donor’s tax deductions. Providing a unique receipt number can also help with record keeping and streamline future communications with donors.

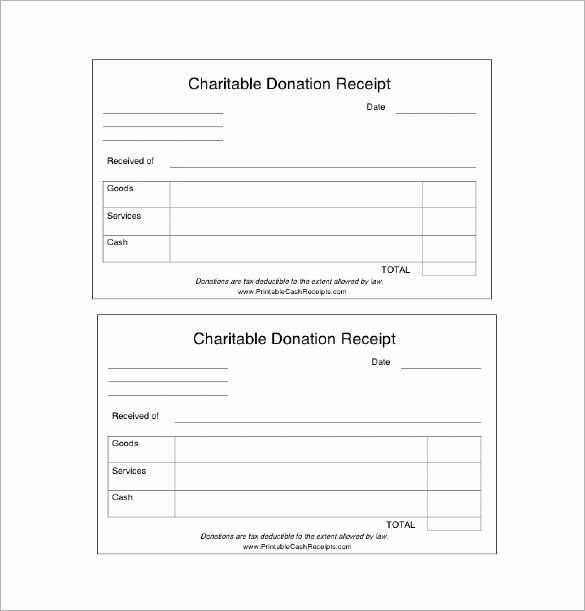

The format of the receipt should be clear and easy to read, with all the required fields logically ordered. By using a template, you save time and ensure consistency in your documentation. You can adjust the template as needed, but maintaining the key elements will keep your records in line with legal standards.

Here are the corrected lines with minimized repetition:

Ensure that the donation receipt includes a clear statement of the non-profit’s legal name and tax ID number. Avoid repeating unnecessary details; only include what’s required by law.

Keep the donor’s information concise but complete, such as full name, address, and donation amount. This ensures clarity and prevents any confusion when reviewing records later.

| Field | Required Information |

|---|---|

| Organization Name | Full legal name and tax-exempt status |

| Donor Details | Full name and address |

| Donation Amount | Exact donation value or description of property |

| Receipt Date | Date of donation |

Minimize redundancy by listing only the necessary details in the “Thank You” note. Be specific and avoid over-explaining the donation process.

Review your template for unnecessary phrasing. A clean format ensures recipients understand the content quickly, reducing any chance for confusion.

- Non-profit Cash Donation Receipt Template

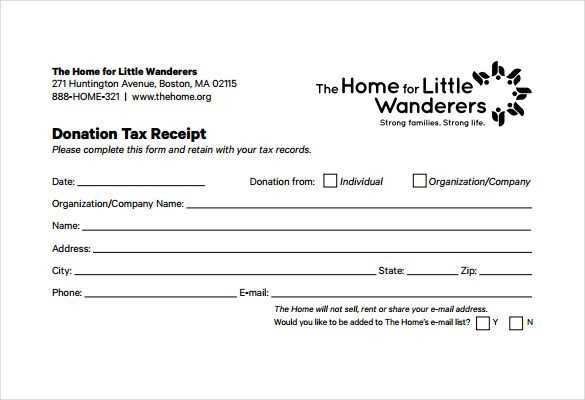

Ensure your cash donation receipts are clear and professional. Include the donor’s name, donation amount, date, and the name of your non-profit organization. Specify that no goods or services were exchanged in return for the donation. This statement is vital for the donor’s tax records. Make the receipt easily understandable, providing space for your organization’s contact details, tax-exempt status, and an acknowledgment message for the contribution. A receipt should always contain the IRS-required language to clarify its non-profit status.

Keep records of all donations, including cash, and organize them chronologically. When creating a template, use a simple, consistent format that allows for quick modifications. Include a unique receipt number for tracking purposes. If possible, offer a section where the donor can provide any notes related to their donation, such as a dedicated cause or event. After issuing the receipt, keep a copy for your records to ensure compliance with tax regulations.

Example template:

Donation Receipt

Non-Profit Organization Name

Address: [Organization Address]

Tax ID: [Tax ID Number]

Date: [Date]

Receipt #: [Receipt Number]

Donor Name: [Donor Name]

Donation Amount: $[Amount]

No goods or services were provided in exchange for this donation.

Thank you for your generous support!

For questions, contact us at [Organization Contact Information].

Include the date of the donation at the top of the receipt. This ensures the donor has an accurate record of when their contribution was made. Follow it with the donor’s full name, mailing address, and contact details. This personal information helps both you and the donor keep track of the transaction. For cash donations, clearly note the exact amount of money donated in words and figures to avoid any confusion.

State that the donation was made in cash, and add a disclaimer that no goods or services were provided in exchange for the donation. This is required for tax-deductible donations, ensuring the donor can claim their contribution properly. Always include your non-profit’s legal name, address, and tax identification number. This is important for both verification and for tax purposes.

For transparency, provide a thank-you message acknowledging the donor’s generosity. Make sure to include your organization’s mission or a brief statement explaining how the donation will be used. This adds a personal touch and reinforces the purpose of their support.

Finally, include a unique receipt number for reference. This helps with record-keeping and ensures each receipt is easily traceable. Make sure all information is legible and formatted consistently to maintain professionalism.

Ensure your non-profit donation acknowledgment includes these important details:

- Donor’s Name: Include the full name of the donor. If the donation is from a business, provide the business name.

- Donation Amount: State the exact amount of the donation received.

- Date of Donation: Record the date on which the donation was received.

- Non-Profit’s Details: Include your organization’s name, address, and 501(c)(3) tax-exempt status number.

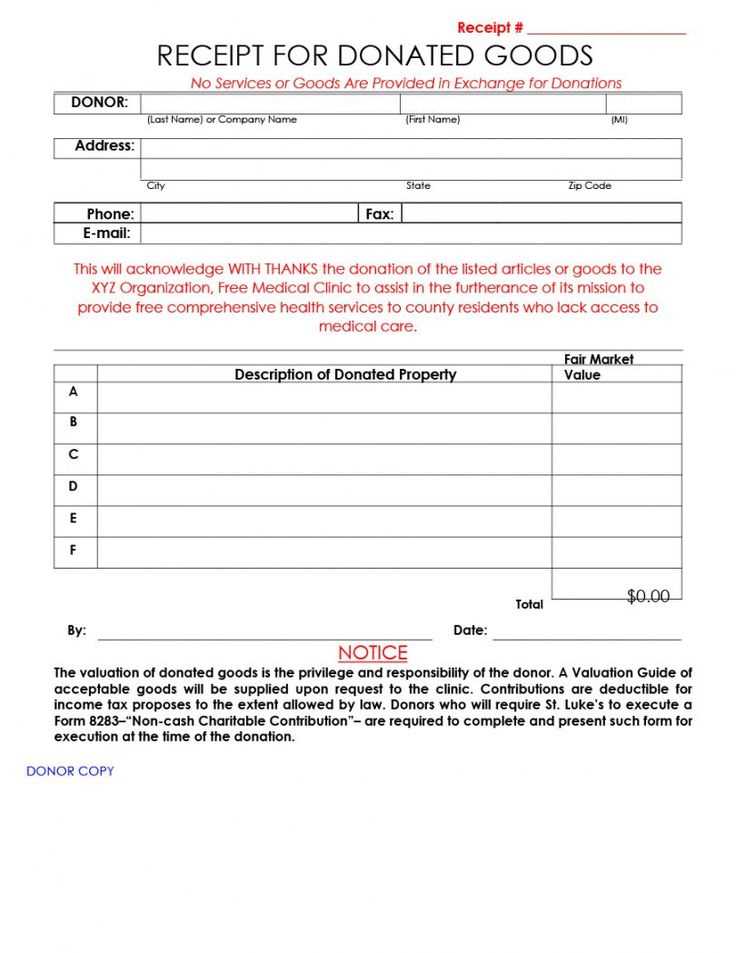

- Non-Donor Benefits: If the donor received goods or services in return, list the fair market value of those items.

- Tax Deductibility Statement: Clearly state that the donation is tax-deductible, per IRS regulations.

Example of Donation Acknowledgment:

“Thank you for your generous donation of $500 received on February 11, 2025. Your contribution will support our mission to provide clean drinking water to underserved communities. This donation is tax-deductible as we are a 501(c)(3) organization. No goods or services were provided in exchange for this donation.”

Distribute receipts immediately after receiving donations. Ensure each receipt includes the donor’s name, amount, donation date, and the organization’s tax-exempt status. This gives the donor clear records for tax purposes.

Provide receipts through both email and physical mail. Email guarantees fast delivery, while a mailed receipt offers a personal touch, especially for larger contributions. Consider adding a thank-you message with the mailed receipts to reinforce the donor’s impact.

For recurring donors, send consolidated receipts quarterly or annually. This reduces the frequency of receipt distribution and simplifies the donor’s record-keeping.

Always highlight any goods or services provided in exchange for the donation. Include their fair market value on the receipt to ensure clarity about the deductible portion of the donation.

Include your organization’s contact information on each receipt. Make it easy for donors to reach out with questions or for further support. This builds trust and keeps communication lines open.

To create a proper receipt for a non-profit cash donation, make sure to include the donor’s name, donation amount, and the date of the contribution. Clearly state that the organization is a non-profit and provide its tax-exempt status, including the registration number if applicable. It’s important to note that the receipt should not provide any goods or services in exchange for the donation, as this may affect the donor’s tax deduction eligibility.

Ensure the receipt includes the non-profit’s contact details such as the address, phone number, and email. This will help if the donor needs to follow up or request further information. The organization’s mission statement or a brief thank-you message also adds a personal touch, confirming the value of the donor’s contribution to your cause.

At the bottom, include a clear statement that the donation was voluntary and without compensation, specifying that no goods or services were provided in exchange. This statement should be concise and easy to read. Lastly, keep the format simple and professional, making it easy for the donor to keep for tax purposes.