Tracking cash receipts from customers can streamline financial management for any business. Use a template to record transactions efficiently, ensuring all incoming payments are properly logged and accounted for. By maintaining accurate records, you can improve cash flow analysis, identify discrepancies, and meet reporting requirements effortlessly.

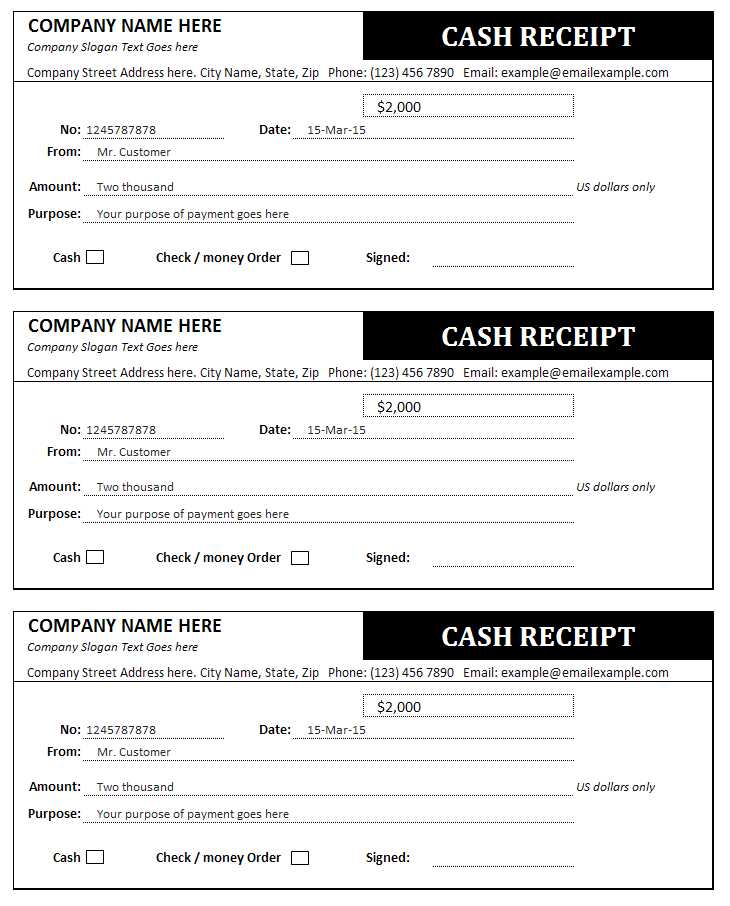

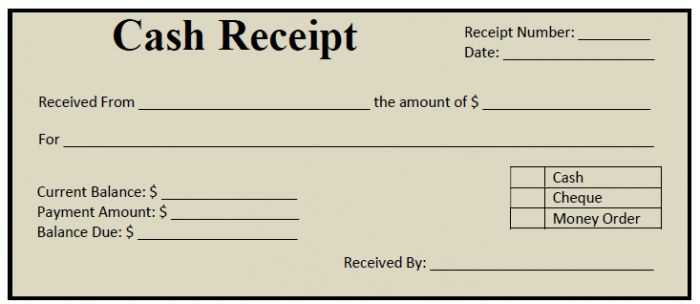

A reliable template should include fields for customer details, payment amounts, date of receipt, and the payment method. This basic structure allows you to organize receipts, making it easy to trace individual transactions. Make sure to categorize the payments correctly based on their type, such as cash, check, or electronic transfers.

It’s also helpful to have a space for referencing invoices or order numbers. This practice connects each payment to a specific sale, ensuring consistency and preventing misunderstandings with customers. By using a template, you reduce the risk of human error and increase accuracy in financial reports.

When creating your template, prioritize clarity and simplicity. Clear labels and logical organization make it easier for both the finance team and stakeholders to review cash receipts. Once set up, this tool becomes a valuable asset for managing incoming funds without the need for complex systems.

Here is the corrected version:

Ensure that all customer payment entries are accurate and well-organized. This template should provide a clear overview of cash receipts from customers, making tracking straightforward.

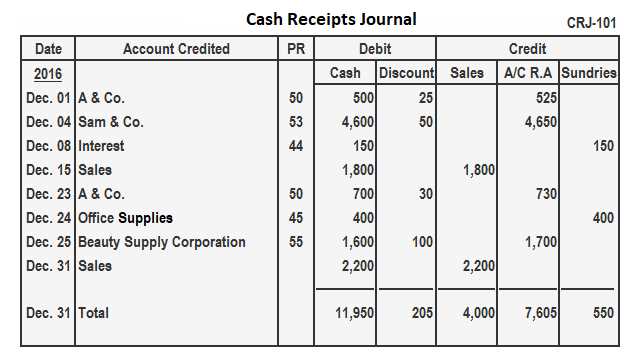

| Date | Customer Name | Invoice Number | Payment Amount | Payment Method | Balance |

|---|---|---|---|---|---|

| 2025-02-11 | John Doe | INV12345 | $500.00 | Cash | $200.00 |

| 2025-02-10 | Jane Smith | INV12346 | $300.00 | Cheque | $100.00 |

Make sure to update the balance after each transaction to maintain an accurate record of outstanding payments. Include payment methods to track how receipts are made.

This template streamlines cash receipt tracking and helps maintain proper financial records. Use it regularly for a more efficient accounting process.

- Cash Receipts from Customers Template

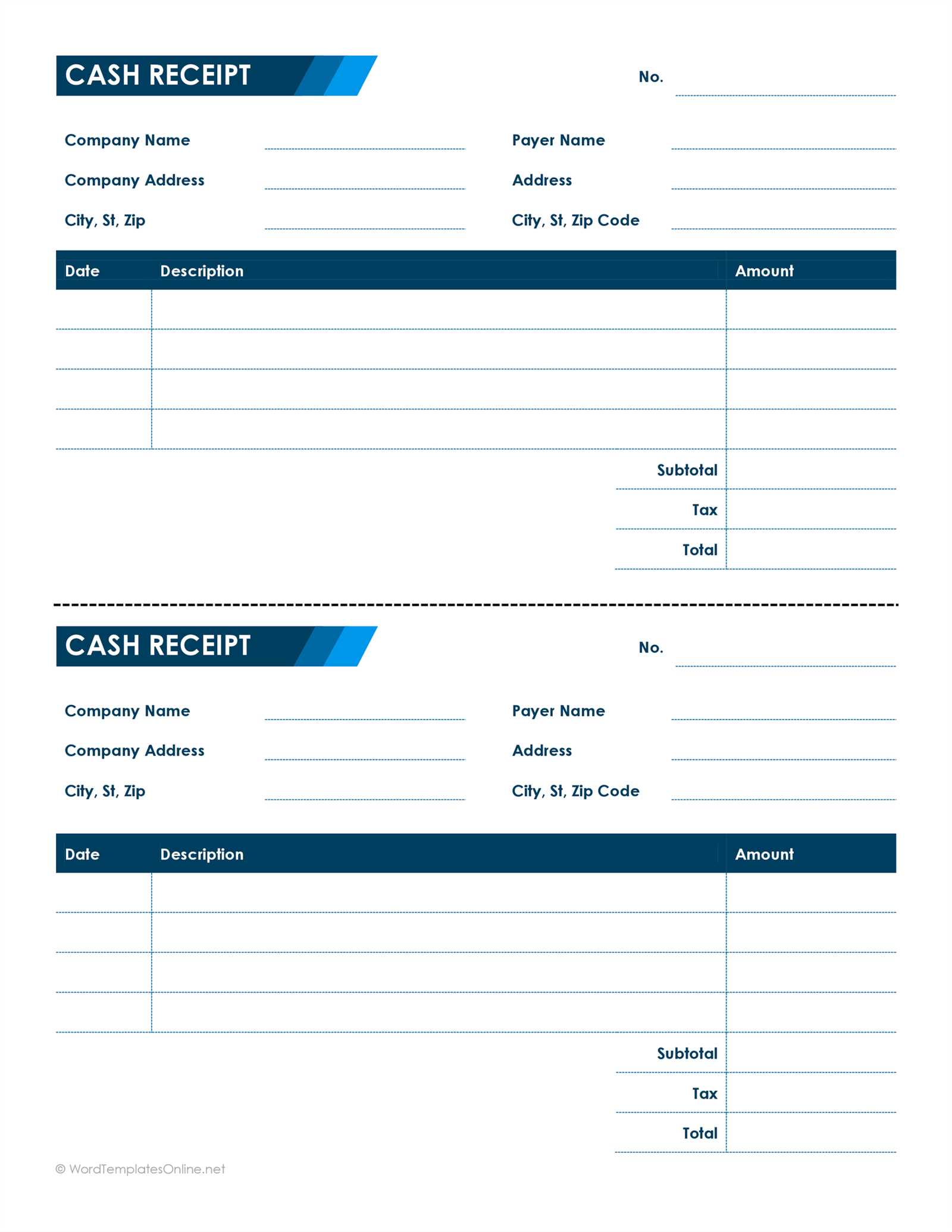

A cash receipts from customers template helps track payments received for goods or services. It ensures accurate record-keeping and simplifies accounting processes. Use this template to capture critical payment details, including customer name, date, amount, and payment method. Proper use of this template can improve cash flow management and financial reporting.

Key Components

- Customer Information: Include the customer’s name and contact details to ensure payments are correctly assigned.

- Date: Record the payment date for proper accounting in your financial period.

- Amount: Specify the exact amount received to maintain accurate records.

- Payment Method: Note whether the payment was made by cash, check, or credit card for easy reconciliation.

- Invoice Number (optional): Include this for payments related to specific invoices, helping you link payments to outstanding balances.

How to Use the Template

- Start by filling out the customer’s name and contact details.

- Enter the payment date and the total amount received.

- Choose the payment method to reflect how the payment was made.

- If applicable, associate the payment with an invoice number for precise tracking.

- Review all entries for accuracy before saving the information.

By maintaining this template regularly, you can ensure consistent tracking of customer payments and avoid discrepancies in your financial records.

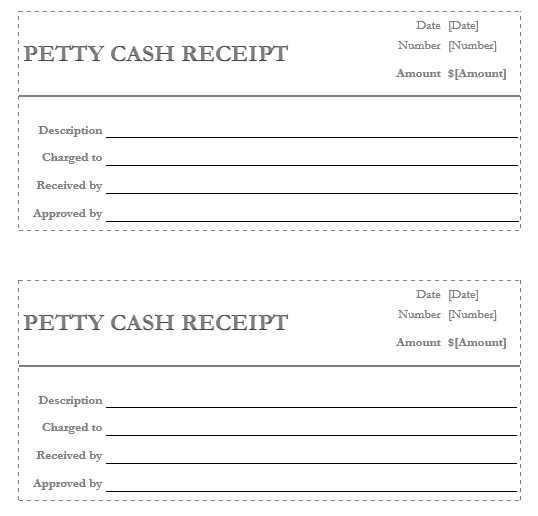

Start by organizing the key details of every transaction. Include columns for the customer name, payment date, invoice number, amount paid, and method of payment. This simple setup allows you to easily track and manage cash receipts without missing any details.

Next, incorporate a column for the payment status. This can be marked as “paid,” “pending,” or “overdue.” Including this helps you quickly identify outstanding payments, and it acts as a reminder for follow-up actions.

For better organization, use a separate row for each transaction. This ensures clarity and avoids confusion when reviewing payments. You can also add a column for notes to track any special agreements or partial payments made by customers.

Consider adding a summary section at the bottom of your template. This section should automatically calculate totals for each payment method and give a grand total of all receipts. This gives a clear picture of cash flow at a glance.

Finally, review your template regularly to ensure it remains accurate and up to date. Adjust columns or add any new fields as your business needs evolve. Keeping your payment tracking system simple and structured saves time and avoids costly mistakes.

Adjust the layout of your cash receipts template to match the specifics of each payment method. For credit card payments, include fields for the card type, authorization number, and payment gateway details. For cash payments, ensure there is space for the amount received and the cashier’s initials. When dealing with bank transfers, add sections for the transaction reference number and the date the transfer was processed.

For online payments via services like PayPal or Stripe, incorporate areas for payment confirmation numbers and transaction IDs. Each payment method should have a clear and concise section for amounts and relevant details, ensuring all transactions are easily identifiable and traceable.

Consider customizing your template further by adding a drop-down menu for payment types. This helps streamline the process and minimizes errors. Align your template with each payment method’s unique requirements to keep your records accurate and organized.

Ensure that cash receipts are recorded accurately in your accounting software. Set up automated entry systems that allow real-time tracking of cash inflows. This reduces errors and prevents discrepancies when reconciling records.

Link Payment Methods to Your Accounting Software

Connect your payment processing systems (e.g., point-of-sale, online payment gateways) directly to your accounting software. This seamless integration ensures that every payment, whether cash or card, automatically updates your financial records. This minimizes manual entry and reduces the risk of errors in the cash tracking process.

Regular Reconciliation and Audits

Perform regular reconciliations between your cash receipts records and your bank statements. Set aside specific times each month to compare your system’s data with actual bank deposits. This practice identifies any discrepancies early, allowing for prompt corrections.

Streamlining Cash Receipts from Customers

Focus on removing redundant phrases and simplifying sentences while preserving the core message. Begin by reviewing each sentence for repetitive terms or ideas that don’t add new information. For example, replace “The payment from the customer was received” with “The customer made a payment.” This keeps the sentence concise and clear. Organize information logically, grouping related actions together to avoid unnecessary elaboration. Clarify complex details into straightforward statements. Edit out words like “actually,” “basically,” or “really” as they don’t contribute meaningfully to the content. Aim for directness and precision in every line.