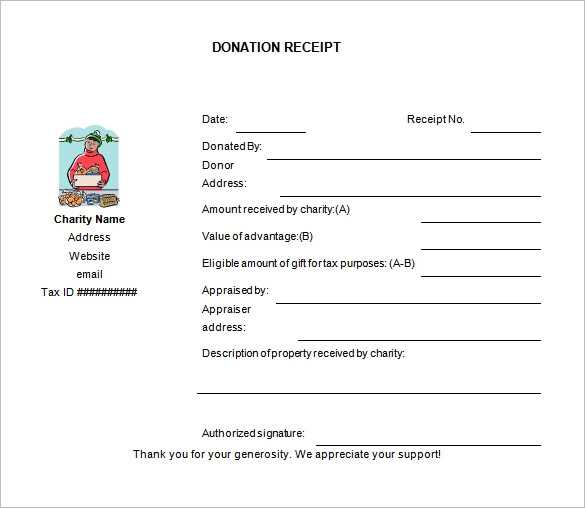

Download and Customize a Donation Receipt

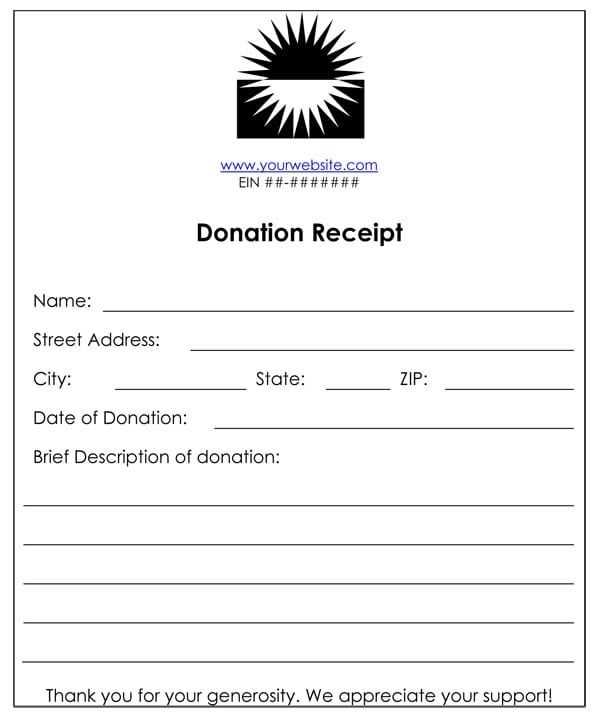

Use a preformatted Word template to create professional donation receipts quickly. Many organizations provide free templates that include all necessary fields. Simply download the file, open it in Word, and personalize it with your organization’s details.

Essential Information to Include

- Organization Name and Contact Details: Ensure donors can verify the legitimacy of your organization.

- Donor Information: Include the donor’s full name and address.

- Date of Donation: Specify when the contribution was made.

- Donation Amount: Clearly state the monetary value or describe in-kind donations.

- Tax Statement: Add a disclaimer stating whether the donation is tax-deductible.

- Signature: An authorized representative should sign the receipt.

Simple Steps to Edit in Word

- Open the template in Microsoft Word.

- Replace placeholder text with your organization’s name, logo, and contact details.

- Fill in the required fields for each donation.

- Save and export the receipt as a PDF for easy distribution.

Best Practices for Issuing Donation Receipts

Provide receipts immediately after receiving donations to maintain transparency. Store digital copies for record-keeping, and ensure all receipts comply with tax regulations. Using a standardized template ensures consistency and professionalism in donor communications.

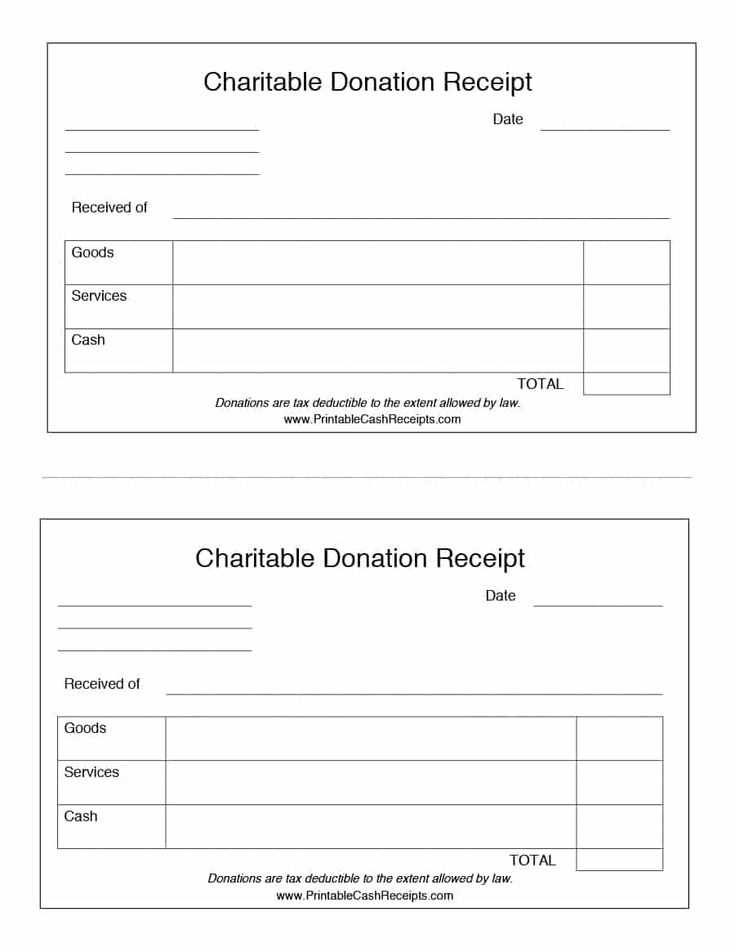

Charitable Donation Receipt Template Word

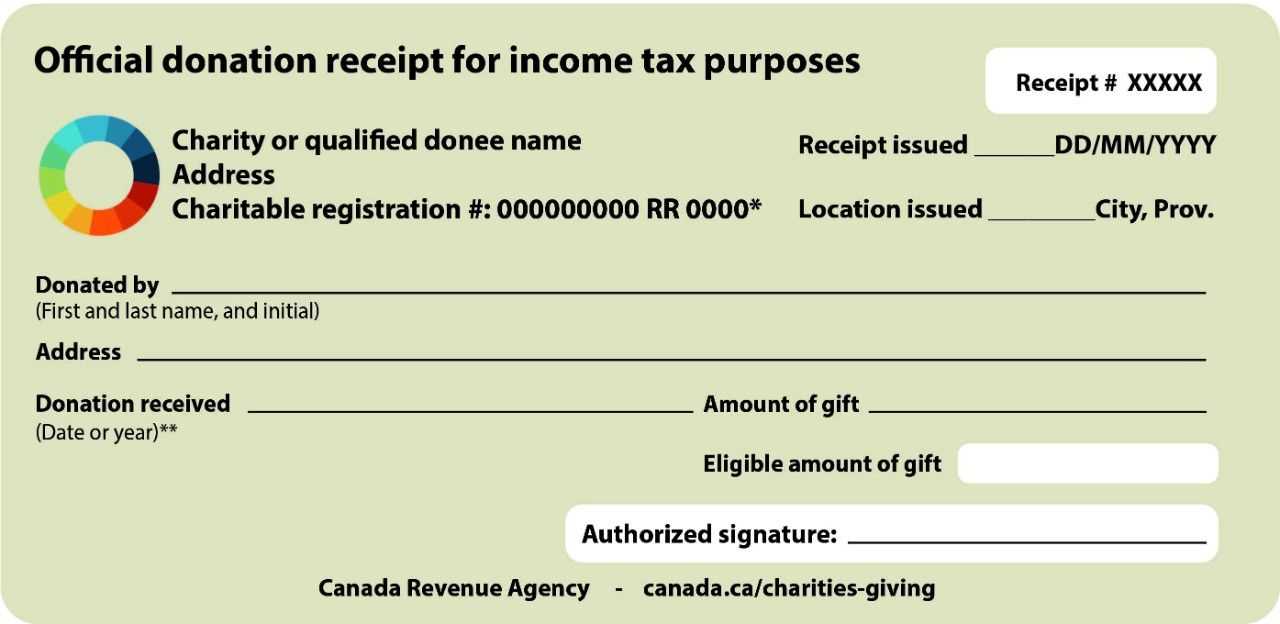

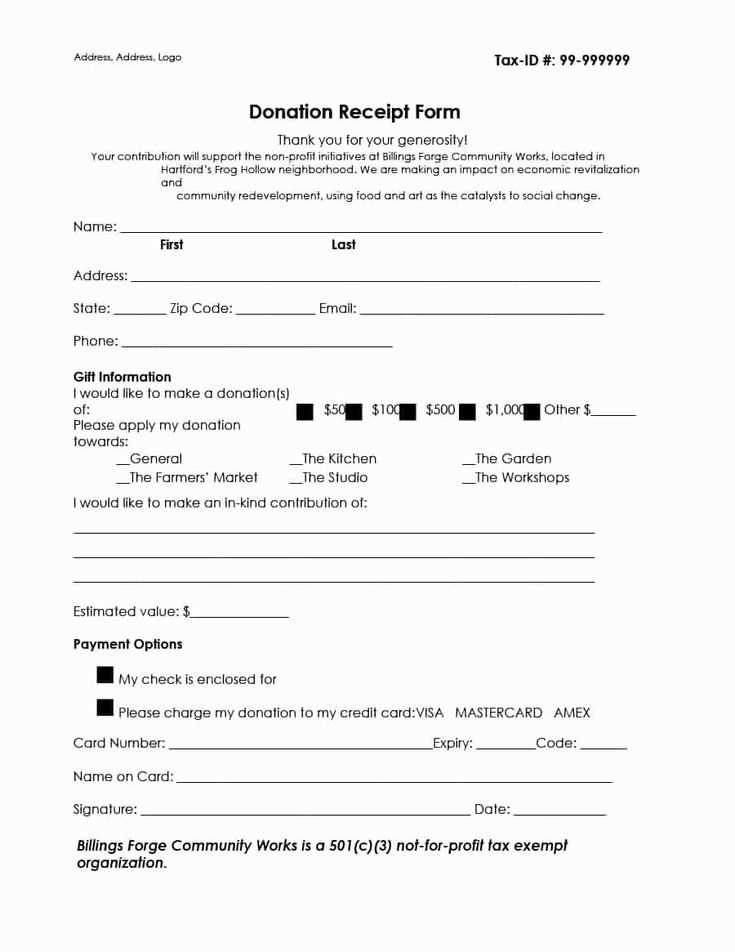

Essential Elements for a Donation Receipt Format

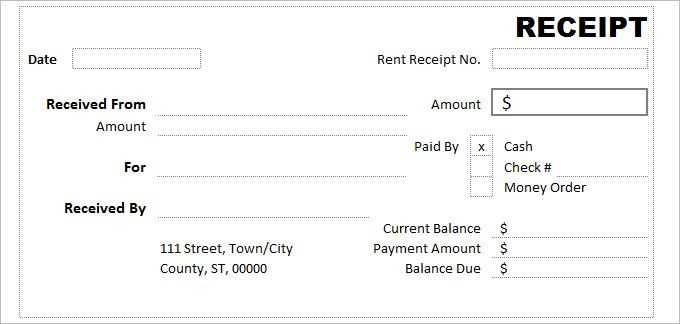

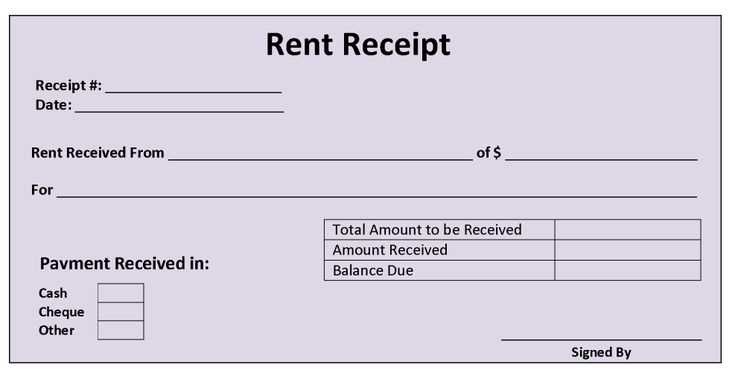

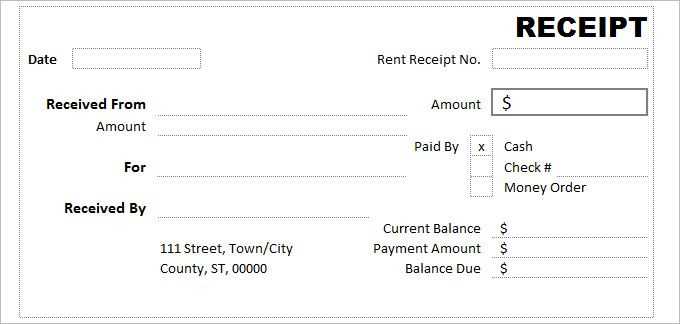

A proper donation receipt must include the donor’s full name, the organization’s legal name, the date of the contribution, and the amount given. If the donation was non-monetary, provide a clear description of the item. Add a statement confirming that no goods or services were exchanged for the gift unless applicable.

Ways to Personalize a Donation Record in Microsoft Word

Customize your receipt template by inserting your organization’s logo, using professional fonts, and structuring the document with tables for clarity. Use merge fields in Word to automate donor details in bulk receipts, ensuring accuracy while saving time. Consider adding a brief note of appreciation to strengthen donor relationships.

Legal and Tax Aspects of Contribution Receipts

A valid receipt should state the organization’s tax-exempt status and include an EIN if applicable. For contributions over a certain threshold, some tax authorities require additional details, such as a declaration that the donor received no substantial benefits in return. Always verify local regulations to maintain compliance.