Keep your financial records organized with a well-structured business receipt book template. A properly designed template ensures clear documentation of transactions, making it easier to track payments, manage taxes, and maintain accurate records for clients and internal use.

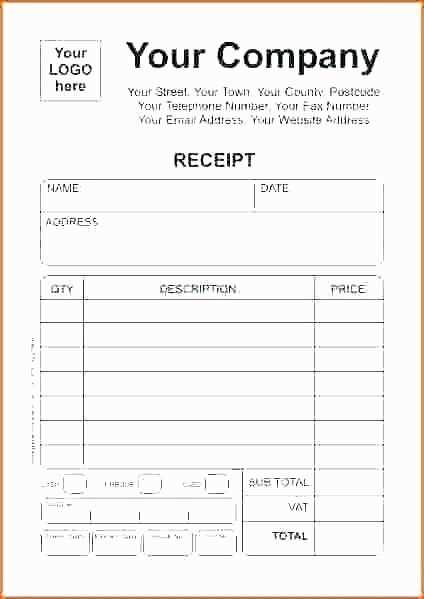

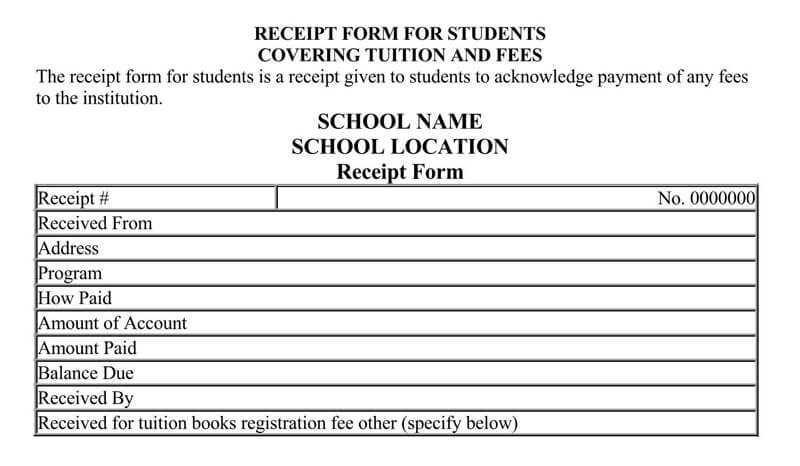

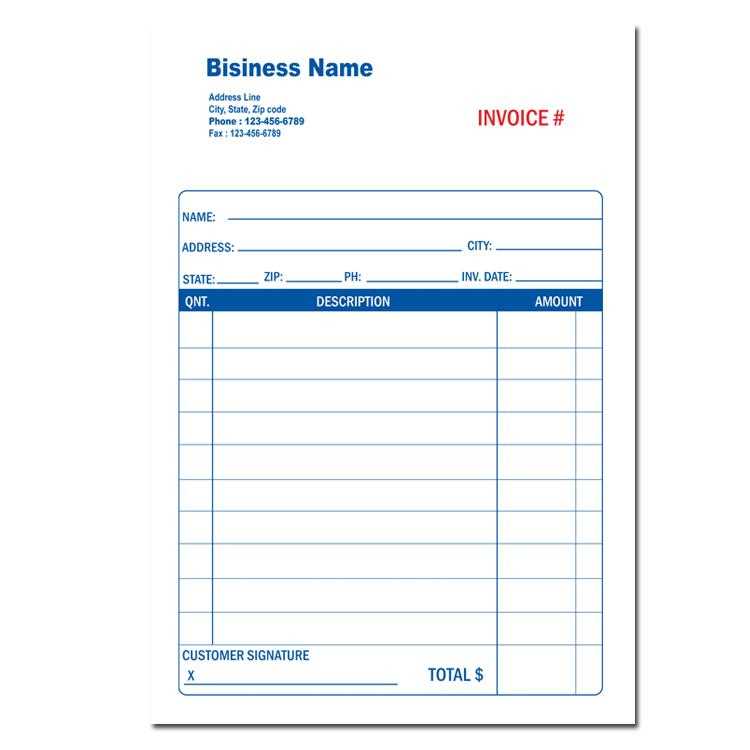

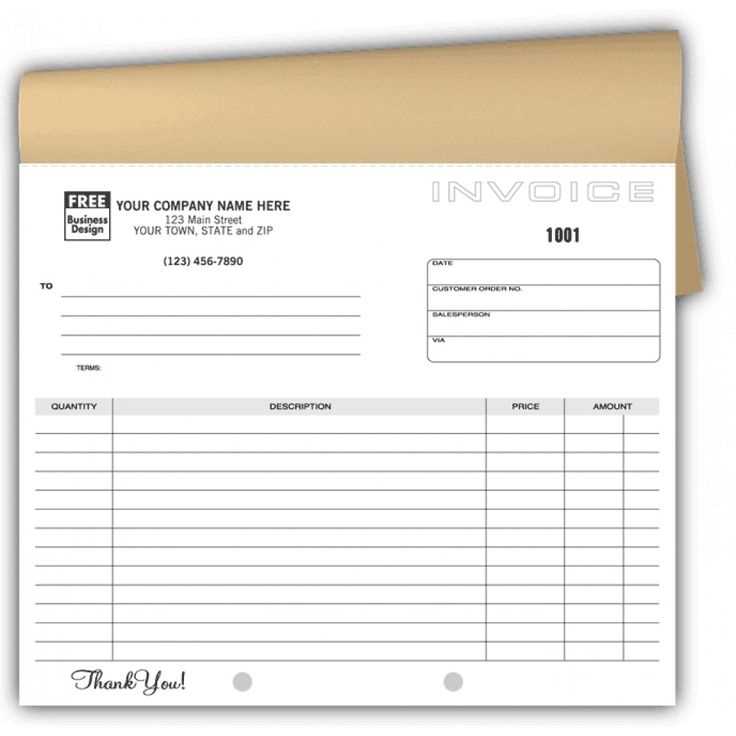

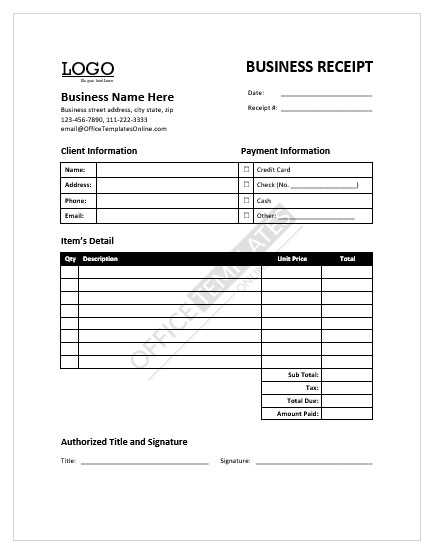

A reliable template should include key details such as the date, transaction amount, payment method, and a description of goods or services. Adding fields for the recipient’s and issuer’s names, along with a unique receipt number, improves traceability and minimizes errors. For businesses handling frequent transactions, a sequential numbering system simplifies record-keeping.

Customization is a crucial factor in creating a practical template. Depending on the nature of the business, you may need additional fields such as tax breakdowns, discount details, or terms of payment. Digital and printable formats provide flexibility, allowing you to generate receipts manually or through accounting software.

Whether you need a simple layout for occasional use or a structured design for high-volume transactions, a clear and functional receipt book template helps maintain transparency and professionalism in financial operations.

Business Receipt Book Template

Choose a template with preformatted sections for date, transaction details, payment method, and signatures. This structure ensures every receipt is clear and legally compliant.

Key Features to Include

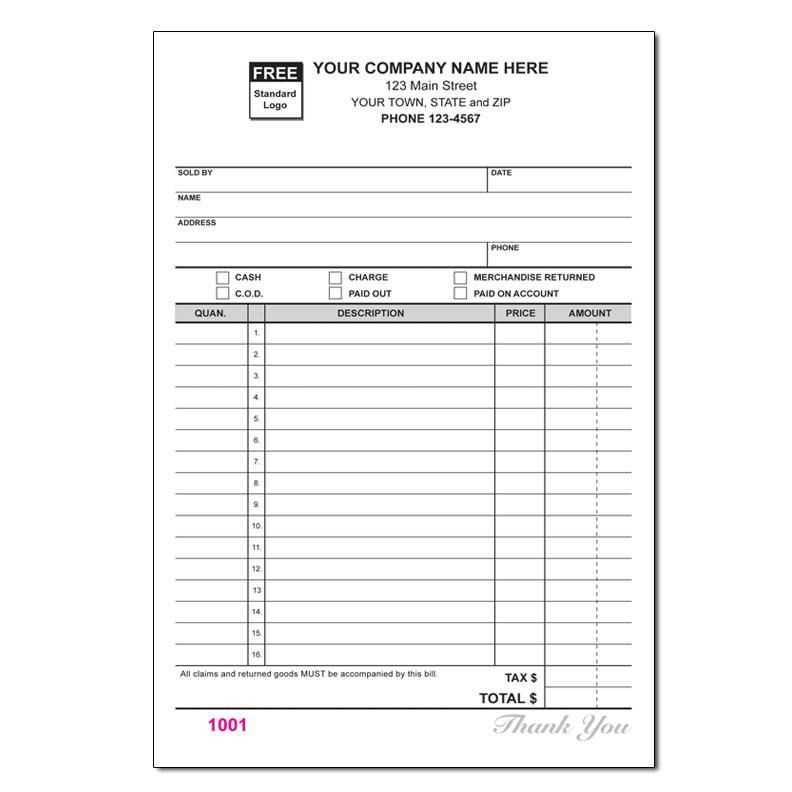

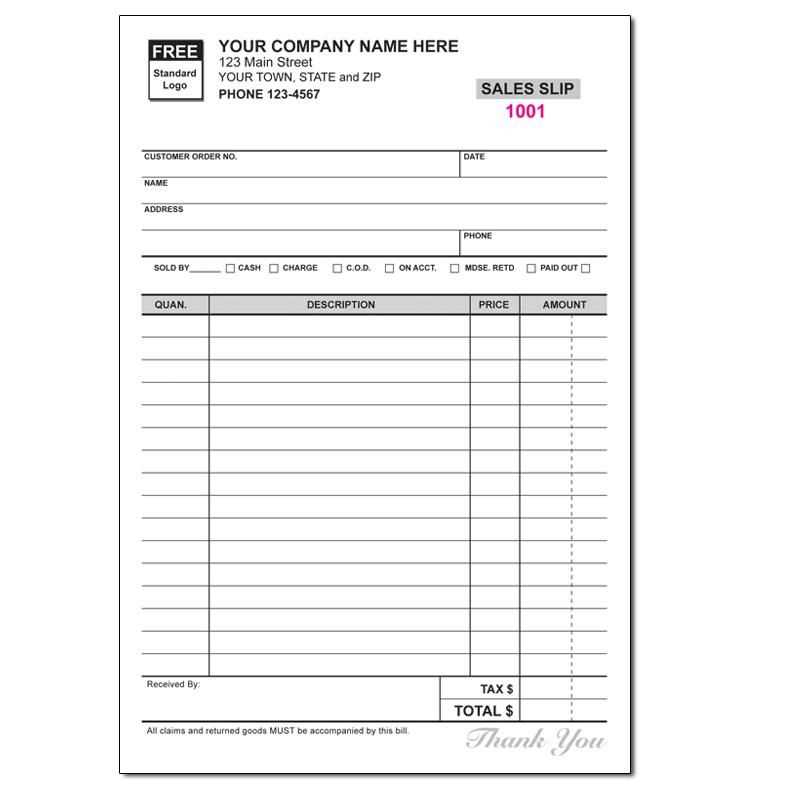

Opt for numbered pages to maintain accurate records and prevent duplication. A duplicate copy, whether carbon or digital, allows for easy tracking. Make sure the layout includes fields for taxes, discounts, and total amounts to avoid miscalculations.

Customization Options

Incorporate your company’s logo and contact details for a professional look. Adjustable templates let you modify fonts, colors, and spacing to match your branding. For added security, consider watermarking or serial numbering each receipt.

Whether printed or digital, a well-structured receipt book streamlines transactions and reinforces professionalism.

Key Elements to Include in a Receipt Book Template

Ensure every receipt captures essential transaction details to maintain accurate records and streamline bookkeeping. A well-structured template should include the following:

Basic Transaction Information

- Date of Transaction: A clear record of when the payment was made.

- Receipt Number: A unique identifier for tracking and organization.

- Seller’s Details: Business name, address, and contact information.

- Buyer’s Information: Name and contact details, especially for large transactions.

Payment and Itemized Details

- Items or Services Provided: A detailed list with descriptions and quantities.

- Price Breakdown: Cost per item, applicable taxes, and total amount.

- Payment Method: Cash, card, bank transfer, or other forms of payment.

- Authorized Signature: A space for verification by the seller or buyer.

Including these elements ensures clarity, prevents disputes, and keeps financial records in order.

Formatting and Structuring Receipts for Clarity

Use a clear, legible font such as Arial or Times New Roman, ensuring all text is easy to read. Keep font sizes consistent, with headings slightly larger than itemized details.

Align text properly. Place business details at the top, followed by the date and receipt number. List purchased items in a structured table or aligned columns, separating descriptions, quantities, unit prices, and totals.

Highlight key information. Use bold text for totals, taxes, and payment methods to make them stand out. Keep sections distinct with spacing or lines for better readability.

Ensure logical flow. Start with seller details, then transaction specifics, and end with a summary of charges and payment confirmation. Include a clear note for returns, warranties, or contact details if applicable.

Maintain uniform formatting across all receipts to create a professional and recognizable document. Consistency improves comprehension and reduces potential disputes.

Choosing the Right Medium: Digital vs. Paper Receipt Books

Go digital for automation and convenience. Digital receipt books reduce errors, speed up transactions, and integrate with accounting software. Cloud storage ensures records are always accessible, and automated backups prevent data loss. Customers appreciate emailed receipts, which they can retrieve anytime without clutter.

Stick to paper for reliability and legal needs. Some businesses require physical copies for tax purposes or customer preferences. Handwritten receipts work without internet access and remain valid even if a device fails. Carbonless duplicates provide instant copies, making them practical for service professionals.

Combine both for flexibility. Use digital receipts for efficiency while keeping a paper option for clients who prefer it. Many modern receipt printers allow printing and emailing simultaneously, ensuring compliance and convenience. Adopting a hybrid approach keeps all customers happy and simplifies record-keeping.