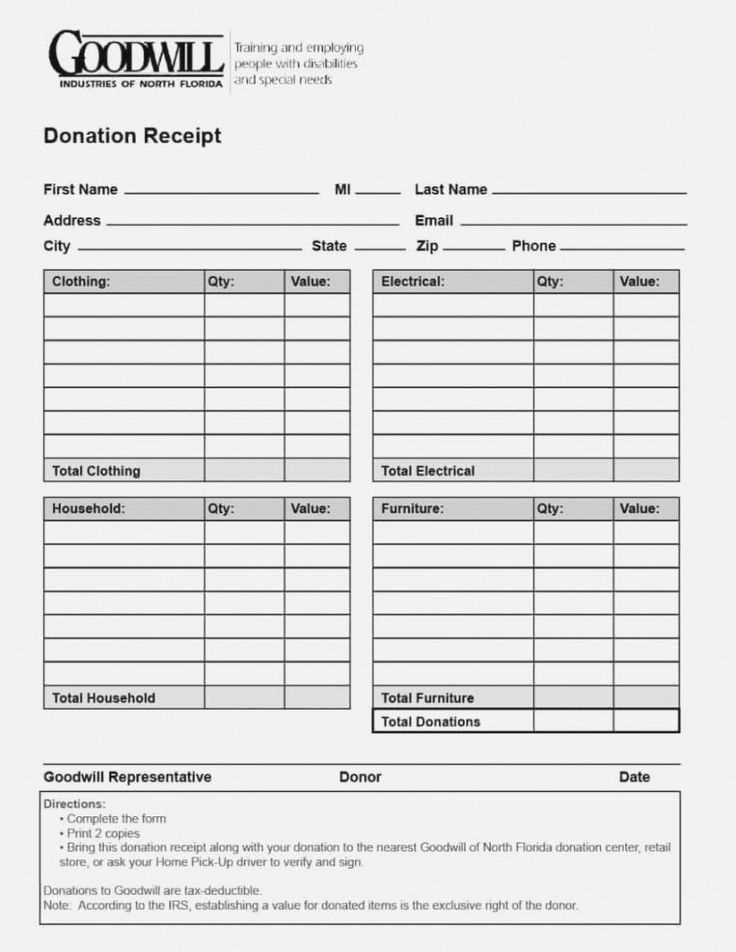

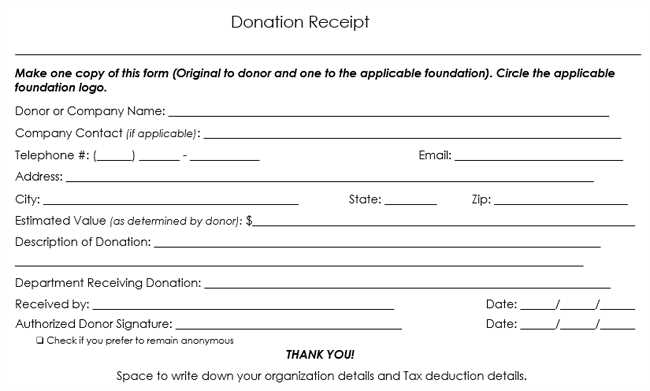

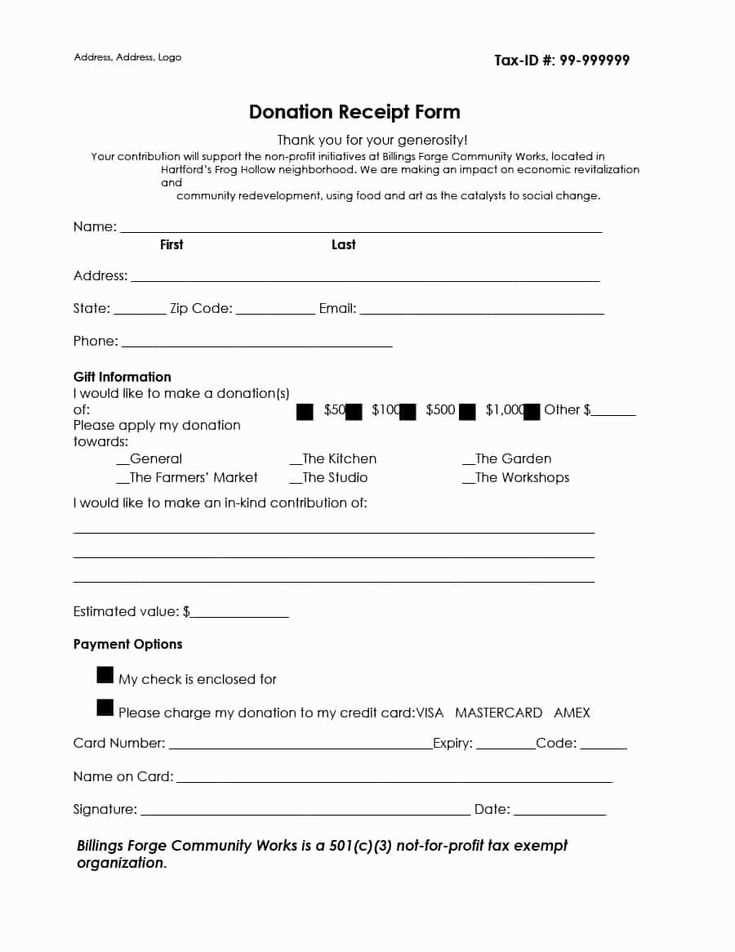

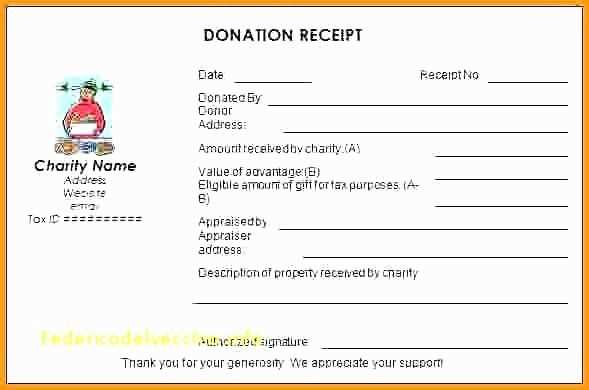

Creating a donation tax deduction receipt is straightforward when you include the necessary details. The template should clearly state the donor’s name, the charity’s name, and the amount donated. Make sure to include the date of the donation and any description of the items donated, if applicable. A receipt can only be used for tax deductions if it contains specific information such as the charity’s tax identification number and a statement confirming whether the donor received any goods or services in return.

Key elements to include are the donation amount, donor details, and a signature from the charity. If the donation is in the form of goods, list those items with their estimated fair market value. For cash donations, a clear amount is necessary. For non-cash donations, be sure to provide a brief description of the items or services given. A thank you note is often included to show appreciation for the donor’s generosity.

When you prepare a template, ensure it follows all local tax requirements and charity regulations. Customize it to fit your charity’s needs, but avoid cluttering the document with unnecessary information. This simple structure will help maintain clarity and make the receipt easily recognizable for tax filing purposes.

Sure! Here’s a version with minimal repetition of words:

Provide the donor’s name, contact information, and donation amount. If the donation is in-kind, describe the items and their estimated value. Ensure you include the date and your organization’s name, along with a statement confirming the donation is tax-deductible.

Detailed Information on the Receipt

If goods or services were received in exchange, include a description and their value. Clearly indicate whether the donor received anything in return for their gift, which will affect the tax-deductible amount.

Final Steps

End the receipt with a signature from an authorized representative. Both parties should keep a copy of the receipt for their records, ensuring compliance with tax regulations.

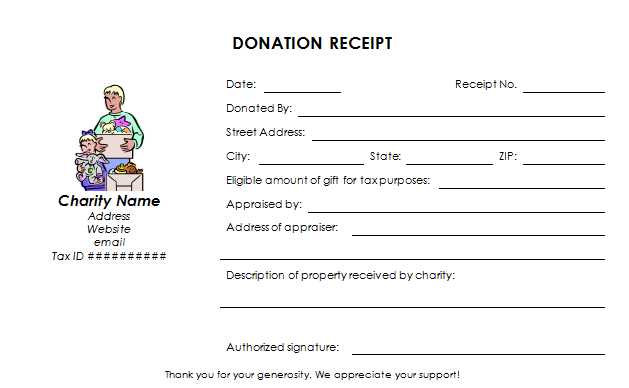

- Donation Tax Deduction Receipt Template

When creating a donation tax deduction receipt, make sure it includes all the necessary details for both the donor and the organization. A well-structured receipt will ensure the donor can claim their tax deduction with confidence. Here’s a simple breakdown of what should be included:

Key Components of the Template

Include the name and address of your organization at the top, followed by the donor’s name and address. Clearly specify the donation amount and the type of donation (whether cash, goods, or services). If the donation involves goods, describe them in detail along with an estimate of their fair market value. Also, ensure to include the date of the donation and a statement confirming whether any goods or services were provided in exchange for the contribution.

Additional Information for Accuracy

Ensure the receipt includes a statement of acknowledgment for the donation, confirming the organization’s tax-exempt status. For larger donations, you may want to include the organization’s EIN (Employer Identification Number). This guarantees the donor that the receipt is valid for tax purposes. Finally, always provide space for your signature or a representative’s signature, which adds authenticity to the document.

A well-crafted donation receipt includes specific details to meet legal and tax requirements. Here are the components that must be included:

1. Donor’s Information

Include the donor’s full name and address. If the donation is from a business, list the organization’s name and address.

2. Date of Donation

Clearly state the date the donation was made. This helps donors when filing their taxes for the applicable year.

3. Amount of Donation

Specify the monetary value of the donation. If non-monetary items were donated, provide a description and, if possible, an estimated value.

4. Organization’s Information

Include the legal name, address, and tax identification number (TIN) of the charity receiving the donation. This validates the receipt for tax purposes.

5. Statement of Non-Refundability

Acknowledge that the donation is non-refundable, ensuring clarity for both the donor and the charity.

6. Acknowledgement of No Goods or Services Received

If the donation was fully tax-deductible, include a statement confirming that the donor did not receive any goods or services in return.

7. Specific Purpose (if applicable)

If the donation was restricted for a particular purpose, mention the intent of the donation. This shows the donor’s commitment to a specific cause or project.

8. Signature of Authorized Person

Sign the receipt or have an authorized person from the charity sign it. This adds authenticity and credibility to the document.

Clearly state the name and address of the organization receiving the donation, along with its tax-exempt status number. Include the donor’s full name and address to ensure proper identification for tax purposes.

Detail the donation amount or describe the donated goods and their estimated value. For monetary donations, list the exact amount given. For non-cash donations, describe the items and provide a reasonable valuation for each one. Avoid vague descriptions–be as specific as possible.

If applicable, note whether the donor received any goods or services in return for the donation. If a benefit was provided, deduct the value of that benefit from the total donation amount to calculate the deductible value. This is important to make the donation tax-deductible.

Include the date of the donation and ensure that the receipt is signed by an authorized person from the organization. This signature confirms the validity of the receipt and its tax-deductible status.

Ensure your donation receipts include accurate donor details. Double-check the name, address, and donation amount before issuing. Even minor mistakes can delay tax deductions for donors.

1. Incorrect or Missing Date

Always include the correct date of the donation. The date must match the actual donation date to avoid confusion. Omitting or providing an incorrect date can lead to complications with tax filings.

2. Missing Organization Details

Failure to provide your organization’s full legal name and tax identification number (TIN) can invalidate the receipt. These details are necessary for donors to claim their tax deductions.

3. Incomplete Donation Description

For non-monetary donations, ensure you describe the item(s) received clearly. Include the item’s condition and, if possible, its fair market value. Lack of this detail can cause confusion for donors and tax authorities.

4. Failing to State Goods or Services Provided

If you provide goods or services in exchange for a donation, clearly indicate their value. Donors can only claim deductions for the portion of their donation exceeding the fair value of any goods or services received.

5. Incorrect Donation Amount

For cash donations, always ensure the exact amount is specified. For check or bank transfers, include the correct transaction details. A mismatch between the donation recorded and the amount claimed can cause complications during audits.

6. Failure to Include a Statement on Non-Refundability

For tax purposes, donors need to be informed that donations are non-refundable. Including a statement on your receipt helps clarify this aspect of the donation.

7. Not Using the Proper Format

Different jurisdictions may have different rules for donation receipts. Research and adhere to local regulations regarding the required content and format of your receipts.

| Error | Impact | Solution |

|---|---|---|

| Incorrect or Missing Date | Donor’s tax deduction may be delayed | Always verify the date before issuing the receipt |

| Missing Organization Details | Invalid receipt for tax purposes | Ensure your organization’s name and TIN are listed correctly |

| Incomplete Donation Description | Confusion over the value of non-cash donations | Clearly describe any non-cash items and their fair market value |

| Failure to State Goods or Services Provided | Donor may not know how much they can deduct | List the fair value of any goods or services given |

| Incorrect Donation Amount | Tax filing errors | Double-check donation amounts before finalizing receipts |

| Failure to Include Non-Refundability Statement | Tax filing complications | Include a statement about the non-refundable nature of donations |

| Improper Format | Receipt may not be accepted by authorities | Follow the relevant local laws for formatting and content |

Donation Tax Deduction Receipt Template

A donation tax deduction receipt should include the following key details to ensure its validity for tax purposes:

- Donor Information: Include the donor’s full name, address, and contact information.

- Organization Information: Provide the name, address, and tax identification number (TIN) of the charitable organization.

- Donation Details: Clearly state the amount donated or the description of donated items, including their fair market value if applicable.

- Date of Donation: The exact date of the donation should be included for accurate record-keeping.

- Receipt Statement: A declaration that no goods or services were provided in exchange for the donation, if applicable.

Additional Information

- Signature: The authorized signature of a representative from the charitable organization may be required in some cases.

- Charitable Status: Mention the organization’s tax-exempt status, such as being registered under 501(c)(3) in the U.S.

Ensure that all details are accurate and provide the receipt promptly to the donor for their tax filing purposes.