Clear Structure for Payroll Records

Ensure every payroll receipt includes essential details to avoid misunderstandings. List the company name, employee information, payment date, and amount paid. A structured layout improves clarity and simplifies record-keeping.

Key Elements to Include

- Company Information: Business name, address, and contact details.

- Employee Details: Full name, job title, and employee ID (if applicable).

- Payment Breakdown: Gross pay, deductions, and net amount received.

- Date and Signature: Both employer and employee should sign for verification.

Simple Format for Consistency

Maintain uniformity in payroll documentation by using a clear and concise format. A structured template helps track financial transactions accurately and meets compliance requirements.

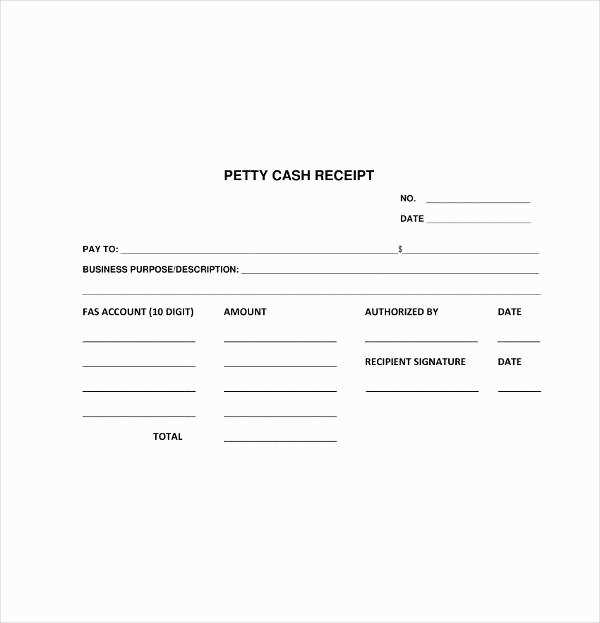

Example Template

Use the following format for a professional payroll receipt:

Company Name: [Your Business Name] Address: [Company Address] Contact: [Phone or Email] Employee Name: [Full Name] Job Title: [Position] Payment Date: [MM/DD/YYYY] Gross Pay: $[Amount] Deductions: $[Amount] Net Pay: $[Final Amount] Employer Signature: __________ Employee Signature: __________

Providing a clear and standardized receipt ensures smooth payroll processing and avoids discrepancies.

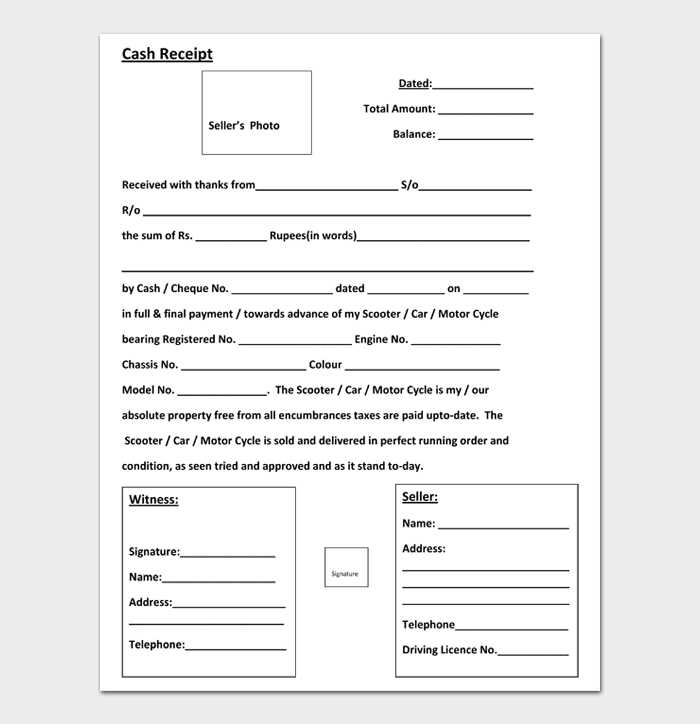

Cash Payroll Receipt Template

A well-structured cash payroll receipt ensures clarity in wage payments and serves as proof of compensation for employees. Include essential details such as employee name, payment date, hours worked, gross pay, deductions, and net pay. A unique receipt number helps track records efficiently.

Key Aspects of a Cash Wage Slip

Accuracy is critical when issuing wage slips. Clearly state the pay period, breakdown of earnings, and any deductions such as taxes or benefits. Signatures from both employer and employee add legitimacy, confirming receipt and agreement on payment details.

Customizing a Payroll Receipt for Your Business

Tailoring wage receipts to company needs improves record-keeping. Add a business logo, adjust formatting for readability, and incorporate necessary legal disclaimers. Digital or printed copies should be securely stored for compliance and future reference.

Legal Factors in Using Cash Payroll Slips

Compliance with labor laws is essential when handling cash payments. Ensure deductions align with tax regulations and that employees receive written confirmation of wages. Keeping detailed records prevents disputes and supports audits if required.