Creating an ABN receipt template is straightforward, but it requires attention to accuracy. The Australian Business Number (ABN) is crucial for tax purposes, and every receipt issued by a business should include this number. It serves as proof of your business identity, which is essential for compliance with the Australian Taxation Office (ATO) regulations.

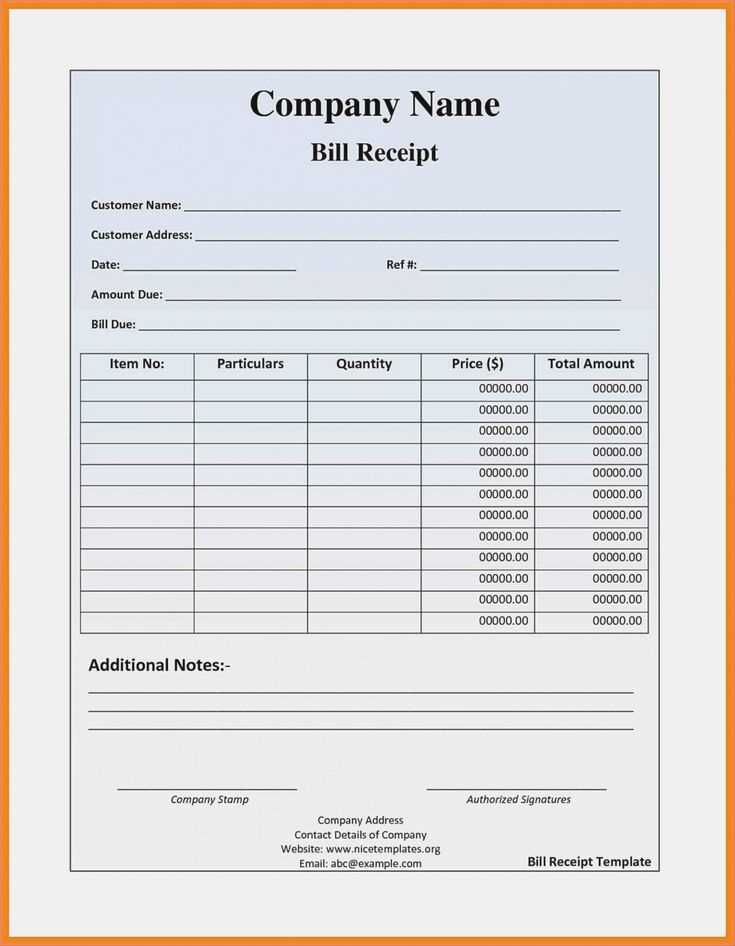

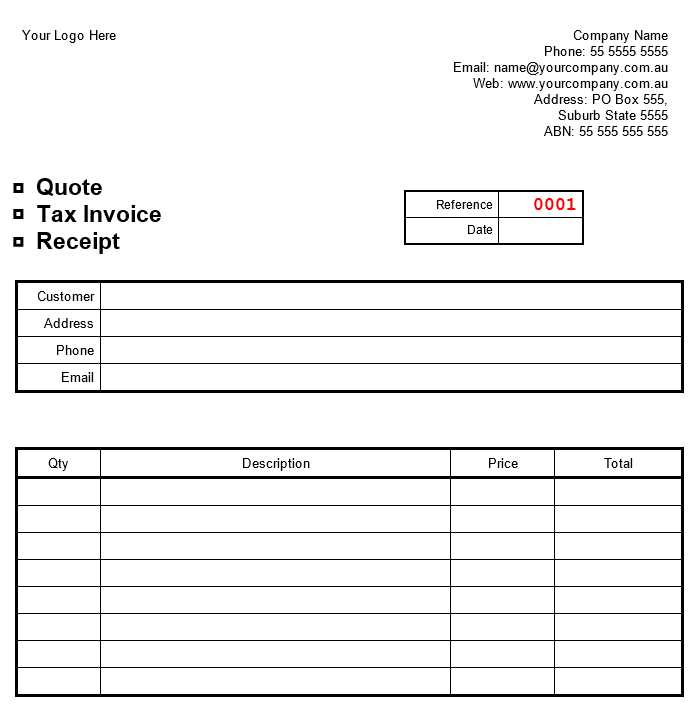

A well-designed ABN receipt template should feature clear fields for transaction details, such as the date of purchase, item description, and the amount paid. Make sure to include a line for your business name, ABN, and contact details. This not only ensures clarity for both you and your client but also serves as a valid document for record-keeping and tax reporting.

Use a simple format that highlights the necessary components without overwhelming the user. You can incorporate automated fields to streamline the process, ensuring all required information is captured consistently every time. This minimizes the risk of missing details that could affect the validity of your receipts in case of audits or disputes.

Finally, consider storing your ABN receipt templates in digital format, allowing for easy access and printing whenever necessary. This digital method ensures you can manage and update your receipts with minimal effort while keeping your documentation organized.

Here’s the corrected version:

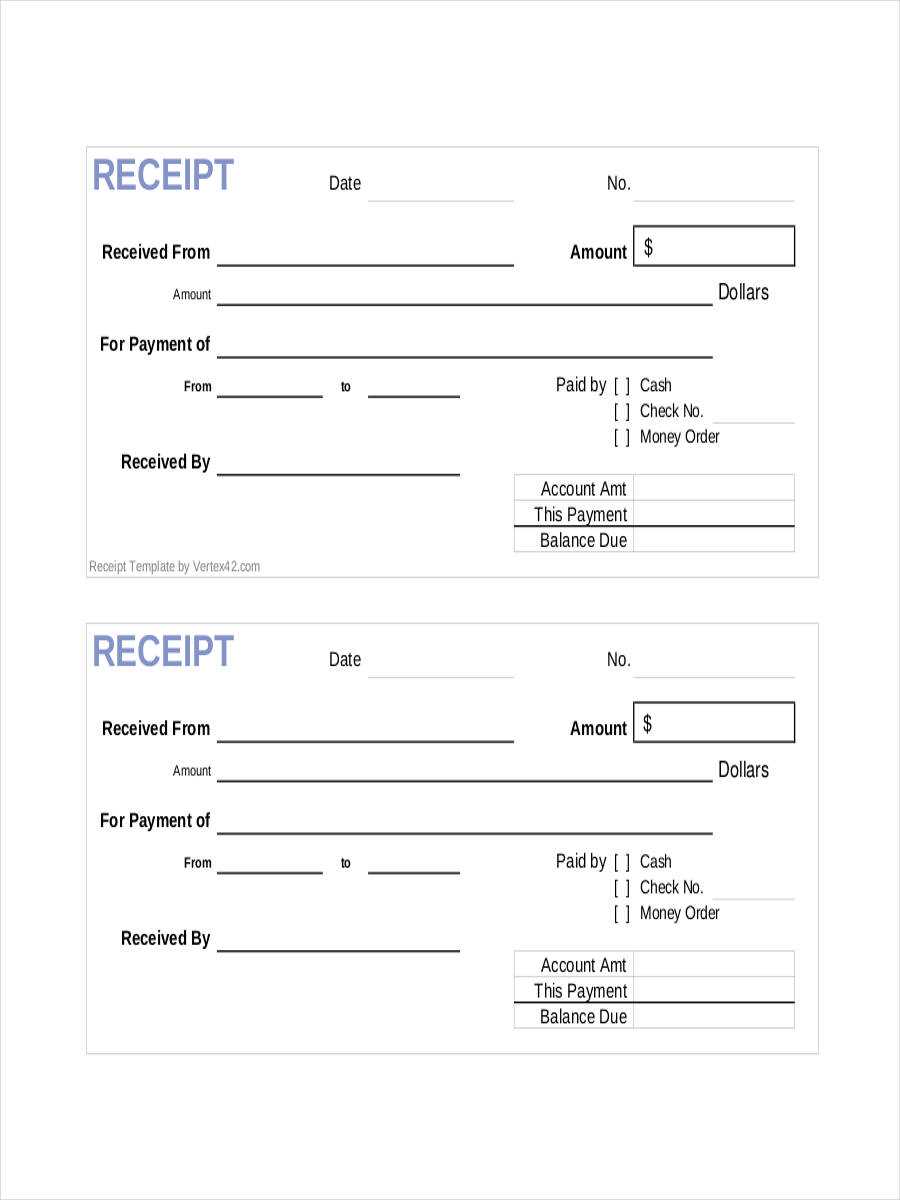

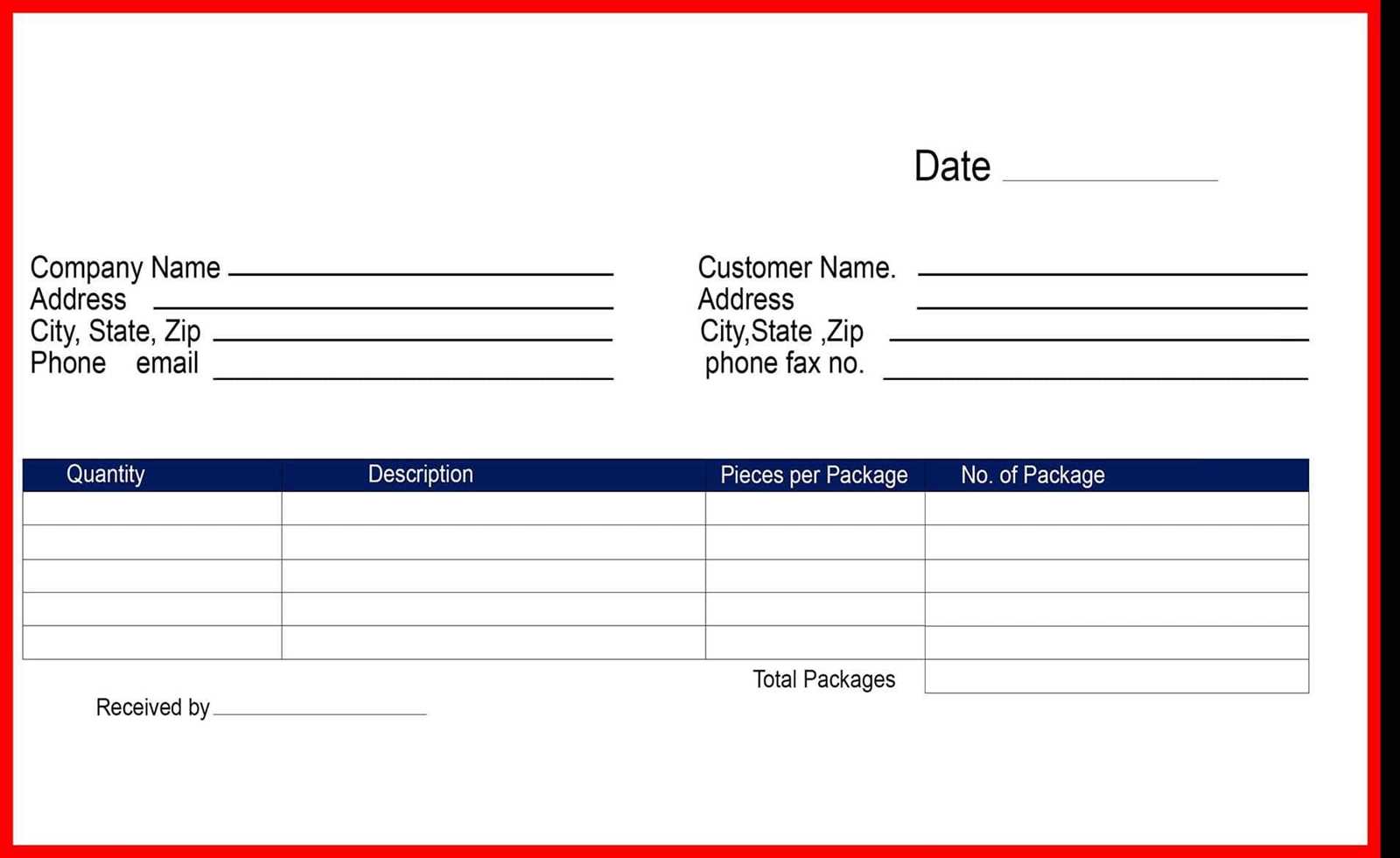

For a clear and professional receipt template, ensure you include the necessary details. Start with the name of your business, address, and contact information. Specify the transaction date and receipt number for easy tracking. List each item or service sold, followed by its price, quantity, and total cost.

Formatting Tips

Use a clean layout with enough space between sections. Align text neatly and avoid clutter. Clearly differentiate between sections like customer information, item details, and total amount. Use bold or larger fonts for important figures, like the total cost or taxes.

Additional Details

Always include payment method information (cash, card, etc.). If applicable, mention any taxes or discounts applied. Lastly, add a thank you note or return policy to enhance the customer experience.

- ABN Receipt Template Overview

Use the ABN receipt template to create clear, accurate, and compliant documentation for your transactions. This template ensures that both the payer and payee have all the necessary details for tax purposes.

Key Elements of the ABN Receipt

- ABN Number: Include your Australian Business Number (ABN) to verify your business registration.

- Receipt Number: Generate a unique receipt number for each transaction to track payments.

- Date of Transaction: Specify the date the transaction occurred to provide a time reference.

- Business Details: List your business name, address, and contact information.

- Recipient’s Details: Include the name and address of the person or business making the payment.

- Itemized List: Provide a breakdown of the goods or services provided, along with their costs.

- GST Information: Indicate whether Goods and Services Tax (GST) was included in the total amount.

Benefits of Using an ABN Receipt Template

- Accuracy: Helps ensure you include all required details, reducing the chance of errors.

- Compliance: Meets Australian tax requirements by including necessary information like the ABN and GST status.

- Efficiency: Saves time when preparing receipts for multiple transactions.

Adjust your ABN receipt template to reflect your brand identity and meet legal requirements. Include your Australian Business Number (ABN), business name, and contact information in a clear, easy-to-read format. Position the ABN prominently to avoid confusion for your clients.

Include Transaction Details

Provide accurate transaction information, such as the date of the transaction, item descriptions, quantities, prices, and applicable taxes. Make sure to clearly list all charges to ensure transparency with your clients.

Personalize Your Template

Customize the design of the receipt by adding your business logo and choosing a font that aligns with your branding. Keep the layout clean and straightforward to ensure that customers can easily reference important details.

For better customer experience, consider offering an email option for sending receipts. This eliminates the need for paper copies and provides clients with quick access to their transaction history.

Include the Australian Business Number (ABN) prominently on the receipt. This number verifies your business identity for tax purposes and assures the buyer that the transaction is legitimate. It should appear clearly, usually near the business name or contact details.

Business Information

Provide the full business name, address, and contact details. These pieces of information help confirm the legitimacy of the business and provide a point of contact for the customer if needed.

Transaction Details

Clearly list the date of the transaction, the goods or services provided, and their cost. Include item descriptions, quantities, and unit prices, if applicable, along with any discounts or additional fees. This provides transparency and ensures the customer can refer to the receipt for specific transaction details.

Make sure the total amount paid is displayed prominently. This should include tax breakdowns, if applicable, for clarity on how the total amount was calculated.

To create a reliable ABN receipt, avoid these common mistakes:

- Incorrect ABN Formatting: Ensure the ABN is listed clearly and follows the correct format, as provided by the Australian Taxation Office (ATO). Missing or incorrect digits can cause confusion and may delay processing.

- Omitting Required Details: A valid ABN receipt must include the correct business name, the transaction date, and the nature of the goods or services provided. Leaving any of these out can lead to compliance issues.

- Using the Wrong Template Version: Always use the most recent version of the ABN receipt template. Older templates may lack essential sections or include outdated information, leading to errors in the documentation.

- Failing to Add GST Information: If your business is registered for GST, include this detail on the receipt. Failing to indicate this can confuse customers and tax authorities.

- Not Double-Checking for Accuracy: Always double-check the details before finalizing the receipt. Errors such as wrong amounts or missing names can lead to costly corrections and delays.

Additional Tips:

- Review your ABN registration status regularly to ensure the information is up-to-date.

- Keep the ABN receipt template consistent across all transactions to maintain professionalism.

Ensure your receipt template follows these guidelines for clarity and simplicity.

Key Elements of an ABN Receipt Template

An ABN receipt template should include the following elements to remain compliant with business standards:

- ABN Number: Your Australian Business Number must be displayed clearly.

- Receipt Date: The exact date of the transaction should be listed.

- Itemized List: Clearly detail all products or services provided, along with quantities and prices.

- Total Amount: Include a final amount that sums up the transaction.

Table for Organizing Receipt Information

Use a table format to present detailed transaction information. This format helps both the customer and the business track their purchases more effectively.

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Service Fee | 1 | $50.00 | $50.00 |

| Product A | 2 | $25.00 | $50.00 |

| Total | $100.00 |