When you provide child care services in the UK, creating a clear and accurate receipt is a key part of maintaining transparency and professionalism. A child care receipt template allows both parents and carers to keep track of payments made for services rendered. This template typically includes key information such as the carer’s name, the child’s name, service dates, and the total amount due.

The receipt should clearly state the amount charged for each session or service provided, any additional fees, and the total amount payable. It is crucial to include the date of service and payment method used to ensure accurate record-keeping. These details help avoid any confusion or disputes and ensure smooth transactions between carers and parents.

A simple template can streamline the process, making it easier for you to provide the necessary documentation without spending excessive time on paperwork. Ensure your template reflects all required information, and make it accessible for easy updates each time a payment is made.

Sure, here is the revised version with reduced repetition of words:

Begin by including the following details on your child care receipt:

- Provider’s Name and Contact Information: Clearly state the full name of the child care provider along with their phone number and email address.

- Date of Service: Indicate the exact dates for which the service was provided, specifying the hours of care for each day.

- Child’s Name: Mention the child’s full name to ensure there is no confusion regarding the service recipient.

- Fee Breakdown: List the hourly or daily rate and the total amount charged. If any discounts were applied, include those details as well.

- Payment Method: Indicate whether the payment was made via cash, bank transfer, or any other method.

- Provider’s Signature: Include the signature of the provider to validate the receipt and ensure its authenticity.

Keep this document as a record for tax or financial purposes, especially if you are claiming child care expenses. This structured approach guarantees clarity and completeness in your receipt.

- Child Care Receipt Template UK

Include the following details in your child care receipt: provider’s full name, business name (if applicable), address, phone number, and email. Specify the child’s name, the care dates, and the number of hours worked.

Payment Information: Clearly state the total amount paid, the method of payment (cash, bank transfer, etc.), and any additional charges, such as VAT or transportation fees. If the payment is in installments, note the amount already paid and any balance remaining.

Signatures: Both parties should sign the receipt to confirm the details. If it’s a digital receipt, ensure the provider’s email or digital signature is included.

Records: Keep a copy for both the caregiver and the parent for reference and tax purposes. This will help maintain clear and organized financial documentation.

Include the date the payment was made. This helps track the transaction and ensures clarity for both parties.

State the name of the child care provider. This identifies the person or service to whom the payment is being made.

Detail the amount paid. Be specific about the amount for each service provided, including hourly or daily rates if applicable.

Describe the services rendered. Include the time or number of days covered by the payment, as well as the type of care provided.

Note any outstanding balance, if applicable. If this payment is part of an ongoing agreement, make sure to mention how much remains due.

Include the payment method used. Whether it’s cash, check, or bank transfer, noting this adds legitimacy to the receipt.

Sign the receipt. A handwritten or electronic signature from the provider adds authenticity and confirms the transaction.

Clearly state the full name of the childcare provider, including any business name if applicable. Include the address and contact details, such as an email address or phone number, so the recipient can easily reach out for follow-up inquiries.

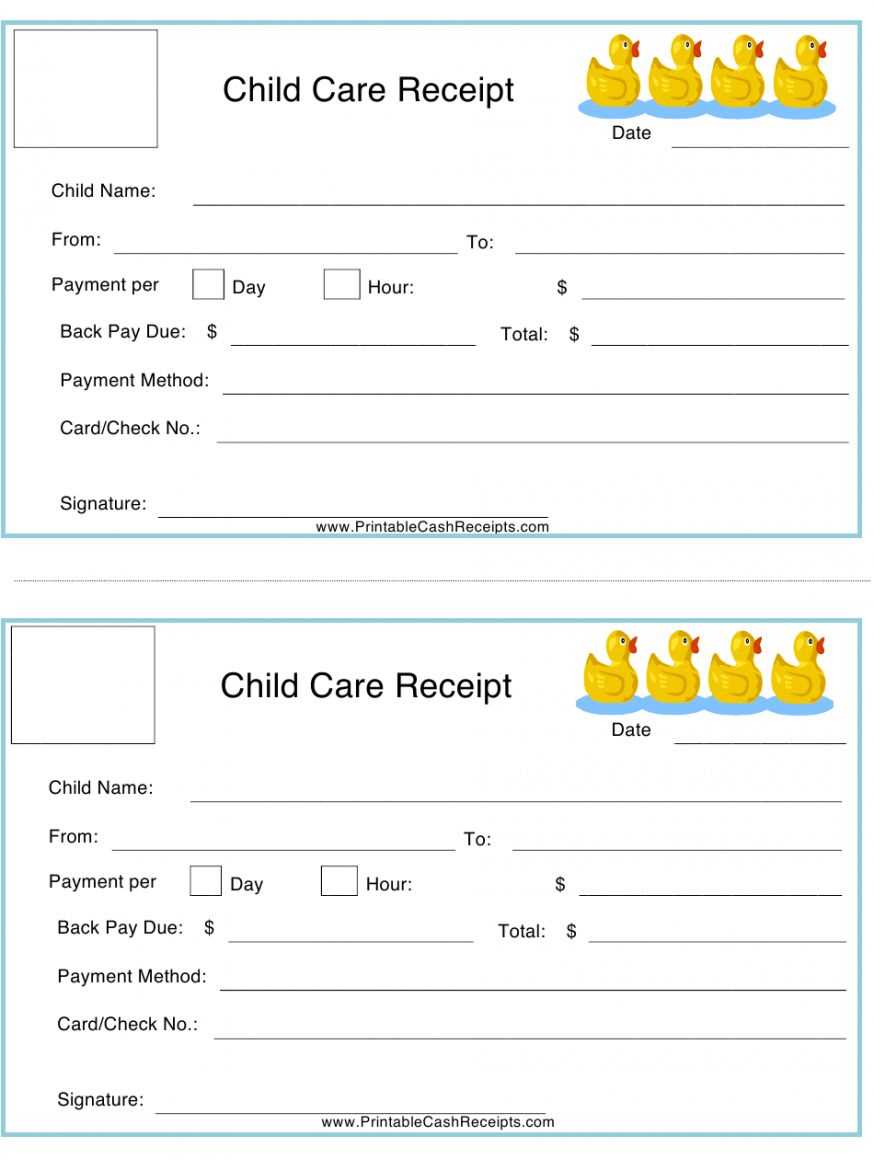

Specify the date when the payment was received. It is important to include both the day and month for accuracy and record-keeping.

List the child’s full name and age. This clarifies which child the care pertains to, especially if the provider cares for multiple children.

Outline the total amount paid for childcare services. Clearly indicate the amount and the payment method used, whether by cheque, bank transfer, or another method.

Detail the period for which childcare services were provided, including the start and end dates. This ensures the recipient understands which service period the payment covers.

Include any relevant reference numbers, such as an invoice number or transaction code. This adds another layer of clarity and allows for easier tracking of payments.

Lastly, provide a brief description of the service rendered, such as the hours of care or specific activities performed, to clarify the terms of the payment.

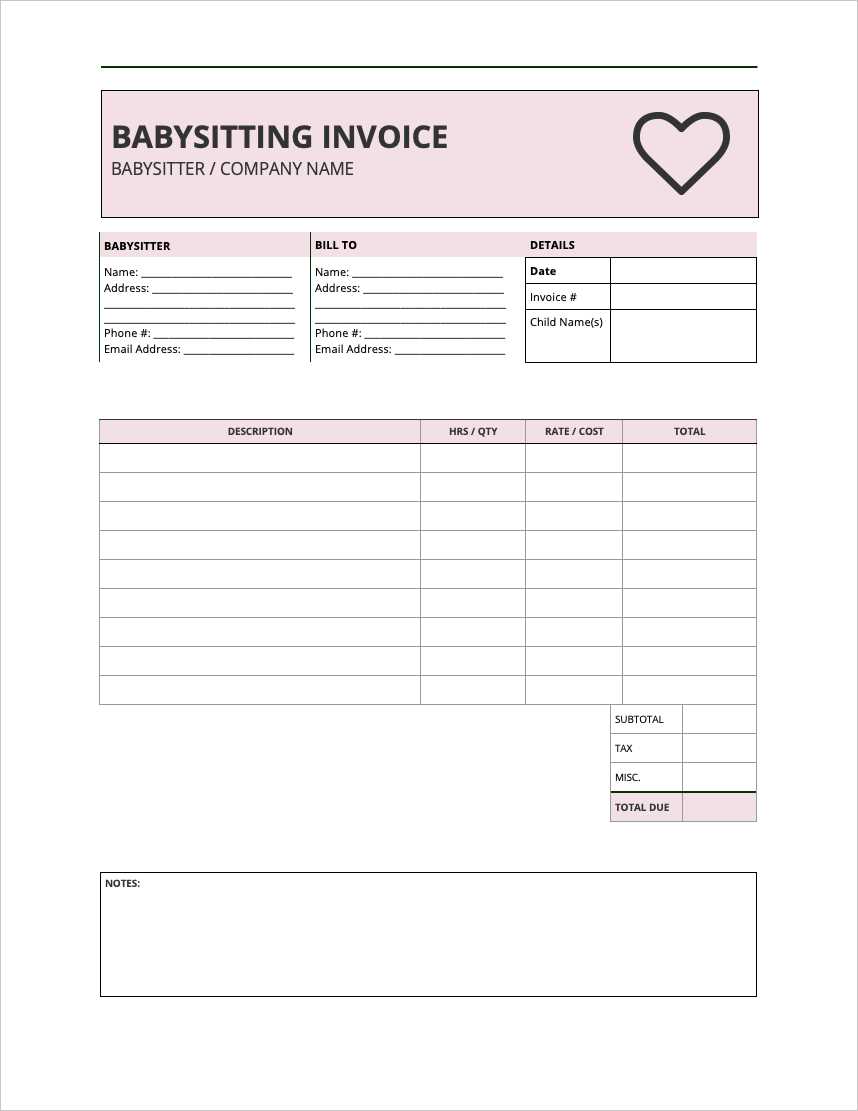

Begin with a clear, bold title at the top, such as “Child Care Receipt” or “Child Care Services Receipt.” This ensures the purpose of the document is immediately evident. Include the date of service next, followed by the provider’s name and contact details. This helps in case any follow-up is needed. Make sure the recipient’s details, including name and address, are correctly listed, ensuring there’s no confusion regarding the recipient of the care services.

Break down the services provided in an itemized list. Include the number of hours worked, the hourly rate, and any additional fees, such as travel or material costs. This clarity prevents misunderstandings and allows for easy tracking of costs. Use bullet points for each service and a clear, concise description of what each charge covers.

End the receipt with a total amount due, ensuring it is prominently displayed. A simple table format can help in organizing charges clearly. If applicable, include payment instructions and your preferred payment methods. Always leave space for the signature of the provider, confirming the accuracy of the details. This ensures both parties agree to the transaction.

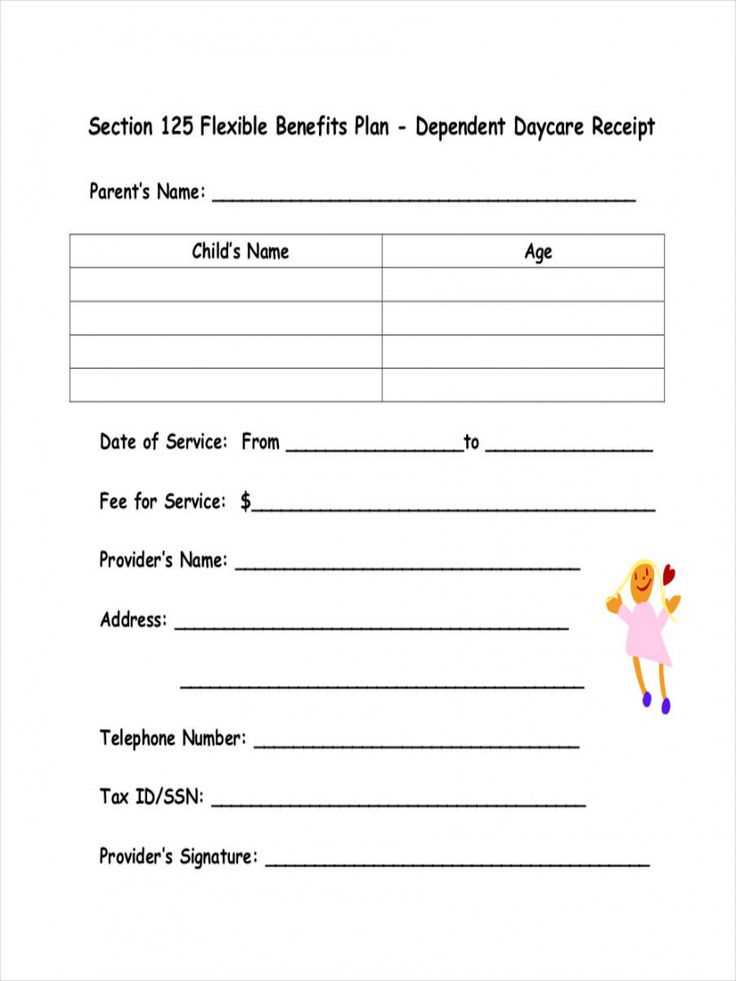

In the UK, child care receipts must meet specific legal requirements to be valid for tax and financial purposes. These receipts must provide clear and accurate details to ensure that they comply with HMRC guidelines. Keep in mind the following key requirements:

1. Required Information on the Receipt

A valid child care receipt should contain the following details:

| Information | Details |

|---|---|

| Provider’s Name | Must include the full name of the child care provider or business. |

| Address of the Provider | The provider’s address should be clearly stated. |

| Date of Service | Each receipt should include the specific date(s) the service was provided. |

| Amount Paid | Clearly state the total amount paid for the child care service. |

| Payment Method | Indicate how payment was made (e.g., cash, bank transfer). |

| Tax Registration Number | If the provider is VAT registered, the tax number must be included. |

2. Specific Requirements for Tax Relief

If you are claiming tax relief or using the receipts for child care voucher schemes, the receipts must meet additional criteria. These include having the correct details for the specific scheme you’re claiming under. Receipts that fail to meet these requirements may result in delays or the rejection of your claim.

For a seamless experience, tailor the template to accommodate different payment methods by adding specific fields. If payments are made via bank transfer, include sections for account number and reference code. For card payments, offer spaces to input card type, last four digits, and transaction approval number. Cash payments can be acknowledged with a simple check-box or a note specifying the amount received.

Each payment method should be clearly labelled in the template to avoid confusion. Include a dropdown menu or checkboxes for the payer to easily select their payment method. Ensure the total amount is automatically updated based on the selected payment type. Add an additional field to capture payment date and confirm the payment status, such as “Paid” or “Pending,” for better tracking.

For recurring payments, create an editable field for the payer to enter the payment frequency, such as weekly, monthly, or yearly. If you’re offering a discount for early payments or a late fee for delayed payments, include those options with automatic calculations to adjust the amount accordingly.

Ensure the receipt includes the full name of both the carer and the person receiving care. Omitting one of these can cause confusion and reduce the receipt’s validity. Double-check that the dates of service are correct and match the care provided. Incorrect or missing dates can lead to issues with reimbursement claims or tax submissions.

Don’t forget to clearly specify the total amount paid for care services. A vague or incomplete payment amount can lead to disputes or misunderstandings. Also, avoid using generic descriptions. Always specify the exact service or care provided, such as “babysitting for 5 hours” or “child care on 01/03/2025,” rather than just “child care.”

Ensure you provide the correct payment method, whether it’s cash, cheque, or bank transfer. Lack of detail in this area can make the receipt appear incomplete and raise questions later. Always issue receipts promptly after receiving payment, rather than waiting too long, as this can cause problems if the receipt is required for tax purposes or a claim.

To create a child care receipt template in the UK, ensure it includes the following key details:

- Child’s Name – Clearly specify the name of the child receiving care.

- Caregiver’s Information – Include the caregiver’s name, contact details, and registration number (if applicable).

- Date and Duration – Record the date(s) of care and the hours provided on each day.

- Amount Paid – Specify the total amount paid for the care services, breaking it down by day if necessary.

- Payment Method – Indicate how the payment was made (e.g., cash, bank transfer).

- Terms and Conditions – Add any applicable terms, such as cancellation policies or refunds.

Formatting Your Template

Use clear and concise labels for each section. Include spaces for signatures from both the caregiver and the parent to confirm the transaction.

Legal Considerations

Ensure your template meets the minimum legal requirements for child care records in the UK, including keeping accurate records for tax and benefits purposes.